France remains one of the most positively perceived countries among Ukrainians. This is evidenced by the results of a sociological survey conducted by Active Group in April 2025 with the participation of the information and analytical center Experts Club.

According to the survey, 74% of Ukrainian citizens have a positive attitude toward France: 47.7% are mostly positive, and another 26.4% are completely positive. Only 6.2% of respondents had a negative attitude (5% mostly negative, 1.1% completely negative), 18.3% chose a neutral position, and 1.5% of respondents were unable to decide on an answer.

“For many Ukrainians, France is associated with military and humanitarian aid, diplomatic support in the European Union, and cultural sympathy. The high level of positive perception is natural,” emphasized Active Group co-founder Oleksandr Pozniy.

These figures confirm once again that Ukrainian society highly values those who demonstrate moral solidarity in difficult times.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

French company GE Vernova and PJSC Zaporizhzhyaoblenergo have signed a EUR13 million agreement to manufacture and supply two mobile substations to the network operator to strengthen the region’s energy resilience, according to the government’s Telegram channel.

“This contract is the last one under the EUR200 million intergovernmental grant agreement between Ukraine and France. Within its framework, 19 projects have been approved in the fields of energy, healthcare, water supply, transport, and demining,” the statement said.

It specifies that 50% of the EUR200 million in non-repayable aid can be used to purchase Ukrainian goods and services.

Egypt is a country that Ukrainians perceive as mostly neutral, with a slight positive bias. This is evidenced by the results of a sociological survey conducted by Active Group in collaboration with the Experts Club think tank in April 2025.

According to the survey, 68.2% of respondents expressed a neutral attitude toward Egypt, which is one of the highest figures among all countries. A total of 17.6% of Ukrainians have a positive attitude toward this country (13.8% mostly positive, 3.7% completely positive), while 7.1% have a negative perception (6.0% mostly negative, 1.1% completely negative). Another 7.1% of respondents abstained from answering.

“Egypt is traditionally associated in Ukraine mainly with tourism, but it has no significant political or humanitarian presence in the context of the war. This explains the high level of neutrality,” commented Oleksandr Pozniy, co-founder of Active Group.

In turn, Maxim Urakin, founder of Experts Club, noted that Egypt has been one of our country’s most profitable trading partners for many years, based on the positive trade balance. However, according to the expert, trade is currently a secondary factor in the minds of Ukrainians compared to moral and political support in the international arena.

At the same time, the neutral-positive perception of Egypt opens up opportunities for deeper cooperation at the diplomatic and cultural levels if the parties so desire.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Among all countries covered by the sociological survey, Algeria turned out to be one of the least known to Ukrainian society, as evidenced by a record high level of neutral responses. These results were published by Active Group in partnership with the Experts Club think tank in April 2025.

According to the survey, 73.6% of Ukrainians said they had a neutral attitude toward Algeria. Only 8.2% of respondents have a positive opinion of the country (6.5% mostly positive, 1.7% completely positive), while 8.8% expressed a negative opinion (6.4% mostly negative, 2.4% completely negative). Another 9.3% were unable to answer.

“Algeria remains terra incognita for most Ukrainians — a country about which there is a lack of information in the Ukrainian media, which explains the extremely high level of neutrality,” said Maxim Urakin, founder of Experts Club.

These results demonstrate the potential for developing intercultural dialogue, but also point to the limited diplomatic and humanitarian presence of Algeria in Ukraine.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Ukrgazvydobuvannya, a member of the Naftogaz Group, set a new drilling record in January-March 2025, reaching 107,136 meters, which is almost twice as much than in the same period of 2024 and exceeds the previous quarterly maximum recorded in the third quarter of 2024 (102,866 meters).

“Increasing domestic gas production is strategically important for Ukraine. Ukrgazvydobuvannya’s record figures, achieved despite hostile shelling, confirm the professionalism of the team and make a significant contribution to strengthening our country’s energy security,” said Naftogaz CEO Roman Chumak, whose words are quoted in a statement on the Group’s website on Wednesday.

According to him, March was the most productive month, with 41,229 meters drilled, which is 6,929 meters more than the planned target (34,300 meters).

“Thus, the monthly record set in April 2024 of 40,059 meters was also broken,” Naftogaz said.

