The temporary administrative board of the Antimonopoly Committee of Ukraine (AMCU) decided to impose a fine on LLC “Ukrstalpostach” and LLC “Ukrainian Pipe Plant” for collusion in their participation in public procurement.

According to a press release on Tuesday, the case involves eight procurement procedures that were announced by different customers.

“When considering the case, the circumstances were established, which in their totality indicate the commission by the defendants of anti-competitive concerted actions to eliminate competition between them when participating in the tenders. There were irrefutable facts that indicate coordinated behavior of the companies in the preparation and participation in the bidding, communication between them and exchange of information,” – stated in a press release.

According to the AMCU, such concerted actions of public procurement is a violation (Clause 4 Part 2 Article 6, Clause 1 Article 50 of the Law on Protection of Economic Competition).

For collusion LLC “Ukrstallpostach” and LLC “Ukrainian Tube Works” have been fined by the Committee in the total amount of UAH 103,256 million. In particular, “Ukrstallpostach” LLC was fined in the amount of 94,890 million UAH, “Ukrainian Pipe Works” LLC – 8, 366 million UAH.

The US dollar rate was changing little against the euro and the pound during the Wednesday morning session, but demonstrated a considerable rise against the yen amid increasing US government bond yields.

The ICE-calculated index showing the U.S. dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) is up 0.1%, as is the broader WSJ Dollar Index.

The dollar/yen exchange rate is up 0.4 percent at 134.08 yen as of 7:48 a.m. ksk, up from 133.50 yen at the end of last session.

The yield on 10-year U.S. government bonds on Wednesday morning is about 3.85%, the highest since early November. The rise in yields is due to fears that China’s successive easing of anti-coverage restrictions could intensify global inflationary pressures, Trading Economics writes.

The dollar also continues to receive support from the Federal Reserve’s (Fed) hawkish mood. The Fed expects to raise its key interest rate to 5-5.25% over the next year and hold it at that level until at least early 2024 to return inflation to its 2% target.

The U.S. rate now stands at 4.25-4.5%, meaning the Fed plans three more hikes of 25 basis points. Many market participants expected the final rate level to be lower and were hoping for a reversal in the Fed’s monetary policy and a rate cut at some point next year.

The euro/dollar pair is trading at $1.0645 versus $1.0642 at the close of Tuesday’s session.

The pound sterling is losing less than 0.1% and is trading at $1.2026 versus $1.2031 the day before.

Sweden will become the fourth European country ready to provide Ukrainian road builders with temporary bridge structures for the resumption of traffic, First Deputy Head of Ukravtodor Andriy Ivko has said.

“Sweden has begun the process of providing assistance to Ukraine to supply critically needed six modular bridges. Currently, preparations are underway to organize transportation,” Ivko said in an interview with the CFTS.

He said that in addition to Sweden, Ukraine received bridge structures from the Czech Republic, France and Norway. And the Czech Republic, in addition to the six temporary bridges already sent to Ukraine, plans to transfer another 12 bridges.

