The desire of Ukrainians who fled the war to stay in Germany even after the end of hostilities is linked to their increasing integration into German society, according to an analysis by the Institute for Research on the Labor Market and Professions (IAB). “The high level of education and strong desire to integrate among Ukrainian refugees create opportunities for both sides, especially given the demographic changes and the lack of qualified personnel in Germany,” said IAB expert Yulia Kosyakova.

However, for mutually beneficial relations to develop, Germany should be more active in helping Ukrainians find jobs, learn the language and recognize professional qualifications, Kosyakova said.

The IAB study shows that on average, only 22% of Ukrainian refugees aged 18 to 64 are employed. 57% of Ukrainian women and 50% of men work in Germany in positions that do not correspond to their qualifications. Most often, Ukrainians find work in the cleaning industry, catering, and social services, including care for people with disabilities. The average monthly gross income of Ukrainians working full-time is EUR 2,600, which is significantly lower than the average in Germany (EUR 4,479).

At the same time, according to the study, 97% of adult refugees have a school education, 75% have vocational or higher education, and 90% have work experience in their home country. Only 20% were able to officially confirm their diplomas and qualifications in Germany.

Source: http://relocation.com.ua/bilshe-polovyny-ukrainskykh-bizhentsi/

Ukraine is a strategic partner of the EU and the world. While a significant part of the world’s land is becoming unsuitable for agriculture due to climate change and soil degradation, in Ukraine, with a total area of 60.35 million hectares, 42.73 million hectares or 70.8% of the territory is already used in agricultural production, according to SEEDS.

Dmytro Ustavytskyi, co-founder of the logistics company NIDERA AGRO, an expert in international logistics and innovative solutions, and industry leader of the NGO Svit.UA, writes about this in a blog on the Svit.UA website.

“Despite the realities of the war, grain exports from Ukraine are crucial for the food security of the world. This month, the EU is presenting the updated Common Agricultural Policy of the European Union, which will be adopted in 2028. Currently, it is being discussed that trade preferences introduced in 2022 due to the war should be extended until 2027, as the war continues.

According to the Ministry of Agriculture, in 2024, exports of agricultural products brought in $24.6 billion, which is 59% of the country’s total exports. Ukrainian farmers managed to increase exports by 12.5% compared to 2023. Sales of grains (+1.1 billion USD) and oilseeds (+0.5 billion USD) increased the most,” says Dmytro Ustavytskyi.

In his opinion, logistics in the agricultural sector of Ukraine plays a crucial role in ensuring food security both domestically and in foreign markets.

“Logistics covers the entire supply chain – from the delivery of seeds, fertilizers and machinery to producers to the transportation of crops to storage, processing, domestic markets and export terminals. Efficient logistics helps to minimize crop losses, preserve its quality and ensure competitive prices,” adds the expert on international logistics and innovative solutions.

Challenges of war: infrastructure losses and risks

Russia’s full-scale invasion has shown the critical importance of stable logistics. The destruction of transport infrastructure, blocking of sea routes, destruction of elevators and mining of agricultural land have complicated agricultural processes. However, Ukraine was able to adapt by expanding export routes through the Danube ports and alternative land corridors to the EU.

Export potential: opportunities and constraints

The European Union remains Ukraine’s main trading partner. Ukrainian grain helps to reduce food inflation in the EU.

“However, neighboring countries view the Ukrainian agricultural sector not only as a partner but also as a competitor, which makes it difficult to enter new European markets. Therefore, the issue of extending trade benefits for exporters and solving the problems of blocking borders is a priority.

Ukraine has significant export potential because of its high quality products. For example, the President of the Ukrainian Grain Association (UGA) conducted an audit in the EU and received positive feedback on the quality of Ukrainian grain, which is recognized as one of the best in Europe,” recalls Dmytro Ustavytskyi.

How medium-sized farmers can enter EU markets

“Ukrainian farmers now have the opportunity to sell grain to the EU without customs barriers. For example, a farmer with 500 hectares of land can supply products directly to processors in Italy. And now Ukrainian grain can reach San Martino in Italy in just 2 weeks!

Currently, 90% of Ukrainian grain (wheat and corn) is supplied to Italy, gradually displacing Russian products from the local market. This demonstrates the effectiveness of Ukrainian logistics, which is gradually integrating into the European infrastructure,” emphasizes the co-founder of the logistics company NIDERA AGRO.

Development of logistics infrastructure: the key to competitiveness

According to the expert, his team has now built a complete logistics chain for farmers:

“Today, farmers have a choice – to sell grain on the domestic market or to export on more favorable terms. Transparency of prices on trading platforms allows us to plan sales more efficiently, which reduces logistics costs,” adds Dmytro Ustavytskyi.

