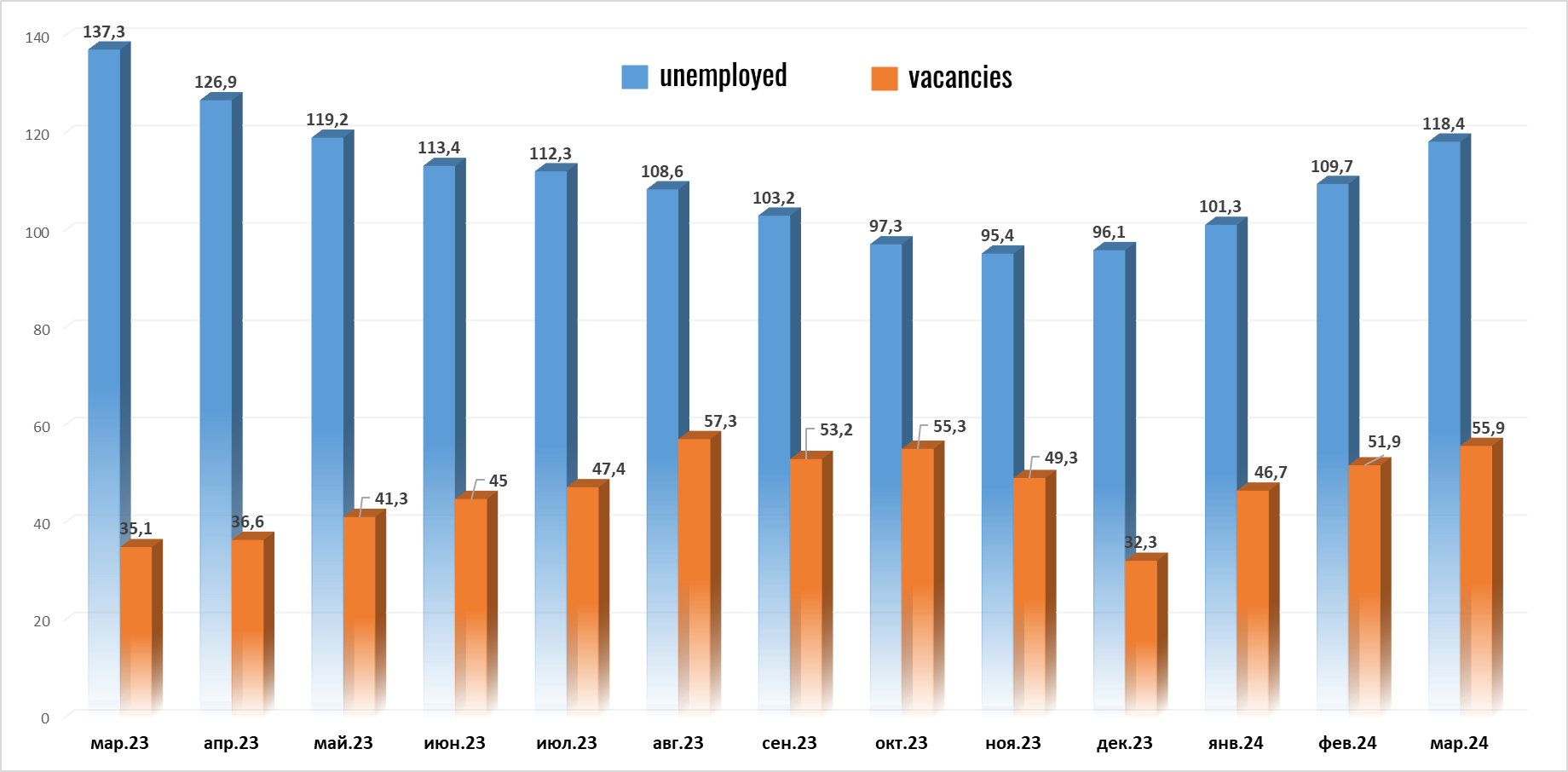

Number of unemployed in Ukraine and job opportunities, 2023-2024

Source: Open4Business.com.ua and experts.news

On Wednesday, the Polish Parliament adopted amendments to the law on assistance to Ukrainian citizens, which, in particular, provide for the extension of the legal stay of Ukrainians in the country, according to the website of the Polish channel RFT24.

