In the first quarter of 2024, KSG Agro agricultural holding reduced its net profit by 37% to $0.96 million, while revenue decreased by 2% to $5.02 million, according to the company’s report on the Warsaw Stock Exchange.

“As in the previous year, the Group used more of its own grain for feed production rather than purchasing it (to reduce dependence on external suppliers of feed components in wartime). In 2024, the Group continues to export grain,” the document says.

According to it, due to a 10-fold increase in the benefits of biological transformation this year (up to $1.06 million), gross profit increased by 10% to $2.26 million, operating profit by 5% to $1.61 million, while EBITDA decreased by 2% to $1.83 million.

It is specified that the higher profit last year was due to the sale of a subsidiary for $0.76 million.

According to the report, KSG Agro managed to slightly reduce its net debt in the first quarter of this year to $15.06 million from $15.63 million due to a reduction in bank loans to $15.17 million from $15.84 million. The agricultural holding’s free cash flows at the end of March amounted to $0.11 million compared to $0.21 million at the beginning of the year.

During January-March 2024, the key operating subsidiary KSG Dnipro issued $5 million of C and D series bonds with a coupon rate of 7% per annum and maturity in August and October 2025, respectively, of which it placed $1.35 million of C series bonds.

As noted, the sowing campaign is proceeding according to plan, without significant interruptions due to military operations. As of the date of the report, the group sowed sunflower on an area of 7.7 thousand hectares, wheat on 2.2 thousand hectares and rapeseed on 1.43 thousand hectares.

According to the report, KSG Agro, a vertically integrated holding company, is one of the top 5 pork producers in Ukraine. It is also engaged in the production, storage, processing, and sale of grains and oilseeds. Its land bank is about 21 thousand hectares in the Dnipro and Kherson regions.

In 2023, KSG Agro reduced its net loss by 30.9% to $1.16 million, while revenue increased by 13.8% to $18.79 million.

The demand for labor of various professions and qualifications is growing in Kyiv. At the beginning of May, the database of the capital’s employment service contained about 3,000 current vacancies. However, many businesses are experiencing a shortage of skilled workers.

Every fifth vacancy is for professionals: engineers, teachers, analysts and economists. Due to the martial law, there is an increased demand for representatives of blue-collar professions that were previously considered predominantly male: installers, electricians, mechanics, electric and gas welders, seamstresses, building maintenance workers, and painters.

Employers are looking for specialists in various fields: accountants, nurses, educators, electricians, personnel inspectors, and paramedics. Trade and service workers are in demand, including cooks, salespeople, educators’ assistants, and social workers. At the same time, there is a growing demand for unskilled labor, such as cleaners, unskilled laborers, loaders, and kitchen workers.

TOP vacancies with the highest salaries:

– Defense forces: inspectors and police officers of the special police – UAH 126 thousand;

– IT industry: software engineers, software development and testing specialists, software engineers – UAH 110 thousand;

– enterprises with foreign investments: professionals in the organization of protection of information with limited access – 69 thousand UAH, sales managers – 67 thousand UAH, journalists – 54 thousand UAH, editors – 51 thousand UAH, analysts – 50 thousand UAH, psychologists – 47 thousand UAH;

– skilled professionals: public procurement specialists – UAH 45 thousand, chief accountants – UAH 43 thousand, plastic surgeons, carpenters and vehicle drivers – UAH 40 thousand each.

While offering modern competitive salaries, employers also place high demands on the qualifications of candidates. The Kyiv City Employment Service, through employment promotion programs, vocational training and an individual approach, will provide jobs for all job seekers and, if necessary, help them increase their competitiveness in the labor market.

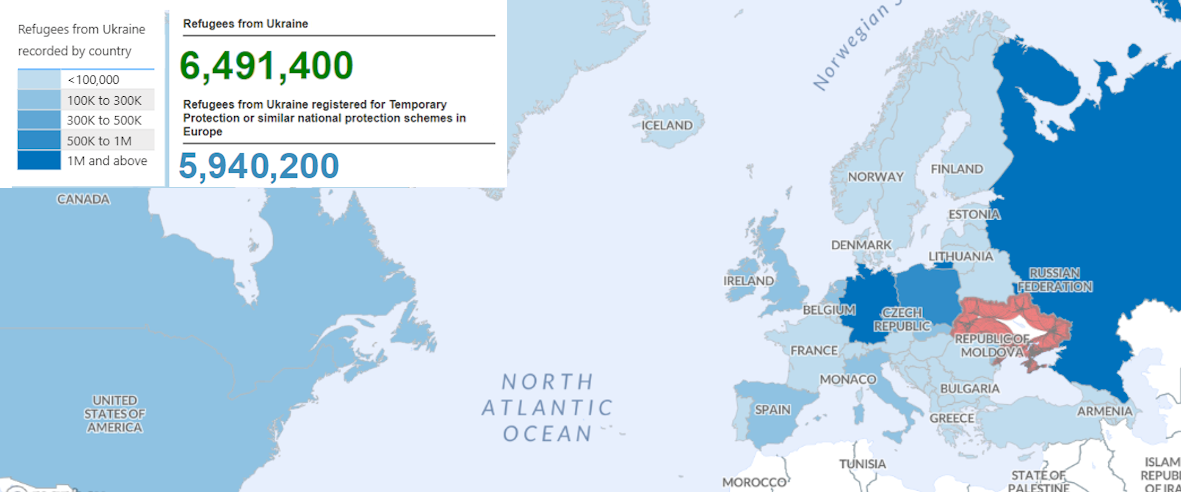

Number of refugees from Ukraine in selected countries as of 31.03.2024

Source: Open4Business.com.ua and experts.news

The British Parliament stopped working on Thursday in connection with the general election on July 4, according to the parliament’s website.

