Ukrainian President Volodymyr Zelensky thanked his American counterpart Joseph Biden for the support of the Ukrainian people.

“Joseph Biden, thank you for the support of our people!” he wrote in his telegram channel.

According to the Ukrainian commander-in-chief, “this visit is carried out on the eve of the new year, which can be extremely important for Ukraine.”

“I’m sure that together we can achieve significant results,” Zelensky stressed.

As reported, Biden and First Lady Jill Biden welcomed the president of Ukraine to the White House on the South Lawn. Biden said that the American people, both Democrats and Republicans, were proud to support Ukrainians.

Oil is rising in price on Thursday morning after a significant increase in the previous session, caused by a reduction in fuel stocks in the U.S.

The value of February futures on London’s ICE Futures Exchange is $82.54 per barrel by 8:55 Moscow time, which is $0.34 (0.41%) above the level at the end of the previous session. At the close of trading on Wednesday these contracts rose by $2.21 (2.8%) to $82.2 a barrel.

The price of WTI futures for February at electronic trades of the New York Mercantile Exchange (NYMEX) is $78.67 per barrel by that time, which is $0.38 (0.49%) above the final value of the previous session. The contract rose by $2.06 (2.7%) to $78.29 per barrel at the end of last session.

Last week stocks of oil in the U.S. fell by 5.9 million barrels, said the Energy Department the day before. Experts interviewed by Bloomberg agency on average expected an increase of 2.5 million barrels.

At the same time, commercial reserves of gasoline increased by 2.53 million barrels and distillates decreased by 242,000 barrels.

“Vigorous exports and falling imports due to the Keystone pipeline shutdown led to a significant drop in crude inventories,” wrote Kplr lead oil analyst Matt Smith. – Refinery utilization has fallen to its lowest in seven weeks, which has somewhat limited the reduction in reserves, as has the release of 3.7 million barrels from strategic reserves.”

Additionally, market participants are keeping an eye on the coronavirus situation in the PRC.

“Despite skyrocketing illness rates and reports of overcrowded hospitals, Chinese authorities are not quarantining cities, which means energy demand is rising as the world’s second-largest economy gets back on track,” Sevens Report Research quoted MarketWatch analysts as saying.

