PrJSC United Mining and Chemical Company (UMCC), which has taken over management of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), posted a net profit of UAH 30 million in January-March this year, compared to a loss in the same period last year.

According to the company’s press release on Monday, the company planned to make UAH 20 million in net profit in the first quarter.

According to Yegor Perelygin, First Deputy Chairman of the Board, the last months of 2023 were difficult, but despite this, the management managed to lay a strong foundation for 2024.

“We have made every effort to ensure that our titanium giant operates even in difficult military conditions. Numerous negotiations with contractors and expansion of the geography of end customers are our main task, which we are successfully implementing. We have successfully rebuilt our logistics and alternative supply routes. Today, the brand of the state-owned company UMCC is returning to the EU markets and strengthening in the US. We already have contracts in place for about 135,000 tons, and the planned volumes are more than 200,000 tons,” said Perelyhin.

He added that the company’s branches – IGOK and VMMC – are currently fully loaded in accordance with their plans. The required categories of employees are booked and there are no salary arrears.

At the same time, all work to stabilize the company’s operations is carried out in close cooperation between management and the State Property Fund. As a result, current issues are addressed in a more comprehensive manner, which demonstrates effective results.

The United Mining and Chemical Company started its actual operations in August 2014, when the Government of Ukraine decided to transfer the property complexes of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovska oblast) and Irshansk Mining and Processing Plant (IGOK, Zhytomyrska oblast) to its management. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

The steps announced by the National Bank of Ukraine in the near future to complete the first stage of currency liberalization may require about $5.5 billion in foreign exchange reserves, but are expected to significantly expand business opportunities, improve conditions for attracting investment and private capital participation in the restored and ultimately have a positive impact on economic dynamics, the press service of the National Bank of Ukraine said.

“Currency liberalization will cost $5.5 billion. This is necessary to give more oxygen to business and the economy,” the press service said, adding that these steps have already been taken into account in the updated forecast, which provides for the preservation of international reserves this year and next year at a level close to the current – $43-44 billion.

Representatives of the NBU specified that the completion of the first stage of liberalization includes the possibility of partial payment of new dividends, the removal of restrictions on the import of services, payment of leasing and rent, the possibility of payments on old loans and a number of easing for the work of volunteers and the purchase of goods for military needs.

At the same time, the central bank noted that individual proposals sounding today, for example, to increase the period of return of foreign currency proceeds from the export of basic agricultural products from 90 to 180 days or from 180 to 360 days – for the metallurgical industry may complicate the implementation of such liberalization.

The press service of the NBU added that by the fall of last year the overdue return of foreign currency proceeds exceeded $4.5 billion. According to representatives of the National Bank, the decision taken in mid-November on the return of foreign currency proceeds from major agro-exports within 90 days instead of 180 days had a positive impact on the foreign exchange market, including for the first quarter of this year, the inflow of foreign currency from agro-exports to the market reached $1.3 billion against $800 million in the first quarter of last year.

As reported, at the monetary briefing on April 25, the head of the NBU Andriy Pyshnyy announced in the near future steps on currency liberalization within the framework of the strategy agreed with the International Monetary Fund to ease currency restrictions.

“So far, we see grounds to complete the first stage, which provides for certain relaxations regarding new dividends, the abolition of the ban respectively on imports of services and currency liberalization of the possibility of servicing old debts. Currently, the National Bank is at the stage of finalization and final calibration of these decisions, which we intend to announce in the near future,” he said.

Taking into account the receipt of record external revenues of almost $9 billion in March, international reserves increased by 18%, or $6.7 billion – to a record $43 billion 762.7 million.

Despite the fact that the EU has sharply reduced the amount of Russian gas it imports, significant volumes are still flowing into the bloc. More than two years after Russia launched its full-scale invasion of Ukraine, its gas is still flowing into Europe.

Although the European Union has significantly reduced the amount of gas it imports from Russia, the hydrocarbon still powers some European homes and businesses, thus increasing the Kremlin’s revenues.

When the war broke out, European leaders were forced to reckon with their long-established dependence on both Russian gas and oil. Gas was a particular problem, as in 2021, 34% of EU gas came from Russia.

