The shareholders of Ovostar agricultural holding have approved the proposal of the Board of Directors to abandon the payment of dividends based on the results of 2023 and allocate the entire net profit of $44.975 million to the retained earnings reserve.

According to the company’s announcement on the Warsaw Stock Exchange, the decision was made at the annual shareholders’ meeting on Wednesday, with 95.05% of the shareholders participating.

The general meeting decided to approve and accept the financial statements and the independent auditors’ report thereon.

In addition, it approved the reappointment of Markiyan Markevych as a non-executive director of the company.

The total remuneration paid to the directors of the agricultural holding during the year ending December 31, 2024, was set by the shareholders at an amount not exceeding EUR 500 thousand.

All directors of Ovostar from all management actions and any liability in relation thereto during the financial year ended December 31, 2023.

The shareholders also authorized the Board of Directors of Ovostar to hold a tender for the selection and appointment of the independent auditors of the agricultural holding for the financial year 2024 and to determine their remuneration.

Ovostar Union is one of the leading producers of eggs and egg products in Ukraine. “In 2023, Ovostar increased its net profit by 7.4 times to $45 million, EBITDA by 4.5 times to $50.4 million, and revenue by 20% to $162.5 million.

In mid-June 2011, the group’s holding company, Ovostar Union N.V., conducted an IPO of 25% of its shares on the WSE at PLN62 per share ($22.78 at the then exchange rate) and raised $33.2 million.

At the end of May this year, the owners of 65.93% of the shares announced that together with Fairfax Financial Holding they had accumulated 95.45% of the agricultural holding and were ready to buy out the remaining 4.55% of the shares held by minority shareholders. During the announced voluntary buyout at a price of PLN70 per share (about $17.5), they acquired another 56,027 shares, or 0.934%, and now own 96.383%.

“The offerors intend to exercise the squeeze-out right … in order to acquire 100% of the company’s shares at a price of PLN70 per share,” Ovostar said in early July, recalling its delisting plans.

Before the trading was suspended, Ovostar shares were listed at PLN68.4 per share, and after the announcement of the Cypriot regulator’s approval of the squeeze-out in early August, the price dropped by 1.44%.

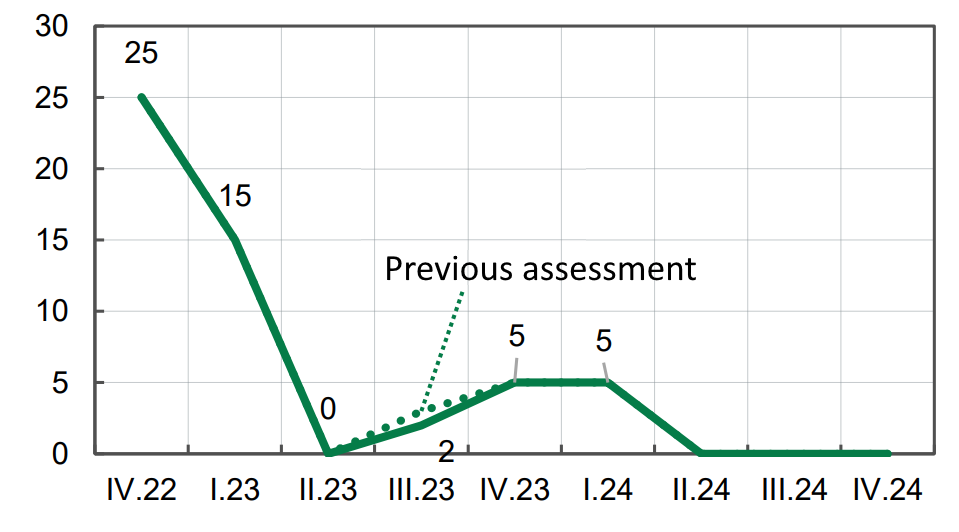

Forecast of power system capacity deficit, %

Source: Open4Business.com.ua

On Thursday, the Verkhovna Rada completed the internal procedures necessary for the entry into force of the Agreement on Political Cooperation, Free Trade and Strategic Partnership between Ukraine and the United Kingdom in terms of trade liberalization: by 2029, all import duties and tariff quotas in bilateral trade are to be abolished, the Ministry of Economy reported.