“The adoption of these amendments was recommended by the parliamentary committee on administration and internal affairs. In accordance with the committee’s recommendation, the MPs rejected a number of Confederation amendments and the PiS amendment. The adopted amendments relate to the extension by four months of the deadline for filing applications for the right to practice the profession of doctor, dentist, nurse and midwife, as well as the recognition of certificates from citizens of a country that has terminated the international agreement on their mutual recognition,” the statement said.

The amendment to the Law on Assistance to Citizens of Ukraine provides, among other things, for the extension of the legal stay for Ukrainians who have been assigned a Ukr Pesel number until September 30, 2025, the preservation of payments for the next year and compulsory school education for Ukrainian children. The law also introduces new rules for confirming the identity of a Ukrainian citizen applying for a Pesel number. The only way to prove your identity is to present a valid travel document.

The amendment also specifies a maximum 36-month period during which students can attend additional free Polish language lessons. The decision will apply to students who started attending classes in 2022/23 and 2023/24. The resolution also expands access to medical, family and social benefits, allowances and the possibility of living in collective accommodation.

“The resolution also stipulates that starting from July 1, funding for accommodation and meals for refugees from Ukraine in a particularly difficult situation will be possible only on the basis of a signed agreement with a local voivode or a local government body acting on the basis of a voivode’s order. The rules for participation in the costs of accommodation and meals in collective centers will also change, making the payment of the subsidies due more efficient than now,” the statement said.

The law also provides for the abolition of benefits related to the compensation of refugees’ accommodation and food costs incurred by owners of private premises. As of July 1, the payment of one-time cash benefits in the amount of 300 zlotys will also be discontinued.

During the committee meeting, Deputy Minister of Education Ioanna Mukha noted that the amendment is related to the recent suspension in Belarus of issuing documents confirming the passing of the final exam to its citizens abroad. She said that refugees from Belarus cannot study in Poland without a high school diploma. She added that about five thousand Belarusian citizens are in this situation, but this may also apply to citizens of other countries.

The law, with the exception of some provisions, will come into force on July 1. It will now be discussed by the Senate (the upper house of the Polish parliament).

According to Ukrainians, the countries of the Arab world are neutral in the Russian-Ukrainian war. This was revealed by a joint study by Active Group and the Experts Club think tank, “Attitudes of Ukrainians toward the Middle East and Central Asia,” which was presented at Interfax-Ukraine on Tuesday.

“The analysis includes a predominantly positive attitude of our citizens towards such countries as Israel (72.5%) and Turkey (55%), while the attitude towards other countries in the region is mostly neutral. Ukrainians are extremely negative about Iran (76%) and mostly negative about Afghanistan (52.6%),” said Oleksandr Poznyi, director of the research company Active Group.

In addition, the expert added that Ukrainians are mostly positive about countries with which they have trade or cultural ties. This is natural, as such ties promote mutual respect between societies and countries.

In his turn, Andriy Yeremenko, founder of the research company Active Group, emphasized that the attitude of Ukrainians towards the Middle East and Central Asia varies depending on many factors.

“We can see that the attitude of citizens is really certain only in relation to two countries – Iran and Israel. These are the countries where the percentage of those who find it difficult to answer is less than 20%. The rest of the countries have a much higher percentage of uncertainty, which indicates that Ukrainians are not well informed about these countries,” emphasized Eremenko.

Maksym Urakin, founder of the Experts Club think tank, added that building cooperation with the Middle East and Central Asia is very important for the development of the Ukrainian economy, especially in the agricultural and IT sectors. These industries have great potential for development and can become the basis for a mutually beneficial partnership.

“It is necessary to implement a state strategy to reduce the trade deficit and increase Ukraine’s export potential. This will create a more balanced and sustainable economy that will be less dependent on external factors. Ukraine may be interested in agricultural products, IT clusters, and educational services. We are interested in sales markets, agricultural technologies, metallurgy, and chemistry,” Urakin emphasized.

According to him, trade between Ukraine and the countries under study is currently growing rapidly.

“Turkey is the largest trading partner among the countries of the Middle East and Central Asia, accounting for more than half of all trade with these countries. This shows the importance of Turkey for the Ukrainian economy,” the founder of Experts Club added.

