PJSC Ukrnafta invites potential and regular contractors to a series of workshops aimed at improving the transparency and efficiency of procurement processes, including the lease of special equipment for production needs in 2025. These events are part of the company’s strategy to develop long-term and reliable partnerships.

Topics of the first meeting:

Types of services to be procured:

The workshops provide a unique opportunity to get better acquainted with the requirements of PJSC Ukrnafta, learn about the specifics of work and establish cooperation with the largest oil company in Ukraine.

Don’t miss the opportunity to become our partner! Register now to learn more and get answers to all your questions during the workshop.

Date of the meeting: September 18, 2024

Time: 11:00

Venue: Headquarters of PJSC Ukrnafta, 3-5 Nestorivskyi lane, Kyiv, Ukraine

Participation format: Personal presence or online connection via Microsoft Teams.

Registration for participation:

Participants should register via the Google form or send an application to the following email address:

ruslan.puzii@ukrnafta.com with a copy to daria.obodets@ukrnafta.com

The letter should include:

Contact information for your reference:

Demian Pashkovsky

Head of the dispatching sector

Phone: +380 50 739 65 29

About PJSC Ukrnafta:

PJSC Ukrnafta is the largest oil company in Ukraine engaged in the production and sale of petroleum products. The company actively develops partnerships and implements innovative solutions to ensure stable energy supply of the country.

Ukrainian mining companies have increased exports of iron ore in physical terms by 2.1 times year-on-year to 23 million 318.681 thousand tons this year.

According to the statistics released by the State Customs Service on Friday, foreign exchange earnings from iron ore exports increased by 72.1% to $2 billion 32.671 million in the period under review.

Iron ore was exported mainly to China (36.39% of supplies in monetary terms), Slovakia (17.04%) and Poland (16.94%).

In January-August 2024, Ukraine imported iron ore worth $223 thousand in the total volume of 794 tons, while in January-August 2023 it imported iron ore worth $81 thousand in the total volume of 118 tons. Imports this year were carried out from the Netherlands (31.70%), Poland (28.57%) and Norway (18.75%).

As reported, in 2023, Ukraine decreased exports of iron ore in physical terms by 26% compared to 2022 – to 17 million 753.165 thousand tons, foreign exchange earnings from iron ore exports amounted to $1 billion 766.906 million (down 39.3%). Iron ore was exported mainly to Slovakia (28.39% of supplies in monetary terms), the Czech Republic (19.74%) and Poland (19.56%).

Last year, Ukraine imported iron ore worth $135 thousand in the total amount of 250 tons. During this period, imports were made from Norway (34.81%), Italy (28.89%) and the Netherlands (28.89%). While in 2022, iron ore was imported for $65 thousand in a total volume of 101 tons.

In January-August this year, Ukrainian companies increased imports of copper and copper products by 20.1% in value terms compared to the same period last year, to $92.824 million.

According to customs statistics released by the State Customs Service of Ukraine on Friday, exports of copper and copper products increased by 16% to $58.224 million over the period under review.

In August, copper was imported for $8.304 million and exported for $8.878 million.

In addition, in January-August 2024, Ukraine increased imports of nickel and products by 68.5% compared to the same period in 2023 to $18.6 million (in August – $1.620 million), aluminum and aluminum products by 20% to $292.701 million (in August – $42.649 million).

At the same time, the country reduced imports of lead and lead products by 14.8% to $615 thousand (in August – $5 thousand), imports of tin and tin products increased by 7.8% to $1.842 million (in August – $307 thousand), and increased imports of zinc and zinc products by 32.9% to $38.242 million (in August – $4.882 million).

Exports of aluminum and aluminum products in the first eight months of 2024 increased by 31.1% compared to the same period a year earlier to $82.966 million (in August – $11.901 million), lead and lead products decreased by 25.9% to $7.315 million (in August – $823 thousand), nickel and nickel products amounted to $508 thousand (in August – $85 thousand), while in January-August 2023 it was $201 thousand.

Zinc exports for the first eight months of this year amounted to $201 thousand (in August – $79 thousand), while in January-August 2023 it was $88 thousand. Exports of tin and products amounted to $344 thousand (in August – $2 thousand) against $53 thousand in the same period a year earlier.

As reported, in 2023, Ukraine increased imports of copper and copper products by 2.2 times compared to 2022 – up to $140.795 million, while exports decreased by 20.1% to $72.078 million.

In addition, in 2023, Ukraine decreased imports of nickel and products by 74.2% compared to 2022, to $15.391 million, and increased imports of aluminum and aluminum products by 7.7%, to $366.463 million.

At the same time, imports of lead and lead products decreased by 65.2% to $989 thousand, tin and tin products by 23% to $2.728 million, but imports of zinc and zinc products increased by 18.8% to $45.966 million.

