The Association of Pharmaceutical Manufacturers of Ukraine (APLU) supports the compromise draft government resolution developed by the Ministry of Health to regulate the size of marketing payments in the retail pharmaceutical market at 20% for over-the-counter drugs and 3% for prescription drugs.

This is stated in the text of the relevant declaration available to the Interfax-Ukraine news agency.

APLU members support the proposal to allow marketing expenses in pharmacies for over-the-counter drugs at a level not exceeding 20% of the total sales of each individual licensee (manufacturer, importer, etc.) of such drugs for the previous year, as well as expenses for services related to ensuring the availability of prescription drugs in pharmacies, in an amount not exceeding 3% of the total sales of each individual manufacturer or importer of such drugs for the previous year.

The APLU explains that “this is a compromise solution reached as a result of interdepartmental consultations, and it now best reflects the achievable balance of interests of all market participants involved—manufacturers, importers, and pharmacies.”

According to APLU members, the draft proposed by the Ministry of Health, in particular, establishes clear rules for the functioning of the market in the marketing services segment and creates a predictable and flexible system that minimizes the risks of abuse and “stimulates the development of fair competition based on product quality and service quality, not just marketing budgets.

In addition, APLU members note that the draft is “a stabilizing tool that prevents a payment crisis at all links in the distribution chain, reduces the risks of monopolization of communication channels, and allows jobs to be preserved and the population to have access to quality medicines at fair prices.”

At the same time, APLU participants propose to adopt the draft “as soon as possible as a transitional but fundamental solution that will stabilize the market” and, after the resolution comes into force, to conduct regular monitoring together with all market participants and state authorities to assess its impact and initiate improvements to the tools, if necessary, ensuring public reporting and transparency of information on the structure of marketing costs and their impact on pricing and the preservation of competition.

“We call on all market participants to join this declaration. The reform of the rules should not be achieved by dismantling the pharmacy sector or demonizing marketing, but through the introduction of clear, controllable, and ethical practices,” the APLU emphasizes.

Source: https://ru.interfax.com.ua/news/pharmacy/1080866.html

In mid-June, the Ukrainian wheat market was dominated by downward price dynamics, according to the information and analytical agency APK-Inform.

“The approaching harvest, low demand from traders awaiting the new harvest, and a downward price trend on the export market put pressure on prices. The supply of grain remained insufficient, while demand from processors was quite high, which continued to support prices,” analysts explained.

Prices for grade 2 wheat were recorded at 10,000-11,300 UAH/t CPT, and for feed wheat at 9,200-10,200 UAH/t CPT, according to APK-Inform.

Since the beginning of the year, exports of wood and wood products from Ukraine amounted to 1.42 million tons worth $671.8 million. Compared to the same period in 2024, when 1.34 million tons were exported for $593.9 million, the volume of exports increased by 81,700 tons, or 6%. At the same time, in monetary terms, there was an increase of $77.9 million, or 13%.

Pine products account for the largest share, 68.6%, indicating high demand for this type of wood on foreign markets. Spruce timber ranks second with 19%, followed by oak with 6.6% of the total volume.

At the same time, since the beginning of the year, customs authorities have detected violations amounting to over UAH 31.4 million.

On June 16, renowned Ukrainian pianist Natalia Pasichnyk received the prestigious Cultural Award from the Friends of the Arts Association, a cultural foundation affiliated with one of Sweden’s most famous museums, the Prince Eugen’s Waldemarsdösa Museum. The award was presented during a ceremony in Stockholm by Her Majesty Queen Silvia, according to the Swedish Royal Court website.

Hans Dillen, chairman of the organization, said: “Natalia Pasichnyk is a renowned pianist with a distinguished international career. But she also uses her talent to tell the story of Ukraine and spread Ukrainian culture – which is more important today than ever before. She builds cultural bridges between Sweden and Ukraine and is one of those rare figures whose artistic work becomes a channel for deeper understanding between peoples.”

