Law enforcement officers exposed and served suspicion notices to seven members of a criminal group who organized four drug laboratories for the production of amphetamine and the precursor phenylnitropropene and sold banned substances in Ukraine and neighboring countries, the Prosecutor General’s Office reports.

“According to the investigation, the suspects have set up a supply channel for precursors and potent drugs, as well as processes for the manufacture and sale of amphetamine and precursors of phenylnitropropene and nitroethane throughout the country. The members of the drug group set up four drug laboratories in apartments in Kyiv region, with a capacity to produce over 50 kg of precursors per month. Of these, 40 kg of amphetamine was subsequently produced. This provided the defendants with a stable income of more than UAH 16 million per month,” the statement said.

The criminals set up a warehouse for precursors at the workplace of one of the group members, who worked in the capital’s market. The suspects sold the “products” through logistics companies using fictitious personal data, as well as to trusted persons from hand to hand. The money was received on bank cards issued to other accomplices.

Law enforcement officers conducted 23 simultaneous searches in drug labs, warehouses, residences and cars of the suspects.

Almost 400 liters of nitroethane, which could be used to synthesize about 300 kg of amphetamine, 25 kg of various precursors, more than 3 thousand MDMA pills, 430 g of amphetamine, 205 g of cannabis, laboratory equipment, weapons and ammunition, and two cars used in their criminal activity were seized.

The estimated value of the seized prohibited substances may amount to UAH 122 million.

The members of the drug group were detained in accordance with Art. 208 of the CPC of Ukraine. The issue of choosing a measure of restraint is being decided.

German industry may not fully recover to levels seen before the energy crisis due to high prices for imported liquefied natural gas (LNG), according to Markus Krebber, chief executive of German energy company RWE.

“Gas prices in continental Europe, and especially in Germany, are structurally higher now because we are ultimately dependent on LNG imports,” he told the Financial Times. – German industry is at a disadvantage.”

Gas prices in Europe have fallen about 90 percent from peak levels seen in 2022, but remain about two-thirds higher than in 2019, the FT wrote, citing data from Argus.

Krebber criticized Angela Merkel’s government’s decision in 2011 to abandon nuclear power without finding an alternative to Russian gas.

“When you know exactly what you want to give up, you should immediately start thinking about introducing new technologies,” he said.

Analysts are pessimistic about the prospects for Germany’s economy, Europe’s largest. According to the assessment of the five leading research institutes of Germany, the country’s GDP in 2024 will grow by only 0.1% due to the decline in exports and weak domestic demand. In 2023, the German economy contracted by 0.3%.

According to S&P Global Commodity Insights, demand for natural gas in the industrial sector in Europe fell by 24% in 2023 compared to 2019. The company’s experts believe that about 6-10% of European demand will be lost irretrievably due to demand destruction.

At the same time, the U.S. has a consistent and comprehensive policy to encourage the return of production capacity to the country, Krebber said. “Europe has the same intentions, but so far there are no proper measures in place,” he added.

A survey by the German Chamber of Commerce and Industry last September showed that 43% of large industrial companies plan to move their business outside Germany, with the US a priority. Last year, German companies announced investments of $15.7 billion in projects in the U.S., compared with $8.2 billion a year earlier, according to fDi Markets.

The number of insurance companies in Ukraine in March 2024 has not changed and as of the end of the month there are 86 risk insurers, 12 specializing in life insurance, one insurer with a special status (“Export Credit Agency”), according to the NBU website. At the same time, two insurance brokers are included in the register.

In general, the number of non-banking financial market participants in March decreased from 1,060 (as of February 29, 2024) to 1,056 (as of March 31, 2024).

The German government will donate about 400 generators to Ukraine to help fight Russian aggression, the German Embassy in Kyiv reports.

“Recent Russian air strikes have destroyed and damaged power plants in Ukraine. Millions of people, especially in Sumy and Kharkiv, were temporarily left without electricity. The German government is supplying > 400 generators to strengthen Ukraine in its fight against Russian aggression,” the statement posted on Facebook reads.