It is specified that the agreement will be in effect until March 31, 2029, with the exception of two commodity items – eggs and poultry products, the liberalization of trade with which will be extended for two years – until April 1, 2026.

“Ukraine will also have the opportunity to plan export logistics more flexibly and increase exports of high value-added goods in the future,” the Ministry of Economy believes.

The ministry predicts a revival of trade between Ukraine and the UK and an increase in exports of domestic products traditionally supplied to the British market by domestic producers. In particular, these include flour, grain, dairy products, poultry and semi-finished products, tomato paste, honey, corn, wheat, juices, sugar, etc.

The Ministry of Economy reminded that Agreement No. 3 in the form of an exchange of letters amending the Agreement on Political Cooperation, Free Trade and Strategic Partnership between Ukraine and the United Kingdom of Great Britain and Northern Ireland in terms of commitments to trade liberalization was ratified by the Rada on February 8 this year.

PJSC Ukrnafta will offer a 3.3 UAH/litre discount on gasoline and diesel and a 0.5 UAH/litre discount on autogas on the 33rd anniversary of Ukraine’s Independence, the company announced on Facebook.

The promotion will run from August 23-25, 2024. It is open to Ukrainian citizens registered in the UKRNAFTA mobile application.

The offer does not apply to purchases of petroleum products in the app’s fuel wallet and when paying with NaftaPAY at the pump.

“Ukrnafta is the largest oil company in Ukraine and the operator of the national network of filling stations. In March 2024, the company took over the management of Glusco assets and operates 545 filling stations – 460 owned and 85 managed.

The company is implementing a comprehensive program to restore operations and update the format of its filling stations. Since February 2023, Ukrnafta has been issuing its own fuel coupons and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state a share of corporate rights of the company, which belonged to private owners and is currently managed by the Ministry of Defense.

The Verkhovna Rada has ratified the Framework Agreement between the governments of Ukraine and the Republic of Korea on loans from the Fund for Economic Development and Cooperation for 2024-2029, which opens up the possibility for Ukrzaliznytsia (UZ) to purchase another 20 Intercity+ electric trains.

“This decision paves the way for the final part of approvals on financing projects critical to the Ukrainian economy, including the program to expand Ukrzaliznytsia’s rolling stock – the purchase of 20 Intercity+ electric trains. The program has already received a favorable assessment from experts involved by the Korean Fund,” Ukrzaliznytsia said on its Facebook page on Thursday.

The ratification of the agreement was supported by 336 MPs at a parliamentary meeting on Wednesday.

According to the report, the next steps will include agreeing on the details of the project and the agreement at the Cabinet of Ministers level and the final signing of the agreement.

According to preliminary agreements, the total cost of the program will be about $450 million, including train maintenance for five years. The trains are expected to be delivered within 18-24 months after the agreement is signed.

It is emphasized that Korean manufacturers are interested in considering options for partial localization in Ukraine.

According to UZ, the loan terms are preferential, given the criticality of the social component of the project: the total term is up to 40 years, and the repayment of the loan body will begin after the first 10 years.

“This is a strategic program to expand the Intercity+ train fleet, which will allow us to increase traffic on existing and open new high-speed routes. This is an additional opportunity for 6 million passengers a year to travel, which will cover the current need for daytime high-speed traffic,” Yevhen Lyashchenko, chairman of the board of UZ, was quoted as saying in the statement.

For his part, Oleksandr Shevchenko, UZ’s spokesman for passenger services, noted on his Facebook page that this summer the railroad is serving 100,000 people a day, and many are facing a shortage of tickets.

“Yes, we provide monitoring, car buybacks, transfers, hub connections, and turn over cars twice a day with maximum efficiency, but this does not eliminate the fundamental problem of car shortages,” he wrote, listing a number of objective reasons for the situation.

