Monobank has launched a new service called Monobazar, which allows customers to sell their own items within the app, according to the bank’s co-founder Oleg Gorokhovsky.

“We are launching a beta version of monoBazar, a simple service within monoMarket where customers can sell their items. The feature is already available, and we are opening testing to everyone,” Gorokhovsky wrote on his Telegram channel on Monday.

According to him, the service has three main advantages: the ability to purchase goods in parts, verification of all sellers through the monobank system, and the creation of a personal showcase that users can share on social networks or send to friends.

The post notes that monoBazar has a number of additional features. In particular, a built-in AI model can automatically generate a detailed description of the product based on a short text provided by the user. An automated trading format has also been implemented: the buyer can offer their price, and the seller makes a decision without the need for correspondence.

According to the co-founder of monobank, the seller receives the funds only after the buyer picks up the parcel from the post office. If the buyer refuses the product, the money is automatically returned to the buyer and the product is returned to the seller.

The service is available in the monobank app in the “Market” section.

The service commission is 0.1% until January 8 during testing, after which it is planned to increase to 1.9%, with the buyer paying the additional cost of delivery.

Gorokhovsky also noted that until January 8, users can sell items for charity: in this case, the amount is transferred to the “Charter” fund, and monobank doubles the contribution.

As reported, the virtual monobank, created by Fintech Band LLC on the basis of Universal Bank, currently ranks second in the market in terms of the number of cards. According to the NBU, as of October 1, 2025, Universal Bank had issued a total of 25.45 million cards, of which almost 9.85 million were used for transactions during the month.

Currently, OLX is the largest player in the Ukrainian market of digital platforms for selling items.

The European Bank for Reconstruction and Development (EBRD) is providing a €16 million loan to Cherkasy to finance the purchase of modern trolleybuses and the modernization of the relevant infrastructure, according to a statement on the EBRD website.

The loan, fully guaranteed by the city, will be co-financed by an investment grant of up to EUR4 million from the EBRD’s Shareholders’ Special Fund and will have partial first-loss risk coverage under the EU Investment Program for Municipal Infrastructure and Industrial Resilience (UIF MIIR).

The EBRD notes that the financing will enable Cherkasyelektrotrans to expand its fleet with new low-floor trolleybuses, modernize its depot and other infrastructure, and expand and redistribute three trolleybus routes.

According to information on the Cherkasy City Council website, the project involves attracting EBRD loan funds for the purchase of trolleybuses with a range of up to 20 km.

“Cherkasy has been preparing to implement this project for almost 10 years. Due to previous debt obligations, the city was unable to obtain a loan for a long time, but after a positive conclusion from the Ministry of Finance, active work on the final decisions was carried out over two years. Currently, all key approvals have been obtained,” said Cherkasy Mayor Anatoliy Bondarenko.

Thanks to the project, Cherkasy will be able to renew up to 90% of the rolling stock of the Cherkasyelektrotrans municipal enterprise.

As reported, the rolling stock of Cherkasyelektrotrans currently includes 12-meter Bogdan trolleybuses manufactured in 2015, Belarusian BKM trolleybuses manufactured in 2012, LAZ trolleybuses manufactured in 2006 and 2008, one articulated Aviant-Kyiv trolleybus manufactured in 1997, as well as ZiU trolleybuses manufactured in the 1980s and 1990s.

Last year, local authorities announced that they wanted to purchase approximately 45 trolleybuses with EBRD loan funds. Currently, the plan is to purchase up to 44 vehicles.