Exports of aluminum and aluminum products in 2023 increased by 0.7% compared to 2022 to $97.616 million, lead and lead products increased by 23.5% to $14.778 million, and nickel and nickel products amounted to $532 thousand, while in 2022 it was $1.268 million.

In 2023, the company exported $130 thousand worth of zinc, compared to $1.331 million in 2022. Exports of tin and tin products amounted to $159 thousand against $424 thousand in 2022.

In early September, the fintech product Ponova by OTP Bank expanded its coverage of the Ukrainian used car market to 69%.

Now the marketplace has more than 100 thousand cars and 2500+ used motorcycles, and the partner network includes more than 550 partners with car lots in 45 cities of Ukraine. Offers of used cars and motorcycles are updated daily in the Auto Bazaar and Motorcycle Bazaar sections, respectively .

The marketplace has built-in filters that help you find the most relevant car offers – car loan / car brand / mileage / year of manufacture / body type, etc.

You can buy a car or motorcycle in two ways: pay the money immediately or get a loan from JSC OTP BANK. In case of approval of the loan application by the Bank, the funds are received within one day.

Buyers can use the help of a personal manager who accompanies the client at all stages: from the selection of a car to the negotiation of financing terms. “The manager will identify the need and help you choose a car. If the client is in one city, say, Ternopil, and the chosen car is in Poltava, the manager will organize a technical inspection of the car before the purchase, and the buyer will receive a report on the technical condition of the car by e-mail based on 27 parameters. These include computer diagnostics, chassis diagnostics, engine and compression checks, body, interior and equipment checks, lighting checks, test drive, camber checks,” said Mykyta Alfyorov, Product Owner of the automotive marketplace Ponova by OTP Bank.

Among the advantages of the marketplace is the opportunity to get a discount on a car from the seller/dealership, and the buyer’s interests at all stages (from car selection to financing) will be represented by a personal manager.

An additional bonus for buyers who purchase a car on credit through the Ponova by OTP Bank marketplace is free car registration. “We will reimburse the costs of paying for the registration certificate form, service center services, and the cost of a regular license plate,” said Mykyta Alfiorov.

In January-August 2024, Naftogaz Group paid UAH 56.5 billion in taxes to the state budget of Ukraine and another UAH 4.3 billion to local budgets, the company reported on its website on Monday.

According to the company, this is more than 7% of all payments controlled by the State Tax Service of Ukraine.

In particular, in August, UAH 7.2 billion was paid to the state budget and UAH 0.6 billion to local budgets.

“The economic stability of the state during the war is a matter of national security. The Naftogaz Group remains a reliable pillar of the Ukrainian economy in wartime,” said Oleksiy Chernyshov, Chairman of the Board of Naftogaz of Ukraine.

As reported, in 2023, Naftogaz Group companies paid UAH 90.2 billion in taxes, UAH 83.4 billion of which went to the state budget and UAH 6.8 billion to local budgets.

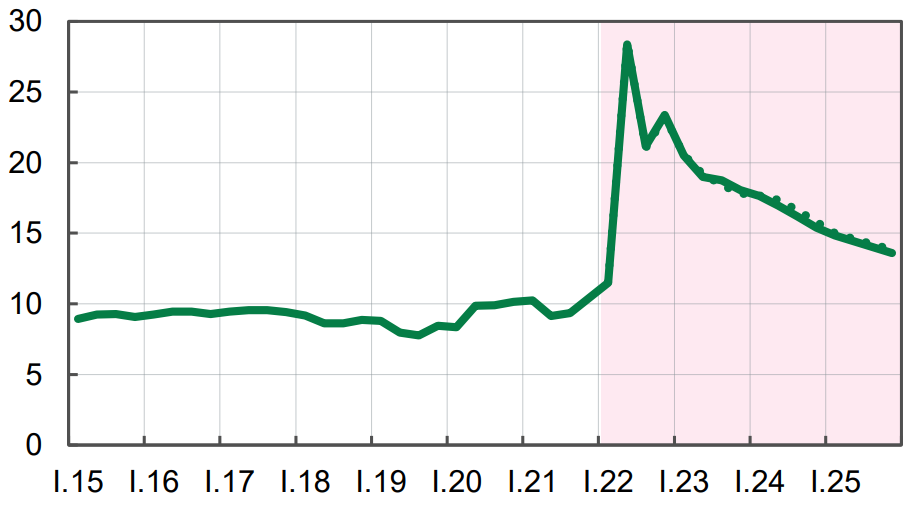

Forecast of unemployment rate in Ukraine according to methodology of international labor organization until 2025

Open4Business.com.ua