Kyiv Cardboard and Paper Mill suffered UAH 233 mln of losses in 9 months, but intends to invest EUR75 mln in equipment

The largest Ukrainian enterprise of the pulp and paper industry of Ukraine, JSC “Kiev Cardboard and Paper Mill” (Obukhov, Kiev region) following the results of nine months of the current year received a 233.4 million UAH loss from economic activity, said the deputy head of the board of the mill Oleg Dubrovka.

“In 2012-2022 the combine received a net profit of more than 2.5 billion UAH, which was reinvested in the development of the enterprise, and only 6 million UAH was paid as dividends. This year’s financial results are affected by both the large-scale invasion of Ukraine by the Russian Federation and the seizure of assets and funds as part of criminal cases,” he said at a press conference in Kiev on Tuesday, answering a question from Interfax-Ukraine.

According to him, in particular, after the Russian invasion of Ukraine had to suspend the project of launching the production of corrugated packaging in Verkhnedniprovsk, where it was planned to create 250 jobs.

“It was planned to launch a shop for the production of cast containers (packaging for eggs) with 123 jobs, but with the narrowing of the capacity of the market of these products plus the destruction of large enterprises in the south, the direction of cast containers for this year is projected to give us a loss of 24 million UAH, and the plant had to suspend”, – explained Dubrovka.

Also, before the start of a full-scale war, “Pulp Mill Holding” (the only shareholder of the mill) had planned to renew the entire equipment fleet of “Pulp Mill Print” – both carton packaging and flexography.

Among other things he noted that with the beginning of full-scale war the Kiev Mill had problems with the departure of the personnel, problems with logistics, delivery of the finished products, we had to look for new ways to supply the raw materials. Dubrovka also noted the staffing problem and said that all requests of the mill for reservations for personnel were never supported.

“But the company’s image is also negatively affected by the ongoing asset seizures. Partners do not understand why sanctions, why arrests and why there is no reaction to our requests to the law enforcement agencies. That is why both war and criminal proceedings lead to problems for the company and, consequently, to losses,” he summarized.

According to the deputy head of the Works, the environmental project of the plant’s waste incineration was to be launched in 2022. He stressed that the financing of the projects has not been stopped, but the company has faced the fact that Western specialists do not want to go to Ukraine to install the equipment.

“That is why last week the Supervisory Board decided to budget EUR75 million for the equipment, and we will look for ways and Ukrainian specialists to install it,” Dubrovka said.

He stressed that the modernization of production requires bank financing, and the mill mostly works with subsidiary banks of foreign banks (Raiffeisen, Credit Agricole). Cooperation with the European Bank for Reconstruction and Development (EBRD) was an important milestone, but had to repay its long-term loan ahead of schedule. “Resuming work with this respected bank will require a lot of effort,” he concluded.

At the same time Dubrovka expressed the opinion that the task of all criminal proceedings against the combine is the transfer of assets to the National Agency of Ukraine on the detection, search and management of assets derived from corruption and other crimes (ARMA), which will actually lead to the shutdown of the combine.

“The power structures need to understand that to stop the enterprise is not a shopping center (like the stopped Ocean Plaza), it will lead to the loss of jobs (about 3.3 thousand people in the group of companies), and Obukhov may be left without water and heating, which today provides Kyiv KBK,” he added.

Kiev KBC is one of the largest enterprises in Europe for the production of cardboard and paper products (corrugated packaging, sanitary products) with a staff of about 2.2 thousand people.

In 2021 the mill increased the production volume by 34.2% compared to 2020 – up to 7 billion 699 million UAH, and in January-September this year it produced goods for 5.4 billion UAH, which is 3.2% less than last year.

In January-September 2021 the net profit of KKBK was 488 million hryvnias.

The producer of tobacco products PJSC “Philip Morris Ukraine” in cooperation with DTF agency organized five social spaces “Spheres of the Sweet” with working areas in Kyiv, Odessa and Lviv, equipped with generators and Starlink satellite communication systems.

According to Philip Morris’ press service on Tuesday, the social spaces can keep you warm, recharge your devices, work and drink hot tea. They will be open until Dec. 30 and can accommodate about 100 people each at a time.

“We work for a large international company with offices and stores in many Ukrainian cities. Like all Ukrainians, we look for communication during blackouts, sit in shelters during alarms and worry if we can’t contact our families. We believe that resilient companies can help to survive a blackout together, so we organized autonomous stations with electricity, internet and heat”, – the company quotes the general director of “Philip Morris Sales and Distribution” Dmitry Zinchenko.

According to him, from the first days of the launch, social spaces have been very popular among city residents and help out in very unexpected situations.

“Employees of different companies during blackouts often make a field office with us. In Odessa, for example, during a blackout, girls from a nail salon nearby moved into the sphere. And in Kiev, our space even became a place for a wedding ceremony”, – added Zinchenko.