Central and Eastern European countries were particularly dependent. When the EU proposed a ban, German Chancellor Olaf Scholz was quick to speak out against it. “Europe has deliberately removed energy supplies from Russia from the sanctions. At the moment, Europe’s energy supply for heat production, transportation, electricity and industry cannot be ensured in any other way,” he said.

Vladimir Putin took advantage of this. Throughout 2022, Russia reduced gas imports to Europe. European leaders feared a winter energy shortage. These fears never materialized, but importantly, they meant that the EU never imposed sanctions on Russian gas.

“It was never a sanction,” says Benjamin Hilgenstock of the Kyiv School of Economics. “It was a voluntary decision of the countries, and a reasonable one, to diversify their supplies and no longer blackmail Russia,” he told DW.

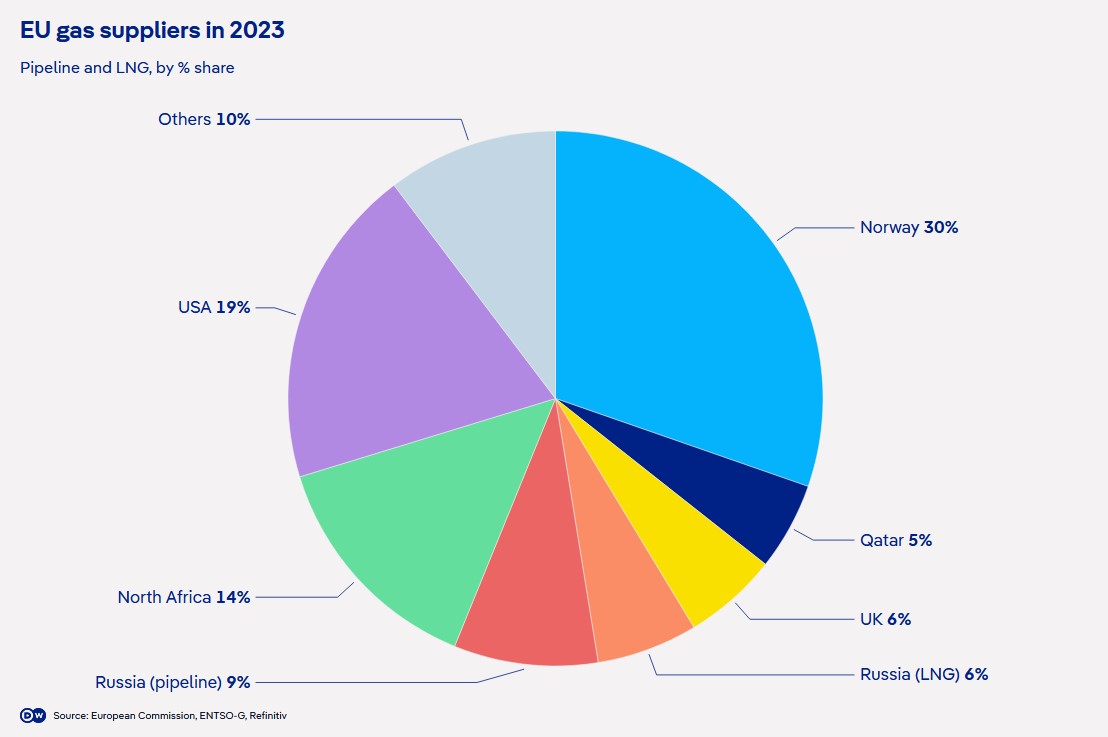

According to EU data, the share of Russian pipeline gas imported by member states has decreased from 40% of the total in 2021 to about 8% in 2023. However, if liquefied natural gas (LNG) – natural gas cooled to a liquid state so that it can be transported by ship – is included, the total share of Russian gas in the EU’s total volume last year was 15%.

One of the main ways to reduce the EU’s dependence on Russian gas has been to increase imports of LNG from countries such as the United States and Qatar. However, this has unwittingly led to a sharp increase in the supply of Russian LNG at high prices to the bloc.

According to Kpler, Russia has become the second largest supplier of LNG to the EU. In 2023, LNG imports from Russia will account for 16% of total LNG supplies to the EU, which is 40% more than in 2021.

