The number of corporate bankruptcies in the U.S. in January-August 2024 reached a four-year high for the period and was the second highest since 2010, according to calculations by S&P Global Market Intelligence. The country recorded 452 bankruptcies in the first eight months of this year, up from 466 in the same period in 2020 and 604 in January-August 2010.

Sixty-three companies declared insolvency in August compared to 49 in July. A higher number of bankruptcies were only seen in June and April, 72 and 68 respectively.

The three companies that filed for bankruptcy court last month have debts above $1 billion are solar energy technology provider SunPower Corp. whose stock trades on the open market, as well as perfume and cosmetics seller Avon International Operations Inc. and gas station and convenience store operator SQRL Service Stations LLC.

“U.S. companies continue to face a number of challenges this year, including high interest rates and geopolitical uncertainty,” S&P said in the report.

In 2023, 634 companies declared insolvency in the U.S. (up from 441 in January-August). In 2020, there was a peak of bankruptcies (638 companies) after the previous peak in 2010, when 827 companies collapsed.

The Experts Club think tank recently released a video on the history of defaults and a table of countries at risk of default in the medium term. For more details, see the video on Experts Club’s YouTube channel:

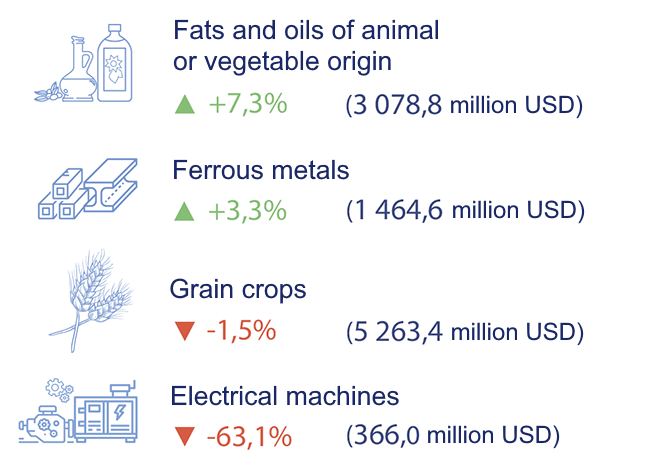

Dynamics of export of goods in jan-june 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua

The number of bankrupt companies in the European Union in the second quarter of 2024 increased by 3.1% compared to the previous three months, according to the EU Statistics Office. The increase in the number of insolvent companies was recorded in construction (+3.8%), financial sector (+2.6%), trade (+2.4%) and industry (+1.6%).

At the same time, their number decreased in education and social activities (-1%), in the hotel and catering sector (-1.1%), in transportation (-1.6%), and in information and communications (-4.8%).

At the same time, the number of business registrations in the European Union fell by 2.1% compared to the first quarter, with declines in all sectors of the economy.

The largest declines were recorded in trade (-4.7%), industry (-3.6%), and education and social activities (-3.4%), with the smallest decline in finance (-0.7%).

Recently, the Experts Club information and analytical center released a video about the history of defaults and a table of countries that may face the risk of default in the medium term. For more details, see the video on Experts Club’s YouTube channel:

The German government intends to allocate 400 million euros for the purchase of weapons for Ukraine, Stern magazine reported on Thursday.

“The federal government wants to allocate an additional 400 million euros for military support to Ukraine as soon as possible. This follows from a letter from the Ministry of Finance to the Bundestag Budget Committee, which was obtained by the State Tax Administration,” the publication informs.

The money is to be used to purchase air defense systems, drones and protective equipment for the Ukrainian military.

At the same time, according to Stern, State Secretary of the German Ministry of Finance Florian Tonkar warned that “without a significant increase in material support, Ukraine will be defeated.”

The magazine reminds that the German government plans to allocate 1.42 billion euros for military support to Ukraine by the end of 2024. This is 397 million euros more than budgeted, so the Bundestag’s consent is required for additional spending.

American Tupperware Brands Corp., known for its plastic food storage containers, has filed for bankruptcy.

“Over the past few years, the company’s financial position has been severely impacted by the challenging macroeconomic environment,” said Tupperware CEO Lori Ann Goldman.

The company’s shares have fallen by 75% since the beginning of 2024.

Tupperware initiated bankruptcy proceedings in accordance with Article 11 of the US Bankruptcy Code. The company needs court approval to continue operations and speed up the process of selling the business while protecting its brand.

