International rating agencies S&P Global and Fitch have downgraded their outlooks for China’s residential real estate market.

real estate, despite Beijing’s announced package of measures to support it.

S&P forecasts a 15% decline in housing sales in China this year, while earlier it expected a 5% decline. According to the agency’s forecast, published on Thursday, the volume of sales of residential real estate in the country will total less than 10 trillion yuan ($1.4 trillion) this year, about half the peak level recorded in 2021.

Fitch this week also worsened its forecast for home sales in the PRC: the agency now expects sales to fall by 15-20% this year, rather than the 5-10% previously estimated.

The lowered forecasts show that rating agencies are not confident in the success of a large-scale package of market support measures, the launch of which the Chinese authorities announced in May. In particular, it includes the abolition of the lower limit on mortgage rates, as well as lowering down payment requirements for real estate buyers using mortgages. In addition, Beijing urged authorities in cities with a surplus stock of ready-made houses to buy back properties at reasonable prices for later use as affordable housing.

Prices of new buildings in China’s major cities fell for the 11th straight month in May. According to a report by China’s State Statistics Office (SSO), the cost of new housing in the country’s 70 largest cities fell 3.9% year-on-year last month, the most since June 2015.

Real estate accounts for about 78% of Chinese residents’ wealth, Bloomberg notes.

Poland is becoming an increasingly popular destination for real estate investment among foreigners. This is due to economic stability, a growing real estate market and attractive prices. In this article, we will look at the peculiarities of buying and selling real estate in three key Polish cities: Wroclaw, Krakow and Warsaw.

Wroclaw: The city of a thousand bridges

Buying real estate in Wroclaw

Wroclaw, with its rich history and cultural heritage, is one of the most attractive cities for investment. Buying real estate in Wroclaw offers a variety from historic buildings in the city center to modern apartments in new residential complexes.

– Prices: The average price per square meter in Wroclaw ranges from 7000 to 11000 PLN, depending on the neighborhood and the condition of the property.

– Buying process: The process begins with selecting a suitable property, checking its legal purity and finalizing the transaction through a notary.

Additional costs such as purchase tax (2%) and notary fees should also be taken into account.

Real estate for sale in Wroclaw

Selling real estate in Wrocław can be profitable, especially if the property is located in a prestigious area or has unique characteristics.

Preparation for sale: It is important to properly prepare the property for sale by making the necessary repairs and putting it in an attractive condition.

Marketing: Effective marketing, including professional photos and advertising on popular platforms, can significantly speed up the sale process.

Krakow: The cultural capital of Poland

Buying real estate in Krakow

Krakow is known for its old town and universities, which makes it attractive for students and tourists. Buying real estate in Krakow can be a great investment for both living and renting.

– Prices: The average price per square meter in Krakow is between 8000 and 12000 PLN.

– Buying process: Buying real estate in Krakow requires a thorough check of the documents and the legal purity of the property. Notary fees and purchase tax should also be taken into account.

Selling real estate in Krakow

Selling real estate in Krakow can be particularly lucrative due to the constant demand from students and tourists.

– Preparing for the sale: Before putting a property up for sale, it is important to assess the market value and, if necessary, improve the condition of the property.

– Marketing: Placing ads on popular websites, using social media and professional photography will help attract more potential buyers.

Warsaw: The capital and economic center of Poland

Buying real estate in Warsaw

Warsaw, as the capital of Poland, attracts investors from all over the world. Many international companies have their headquarters here, which makes the real estate market very active.

– Prices: The average price per square meter in Warsaw varies from 9000 to 15000 PLN.

– Buying process: Buying real estate in Warsaw requires attention to detail and legal aspects. It is recommended to use the services of professional realtors and lawyers.

Selling real estate in Warsaw

Selling real estate in Warsaw can be very profitable, especially in central areas and areas with good infrastructure.

Preparation for sale: High-quality preparation of the property, including renovation and decoration, will help to increase its attractiveness.

– Marketing: The use of various marketing channels, including online platforms and social media, will help to reach a wide audience.

Conclusion.

Buying and selling real estate in Wroclaw, Krakow, and Warsaw has its own peculiarities, but in all cases it is important to take into account legal aspects, market trends, and effective marketing strategies. Whether you are looking for a home for yourself or an investment, Poland offers many opportunities for successful real estate transactions.

More than a thousand families have received monetary assistance from the Ukrainian Red Cross for rehabilitation.

“1,196 families from Kiev and Mykolaiv have received monetary assistance from the Ukrainian Red Cross for the rehabilitation of children and adults totaling more than 35 million hryvnias,” the Ukrainian Red Cross said on Facebook on Thursday.

The Ukrainian Red Cross provided cash assistance to patients undergoing rehabilitation at the National Children’s Specialized Hospital of the Ministry of Health of Ukraine “Okhmatdet” in Kiev and several rehabilitation centers in Mykolaiv under the Cash for Rehabilitation program supported by the British Red Cross. Each patient under the program received 30 thousand hryvnias.