Financial opportunities for exporters

According to the expert in international logistics and innovative solutions, farmers have already learned how to work with foreign exchange contracts, which simplifies export operations. Banks have simplified the mechanism for servicing foreign currency accounts, which helps to avoid exchange rate risks.

“However, exports require certification and professional support. We help small producers to go through this process without risks by providing solutions for exporting consignments of 1,800 tons or more. Quality assurance is a key factor in successful exports,” says Dmytro Ustavytskyi.

Trade strategies and training for farmers

One of the common mistakes, the expert believes, is selling grain immediately after harvest, when prices are lowest. In his opinion, it is more profitable to store products and analyze the market to sell at the most favorable time.

In addition, further improvement of agro-logistics is impossible without investment in:

“At NGO Svit.UA, we are raising these issues and will be organizing meetings with the Ministry of Agrarian Policy to discuss the possibilities of state support for small and medium-sized farmers in entering international markets.

In times of war, export support for small and medium-sized farmers is becoming a strategically important area for food security and economic development.

Ukrainian producers remain important partners for the EU, so there must be a certain trade culture, because the main requirement of European buyers is honesty in terms of quality and quantity of products,” adds Dmytro Ustavytskyi.

In his opinion, Ukraine has unique opportunities to integrate into the European market even despite the challenges of war. Investments in logistics, digital solutions and international cooperation will help make this process efficient and profitable for Ukrainian farmers.

Chinese short video-sharing service operator TikTok plans to invest $8.8 billion in building data centers in Thailand over five years, TikTok’s Vice President of Public Policy Helena Lersch said during an event in Bangkok on Friday.

In January, Thailand’s Board of Investment announced TikTok’s plans to invest $3.8 billion in the country. It is unclear whether this amount is included in the total amount of investments announced by Lersh. The number of TikTok users in Thailand is over 50 million.

Assets of non-state pension funds (NPFs) under the management of ICU Investment Group grew by 20.4% to UAH 1.07 billion in 2024, while the total increase in assets of the entire non-state pension system of the country amounted to 17.3% to UAH 5.72 billion, the group said in a press release on Friday.

“Despite the wartime challenges, the stable operation of NPFs and the growing need for long-term motivational tools for employees have attracted the attention of employers to corporate pension programs,” it quotes Grigory Ovcharenko, director of asset management at ICU Group in Ukraine, as saying.

It is noted that excluding the NPF of the National Bank of Ukraine, the share of assets of the investment group in the context of the entire non-state pension system amounted to 32.1% at the end of this year.

The company reminded that ICU manages the assets of six NPFs: NCPF “Ukreximbank” (NAV as of February – UAH 413.5 million), VNPF “Emerit-Ukraine”, NPF “Dynasty”, NPF “Priчастность”, NPF “Mutual Aid”, NPF “Turbota”.

According to the release, NPF “Turbota” at the end of 2024 increased the amount of contributions by 84.8% (net asset value, NAV as of February was UAH 2.55 million), NPF “Dynasty” – by 42.8% (NAV of UAH 292.4 million) and NPF “Mutual Aid” – by 33% (NAV of UAH 10.6 million).

The leaders of ICU NPFs in terms of net profitability according to the results of 2024 were: NPF “Dynasty” (+19.8%), NPF “Mutual Aid” and ONPF “Emerit-Ukraine” (+18.3%, NAV 328.8 million UAH), which took the fourth, fifth and sixth positions among all NPFs in the country.

“All these funds outperformed inflation, devaluation and yields on hryvnia-denominated government bonds and deposits,” the company notes in the release.

According to ICU information, the number of clients in funds managed by the group increased by 4.4% over the year – to more than 124 thousand people.

ICU Group is an independent financial group providing brokerage, asset management and private equity services. The company is also engaged in venture capital and fintech investments. ICU’s geographic focus is on emerging markets around the world. It has more than $500 million in assets under management and a client investment portfolio of UAH 23.8 billion.

The group, according to its data, has been the largest broker of government bonds in Ukraine for more than 15 years.

The co-owners of ICU are Makar Pasenyuk and Konstantin Stetsenko.

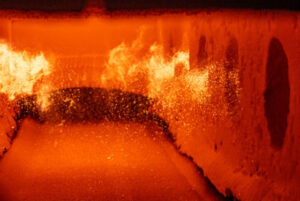

In 2024, Central Mining and Processing Plant (CMP, Kryvyi Rih, Dnipro region), a part of Metinvest Group, implemented a number of energy efficiency projects and increased the percentage of natural gas substitution with biofuels from 50% to 53%.

According to the company, the pelletizing plant ended the year and started 2025 with high productivity and operational improvements based on the results of last year’s work.