Tupperware was founded in 1946 by chemist Earl Tupper, who developed airtight plastic containers to help American families preserve food and save on costs. The company’s products are distributed through direct sales by Tupperware consultants around the world. The so-called “Tupperware parties” – events for cooking together using the company’s products – have also gained popularity.

In recent years, however, Tupperware has been experiencing serious difficulties, facing a decline in demand for its core products, increased competition, and a lack of liquidity, the WSJ notes.

Recently, the Experts Club information and analytical center released a video on the history of defaults and a table of countries that may face the risk of default in the medium term.

Watch the video on the Experts Club YouTube channel for more details: https://youtu.be/gq7twYrWuqE?si=KneYUbl2rNOUIGTM

PrJSC United Mining and Chemical Company (UMCC), which has taken over management of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), is expected to increase its sales by 68% year-on-year to 221,847 thousand tons in January-September this year.

In particular, sales of ilmenite by IGOK in the first nine months of 2014 will amount to 60.961 thousand tons (a twofold increase), by VMMC – 51.755 thousand tons (a 1.66-fold increase), rutile – 6.767 thousand tons (minus 19%), and zircon – 7.436 thousand tons (a twofold increase).

As UMCC’s acting CEO Yegor Perelygin told LIGA.net in an interview, both branches of the company are currently operating steadily, although there are nuances with electricity, lack of working capital – liquidity of working capital, and staff shortages.

“At VMMC, we were able to reach healthy stripping rates in the summer, ranging from 800,000 to one million cubic meters per month. These are optimal parameters in the context of the ratio of stripping to production in the warmer months of the year. The plant itself operates at a stripping ratio of about 4.5. That is, if we want to produce 200 thousand cubic meters of ore steadily every month, we need to continue stripping according to these parameters,” explained the head of UMCC.

In July, IGOK restarted stripping and mining operations to fulfill the US contract. Two open pits are now in operation, one for stripping and one for mining.

Currently, the company has no debts for electricity, gas, reagents, etc., and its equipment is working steadily.

The CEO clarified that 90% of production is exported, almost all ilmenite is supplied to the US and Mexico to the end user, Chemours.

“Taking into account September, we have already started all the planned shipments. There is an accumulated warehouse in the port of Constanta in Romania. There is ilmenite in Pivdenne, some of it is going to Izmail and Chornomorsk. And there is already accumulated ilmenite at the plants, which we will sell and ship in the near future,” stated Perelygin.

Over the past nine months, VGMK sold more than 50 thousand tons of ilmenite and IGOK sold more than 60 thousand tons of ilmenite. In total, we sold 110 thousand tons of ilmenite during this period, which is a significant dynamic that we could not even imagine at the beginning of 2023, the acting Chairman of the Board noted.

“If we take rutile and zircon together, we have sold 15 thousand tons since the beginning of the year. The situation with zircon is better than last year. Rutile is another matter. There is a lot of low-TiO2 rutile from Africa and China on the global market. China buys collective HMC (Heavy Mineral Concentrate) from Africa and Asia. They don’t even expect it to be used as a final product; they process it at home. Then they put it on the market at dumping prices. This is a problem for all of us. We will never be able to compete with the notional Sierra Leone or Mozambique, where mining is done by an open-pit method and at low cost. We also have an open-pit mining method, but we are dealing with low beta and rather high production costs,” the top manager explained.

He added that one of our main problems is the high cost of electricity: currently, the share of electricity is 33-35% of production costs.

Regarding ilmenite, UMCC has a very limited geography where it can sell. Ilmenite is considered a dual-use commodity in Ukraine, as it is the raw material for a very difficult and intensive processing process that can produce a titanium sponge. If you go through several very intensive processing stages in terms of energy consumption and capital investment – from ilmenite concentrate to titanium slag, then to titanium tetrachloride and then to titanium sponge – then it becomes possible to melt down titanium sponge into ingots.

But even an ingot is a semi-finished product that still needs to be processed into the final form and product. And then it can be used to make an aircraft part, a medical implant, etc. However, most ilmenite is processed into TiO2 pigment.