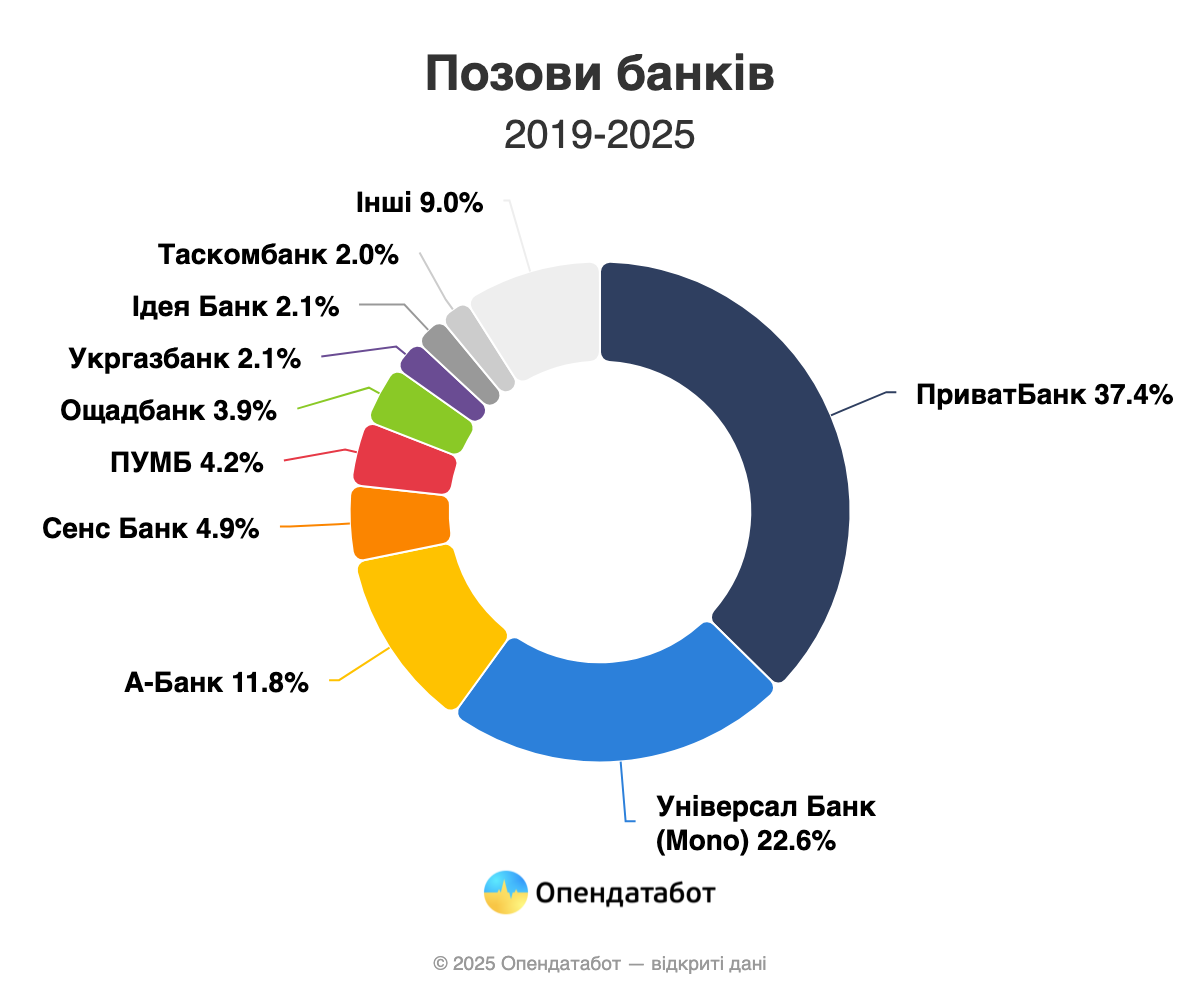

Banks are increasingly suing their debtors. According to the State Judicial Administration of Ukraine, a record 100,000 lawsuits were filed by Ukrainian banks this year. This is almost 1.5 times more than in the same period last year. In total, more than half a million lawsuits against debtors have been filed by banks over the past 7 years. Universal Bank (Mono), Privat and A-Bank account for 70% of the claims.

100,434 lawsuits against debtors were filed by Ukrainian banks. This is 1.5 times more than in the same period last year and a record for the last 7 years. A total of 511,865 lawsuits have been filed by banks since 2019.

Universal Bank/Mono (28,213 claims), A-Bank (22,221), and Privat (20,278) accounted for more than 70% of all claims this year. FUIB (9 , 225) and Sense Bank (6,831) are far behind.

In general, over the past 7 years, Privatbank has remained the unchanged leader in lawsuits against debtors – 191,353 lawsuits. It is followed by Universal Bank (115,702), A-Bank (60,421), Sense Bank (25,283) and FUIB (21,476).

TASKOMBANK saw the largest increase in the number of claims this year, up 3.5 times. PrivatBank (1.8 times), Kredobank (1.7 times), Accent Bank (1.6 times), and Sens Bank (1.6 times) also saw a significant increase.

At the same time, many banks have significantly reduced the number of court appeals. Unex Bank (4 times), Credit Agricole (2 times) and Ukrgasbank (2 times) showed the biggest drop.

It is worth noting that the ranking of the most “litigious” banks has been updated this year. New players entered the top – Radabank and Bank Alliance, which were not on the list last year. Instead, Accordbank and Unex Bank dropped out of the top twenty.

https://opendatabot.ua/analytics/banks-courts-2025

Last week, Oschadbank officially opened its first business hub, Oschadbiznes, in Kyiv and declared it a flagship space for micro, small, and medium-sized businesses (MSMEs).