Shevchenko notes that at the current rate of retirement/ageing/destruction of railcars, the shortage of railcars risks becoming critical by 2028.

“That is, you will have a conditional 30% chance of finding a ticket to Lviv, modeling a kind of optimism,” he said, adding that one solution to the problem is to purchase an additional 20 units of Korean Hyundai Rotem trains.

Shevchenko also reminded that UZ is simultaneously modernizing cars on its own, and Kryukiv Carriage Works (Poltava region) is actively building 66 new sleeping cars, including inclusive ones.

In July this year, Ukrainian steelmakers increased steel production by 17.9% year-on-year to 709 thousand tons from 602 thousand tons, but decreased by 3.5% compared to the previous month, when they produced 735 thousand tons.

At the same time, Ukraine took 20th place in the ranking of 71 countries that are global producers of these products, compiled by the World Steel Association (Worldsteel).

According to Worldsteel, in July, most of the top ten countries, except China, Japan, Russia and South Korea, recorded an increase in steel production by July 2023.

The top ten steel producing countries in July are as follows: China (82.940 million tons, down 9% by July 2023), India (12.285 million tons, up 6.8%), Japan (7.1 million tons, down 3.8%), the United States (6.931 million tons, up 2.1%), the Russian Federation (6.250 million tons, down 3.1%), South Korea (5, 522 million tons, down 3.4%), Germany (3.1 million tons, up 4.8%), Turkey (3.055 million tons, up 4%), Brazil (also 3.055 million tons, up 11.6%) and Vietnam (1.927 million tons, up 17%).

In total, in July 2024, steel production decreased by 4.7% compared to the same period in 2023 to 152.849 million tons.

In January-July 2024, the top ten steel producing countries were as follows: China (613.720 million tons, down 2.2% compared to January-July 2023), India (86.372 million tons, up 7.2%), Japan (49.798 million tons, down 2.8%), the United States (46.854 million tons, down 1.8%), and the Russian Federation (43.082 million tons, minus 3%), South Korea (37.069 million tons, down 5.9%), Germany (22.460 million tons, up 4.5%), Turkey (21.670 million tons, up 14.9%), Brazil (19.4 million tons, up 3.3%) and Iran (18.416 million tons, up 2.9%).

Overall, in 7M2024, steel production decreased by 0.7% y-o-y to 1 billion 107.235 million tons.

At the same time, Ukraine produced 4.583 million tons of steel in 7M2024, up 33.6% from 3.430 million tons in 7M2023. The country ranks 20th in January-July.

As reported, in 2023, China produced 1 billion 19.080 million tons at the level of the previous year), India (140.171 million tons, +11.8%), Japan (86.996 million tons, -2.5%), the United States (80.664 million tons, +0.2%), Russia (75.8 million tons, +5.6%), South Korea (66.676 million tons, +1.3%), Germany (35.438 million tons, -3.9%), Turkey (33.714 million tons, -4%), Brazil (31.869 million tons, -6.5%) and Iran (31.139 million tons, +1.8%).

In total, 71 countries produced 1 billion 849.734 million tons of steel in 2023, which is 0.1% less than in 2022.

At the same time, Ukraine produced 6.228 million tons of steel in 2023, which is 0.6% lower than in 2022. The country was ranked 22nd in 2023.

In 2022, the top ten steel producing countries were as follows: China (1.013 billion tons, -2.1%), India (124.720 million tons, +5.5%), Japan (89.235 million tons, -7.4%), the United States (80.715 million tons, -5.9%), the Russian Federation (71.5 million tons, -7.2%), South Korea (65, 865 million tons, -6.5%), Germany (36.849 million tons, -8.4%), Turkey (35.134 million tons, -12.9%), Brazil (33.972 million tons, -5.8%) and Iran (30.593 million tons, +8%).

Ukraine ranked 23rd in 2022 with 6.263 million tons of steel produced (-70.7%).

In total, 64 countries produced 1 billion 831.467 million tons of steel in 2022, which is 4.3% less than in 2021.