According to Urakin, a balanced foreign economic policy in the region can not only significantly improve Ukraine’s relations with Middle Eastern countries, but also have a positive impact on the overall state of the economy.

The results of the study are available here.

ACTIVE GROUP, ALEXANDER POZNIY, ANDREY EREMENKO, CENTRAL_ASIA, ECONOMICS, EXPERTS CLUB, MAXIM URAKIN, MIDDLE_EAST, POLL, SOCIOLOGY

Ukrainian ports handled 37.7 million tons in January-April, up 1.7 times compared to the same period in 2023, the Ukrainian Sea Ports Authority (USPA) reported on Facebook on Wednesday.

In April, port operators handled 9.9 million tons of cargo in seaports, almost twice as much as in the same period in 2023, the USPA said in a statement.

It is indicated that the largest share in April is the processing of grain cargo – 6.3 million tons against 3.9 million tons in 2023.

The cargo turnover of the Black Sea ports, thanks to the Ukrainian sea corridor, amounted to 7.7 million tons in April, of which 5.1 million tons were the products of Ukrainian farmers, the report says.

Earlier it was reported that since August 2023, the sea corridor created by the Navy has exported almost 45 million tons of cargo to 44 countries.

In 2023, Metinvest Group’s Central, Ingulets and Northern Mining and Processing Plants (GOKs) implemented investment projects aimed at ensuring the stability of production processes and overhauling machinery and equipment, using a total of UAH 2.3 billion.

According to the company’s press release, last year, Metinvest’s Kryvyi Rih mining enterprises invested in projects to improve productivity, product quality, ensure the smooth operation of key equipment, and reduce the cost of producing iron ore.

The main projects implemented last year at Pivdennyi GOK included the modernization of sections and the installation of a new economical engine on the 2TE10M diesel locomotive, which is used to transport ore from the Pervomaisky open pit to the first crushing plant. It also includes the installation of roller screens for raw pellets at the LURGI-552A roasting machine to maintain competitive positions in the European iron ore market.

To ensure that the concentrate moisture content is met, a new vacuum filter was installed at Ore Dressing Plant No. 1 and a vacuum pump was replaced at Ore Dressing Plant No. 2.

Last year, Central GOK completed an important energy efficiency project. Pumping equipment was replaced at the facilities of the sludge management and technical power supply shops to reduce electricity costs. The company also launched a project to build a complex of treatment equipment to provide the plant’s facilities with drinking water.

The report emphasizes that even in the midst of the war, the program to improve working conditions at the plant continues. Repairs were carried out in the canteens of the Petrovsky open pit, crushing and concentrating plants. The crusher’s administrative and amenity building had its showers overhauled.

Last year, the bulk of capital investments at Ingulets Mining and Processing Plant were directed to projects to maintain production capacity, namely the reconstruction of the tailings dump. To ensure the smooth operation of the technological chain for the extraction and production of concentrate, the plant is preparing additional tanks for storing production residues.

Another major project of the year, which will ensure the development of mining operations at InGOK, concerned the rebuilding of railway tracks at the open pit horizons and the extension of the open pit and dump railroad dead ends.

A significant portion of the GOK’s investments was directed to overhauling machinery and equipment. To ensure uninterrupted mining and transportation of rock mass, the enterprises repaired dump trucks, bulldozers, dump trucks, motor-wheel sets, railway tracks and switches. Crushing and processing plants overhauled sections, crushers, dredgers, grab cranes, floors and fencing structures.

To maintain pellet production at the required level, the roasting machines LURGI 552 A and LURGI 552 B at Northern GOK and OK-324 at the pelletizing plant of Central GOK were shut down for repairs. At the same time, the companies implemented a number of projects to save energy, organize a safe working environment, maintain infrastructure facilities, etc.

“In total, in 2023, Kryvyi Rih GOKs utilized a total of UAH 2.3 billion in investments to maintain production capacity. During the war in 2022-2023, Metinvest Group was recognized by Forbes Ukraine as one of the largest Ukrainian investors. The company’s capital investments during that time amounted to UAH 22.7 billion. Currently, Metinvest’s investment strategy is focused on maintaining the operability of its assets,” the press release states.