It is specified that the high rating of the plant’s performance was ensured, in particular, by the implementation of the production program. In 2024, the plant’s utilization rate remained at 100%, and the shop operated at its maximum capacity of up to 298 tons of pellets per hour. In total, the plant produced about 2.2 million tons of high-quality products last year. The mill ships its pellets to domestic customers and to the European market.

During the year, the pelletizing plant implemented a number of investment projects to ensure stable production. In March and November, the OK-324 roasting machine complex was overhauled twice.

The specialists restored the refractory masonry of the kiln and repaired six nozzles. A smoke exhauster shaft rotator was installed, which significantly reduced its operating time during scheduled maintenance at the plant. The installation of the mechanism reduced energy consumption and increased the reliability of the equipment. To reduce the environmental impact and improve energy efficiency, two drip traps on two smoke exhausters were partially replaced and the flues on the other two smoke exhausters were repaired. All this ensures the reliability of the entire equipment complex.

The key areas of the plant’s operation that the team focuses on are specific costs, such as gas and electricity, as well as such expenditure items as biofuel, bentonite, etc. As a result of systematic work, the plant implemented a number of operational measures last year. For example, the installation of a shaft rotation mechanism for the D-3 smoke exhauster and the automation of closing the D-6 smoke exhauster guides contributed to energy savings.

Andrey Zhilkinsky, head of the pelletizing plant at Central GOK, noted that timely repairs, along with equipment modernization and automation of certain processes, allow the company to maintain a stable production rhythm, meeting all the requirements for the quality of iron ore and the volume of customer orders.

“On the other hand, time requires us to look even more closely at all processes and focus on developing measures that would save our key cost items, contributing to the sustainability of the plant. Therefore, the plant’s team continues to develop and implement innovative solutions and rational ideas to optimize the use of resources in the production process and improve production efficiency,” summarized the plant’s head.

Central GOK is one of the five largest producers of mining raw materials in Ukraine. It specializes in the extraction and production of iron ore concentrate and pellets.

CGOK is a part of Metinvest Group, whose major shareholders are System Capital Management (SCM, Donetsk) (71.24%) and Smart Holding Group (23.76%). Metinvest Group’s management company is Metinvest Holding LLC.

Philip Morris in Ukraine has brought a new factory in Lviv region to its planned capacity, which was launched in May 2024, the company said in a press release.

“Since January this year, our factory has reached full capacity. This means that we can fully provide the Ukrainian market with our own products. Also at the beginning of 2025, we have fully completed the contract with a partner company in Ukraine, which has been producing products under our brands for more than two years. We are grateful to our colleagues for cooperation, because thanks to this partnership we were able to maintain production in Ukraine and continued to pay taxes here”, – commented Maxim Barabash, CEO of Philip Morris Ukraine.

The company reminded that Philip Morris (PMI) invested $30 mln in the launch of the Lviv factory, where five production lines are installed and put into operation. Their planned capacity is 10 billion cigarettes per year. The company has created 250 jobs, to which employees from the company’s Kharkiv facility have already been fully relocated.

According to Barabash, the company’s investments in Ukraine are not limited to the factory. In 2025, PMI plans to invest an additional 60 million UAH in a full-fledged large shelter on the territory of the factory, so that people could stay there in comfort and safety. Works on its arrangement have already started. The construction is planned to be completed by May 2025.

In addition, the company helped to modernize the existing shelter on the territory of Lviv city territorial community for about UAH 1.3 million.

Philip Morris was spun off from Altria in 2008 and is among the world’s largest tobacco manufacturers. The company’s 2023 revenue grew by 10.7% year-on-year to $35.2 billion in 2022. The report indicated that Ukraine accounted for about 2% of total sales in volume terms and 1% in cash terms.

PMI reduced shipments in the Ukrainian market by 30.1% to 11.07 billion cigarettes and tobacco sticks in 2022 due to the war, but it managed to increase finished goods shipments by 8.4% in 2023, including a 14.9% increase in the fourth quarter. The company reported in October 2023 that its share of the Ukrainian market had recovered to 24%. Ukraine figures were excluded from PMI’s quarterly reports in 2024.

In addition to cigarettes, PMI develops and manufactures smokeless products – electrically heated tobacco products (EHT), nicotine-containing PODs, and oral nicotine products. Sales from smokeless products accounted for 39% of PMI’s total net revenue in the first quarter of 2024 and 38% in the third quarter.

Philip Morris Ukraine has been operating in the Ukrainian market since 1994 and has invested more than $750 million in the Ukrainian economy since the beginning of the full-scale invasion, allocating more than UAH 400 million for humanitarian projects.