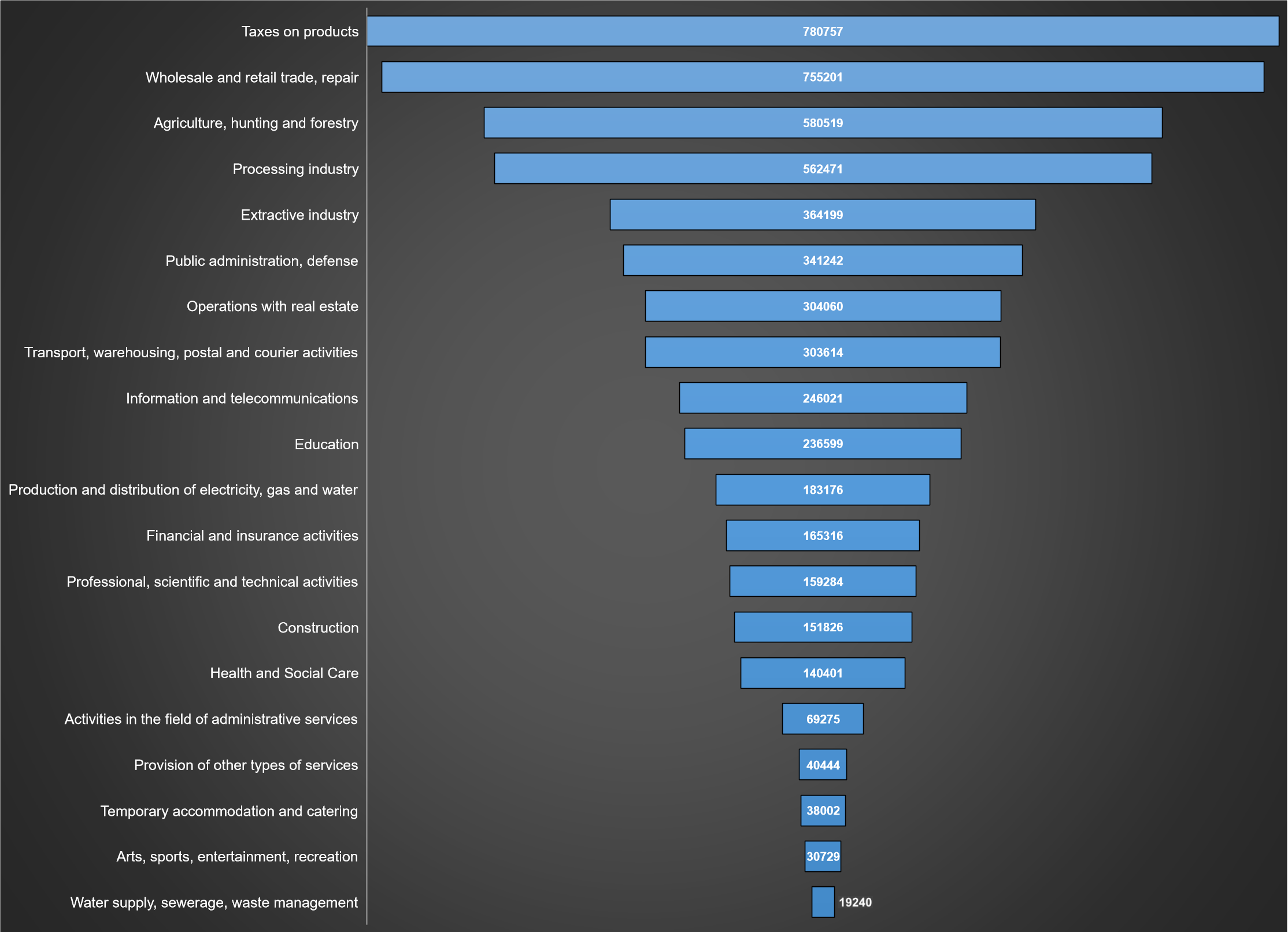

Structure of Ukraine’s GDP in 2021 (production method, graphically)

SSC of Ukraine

Ukraine in January-November this year, Ukraine reduced the export of pig iron in physical terms by 57.8% compared to the same period last year – up to 1 million 227.821 thousand tons.

According to statistics released by the State Customs Service (SCS), exports of pig iron in monetary terms fell by 59.7% to $602.691 million over the period.

In January-November 2022, Ukraine imported 40 tons of pig iron worth $23 thousand, while in 11M2021, it imported 172 tons of pig iron worth $202 thousand.

As reported, Ukraine in 2021 increased the export of pig iron in volume terms by 4.2% compared to 2020 – up to 3 million 235.772 thousand tons, iron exports in monetary terms increased by 78.1% to $ 1 billion 642.596 million. In this export was carried out mainly in the U.S. (53.61% of supplies in monetary terms), Italy (22.08%) and Turkey (9.74%).

In 2021, Ukraine imported 185 tons of cast iron worth $226 thousand from Germany (74.34%), Russia (20.35%) and Slovakia (5.31%), while in 2020, Ukraine imported 593 tons worth $417 thousand.

Ukraine in January-November this year, Ukraine decreased imports of aluminum ores and concentrate (bauxite) in volume terms by 79.8% over the same period last year – up to 945.396 thousand tons, in November imports were not carried out.

According to statistics released by the State Customs Service (SCS), during this period, imports of bauxite in monetary terms decreased by 77.5% – to $48.166 million.

Ukraine did not re-export bauxite in January-November 2022.

As reported, Ukraine in 2021 decreased imports of aluminum ore and concentrate (bauxite) in volume terms by 0.1% compared to 2020 – to 5 million 114.227 thousand tons. Imports of bauxite in monetary terms increased by 4.2% to $236.638 million.

Imports were carried out mainly from Guinea (59.33% of supplies in monetary terms), Brazil (21.33%) and Ghana (16.8%).