“Ukrainian businesses need not only loans, but also an environment where ideas, partnerships, and scaling are born. That is why we have created the Oschadbusiness hub, which combines financing, knowledge, and opportunities,” said Serhiy Naumov, chairman of the board of Oschadbank.

The bank noted that the space also provides for educational and business events and has a place for networking.

In turn, Natalia Butkova-Vitvitskaya, a member of the board responsible for SMEs, noted that the hub will operate on a “single window” principle and will become a platform for consultations, participation in grant and partnership programs, as well as access to credit products.

“Next year, the bank plans to expand the Oschadbiznes hub network beyond the capital,” she said, without specifying the number of hubs.

The new branch is located at 26/14 Spaska Street and also includes a premium customer service area.

Oschadbank is the leader in Ukraine in terms of the number of branches—1,142—although in the third quarter, it reduced its network by five branches.

According to Oschadbank, its SME loan portfolio tripled between 2022 and 2025. State grants were received by 25,000 bank customers, and international financial organizations (IFOs) provided approximately UAH 1.5 billion in support. About 20% of the funding was directed to businesses in frontline regions, and half of the customers took advantage of IFO and government guarantee instruments.

As reported, in October 2025, the corporate segment’s loan portfolio grew by 2.6%, or UAH 26.9 billion, to UAH 970.1 billion. Hryvnia loans to businesses added 1.7%, or UAH 11.5 billion, reaching UAH 689.7 billion, while foreign currency loans increased by 4.2%, or $267 million, to $6.68 billion.

According to the National Bank, as of October 1 this year, Oschadbank, with total assets of UAH 485.81 billion, ranked second among 60 banks in Ukraine in terms of this indicator.

€16 million, with EU support, will support procurement of modern trolleybuses and infrastructure improvements

The European Bank for Reconstruction and Development (EBRD) is lending €16 million to the City of Cherkasy in Ukraine to finance the purchase of modern trolleybuses and the upgrade of related infrastructure for the city. The investment will strengthen sustainable urban mobility and ensure uninterrupted public transport services amid the wartime challenges facing Ukraine.

The loan, fully guaranteed by the City, will be co-financed by an investment grant of up to €4 million from the EBRD Shareholder Special Fund and will benefit from partial first loss risk cover under the European Union’s Ukraine Investment Framework Municipal Infrastructure and Industrial Resilience Programme (UIF MIIR). This promotes green transition and resilience in Ukraine’s economy by supporting sustainable investments in green city infrastructure, greening logistics chains, energy efficiency and green technology transfers.

The financing will enable Cherkasyelektrotrans, the municipal public transport operator in Cherkasy, to expand its fleet with new low-floor trolleybuses, modernise depots and other infrastructure, and extend and realign three trolleybus routes.

The project forms part of the EBRD’s Resilience and Livelihoods Framework, aimed at safeguarding essential municipal services during wartime. It will improve mobility for residents, including internally displaced people, and significantly reduce polluting emissions, contributing to better air quality. Aligned with the Paris Agreement’s mitigation and adaptation goals, the project is classified as 100 per cent green finance.

It also promotes inclusion by increasing accessibility for passengers with limited mobility and supporting gender equality through a partnership with UN Women’s She Drives programme, which will train and certify women and youth as trolleybus drivers.

By investing in Cherkasy’s public transport system, the EBRD is helping to maintain vital services, strengthen resilience and advance Ukraine’s green transition during a time of unprecedented challenge.

The EBRD has substantially increased its investments in Ukraine since Russia began its full-scale war there in 2022, deploying more than €8.5 billion to support energy security, vital infrastructure, food security, trade and the private sector.

The Swedish government plans to significantly increase aid to Ukraine, to at least SEK 10 billion in 2026, and in this regard is gradually phasing out development aid to five countries: Zimbabwe, Tanzania, Mozambique, Liberia, and Bolivia.

According to the Swedish government’s official website, in June 2025, the government decided to redirect Swedish aid and allocated approximately SEK 1.7 billion from the aid budget to provide additional support to Ukraine and for vital humanitarian measures around the world.

“We are at a decisive moment in European history. Ukraine is under pressure both at the negotiating table and on the front lines. To increase support for Ukraine, we need to make difficult priorities. Therefore, Sweden is gradually phasing out development aid to Zimbabwe, Tanzania, Mozambique, Liberia, and Bolivia,” said Minister for Aid and Foreign Trade Benjamin Dusa.

Due to the termination of bilateral strategies, embassies in Bolivia, Liberia, and Zimbabwe are being closed. Diplomatic relations with these countries remain important and will be maintained, for example, through accreditation from another country in the region.

It is specified that humanitarian aid is not affected by the termination of development aid, and Sweden continues to be one of the world’s largest donors of humanitarian aid and long-term development cooperation worldwide.