Lars Edelholm

The Cultural Award, presented by the Renässans Society for the Humanities, is awarded annually by the Association of Friends of Artists to individuals who have made a significant contribution to cultural life in Sweden. The award ceremony is traditionally attended by members of the royal family.

“I am grateful for this recognition and attention to the promotion of Ukrainian culture—and Ukrainian music in particular—in Sweden. Today is not a time for celebration, but it is time to remind everyone once again of Ukraine’s need to be heard, to have the support of the world, and to talk about the existence of a distinct, deep, rich, and integrated Ukrainian culture within the European context,” emphasized Natalia Pasichnyk.

Fredrik Jönsson

The pianist has lived in Sweden for over 30 years and is one of the key figures in Ukrainian cultural representation in Europe. She is the founder and artistic director of the Ukrainian Institute in Sweden, as well as the artistic director of the large-scale European festival “Ukrainian Spring,” which takes place every year at the Royal Philharmonic Hall in Stockholm.

The Association of Friends of Artists was founded in 1937. Its long-time chairman was Prince Eugen, a member of the ruling Bernadotte dynasty and the fourth son of King Oscar II of Sweden. He was a renowned artist, collector, and patron of the arts. The association’s goal is to support and encourage people working in the humanities and arts in Sweden, especially through an annual cultural award. The Waldemarstad Museum (translated from Swedish as “Waldemar’s Cape”) is now in the prince’s old villa.

Alliance Novobud Marketing Director Iryna Mikhailova has been included in the rating of Ukraine’s best top managers of 2025 according to the authoritative business publication Focus.

The magazine recognized professionals who demonstrate leadership strategy, adaptability to challenges, and consistent results in difficult times. Irina Mikhailova was recognized as a leader who shapes the image of a progressive developer by implementing innovative approaches to communications, branding, and marketing of residential real estate.

Alliance Novobud successfully implements large-scale residential projects, particularly in Brovary and Kyiv, and is consolidating its position as one of the most recognizable developers in the country.

Alliance Novobud congratulates Ms. Irina on her honorable recognition and is proud to have specialists who are shaping the future of Ukrainian development on the company’s team.