Ukraine in 2021 made re-export of bauxite in the amount of 277 tons worth $ 70 thousand to Belarus (48.57%), Poland (40%) and Russia (7.14%), while in 2020 was re-exported to Poland 255 tons of bauxite worth $ 41 thousand.

Bauxite is an aluminum ore used as a raw material for producing alumina, and from it, aluminum. They are also used as fluxes in iron and steel industry.

Bauxite is imported into Ukraine by the Nikolaev Alumina Refinery (NGR), which before the war was affiliated with the United Company (UC) Russian Aluminum (RusAl, RF). Bauxite is used to produce alumina.

“RusAl in Ukraine also previously owned a stake in the Zaporozhye Aluminum Plant (ZALK), which stopped producing primary aluminum and alumina.

14 December 2022, Multi Corporation’s managed shopping centres across Europe, including Forum Lviv in Lviv, have joined forces to raise money for Ukraine to purchase first-aid medical kits. The campaign is a cooperation with UNITED24, a platform launched by Ukrainian president Volodymyr Zelensky.

With the fundraising, Multi wants to help Ukrainians who are affected by the war. The fundraising campaign has started on 14 December and will run for three months.

The first aid medical kits – a necessity in the war-stricken zones of Ukraine and in high demand – cost approximately 110 euros. Customers and tenants of Multi managed shopping centres can contribute through Donorbox, an effective online tool to manage fundraising activities.

Donations from the campaign are transferred to the National Bank of Ukraine and allocated to the Ministry of Health, specifically for the purchase of these medical first-aid kits. UNITED24 ensures that the proceeds are allocated for the right purpose. UNITED24 is audited by Deloitte.

Multi Corporation manages more than 80 properties across Europe and Turkey. Thirteen of its employees work in Forum Lviv, in Ukraine and their safety is constantly at risk.

“For over a decade, Multi has been active in Ukraine. We want to support the people of Ukraine during these difficult times,” says Elmar Schoonbrood, Co-CEO of Multi Corporation. “We are keen to raise money for first-aid medical kits, since these are much needed at the moment.”

“The idea behind UNITED24 is simple: to unite the world around Ukraine. To bring us closer together to save our people, defend and rebuild our land,” says Yaroslava Gres, UNITED24 coordinator. “It allows one-click donations to Ukraine from any country. Why is this so important? Because Ukraine knows best what it needs. Because Ukraine can deliver aid directly to where it is needed. Because only the government can rebuild cities or roads in Ukraine to help people come back home.”

UNITED24 is a fundraising platform, initiated by the President of Ukraine, Volodymyr Zelenskyy. It is the central venue for charitable donations in support of Ukraine. During the first 5 months of operation, UNITED24 collected more than 200 million dollars from citizens of 110 countries around the world. Among UNITED24 ambassadors are famous athletes – Andriy Shevchenko, Elina Svitolina and Oleksandr Usyk, creative director of Balenciaga – Demna, American actors – Liev Schreiber and Mark Hamill, music band Imagine Dragons, singer and actress Barbra Streisand.

About Multi

Multi Corporation is the leading pan-European platform for integrated real estate management services. Since its foundation in 1982, the company has completed over 200 real estate projects with a total GLA of over 5 million sqm, an asset value of nearly 13 billion Euros and has received over 200 industry awards from its peers. Multi currently manages over 80 properties across Europe and welcomes over 400 million customers annually, spending an estimated €4 billion across over 7,200 stores, restaurants, and leisure facilities. Multi offers a full spectrum of services, including active asset and property management, operations, redevelopment and refurbishment, leasing, advisory, legal and compliance. Multi’s in-depth knowledge of retailers, investors, visitors, and local markets provides owners of real estate an integrated and independent platform to protect and drive asset value at every phase of the property’s lifecycle. Multi’s broad financial, commercial, and technical expertise has enabled us to outperform the industry in terms of occupancy, net rental income and state-of-the-art marketing over the years. Multi actively manages assets in 13 countries. The company’s headquarters are in The Netherlands, and has offices in Belgium, Germany, Hungary, Italy, Latvia, Poland, Portugal, Slovakia, Spain, Switzerland, Turkey and Ukraine. Visit www.multi.eu for more information and to download the corporate profile.