India imported $3.13 billion worth of gold in July 2024, the country’s Ministry of Commerce and Industry said. This is 11% less than in July last year, but 2% more than in June this year.

Demand for gold in India both this year (the season of purchases – August-December), and in the long term can grow significantly due to the reduction of customs duties, says World Gold Council analyst Kavita Chako. Duties on gold have been reduced from 15% to 6%, on gold doré – from 14.35% to 5.35% – such a sharp decline has never been. Moreover, for almost 11 years the duties have never fallen below 10%. The changes came into force on July 24.

In total for 7 months of the year gold imports to India amounted to $22.234 billion, which is 12% more than the result of the corresponding period last year. India is one of the largest consumers of gold in the world, practically not producing it itself.

The Ukrainian Hydrometeorological Center warns of an extraordinary level of fire danger in Kyiv and the region on August 17 and 18.

“Weather conditions will contribute to a high probability of fires in ecosystems in the presence of sources of ignition (open fire),” the center said in a statement on its Telegram channel on Friday.

The Kyiv City State Administration (KCSA) asks residents and guests of the capital to follow fire safety rules, not to use faulty or damaged electrical equipment, not to make fires, in particular, in parks and forest park areas, etc.

The KCSA reminds of the decision of the Kyiv City Defense Council to ban visits to forests and forest park areas under martial law, both on foot and by transport.

In addition, it is reported that according to Article 152 of the Code of Administrative Offenses of Ukraine, a fine of UAH 340 to UAH 1,360 is provided for lighting a fire in unauthorized places.

There is also a strict ban on burning dead wood in Ukraine, the violation of which is punishable by a fine: for citizens – from UAH 6120 to 12240; for officials – from UAH 21420 to 30600.

According to customs statistics released by the State Customs Service of Ukraine, zinc exports for seven months of this year amounted to $120 thousand (and in July – $21 thousand), while in January-July last year it amounted to $86 thousand.

Zinc exports abroad in 2023 amounted to $130 thousand against $1.331 million in 2022.

Pure metallic zinc is used to restore noble metals, used to protect steel from corrosion and for other purposes.

Prices for live pigs increased by 5.5% over the week and reached 61.8 UAH/kg on average in the country, the Ukrainian Pig Association (UPA) reported.

According to the report, last Friday’s auction ended with an increase in purchase prices for slaughter pigs by 2-4 UAH/kg. Therefore, in mid-August, live pork prices mostly tended to 61.5-62 UAH/kg, although in some places quotes were announced in a wider range – 60-63+ UAH/kg.

“The expectations of the meat processing industry representatives regarding further price dynamics are not uniform. Thus, some operators note that the trade is quite stable, while others, on the contrary, have felt some activation since the second half of the week, as additional applications began to arrive,” analysts said.

Processing enterprises consider the seasonally adjusted supply of conditioned pork to be mostly sufficient to meet their current needs for raw materials, but do not rule out the possibility of further positive price correction by at least 1-2 UAH/kg, the industry association summarized.

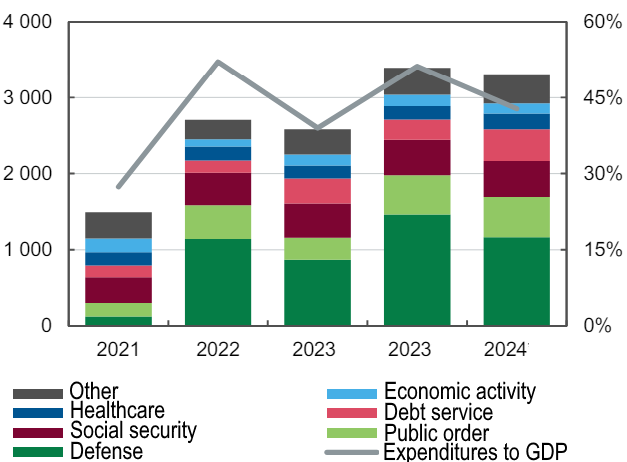

Components of state budget expenditures in 2021-2024, UAH bln

Source: Open4Business.com.ua

Agrotrade has started sowing winter crops for the 2025 harvest on 27.9 thousand hectares, the company’s press service reports on its Facebook page.

According to the report, the sowing campaign started with winter rapeseed, for which almost 12.5 thou hectares have been allocated in Kharkiv, Chernihiv, Sumy and Poltava regions, which is 1.3 thou hectares more than last season.

“The change in the area under winter rapeseed is primarily due to crop rotation requirements. This year, we started the sowing campaign simultaneously in Kharkiv, Sumy and Chernihiv regions. The work has already gained momentum and will last a total of two weeks. They were preceded by high-quality preparation, such as peeling, plowing, leveling and fertilizing,” said Oleksandr Ovsyanyk, Director of Agrotrade’s Agricultural Department.

Currently, more than 24% of the planned area has been sown with the crop, and 15 units of machinery are involved.

“We will soon start sowing winter wheat, for which Agrotrade has allocated 15.4 thousand hectares,” the agricultural holding summarized.

The Agrotrade Group is a vertically integrated holding company with a full agro-industrial cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernihiv, Sumy, Poltava and Kharkiv regions. Its main crops are sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a simultaneous storage capacity of 570 thousand tons.

The group also produces hybrid seeds of corn and sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20 thousand tons of seeds per year was built on the basis of Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

Vsevolod Kozhemiako is the founder and CEO of Agrotrade.