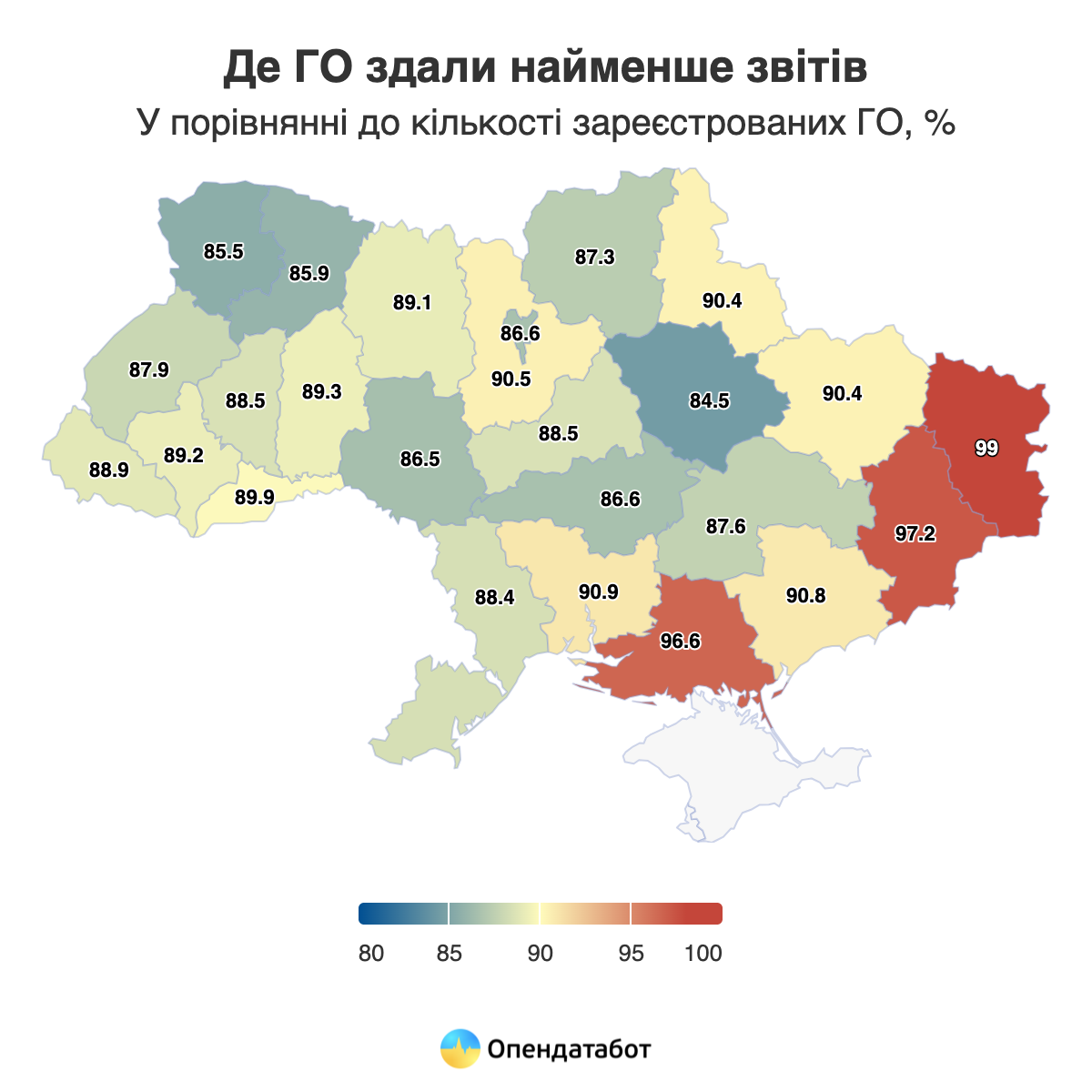

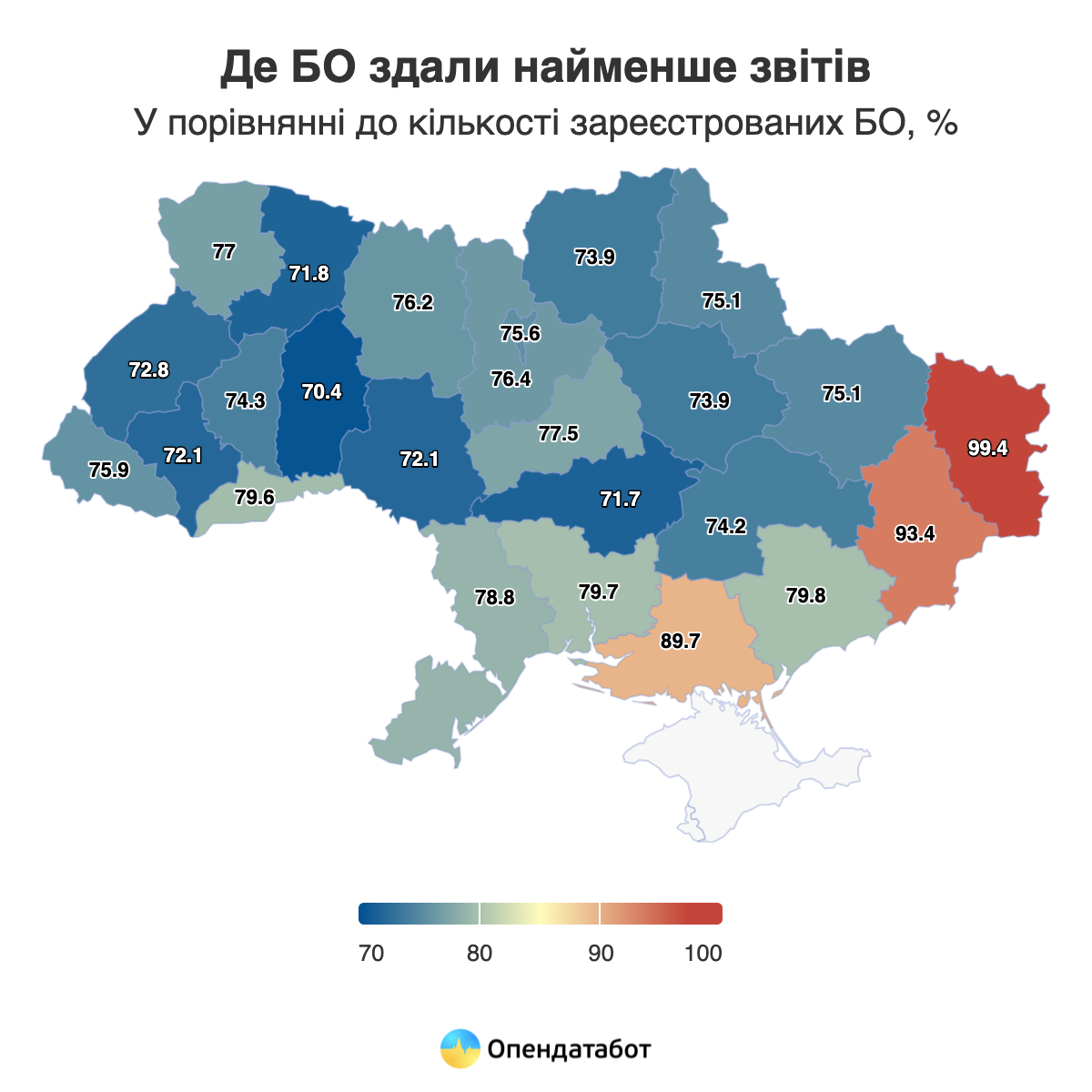

Which regions submitted the fewest financial reports

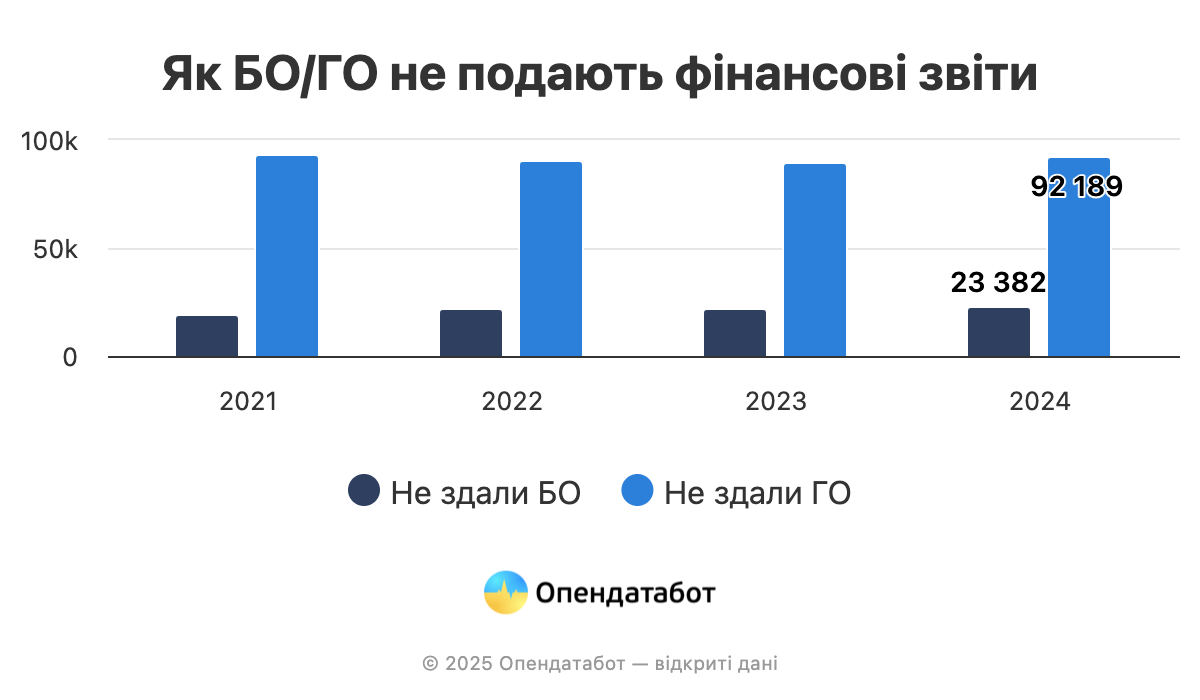

According to the State Statistics Service, 92,189 public organizations (POs) and 23,382 charitable organizations (COs) did not submit their financial reports for 2024. This trend began long before the full-scale war. Among the regions that are not occupied or where there is no fighting, the most frequent evaders of reporting are in the Kyiv and Chernivtsi regions.

89% (92,000) of public organizations in Ukraine did not submit financial reports for 2024. This is 2,225 more NGOs than in 2023. In general, the number of such organizations gradually decreased from 2021 to 2023, and last year’s figure can be attributed to statistical error.

The same trend can be observed among charitable reports. Last year, their number increased by 965 charitable foundations, or 4%. In total, 77% of the total number, or 23,000 foundations, did not submit financial reports.

The trend of ignoring reporting did not arise during the full-scale invasion, but is rather an established tradition. 97% and 94% of CSOs and CFs did not submit financial reports despite the legal requirement in 2021. In other words, with the start of the large-scale war, the number of non-transparent organizations actually decreased.