“Parliament was dissolved on Thursday, May 30, 2024. All business in the House of Commons and the House of Lords has been completed. There are currently no MPs, and all seats in the House of Commons remain vacant until the general election on July 4, 2024,” the website said.

Sky News notes that the parliament was dissolved immediately after midnight.

The dissolution of parliament before elections is a standard procedure.

Earlier, The Guardian reported that on July 9, the parliament would reconvene with a new composition to elect a speaker and swear in MPs.

The opening ceremony is scheduled for July 17.

Earlier, the Experts Club think tank presented an analytical material on the most important elections in the world in 2024, the possible elections in the UK are in the TOP 5 most important in the world in 2024, more detailed video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU

You can subscribe to the Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

One of the largest grain market operators in Ukraine, Nibulon JV LLC (Mykolaiv), is launching a large-scale modernization of its elevator business, which will include automation, unification of services and mechanisms to ensure quality standards, the grain trader’s press service reported on Facebook.

“Additionally, the capacities of Khmilnyk, Vradiyevsky, Kolosivsky elevator and Transshipment Terminal branches will be significantly expanded,” the company said in a statement on Wednesday.

According to the grain trader, the second stage of the elevator will be built at the Khmilnyk branch (Vinnytsia region), where the total investment will amount to $3.9 million, and will be equipped with four new tanks and transportation equipment. In addition, two STRAHL grain dryers will be installed to increase the drying capacity to 2200 tons per day (from scratch) to attract agricultural producers to cooperate. Previously, this branch served the needs of Nibulon’s own agricultural production exclusively.

Investments in the modernization of Vradiyivskyi (Mykolaiv region) will amount to $800,000. The company will double its capacity and change the scheme of acceptance and shipment, which will allow it to work with several crops at the same time and reduce waiting time for the grain trader’s partners.

“Kolosivskyi elevator (Mykolaiv region) will also get a second wind, with the company allocating $265 thousand for the reconstruction of the first stage. The focus is to double the productivity of grain receiving and shipping,” the agricultural holding said.

In addition, the transshipment terminal in Mykolaiv will receive $720 thousand in investments to build a new gallery that will allow it to receive cargo from water transport and transfer it to rail transport and then to the Bessarabian branch. With Mykolaiv port hub blocked, this will help reduce logistics costs on the way to Izmail ports.

“We are planning to automate all elevators and equip them with sensors that will record the service life of the equipment and automatically transfer this data to a single control center. As a result, we expect to increase the efficiency of the elevator business through optimization and automation, reduce the cost of services through the rational use of resources and increase salaries for the branch teams,” Nibulon summarized.

Nibulon JV LLC was established in 1991. Prior to the Russian military invasion, the grain trader had 27 transshipment terminals and crop reception complexes, a one-time storage capacity of 2.25 million tons of agricultural products, a fleet of 83 vessels (including 23 tugs), and owned the Mykolaiv Shipyard.

“Before the war, Nibulon cultivated 82 thousand hectares of land in 12 regions of Ukraine and exported agricultural products to more than 70 countries. In 2021, the grain trader exported the highest ever 5.64 million tons of agricultural products, reaching record volumes of supplies to foreign markets in August – 0.7 million tons, in the fourth quarter – 1.88 million tons, and in the second half of the year – 3.71 million tons.

Nibulon’s losses due to Russia’s full-scale military invasion in 2022 exceeded $416 million.

Currently, the grain trader is operating at 32% of capacity, has created a special unit to clear agricultural land of mines, and was forced to move its headquarters from Mykolaiv to Kyiv.

The funeral service for Oleksandr Martynenko, the founder and head of the Interfax-Ukraine news agency, will take place on May 31 at 11:00 a.m. at Baikove Cemetery in Kyiv.

A bus transfer will be organized from Mykhailivska Square at 10:30 a.m. for those wishing to pay their last respects.

As a reminder, Oleksandr Martynenko passed away on Tuesday, May 28, at the age of 63.

Born in 1960, Oleksandr Martynenko graduated from the Economics Department of Kharkiv State University and founded and headed the Interfax-Ukraine news agency in 1992. He was also Deputy Head (1991) and Consultant (2001) of the Presidential Administration of Ukraine, Press Secretary of the President of Ukraine (1998-2001), Secretary of the Presidential Council on Information Policy (2001-2002), and member of the National Council on Television and Radio Broadcasting (2002-2003).

He is a holder of the Order of Merit III degree (2022), the Order of Prince Yaroslav the Wise, V degree (2020). Since 2010, he has been an Honored Journalist of Ukraine.

“Interfax-Ukraine is an independent Ukrainian news agency that has been operating in the Ukrainian political and economic information market since 1992. It produces more than 40 news products in four languages. The agency’s editorial office is located in Kyiv. “Interfax-Ukraine is not part of any foreign media holdings. The founder and owner of Interfax-Ukraine was Oleksandr Martynenko. As reported at the end of 2023, Interfax-Ukraine news agency became the official representative of the international company Dun & Bradstreet (D&B) in the Ukrainian market. The agency has been a member and official service provider of the American Chamber of Commerce in Ukraine since 2005.