As reported earlier, Metinvest is implementing a new model for its Kryvyi Rih mining operations by uniting its mining and processing plants in Kryvyi Rih under a single management.

“Given the current challenges, with no objective way to bring the workload of the GOKs to the optimal level, we are looking for the effect of combining their capabilities and business processes. To this end, the company sees its GOKs not as separate facilities with separate teams, but as one large production site and one large team, and tries to use the advantages of each GOK in a single technological chain. The creation of a single administrative and management center, so to speak, a consolidated GOK, will significantly simplify, speed up and increase the efficiency of these processes, as well as contribute to the creation of new synergies between the enterprises,” explained Yuriy Ryzhenkov, CEO of Metinvest, earlier.

“Metinvest comprises mining and metallurgical enterprises located in Ukraine, Europe and the United States. Its major shareholders are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage it.

Metinvest Holding LLC is the management company of Metinvest Group.

Ensuring the stability of the energy system and organizing international support are the tasks that Ukrainians believe the government is doing best. At the same time, the lowest ratings were given to the state’s efforts to fight corruption and manage the seized property of sanctioned persons. These data were presented by Active Group at a press conference at Interfax-Ukraine on Wednesday.

“Our research was focused on assessing public opinion, which is a key element in the process of governance. We decided to find out how and in what state public opinion is now regarding certain socially important issues,” said Roman Yaroshenko, director of the Foundation for Research for the Future.

He also emphasized that an important part of the research was to study attitudes towards various agencies and organizations.

In his turn, Andriy Yeremenko, founder of the research company Active Group, emphasized that modern technologies were used to analyze the survey results. According to the survey results, the statistical error does not exceed 2.2%, which makes the data quite representative.

“Answering the question ‘What tasks does the Ukrainian government do best?’ 29.6% of Ukrainians said that they are coping with ensuring the stability of the energy system, 26.6% – with organizing international support, 20.7% – with defense against Russian aggression. The last on the list were the tasks of fighting corruption: only 3.5% of respondents believe that the government has coped with this task; managing the property of sanctioned persons, which is handled by the Asset Recovery and Management Agency (ARMA) – 2.5%; and justice – 1.1%. A third of respondents (33.2%) believe that the government is not coping with any of the tasks, and one in five (21.3%) have not decided on the answer,” said Andriy Yeremenko.

To the question “What is your attitude to the seizure of assets of persons under sanctions in Ukraine?” 72.8% of Ukrainians answered positively, of which 50.9% were very positive, 21.9% were rather positive, and 12.6% were neutral. On the other hand, 3.9% of respondents have a negative attitude toward asset seizures, including 3.3% who are rather negative and 0.6% who are very negative. 10.7% of respondents have not decided on the answer.

To the question “In your opinion, how transparent is the management of seized assets in Ukraine?” 12.9% of respondents believe that it is transparent, of which 2% said it is completely transparent, and 10.9% said it is mostly transparent. However, 62.7% of respondents believe the opposite, of whom 35.1% said it is mostly not transparent, 27.6% said it is completely not transparent. A quarter of respondents (24.4%) have not decided on their answer.

Answering the question “In your opinion, how effective is the management of seized assets in Ukraine for the state?” 13.9% of respondents believe that it is effective, of which 2.2% said “completely effective” and 11.8% said “mostly effective”. On the other hand, half of the respondents (50.3%) do not think so, 43% of them said that management is mostly ineffective, 7.3% – completely ineffective. More than a third of respondents (35.7%) have not decided on the answer.

The respondents were also asked “Which of these bodies best contribute to Ukraine’s development?” According to the respondents, the Security Service of Ukraine (29.4%), the President (27.8%), and the local authorities of your city (20.7%) are the best helpers. The last places on the list are occupied by the Prosecutor’s Office (3.5%), the National Agency for the Prevention of Corruption and the Agency for Finding and Management of Assets Derived from Corruption and Other Crimes (3.3%). The fact that no government agency helps is believed by 36.4% of respondents.

The full presentation with the results of the survey can be downloaded here.

The research was conducted by Active Group using the SunFlower Sociology online panel. Method: Self-completion of questionnaires by Ukrainian citizens aged 18 and older. Sample: 2000 questionnaires (representative by age, gender and region of Ukraine). Data collection period: May 4, 2024.