Import volumes in 2023 were slightly down on 2022, but data for the first quarter of 2024 show that Russian LNG exports to Europe were up again by 5% year-on-year. France, Spain, and Belgium were particularly large importers. These three countries accounted for 87% of the LNG that entered the EU in 2023.

However, most of this LNG is not needed by the European market and is transshipped in European ports and then re-exported to third countries around the world, resulting in profits for some EU states and companies.

Most of the Russian LNG that comes to Europe is simply “transshipped,” says Hilgenstock. “So it has nothing to do with the supply of natural gas to Europe. It’s just European companies making money by facilitating Russian LNG exports.”

According to a recent report by the Center for Research on Energy and Clean Air

(CREA), just under a quarter of Europe’s LNG imports from Russia (22%) will be transshipped to world markets in 2023. Petras Katinas, an energy analyst at CREA, told DW that most of this LNG was sold to Asian countries.

As a result, some EU members, such as Sweden, Finland and the Baltic states, are putting pressure on the bloc to impose a complete ban on Russian LNG, which would require the consent of all member states.

The EU is currently discussing a ban on re-exporting Russian LNG from European ports. According to the Bloomberg news agency, they are also considering imposing sanctions on key Russian LNG projects, such as Arctic LNG 2, the UST Luga LNG terminal, and the Murmansk plant.

“We really should basically ban Russian LNG,” said Hilgenstock. “We don’t think it plays any significant role in Europe’s gas supply, or that it can be replaced relatively easily with LNG from other sources.” A 2023 study by the Bruegel think tank confirms this analysis.

However, Acer, the EU’s energy regulator, recently warned that any reduction in Russian LNG imports should be done in “gradual steps” to avoid an energy shock.

EU countries continue to receive Russian gas

Pipeline gas from Russia also continues to flow to the EU. Although the Nord Stream pipelines are not working and the Yamal pipeline no longer carries Russian gas to Europe, it still arrives at the Austrian gas hub of Baumgarten via pipelines that pass through Ukraine. Austrian state-owned energy company OMV has signed a contract with Russian gas company Gazprom until 2040.

In February, Austria confirmed that 98% of its gas imports in December 2023 will come from Russia. The government says that it wants to terminate the contract with Gazprom as soon as possible, but for this to happen, EU sanctions against Russian gas must be legally imposed.

Like Austria, Hungary continues to import large quantities of piped Russian gas. Hungary has also recently signed a gas deal with Turkey, but experts say that this gas, which is supplied by the Turkstream pipeline, also comes from Russia.

Gilgenstock says that some countries continue to buy Russian gas because they benefit from cheap and attractive contracts. “So if there is no embargo on Russian gas, it all depends on these countries,” he says.

For countries such as Austria and Hungary, the possible suspension of pipeline imports from Russia may ultimately depend on Ukraine. Kyiv insists that it will not extend the existing agreement with Gazprom on gas supplies through its territory. This agreement expires at the end of 2024.

Although Russian gas is still imported into Europe, its overall share of European gas imports has fallen sharply since 2021. The EU says it wants to be completely free of Russian gas by 2027, a goal that Gilgenstock believes is looking increasingly realistic.

“I think that if this whole messy story has shown us anything, it’s that we can diversify our gas and other energy supplies relatively quickly by getting off Russia,” he said.

However, in his opinion, the political environment is “not very favorable” for a full gas embargo, especially for a pipeline embargo. He cites Hungary’s EU presidency in the second half of 2024 as a potential obstacle. Budapest has closer ties to Moscow than most EU member states.

As for LNG, he is more optimistic and says that, in addition to EU action, major LNG importers such as Spain and Belgium must take action themselves.

“This illegal import of Russian gas is a huge problem, especially in terms of messaging,” he said. “And we are helping Russia with its LNG supply chain, which we shouldn’t be doing.”

Which energy companies were included in the Opendatabot Index?

According to the Opendatabot Index, the total revenue of the top 10 energy companies in Ukraine amounted to almost UAH 750 billion. Half of the top companies are state-owned, and 4 more belong to Rinat Akhmetov’s SCM Group. For the second year in a row, D.Trading, which is part of SCM Group, remains the leader.

According to the Opendatabot Index, the leaders of Ukraine’s energy sector earned UAH 745.87 billion last year. This is 8% more than the total revenue of these companies in 2022, which is UAH 688.45 billion.