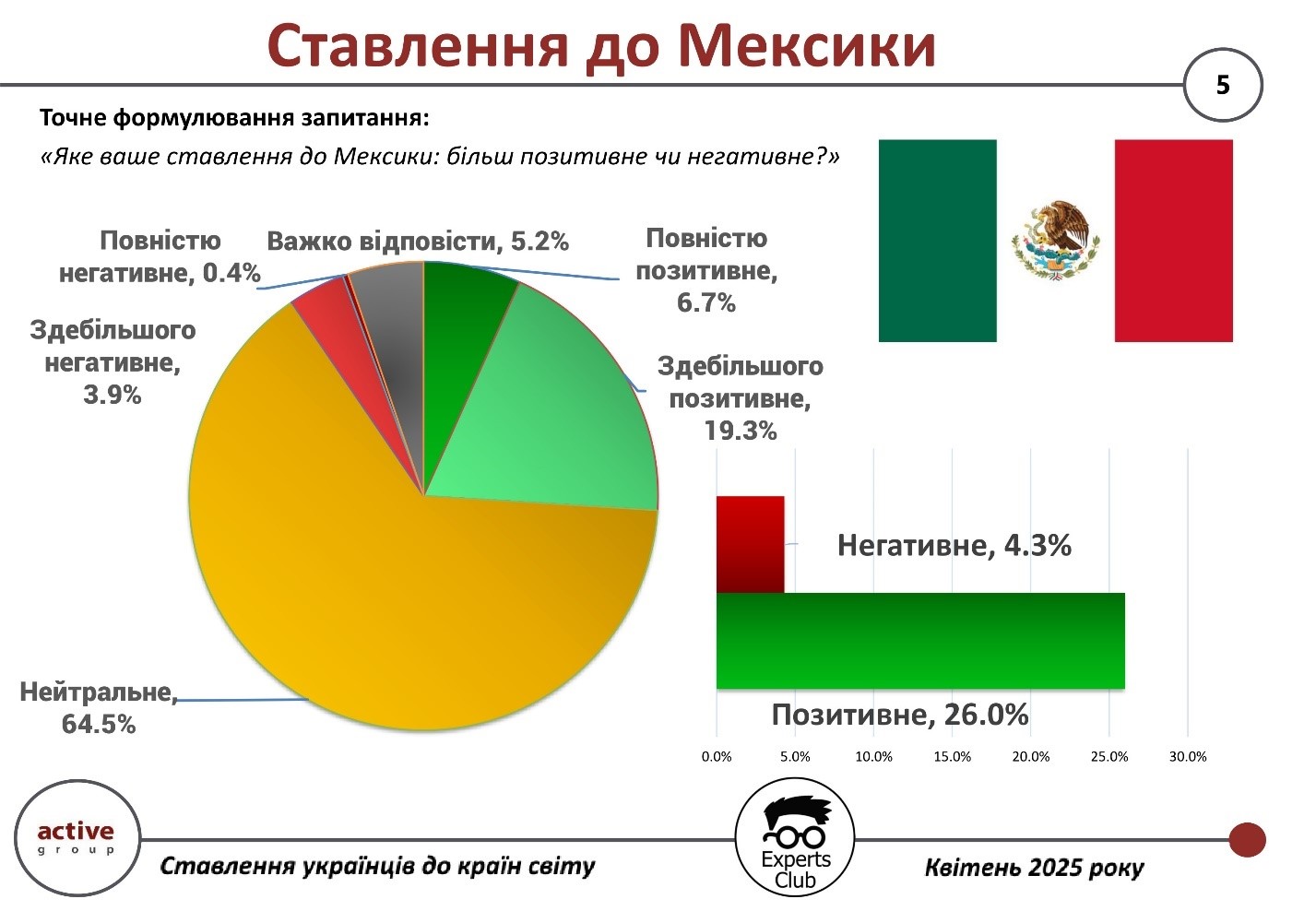

According to the results of a sociological survey conducted by Active Group in collaboration with Experts Club in April 2025, Ukrainians’ attitudes toward Mexico are generally characterized by a high level of neutrality, but with a positive bias.

The majority of respondents — 64.5% — expressed a neutral attitude toward this Latin American country. At the same time, 26% of respondents have a positive perception of Mexico (19.3% — mostly positive, 6.7% — completely positive), while only 4.3% have a negative opinion (3.9% — mostly negative, 0.4% — completely negative). Another 5.2% of respondents were undecided.

“These results demonstrate that the image of Mexico for most Ukrainians does not yet have a clearly formed emotional or political association. Neutrality dominates, but positive feelings outweigh negative ones,” explained Maksim Urakin, founder of Experts Club.

The survey once again confirms that both political support and cultural presence in the global arena play an important role in shaping a stronger international image.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN