The Ukrainian real estate marketplace DIM.RIA analyzed how the Ukrainian real estate market has changed as of the end of summer 2024. The analytical study includes the state of the primary and secondary housing sales market, the state of the rental market, and the behavior of Ukrainians looking for apartments.

Primary market

Supply.

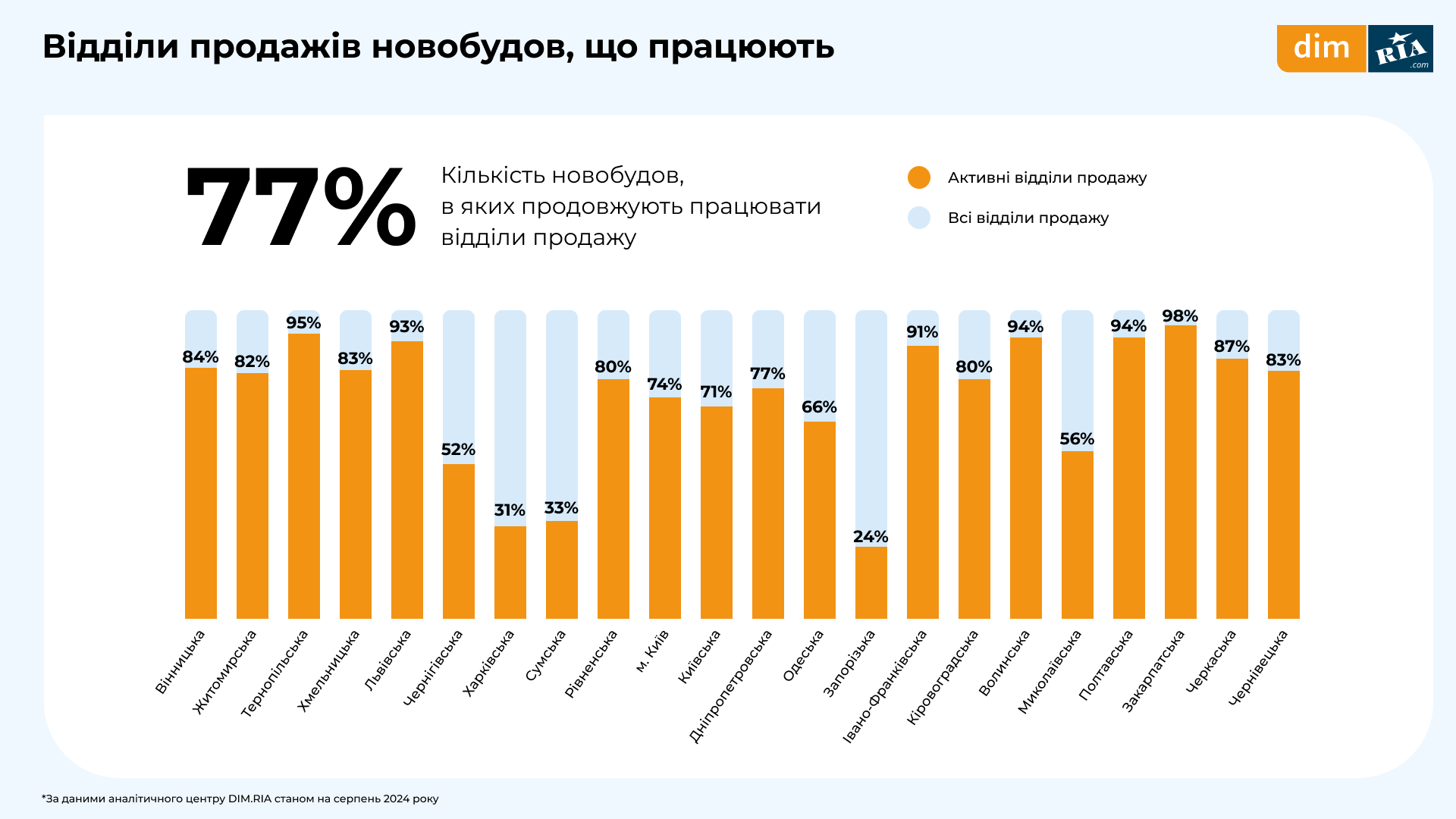

As of the end of August 2024, sales departments in 77% of new buildings were active. Since the beginning of the summer, 23 new buildings with 72 sections have been commissioned in Ukraine: 6 in Kyiv and Lviv regions, 5 in Ivano-Frankivsk region, 2 in Dnipropetrovs’k and Odesa regions, and one in Zhytomyr and Khmelnytsky regions.

Prices

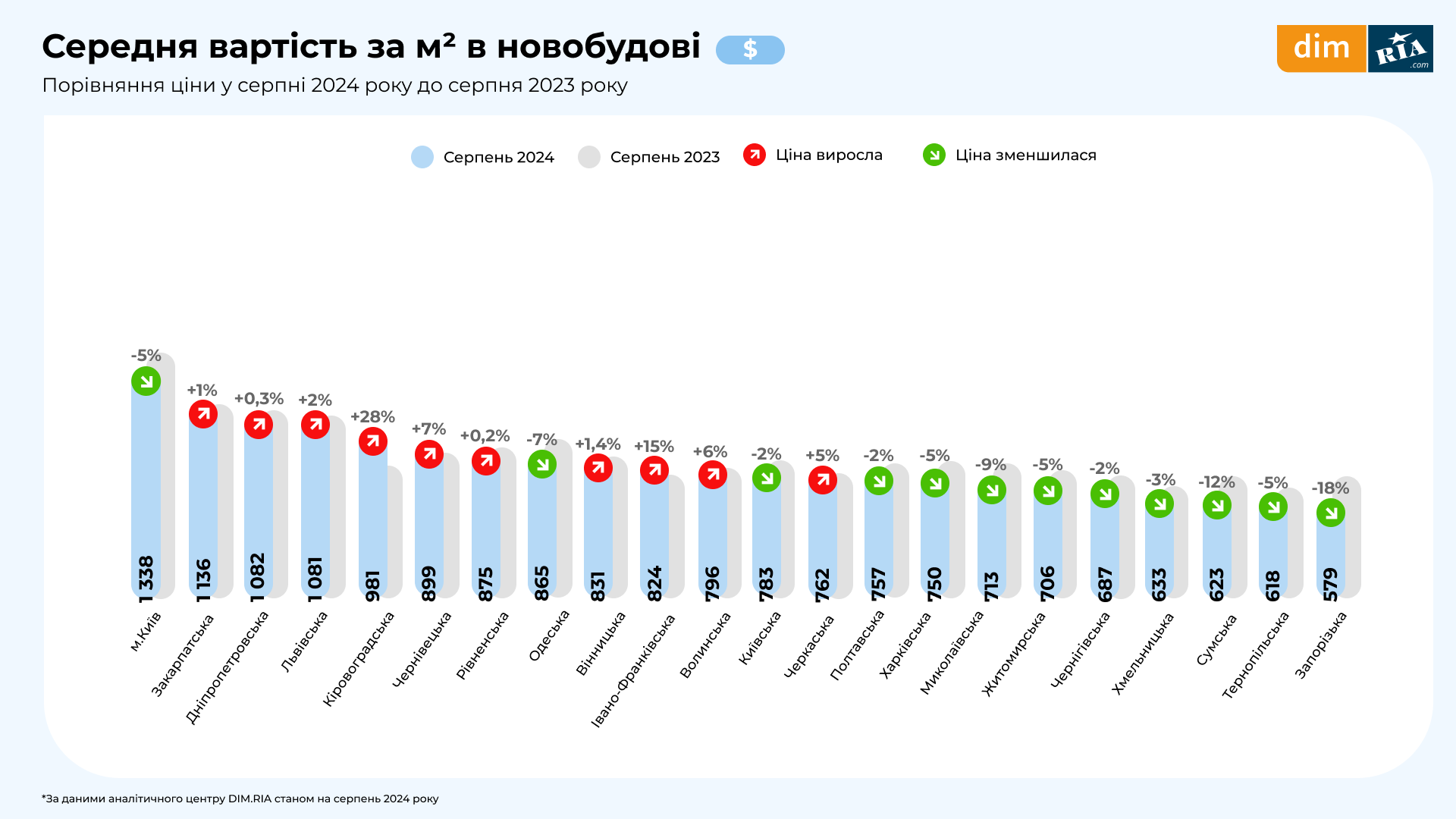

The average price per square meter in dollar terms slightly decreased in almost every region of Ukraine in August, but year-on-year growth was observed in half of the regions. Analysts noted the most rapid price growth in Kirovohrad, Ivano-Frankivsk, Chernivtsi, Volyn and Cherkasy regions. Kyiv remains the most expensive in the primary market with an average price of $1,338 per m².

Demand

In August, DIM.RIA analysts noted a significant revival of interest in primary housing among users from all regions, but the downward trend in activity continued on a yearly basis. It bypassed only the Kyiv region, where users made one and a half times more search queries compared to August 2023, and the Zhytomyr region, where searches also increased slightly.

Secondary market

Supply.

In the secondary housing market, the number of offers increased the most during the year in Kyiv, Ivano-Frankivsk and Zaporizhzhia regions, while in most other regions it decreased, sometimes by more than 50% (Kharkiv and Sumy regions). Also, much fewer owners began to offer their homes for sale in Dnipropetrovska, Odesa and Zaporizka oblasts: the number of ads there decreased by 37-47% during the year.

Price

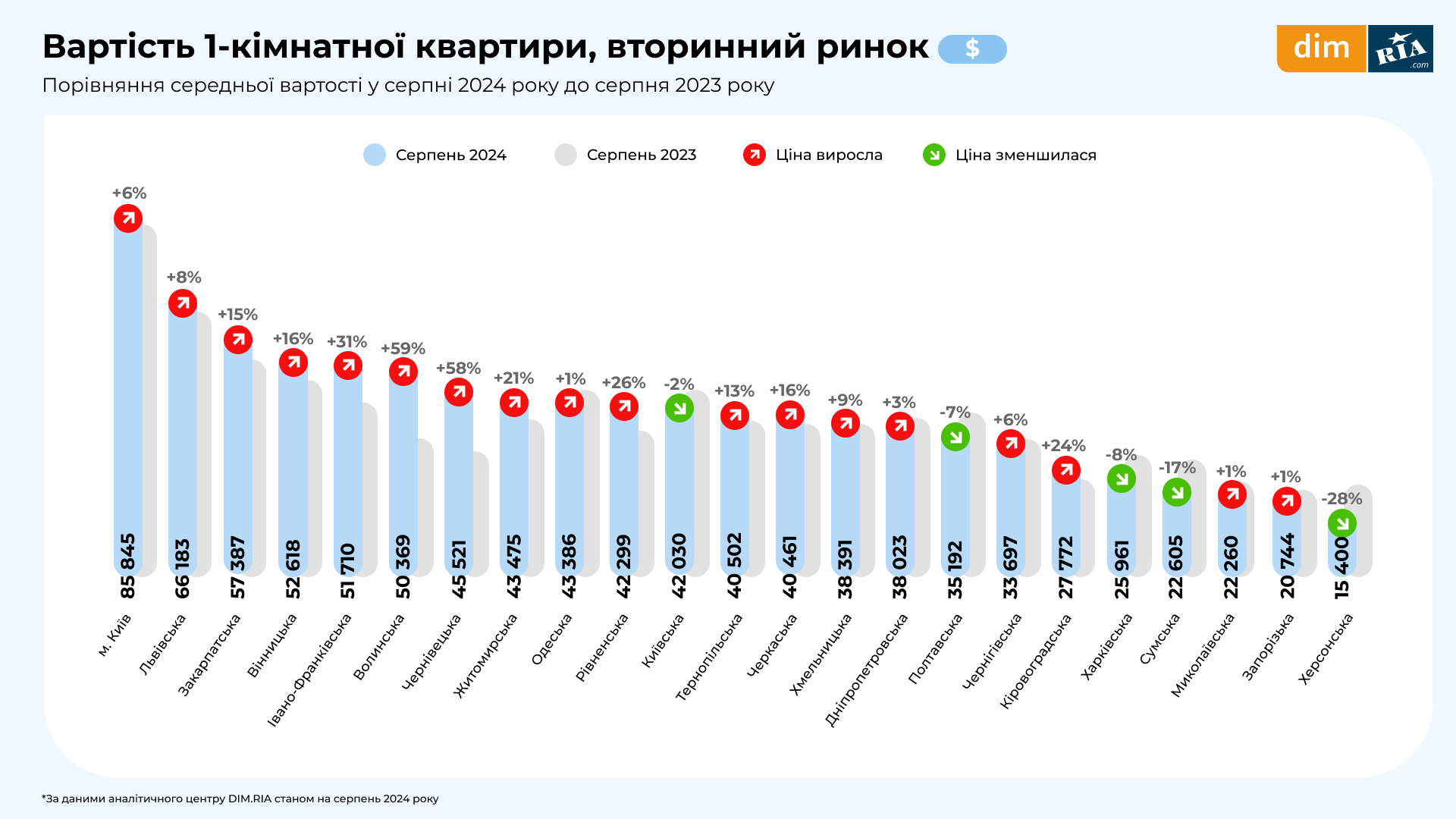

In August 2024, the sale price of a one-bedroom apartment fluctuated in most regions within a few percent, while it mostly increased compared to the data for August 2023. Volyn, Chernivtsi, and Ivano-Frankivsk regions showed the highest growth. Kyiv remains the most expensive city: owners in the capital ask an average of $85,845 for a one-bedroom apartment.

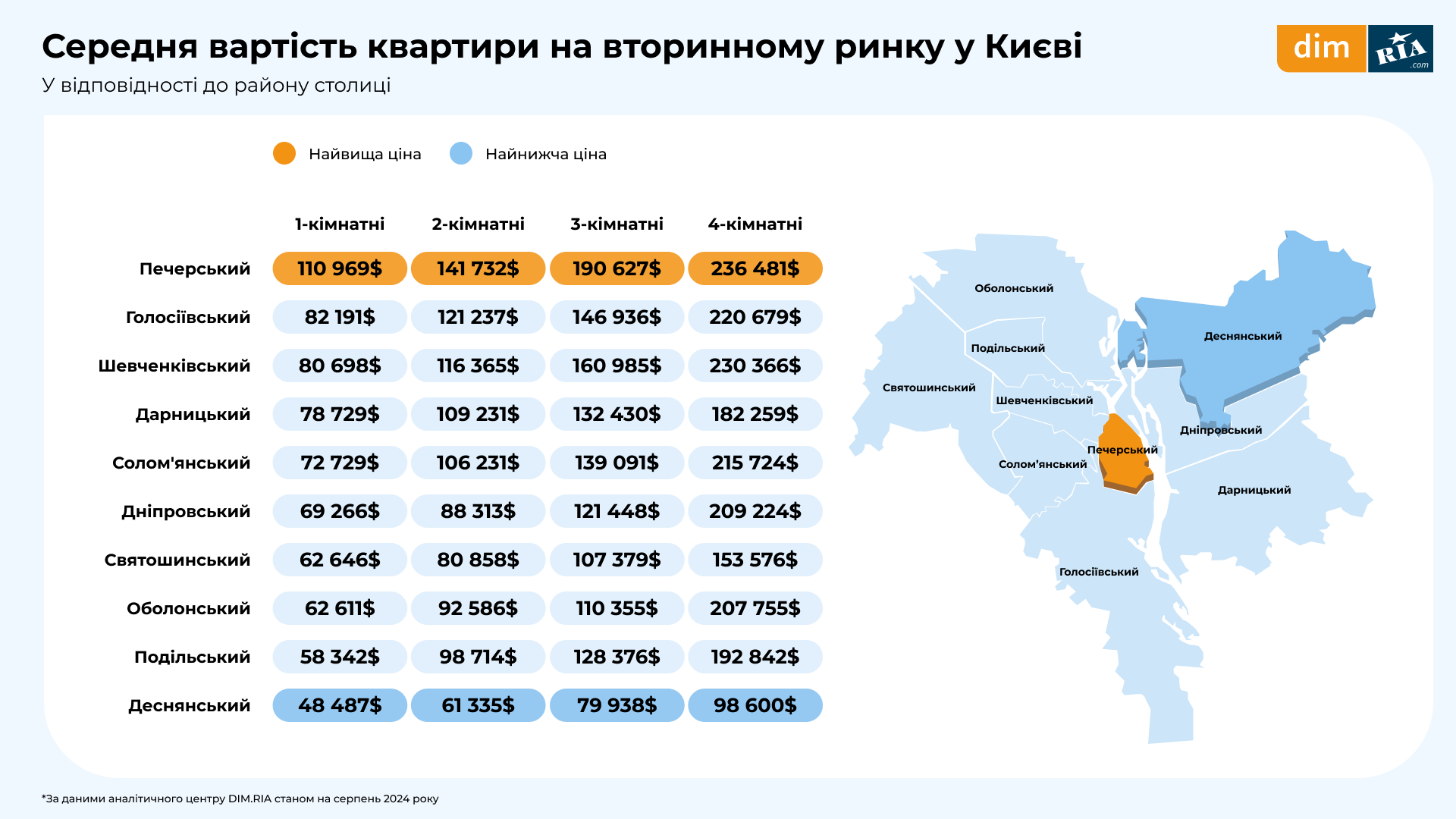

Looking at the capital in more detail, Pecherskyi district remains the most expensive with an average price of a one-bedroom apartment of $110,969, while the lowest price is reported by homeowners in Desnianskyi district – $48,487.

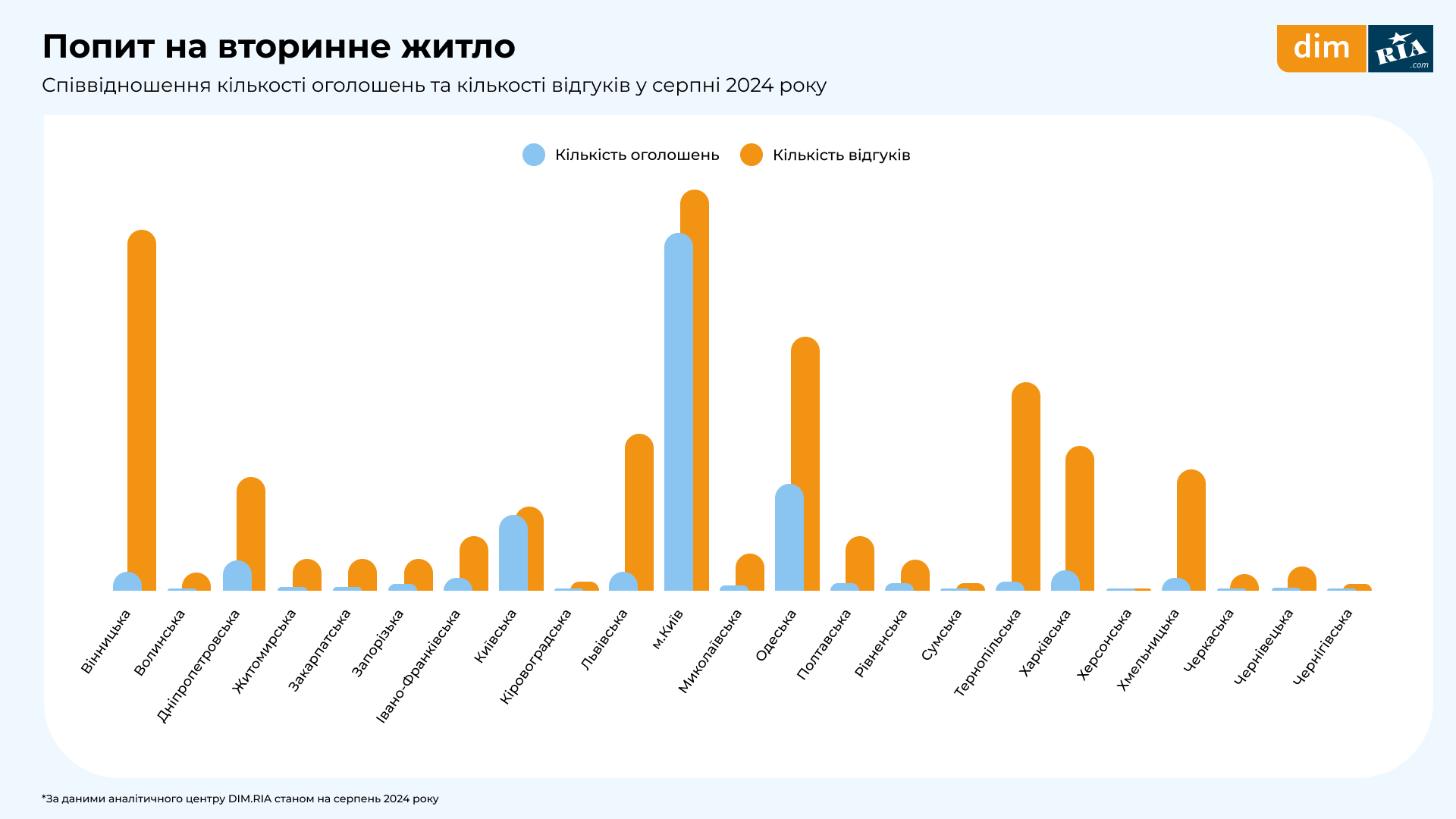

Interest

In August, users’ interest in secondary housing revived in most regions, with the largest increase in search queries occurring in Odesa and Lviv regions. However, in comparison with the current and last year’s situation, all regions began to receive fewer search queries for the purchase of housing. Kherson and Sumy regions lost the largest percentage of buyers, and Ivano-Frankivsk, Cherkasy, Kirovohrad, Volyn, Chernivtsi, and Lviv regions experienced a significant decline in interest: from -40% to -46%.

Despite the decline in search queries, the number of user reviews everywhere exceeds the number of ads posted. The five regions where demand exceeds supply the most are Volyn, Ternopil, Vinnytsia, Chernivtsi, and Zhytomyr, where there are an average of 12-23 responses per new ad. The largest number of ads and responses to them is in the capital, but there is almost no gap between supply and demand there.

Rental market

Supply.

In the rental market, the number of housing offers in Volyn, Ivano-Frankivsk, Lviv, and Zakarpattia regions increased by one and a half to two times compared to August of the previous year. At the same time, analysts noted a decline in the number of housing in the central regions, including Kyiv.