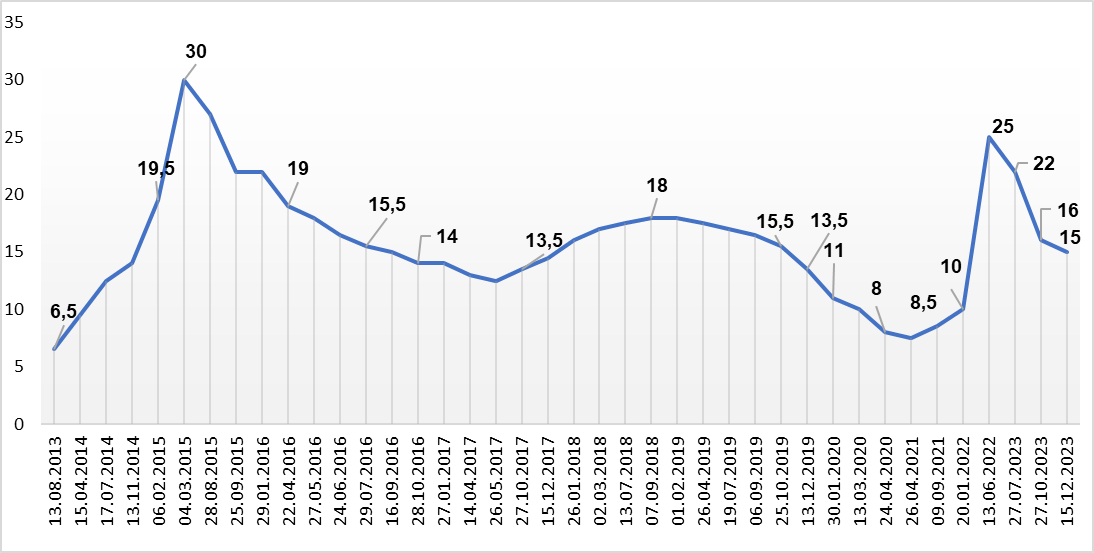

Dynamics of changes in discount rate of NBU – from 2013 to end of 2023

Source: Open4Business.com.ua and experts.news

PJSC Ukrnafta is launching a revitalization program and invites investors to participate in the restoration of the first 20 wells.

“An important part of the company’s strategy to increase production is the restoration of already drilled but abandoned wells that have prospects through the use of modern technologies,” the company said in a press release, citing Ukrnafta CEO Serhiy Koretsky.

Currently, 4222 such wells have been identified, of which 2100 are within Ukrnafta’s special permits, 700 of which are within the reserve contours.

“The company has selected 30 wells out of these 700 for the pilot. 10 will be restored on our own, and a tender is announced for 20. The company invites partners to help restore production at these sites by drilling horizontal sidetracks,” the document explains.

The company offers a deal based on the Risk Service Agreement, under which the investor must pass compliance and get access to the Virtual Data Room with information about the well.

“Ukrnafta, for its part, together with specialists, is forming a pool of wells, from three to 12, which will be restored by drilling at the expense of partners. The cost of restoring production from the wells is determined by bidding in the Prozorro system.

Subsequently, Ukrnafta receives an additional resource and pays for the revitalization using the funds from production from the restored wells. The partners, for their part, receive a share of the additional production from the revitalized wells.

“Any Ukrainian and international company that passes the compliance procedure can join,” the company said.

As reported, in 2023 Ukrnafta increased oil and condensate production by 3% (by 39.9 thousand tons) compared to 2022 – up to 1 million 409.9 thousand tons, gas production by 5.8% (by 60.4 million cubic meters), up to 1 billion 97.4 million cubic meters.

The company’s strategic goal is to double oil and natural gas production to 3 million tons and 2 billion cubic meters by 2027, respectively.

“Ukrnafta is the largest oil company in Ukraine and operates a national network of 537 filling stations, of which 456 are in operation. The company is implementing a comprehensive program to restore operations and update the format of its filling stations. Since February 2023, Ukrnafta has been issuing its own fuel coupons and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share. On November 5, 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state a share of corporate rights of the company owned by private owners, which is now managed by the Ministry of Defense.