“Today, the export of ilmenite is strictly regulated by the State Export Control Service (SECS). We have now reached an understanding with this authority and implemented all the necessary procedures and regulations for exporting to the US market and other markets as well. There are not many companies in the US that could buy ilmenite. Therefore, there are no problems with America. There is full support from us and from the State Energy and Environmental Protection Agency. But we cannot work only on the US market, concentration is a risk for us,” the CEO said.

The US buys ilmenite concentrate from Ukraine to produce TiO2 pigments. The US is currently building a new complex for processing cast metal billets, which means they will buy sponge from somewhere else and process it into the final product.

He added that UMCC is also working with a large European company in the Czech Republic.

“It is important for me that our ilmenite gets to the Asian market. For example, to Japan. And that we gradually look for an opportunity to discover China, the largest titanium market in the world. But as for China, we need to make sure that our products are processed into pigment. Relatively speaking, white paint,” said Perelygin.

Regarding the resource base of UMCC, he explained that the nominal capacity of IGOK is 180-200 thousand tons of finished products per year, or 2.5 million tons of ore production per year. Reserves are 35-40 million cubic meters, for 15 years of production. However, the company has a Selyshchansky area near Irshansk, where a full geological study is underway. According to estimates, the reserves could be more than 30 million cubic meters. In total, in Zhytomyr region, the company can optimally operate for at least 25-27 years on the existing reserves.

IGOK was built with a focus on sulfate processing, with a focus on processing into pigment. This is the main raw material for the Czech Republic, Poland, Slovenia, Ukraine, and China, and the issue of expanding sales is currently being addressed.

“If there are opportunities for systemic investment in the future, we can produce titanium slag. But then the question of production costs and competitiveness will arise. In particular, with regard to global players such as China. To work with the US market on a large scale, we need desulphurization. To enter the Saudi market with our ilmenite, we need to reduce phosphorus, magnesium and SiO2. We will look for options to make a cleaner product,” the CEO said.

As for VGMK, the North and South areas are currently being developed at the end of the open pit with reserves of 20 million cubic meters. The North site will be completed soon, then the focus will be on the South site starting in mid-2025. At the same time, there are so-called Blocks 7-10, which are planned to be developed after the documentation and calculations are completed – most of the reserves are there, but there are questions about the development technology. If we develop 2 to 3 million cubic meters annually, we will have enough reserves for six years.

“Does it make sense to expand the possibilities of connecting other assets to UMCC? Of course it does, because expanding the resource base is always a plus. Of course, the merger of Matronovskiy GOK with VGMK would be a big plus. However, I cannot provide a legal assessment of what is happening around this idea. As a 100% state-owned company, it is very difficult for us to take individual steps. We can’t just buy out the debt of this company,” Perelygin said.

At the same time, he pointed to the search for investments. It is also necessary to deal with the license, which is now in court, and hold an auction at an open tender. UMCC is ready to participate in auctions for special permits that interest the company.

As for Demurinsky GOK, Perelygin assured that he could make Demurinsky GOK profitable. However, the maximum production capacity of Demurinsky GOK is 400-500 thousand cubic meters of ore per year, which is a small volume. Therefore, we need to focus on more tactical and short-term actions. If we merge DGOK with UMCC, it would make sense to transport DGOK’s collective concentrate to VMMC and mix it during the production cycle.

As for the loan from Ukreximbank, it was successfully restructured in early summer and relations with the bank have been normalized. This year, we have repaid more than UAH 50 million of the principal debt, and over the year, the debt has decreased from UAH 276 million to UAH 207 million. This loan is no longer critical for the company’s operations.

“UMCC really needs optimization and automation. Firstly, it has a Soviet legacy in the form of various sanatoriums, homes and boarding houses. These are so-called non-core assets that burden the company financially. The second is the large number of labor, sometimes duplicated. The third problem is the automation of decision-making and accounting systems. The fourth is the launch of new energy-efficient equipment and programs to optimize electricity consumption,” said the CEO.

UMCC started its actual operations in August 2014 after the property complexes of Vilnohirsk Mining and Metallurgical Plant and Irshansk Mining and Processing Plant were transferred to its management by the Cabinet of Ministers. On December 8, 2016, the state-owned enterprise was reorganized into UMCC, and on December 26, 2018, it was transformed from a PJSC into a PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

Ukraine has scheduled the auction of a 100 percent stake in UMCC for October 9, 2024, via Prozorro.Sale. The starting sale price is UAH 3 billion 899.358 million.