Naftogaz Ukrainy Group in January-September 2019 increased its consolidated net profit by 27.4% (UAH 4.578 billion) compared to the same period in 2018, to UAH 21.309 billion. “Pretax profit in the nine months of 2019 amounted to UAH 28.9 billion, which is 26% more than for the same period last year. This result occurred mainly due to the performance of the Natural Gas Transit and Integrated Gas Business segments,” the report says.

According to the statements posted on the company’s website, its sales revenue in January-September 2019 decreased by 3.7% (by UAH 6.36 billion), to UAH 165.308 billion, while gross profit increased by 10.6% (by UAH 5.164 billion), to UAH 53.848 billion.

In terms of geography of sales revenues, the largest share fell to domestic revenues with UAH 106.748 billion against UAH 113.236 billion in January-September 2018, the Russian Federation (UAH 55.977 billion and UAH 55.931 billion), Europe (UAH 2.31 billion and UAH 2.109 billion), and Egypt (UAH 273 million and UAH 392 million).

Naftogaz Ukrainy unites the largest oil and gas producing enterprises of the country. The group is a monopolist in transit and storage of natural gas in underground gas storage facilities, as well as in the transportation of oil by pipeline through the country.

Kyivstar mobile communications operator has connected 68 more settlements in Zaporizhia, Poltava, Ivano-Frankivsk and Luhansk regions to the 4G communication network, the operator has reported.

In Zaporizhia region, the cities of Energodar and Dniprorudne were connected to the high-speed data network, in Poltava region – Hlobyne, in Ivano-Frankivsk – the city of Burshtyn, and in Luhansk – Popasna. In addition to these cities, 4G communications from Kyivstar began to work in dozens of surrounding villages.

As of the end of December, the operator’s high-speed mobile Internet with 4G technology is already available for more than 74% of the population of Ukraine.

To provide the population of Ukraine with access to new communication technologies, Kyivstar has installed more than 8,000 towers that support the 4G standard, and more than 8 million subscribers have already been able to use such communication services.

In November 2019, subscribers in the Kyivstar network used 45% more traffic data than for the entire 2016.

Kyivstar is the largest Ukrainian mobile operator. It provides communication and data transfer services based on a wide range of mobile and fixed line technologies, including 4G. As of the end of 2018, its services were used by about 26.4 million mobile subscribers and about 0.9 million fixed line Internet customers.

VEON Group fully owns Kyivstar. The groups’ shares are NASDAQ-listed.

Ukraine has retained the zero quotas for exports of unprocessed gold and silver (apart from banking metals) and scrap precious metals and extended the licensing of exports of anthracite for 2020.

The Cabinet of Ministers approved resolution No. 1109 on December 24 and posted it on its website on December 27.

In addition, according to the Montreal Protocol on Substances that Deplete the Ozone Layer, in 2020, exports and imports of the respective substances and goods will be licensed as previously.

The area sown with winter grains for the harvest of 2020 amounted to 7.6 million hectares, which is 0.2% more than the area for the harvest of this year, the State Statistics Service has reported.

According to the agency, the following crops were sown: winter wheat on 6.4 million ha (0.6% less than in 2019), winter barley one 1 million ha (3.9% more), and rye one 135,000 ha (16.7% more).

In addition, the area under winter rapeseeds for the next year’s crop amounted to 1.3 million hectares (0.3% more from 2019).

As reported, with reference to the information-analytical portal of the agro-industrial complex of Ukraine, as of December 10 Ukraine had threshed 75.2 million tonnes of grain and leguminous crops from an area of 15.2 million hectares with the average yield being 4.95 tonnes/ha, exceeding the result of grain harvest for the whole of 2018, when the gross harvest amounted to 70.1 million tonnes.

Electricity consumption in Ukraine in January-November 2019, taking into account in-process losses in power grids, decreased by 1.2% (by 1.648 billion kWh) compared to the same period in 2018, to 136.220 billion kWh, the Ministry of Energy and Environment Protection has reported.

Excluding in-process losses, electricity consumption for the 11 months decreased by 0.5% (by 586.3 million kWh), to 109.736 billion kWh.

The country’s industry, excluding in-process losses, reduced electricity consumption by 0.6%, to 47.112 billion kWh. In particular, metallurgy consumed 26.623 billion kWh (1.4% less compared to January-November 2018), fuel industry some 3.111 billion kWh (3.5% less), machine building sector some 3.354 billion kWh (8.6% down), chemical and petrochemical some 3.395 billion kWh (19.6% more), food and processing some 4.142 billion kWh (0.6% more), construction materials some 2.073 billion kWh (0.1% more), and others some 4.414 billion kWh (1% down).

In addition, agricultural enterprises consumed 3.430 billion kWh (2.6% less), transport some 5.965 billion kWh (5% less), and construction some 873.5 million kWh (2.5% down).

The population of the country in January-November 2019 consumed 31.981 billion kWh (0.9% less), household consumers some 13.694 billion kWh (1.4% less), and other non-industrial consumers some 6.680 billion kWh (9.4% more).

In the 11 months of 2019, the share of industry in total electricity consumption remained unchanged at 42.9%, and the share of the population decreased from 29.3% to 29.1%.

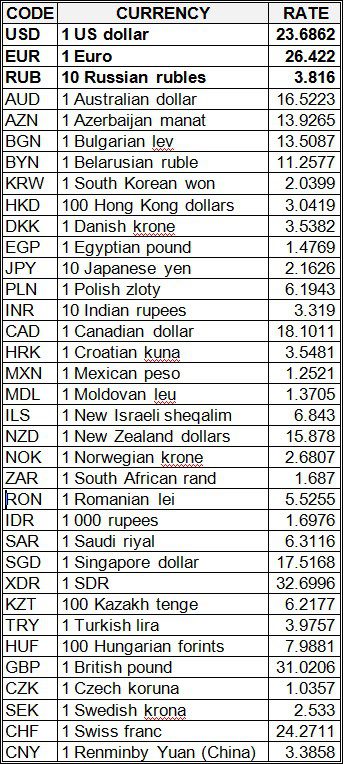

National bank of Ukraine’s official rates as of 28/12/19

Source: National Bank of Ukraine