“This amount was determined based on the results of a preliminary survey among families whose children or relatives are undergoing or need physical rehabilitation in medical institutions of the country, in particular, in the Okhmatdet hospital in Kiev and institutions in Mykolaiv,” said Elena Skrypnikova, head of the Innovative Financing Department of the Ukrainian Red Cross.

According to her, the categories of injuries and illnesses for which monetary assistance is provided have also been defined: rehabilitation after wounds received as a result of hostilities or the action of explosive objects; rehabilitation services due to congenital diseases; rehabilitation due to chronic diseases, in particular, oncological, cardiovascular and others.

The majority of children and adults who received cash assistance already have disability status or are in the process of obtaining it. In addition, families surveyed indicated a need for auxiliary aids such as wheelchairs, walkers, hand or foot orthoses.

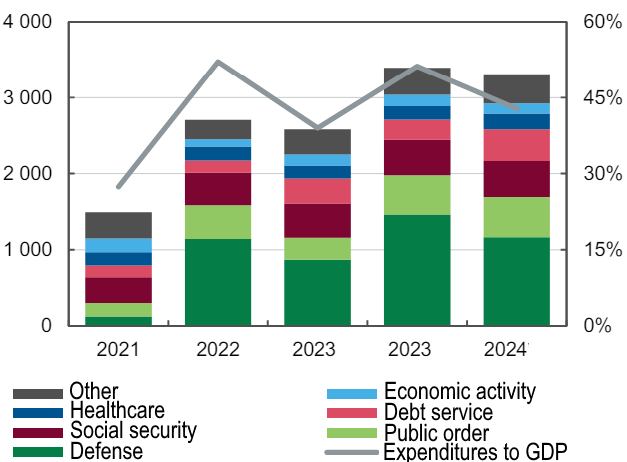

Components of state budget expenditures in 2021-2024, UAH bln

Source: Open4Business.com.ua and experts.news

The Ministry of Economy of Ukraine, together with the European Union and the German government, has launched a new grant program worth EUR 480 thousand, under which 12 small and medium-sized enterprises will be able to receive funding of up to EUR 40 thousand to develop their exports, the press service of the Ministry of Economy reports.

According to the report, the program is open to small and medium-sized Ukrainian businesses operating in the processing industry (food, light industry, mechanical engineering, construction, furniture manufacturing, etc.), the creative industry (fashion, design, etc.), and other industries with export and innovation potential.

The project is expected to provide 12 selected participants with a grant of up to EUR 40 thousand each, as well as group and individual consultations from experts, networking sessions, and other activities that will help identify and eliminate processes that “block” businesses on the way to export and innovation development.

Applications for participation in the grant program can be submitted until 23:59 on June 25, 2024 on the project website.

“Since the start of the full-scale Russian invasion, the EU4Business program has provided almost EUR 8 million to support SMEs in Ukraine (…). With this grant program, we want to help Ukrainian businesses overcome the consequences of the war, provide access to finance, help them find new markets, and improve the business environment in Ukraine,” said Henrik Witfeldt, Head of Public Finance, Business Support and Social Policy at the EU Delegation to Ukraine.

As reported, the EUR 480,000 grant program for small and medium-sized businesses is part of the EU4Business international cooperation program: SME recovery, competitiveness and internationalization. It is jointly funded by the European Union and the German government and implemented by the German federal company Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. The program’s implementing partner in Ukraine is the Global Compact Network in Ukraine.

The European Bank for Reconstruction and Development (EBRD) plans to provide EUR140 million in guarantee financing to state-owned PrivatBank (Kyiv), which will cover up to 50% of the credit risk on new loans of EUR400 million in equivalent.

According to information on the bank’s website on Thursday, its board of directors intends to consider this project on July 24, 2024.

It is specified that the guarantee funding will be provided to PrivatBank in two equal tranches, each of which will provide partial coverage of risks under new loans worth EUR 200 million, while only one tranche has been agreed upon so far.

The project also provides for a sub-limit of up to EUR 60 million to finance long-term investments by micro, small and medium-sized enterprises (MSMEs) to modernize technologies and equipment in accordance with EU standards, including investments in sustainable and green technologies (70% of the sub-limit), thereby increasing the competitiveness of enterprises.

It is noted that eligible sub-borrowers will also receive EU-funded technical assistance and grant support in the form of investment incentives after the completion of investment projects.

According to the EBRD website, the financing is intended primarily to support Ukrainian companies in primary and secondary agriculture, as well as other critical sectors necessary to ensure the country’s energy security.

“At the same time, priority will be given to MSMEs and corporate borrowers investing in projects that increase energy security and efficiency in Ukraine,” the release says.

As reported, EBRD Vice President Matteo Patrone and PrivatBank CEO Gerhard Bösch signed a letter of intent to start working on a risk-sharing agreement during the Ukraine Recovery Conference in Berlin on June 11-12.

According to the National Bank of Ukraine, as of May 1, 2024, PrivatBank ranked 1st in terms of assets (UAH 857.00 billion) among 63 banks operating in the country. The financial institution’s net profit last year amounted to UAH 37.8 billion. The EBRD notes that the state-owned bank’s network currently includes 1,200 branches across the country, 6,800 ATMs and 1,040 terminals.