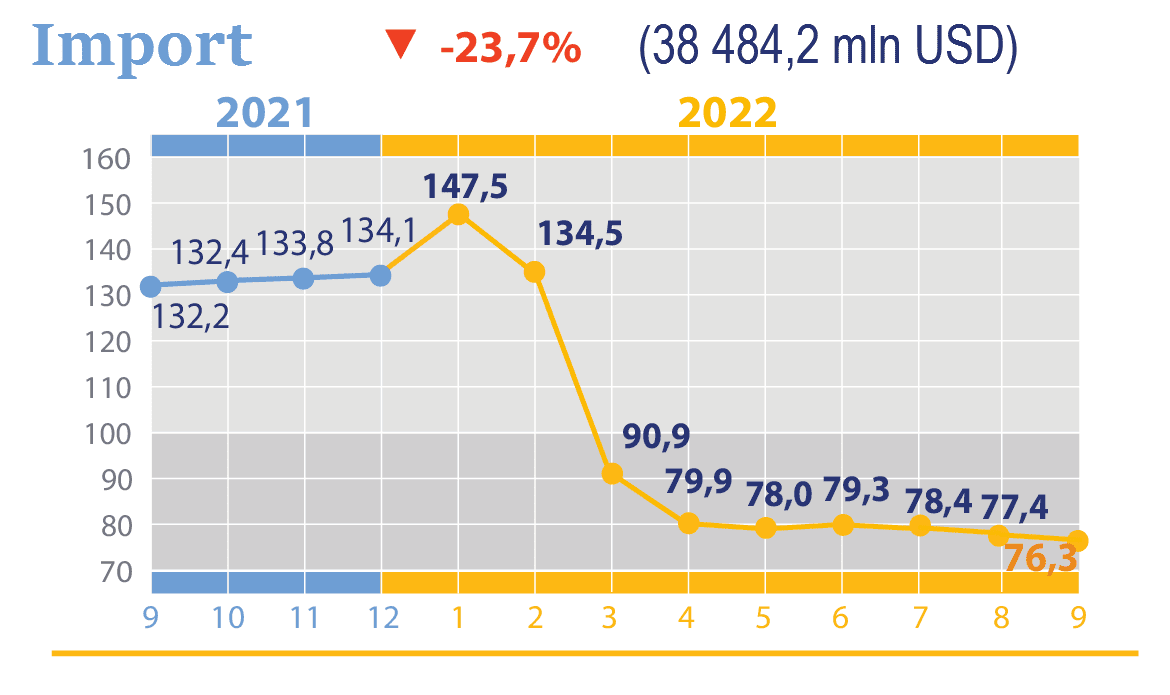

Import changes in % to previous period in 2021-2022

Daten: SSSU

PJSC “Ukrgazvydobuvannya” (UGV) drilled 47 new wells, which is an indicator that is almost the same as before the war, the group “Naftogaz” reported in Telegram-channel in the evening of December 27.

“47 new wells were drilled by Ukrgasvydobuvannya this year. This figure is practically the same as before the war. Ten months of full-scale war, constant shelling, and terror of the energy infrastructure have made our specialists even more motivated and angry,” the group noted.

As Naftogaz informed, Ukrainian gas producers are losing the rate of gas production in eastern Ukraine, but methodically increasing it in the west.

“Our gas producers managed to achieve record drilling rates. In October 2022, the drilling division of Ukrgazvydobuvannya – Ukrburgaz – set a record for the monthly drilling footage – 30,505 m,” also stated in “Naftogaz”.

As it was reported, Ukrhazvydobuvannya launched 50 new wells in 2021 against 41 in 2020.

At the same time, UGV in 2021 reduced the gross production of natural gas by 3.7% (by 527.3 billion cubic meters) compared with 2020 – to 13.666 billion cubic meters, marketable gas – by 3.6% (477.7 billion cubic meters), to 12 billion 932.5 million cubic meters. In addition, in 2021 the Company decreased the production of liquid hydrocarbons by 3.7% (by 23.4 th. tons) to 614.5 th. tons.

In 2021 UGV drilled 50 new wells and connected them to the surface infrastructure, performed 243 well workovers, performed 609 coiled tubing operations, 105 hydraulic fracturing operations, 11 sidetracking operations, equipped 77 wells with the system of mechanized mining.

Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.

Oil prices are changing weakly on Wednesday morning amid low trading volumes during the short pre-New Year’s week.

Investors are assessing the supply and demand situation in the global fuel market and are closely following news from China and the United States.

The value of February futures for Brent at London’s ICE Futures Exchange didn’t change since yesterday’s close of trading and was $84.33 per barrel by 7:15 pm (KSC). At the end of Tuesday’s trading these contracts rose by $0.41 (0.5%).

The price of WTI futures for February at electronic trades of the New York Mercantile Exchange (NYMEX) is $79.58 per barrel by that time, which is $0.05 (0.06%) above the final value of the previous session. The contract fell by 3 cents (0.1%) to $79.53 per barrel at the end of last session.

The oil was traded in plus for the most part of the session the day before on the news that Chinese authorities would cancel obligatory quarantine for those coming to the country since January 8. Analysts believe that the removal of the last restrictions will accelerate the growth of the world’s second-largest economy and increase the demand for fuel.

The market was also supported by reports that the production of petroleum products at major U.S. refineries was suspended due to a snowstorm. As early as Tuesday, however, operations began resuming.

“Throughout 2022, lockdowns in China led to sharp short-term drops in demand, and now many are raising their expectations for 2023,” said Robbie Fraser of Schneider Electric. – But recession risks and rising interest rates remain major negatives for oil futures, limiting any attempt to move higher.