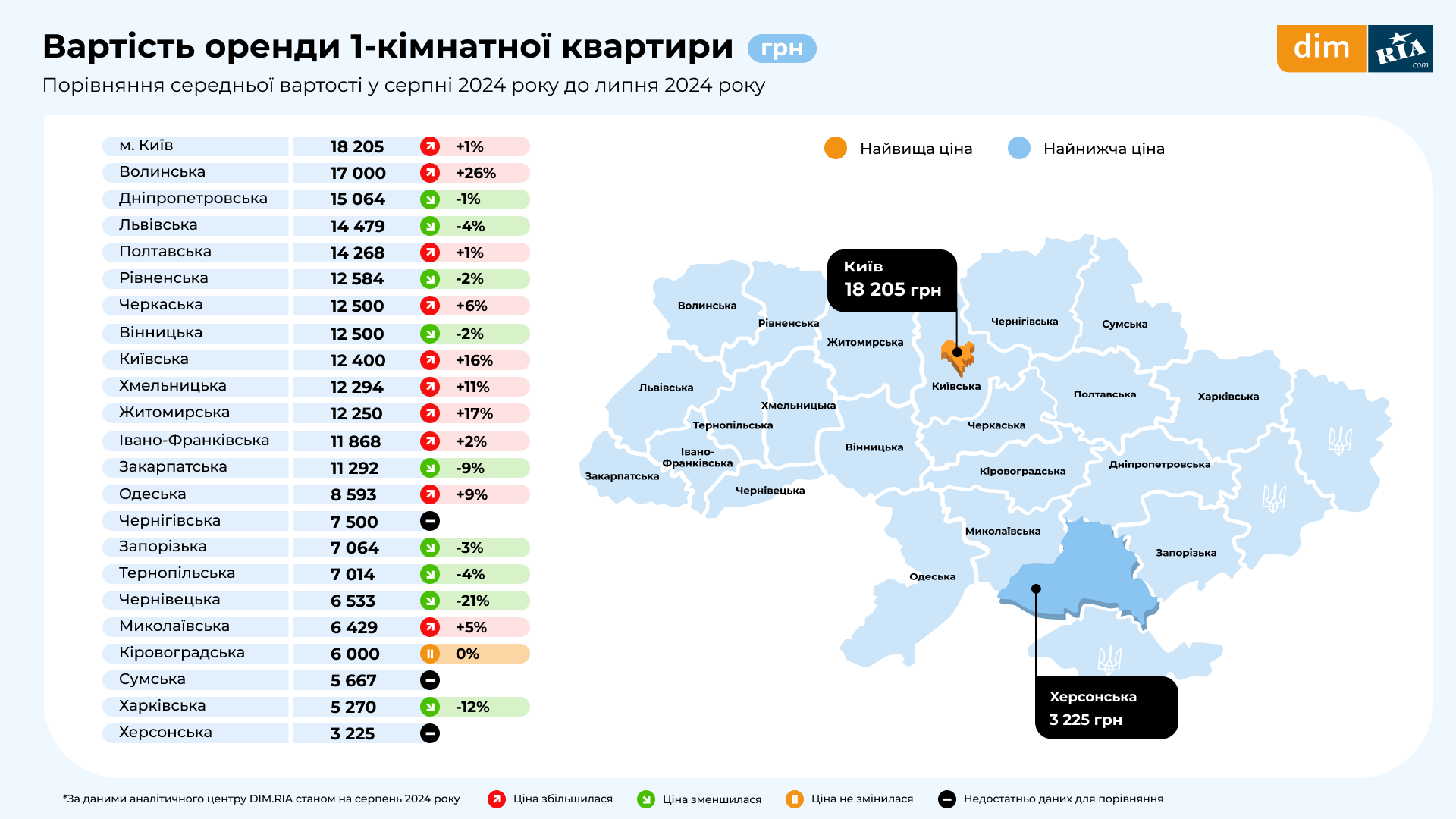

Price

Kyiv remains the most expensive location for renting an apartment with an average price tag of UAH 18,205 for a one-bedroom apartment. Over the past month, housing prices in the capital rose by 1%, and over the past year, the increase was 18%. Prices are also rising in other regions, most actively in Zhytomyr, Volyn, and Rivne regions (from +39% to +114% over the year).

The capital allows you to choose more affordable housing depending on the district. The lowest prices can be found in the Desnianskyi district, with an average of UAH 10,293 for a one-bedroom apartment, while the most expensive is the Shevchenkivskyi district with an average monthly rent of UAH 23,408.