This year’s ranking includes 5 state-owned companies and 4 companies belonging to Rinat Akhmetov’s SCM Group. Another company, Kyiv Oblast Energy Company LLC, is owned by Nelia Kostenko.

8 of the top companies are engaged in electricity generation and trading, and two more are engaged in gas trading.

D.Trading, which is part of SCM Group, has been the leader of the group for two years in a row. Last year, the company’s revenue increased by 15% compared to 2022: from UAH 144.18 billion to UAH 165.65 billion. At the same time, net profit increased by 30% in 2023.

Two other companies of Rinat Akhmetov managed to get the biggest increase in revenue. Thus, Kyiv Energy Services increased its revenue by 1.5 times, and Dnipro Energy Services by one third compared to 2022.

It is worth noting that Dnipro Energy Services received the largest increase in profits – 2.5 times – among all the companies included in this year’s Energy Index.

On the contrary, DTEK Zakhidenergo, the fourth company of SCM Group, decreased its revenue by 16% over the year. Last year, the company suffered a loss of UAH 164 million.

Overall, the total revenue of 4 companies owned by Rinat Akhmetov amounted to UAH 262.48 billion in 2023. This is 35% of the total revenue of the top 10 energy companies in the Opendatabot Energy Index.

The ranking of the best companies in the energy sector includes 5 state-owned companies, but only two managed to increase their revenue last year. Thus, Ukrhydroenergo increased its earnings by 30%, and NNEGC Energoatom – by 15%.

It is worth noting that Ukrhydroenergo received the largest net profit among the 10 companies in the Index in 2023 – UAH 17.3 billion. This is almost half as much as in the first year of the full-scale invasion. The revenue of state-owned Ukrenergo remained almost unchanged over the year, at over UAH 82 billion.

Two other state-owned companies involved in gas trading reduced their revenues in 2023 compared to 2022: Naftogaz of Ukraine by 4% and Naftogaz Trading by 9%. Both companies suffered losses in 2023, totaling UAH 10.29 billion.

The last place in the top is taken by Kyiv Regional Energy Company LLC, owned by Nelia Kostenko. The company increased its revenue by 29%, while its profit decreased by a quarter compared to the first year of the full-scale invasion.

https://opendatabot.ua/analytics/index-electricity-2024

In January-March 2024, PZU Ukraine Insurance Company (Kyiv) collected UAH 481 million in insurance premiums, which is UAH 170 million or 54.66% more than in the first three months of 2023.

According to the insurer’s information, the largest increase in payments for the reporting period was recorded in the CASCO and Green Card segments – by 30% and 79%, respectively. In total, UAH 98 million of premiums, or 20% of the insurer’s total payments, were attracted under hull insurance contracts in the first quarter.

Under the Green Card and ROM policies, PZU Ukraine attracted UAH 109 million in premiums, which is 23% of the insurer’s total revenues.

The share of compulsory motor third party liability insurance (MTPL) in the company’s portfolio amounted to 28%, or UAH 135 million of premiums, which is 78% more than in the same period last year. The share of voluntary health insurance amounted to 16%, or UAH 79 million (+63%).

The company’s revenues from other insurance contracts in January-March amounted to UAH 60 million.

PZU Ukraine is a part of one of the largest insurance groups in Central and Eastern Europe – PZU Group (which includes the parent company of PZU Ukraine – PZU S.A.).

The pizza chain Domino’s Pizza Inc. reported an increase in net profit and revenue in the first quarter of 2024, both of which were better than market forecasts.

According to the company’s press release, its net profit in January-March amounted to $125.8 million compared to $104.8 million in the same period a year earlier. Earnings per share increased to $3.58 from $2.93.

Meanwhile, revenue increased by 6% to $1.085 billion from $1.02 billion.

Analysts surveyed by FactSet had on average forecasted earnings of $3.40 per share on revenue of $1.08 billion.

Comparable sales of Domino’s in the United States grew by 5.6% last quarter and by 0.9% globally, according to the report.

Domino’s share prices are up 4.6% in pre-market trading on Monday. Since the beginning of the year, the company’s capitalization has increased by 21% to $17.38 billion.