You can check the financial reports of foundations and CSOs using the services of OpenDataBot.

Most of the organizations that did not submit reports are located in regions whose territories are temporarily occupied. Among the regions that are completely controlled by Ukraine, the largest number of CSOs did not submit reports in the Kyiv region – 90.5%. The largest number of charitable foundations that did not report are registered in the Chernivtsi region – 80%.

The five leading public organizations by income in 2024:

● Ukraine is Invincible – 2023 (Mykolaiv region) – UAH 6.1 billion;

● Against Corruption (Cherkasy region) – UAH 3.5 billion;

● Security and Welfare (Zaporizhzhia region) – UAH 2 billion;

● Together Against Corruption (Kyiv city) – UAH 1.8 billion;

● 68 Brigade 3 Battalion (Ivano-Frankivsk region) – UAH 1.7 billion.

The five leading charitable organizations by income in 2024:

● Come Back Alive (Kyiv) – UAH 4.9 billion;

● Kyiv Center for Support of Children and Youth (Kyiv) – UAH 2.7 billion;

● Caritas Ukraine (Lviv region) – UAH 2.6 billion;

● Plast Endowment in Ukraine (Kyiv) – UAH 2.5 billion;

● 100 Percent Life (Kyiv) – UAH 2.3 billion.

The Come Back Alive Foundation is the largest charitable organization in Ukraine among those that reported their income. Despite the fact supporting the organization’s activities at this level requires significant resources, the fund states that it is guided not by bureaucratic ideas, but by the criterion of transparency before the state, partners, and donors, building relationships based on integrity and openness — therefore, it publishes even more data than required by law.

Come Back Alive strives to maintain and develop trust in charitable activities in Ukraine by providing access to information about its economic activities and implementing unique projects that often require high-quality accounting and legal support in order to best promote Ukraine’s defense and mobilization readiness and protect its population.

Supporting and developing accounting and financial reporting is a constant and mandatory task for a charitable organization. We work strategically and for the long term, so our open reporting on the website helps to improve the results of cooperation and activities by minimizing the risks that arise when access to essential information is restricted,” comments Lesya Melnyk, Financial Director of the Foundation.