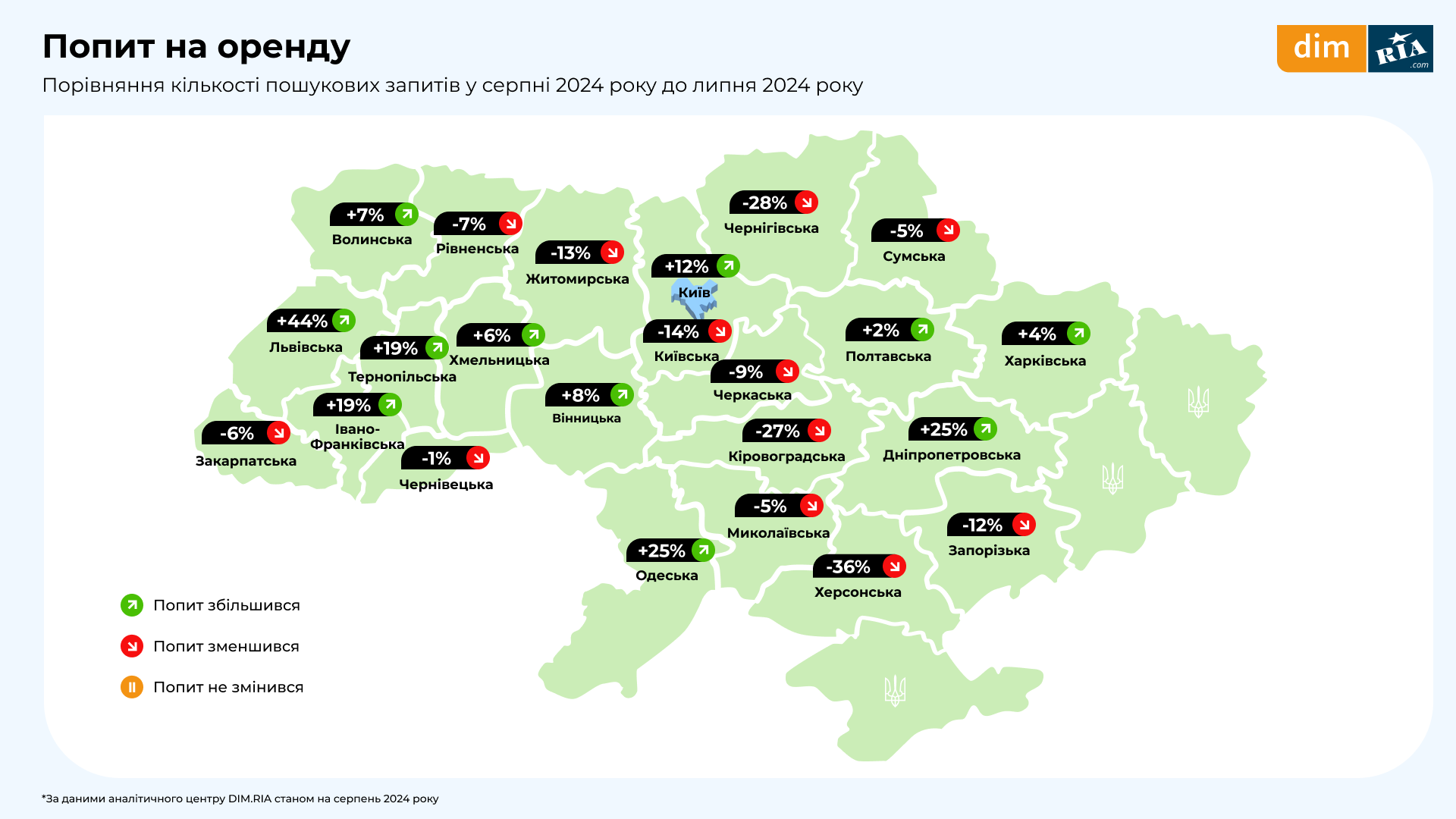

Interest

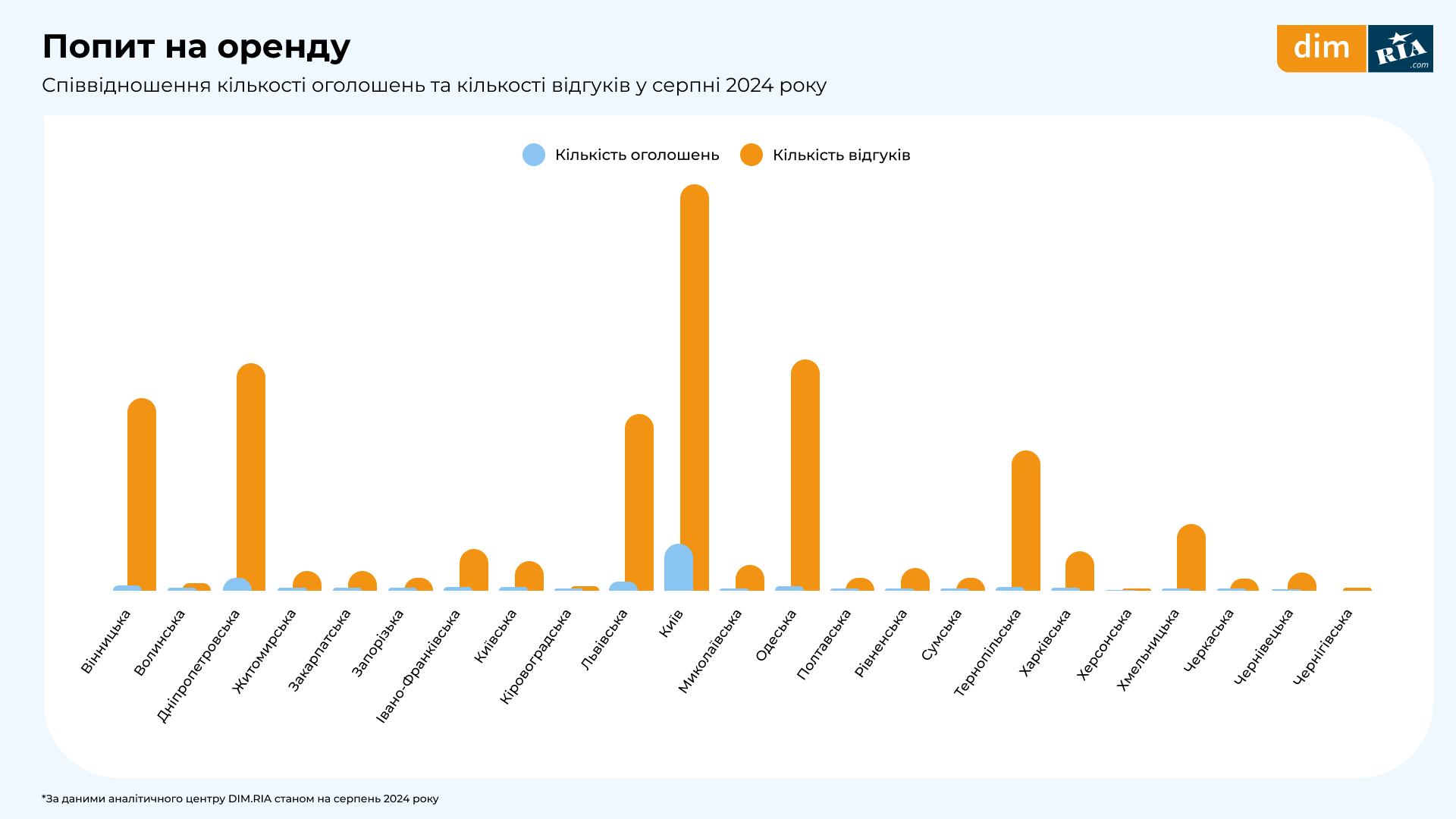

In August, users were more active in searching for housing in Lviv, Odesa, Dnipropetrovs’k, Ternopil, Ivano-Frankivsk regions and in the capital. The number of searches there increased from +12% to +44%.

The ratio of the number of rental ads to the number of responses to them in August in Kyiv was 1:9. At the same time, in the Kyiv region, excluding Kyiv, there were an average of 18 user responses per new ad. Odesa, Khmelnytskyi, Vinnytsia and Ternopil regions also stood out for their high demand relative to supply.

German Chancellor Olaf Scholz said that several hundred thousand more Ukrainians in the country should work, reports Tagesschau.

According to the publication, during a dialog with residents of the town of Teltow, Scholz said that, in his opinion, many Ukrainians receiving support in Germany should work.

According to him, the number of Ukrainians already having a job has increased to more than 200 thousand thanks to the government’s Jobturbo program.

“But there were still a few hundred thousand, if I can put it that way. That’s why I would like to see the work done,” he said.

New registrations of commercial vehicles (trucks and special vehicles) in August 2024 increased by 13% compared to the same month in 2023 – up to 1,083 units, which is also 13% more than in July this year, Ukravtoprom reported in its Telegram channel.

As reported with reference to the association’s data, the demand for these cars has shown a monthly increase since the beginning of this year, but in July it turned into negative dynamics, decreasing by 2% by July 2023 and by 20% by June 2024.

According to the association, Renault retained its market leadership in August with 282 units (in August 2013 it was the leader with 191 units), MAN took second place with 102 units (in August last year it was in ninth place with 42 units), and Ford took third place with 96 units (fifth place with 72 units).

Also in the top five are Citroen (72 units) and Scania (58 units), which were 10th (39 units) and second (98 units) respectively in August last year and third and second respectively in July this year.

According to Ukravtoprom, almost 8.3 thousand new vehicles were added to the Ukrainian truck and special vehicle fleet from January to August, 16% more than in the previous year.

At the same time, an analysis of the segment of trucks with a gross vehicle weight of more than 3.5 tons by the information and analysis group AUTO-Consulting showed an increase of almost 15% to 480 units in August.

“While the passenger car market was in turmoil in August due to rumors of a 15% military tax, this factor had no impact on the truck segment,” the group said in a statement on its website.

The light segment also recorded a good increase, while truck sales fell slightly (-1%).

“Against this background, European companies began to actively participate in the development of specialized equipment at Ukrainian enterprises, which led to the emergence of new models,” the report states.

State-owned companies, which are increasingly switching to European chassis, actively rejected Russian equipment, the analysts said.

According to AUTO-Consulting, MAN became the market leader in August with a market share of 17%, Scania was in second place with 12%, and Ford, which is developing cooperation with Ukrainian manufacturers of bodies, took third place. Volvo and Renault dealers were active in August, while JAC and Isuzu were the leaders in terms of growth.

As reported, according to Ukravtoprom, new registrations of commercial vehicles in Ukraine in 2023 increased by 65% compared to 2022 to 11.3 thousand units.

At the same time, the segment of trucks over 3.5 tons grew by 56.5% to 4,853 units, according to AUTO-Consulting.

Metinvest Mining and Metallurgical Group’s consolidated revenue in the first half of 2024 amounted to $4.319 billion, up 22% to the first half of 2023, this result is mainly due to a 63% increase in sales to $1.847 billion of the mining segment due to the easing of logistical restrictions for Ukrainian exports and increased demand for pellets.

“The Black Sea corridor has enabled the sale of iron ore products to China… External revenues of the steel and mining segments grew by 2% and 63% year-on-year respectively, with the steel segment accounting for 57% and the mining segment 43% of total revenues,” the company said in a report Friday evening.

According to it, adjusted EBITDA increased to $650 million, up 33% due to improved performance in both segments, with the metals segment contributing 25% and the mining segment 75%.

Total debt and net debt decreased by 12% and 4%, respectively, to $1.740 billion and $1.284 billion. It is noted that the group managed to repay more than $500 million of debt from the start of full-scale invasion until the end of June 2024.

Ukraine’s international reserves in August, according to preliminary estimates of the National Bank of Ukraine (NBU), increased by 13.7%, or by $5 billion 98.6 million – to $42 billion 330.5 million.

“Such dynamics is due to significant volumes of receipts from international partners, which exceeded the net sale of foreign currency by the National Bank and the country’s debt payments in foreign currency,” the central bank said in a statement on its website on Friday evening.

At the same time, the NBU’s net international reserves in August even slightly decreased – by $2 million – to $23.301 billion.

According to the Quantitative Performance Criterion (QPC) in the updated EFF Extended Funding Facility, Ukraine’s NIRRs should be at least $28.8 billion at the end of September this year and at least $26.3 billion at the end of the year.

According to the published information, the National Bank sold on the foreign exchange market $2.696 billion and bought back into reserves $0.3 million, the net sale of foreign currency by the NBU in August decreased from $3.05 billion to $2.696 billion.

It is noted that the government’s foreign currency accounts in the National Bank received $8.465 billion, of which $4.553 billion from the EU within the framework of the Ukraine Facility and $3.89 billion through the World Bank.

For servicing and repayment of the state debt in foreign currency, $724.1 million was paid, of which $266.0 million – servicing and repayment of debt to the World Bank; $239.9 million – payments related to the restructuring of Eurobonds, $130.1 million – payments on state derivatives and $88.1 million – payments to other international creditors.

In addition, Ukraine paid $392.4 million to the International Monetary Fund.

“In August, due to revaluation, the value of financial instruments increased by $443 million. The current volume of international reserves provides financing for 5.4 months of future imports,” the regulator stated in a release.

President of Ukraine Volodymyr Zelenskyy met with representatives of Italian business – more than 30 leading companies from various sectors of the economy – on the sidelines of the Ambrosetti Forum in Cinobbio.

As reported on the website of the head of the Ukrainian state on Saturday, he thanked Italian entrepreneurs for developing their projects in Ukraine right now. Zelensky noted the companies that provide Ukrainian partners with energy equipment, in particular as humanitarian aid.

The participants of the meeting discussed the post-war reconstruction of Ukraine. “The reconstruction of Ukraine should include the introduction of innovative technologies and the latest infrastructure,” Zelensky said.

He noted that Italian business may be interested in cooperation with Ukraine primarily in defense production, mechanical engineering, energy, aerospace, and IT industries.

The Ambrosetti Forum takes place in Cinque Terre, Italy, on September 6-8. Zelenskyy arrived there after the 24th meeting of the Contact Group on Ukraine’s Defense, which took place on Friday at the Ramstein air base in Germany.