Social spaces are located in Kiev on Lesya Ukrainka Square, 1 (Central Election Commission) and Kontraktova square (near the Ferris wheel), in Odessa in the Park of enthusiasts (Akademika Zabolotnogo 66/2v) and in the Square “Ray” (Levitan 95a), and in Lviv on Vinnichenko Street 24 (Powder Tower).

Philip Morris International, which includes “Philip Morris Ukraine” is one of the world’s largest tobacco manufacturers. It operates in Ukraine for more than 20 years, owns a factory in the Kharkov region. Before the Russian armed invasion the company employed about 1.3 thousand people. Before the war, the factory was an export hub for more than 20 countries, in particular such major markets as Japan and Egypt.

The U.S. dollar is getting cheaper against the euro, the pound sterling and the Japanese yen in trading Tuesday afternoon.

The ICE-calculated index showing the dollar’s dynamics against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) lost 0.73% in trading, while the broader WSJ Dollar Index lost 0.64%.

The yen was up 3% against the dollar at 132.73 yen/$1 as of 2:10 p.m., compared with 136.91 yen/$1 at Monday’s market close.

The Japanese national currency was actively growing after the Bank of Japan unexpectedly decided to increase the borders of the band within which the yield of ten-year government bonds may fluctuate to plus/minus 0.5% from plus/minus 0.25% at the end of its regular meeting that ended on Tuesday.

According to the regulator, this decision will improve the stability of the existing monetary policy, but many economists took this step as laying the foundation for the exit from the ultra-soft monetary policy (MP), maintained for a long time, writes Bloomberg.

At the same time, the Bank of Japan left the main parameters of MP unchanged: the short-term interest rate on deposits of commercial banks in the Central Bank remained at minus 0.1% per annum, the target yield on ten-year government bonds – about zero. This coincided with the expectations of most analysts.

The euro/dollar pair is trading at $1.0635 compared to $1.0609 at the close of the previous session.

The pound has fallen in price to $1.2148 against $1.2145 at the close of trading on Monday.

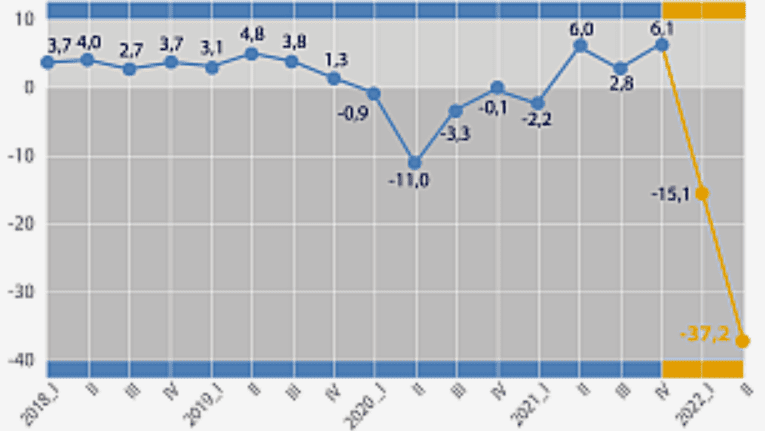

Real GDP percentage changes over previous period in 2018-2022

SSC of Ukraine

Hotel operator Ribas Hotels Group (Odessa) started construction of WOL.GREEN Polyana complex in Zakarpattya, Ribas Hotels Group founder Artur Lupashko said,

“We are implementing our new project WOL.GREEN Polyana together with the Arena Bud development company in Zakarpattya. Construction has already begun,” he said on Facebook.

WOL.GREEN Polyana – is a complex of 78 apartments with own SPA and swimming pool, co-working place, fitness-centre, equipped sportive zones in the open air.

Lupashko reminded that the format WOL home+hotel, realized by the operator, suppose the possibility of short-term and long-term rent. In this case investors are offered to become a co-owner of the complex, to buy an apartment, which will be managed by the company Ribas Hotels Group.

“We are constantly moving and developing our hotel industry and country in all conditions and we see that the Ukrainian investor is ready to invest in the future of our country”, – added Lupashko.

Ribas Hotels Group cooperates (management, franchising and booking) with 26 hotel and restaurant properties (city, beach and ski hotels). The company’s portfolio includes business hotels Wall Street by Ribas and Bossfor by Ribas, hotel Wol.121 by Ribas (Odessa), ski hotel Ribas Karpaty (Bukovel, Ivano-Frankivsk region), beach complex Richard by Ribas (Gribovka, Odessa region). Hotels in Lviv, Kyiv, Odessa and other cities, as well as in Poland are now at the design and construction phase.

The total room stock of the network is more than 1 thousand rooms in different forms of cooperation in eight cities and resort locations in Ukraine.

Zaporizhzhya municipal enterprise “Zaproelectrotrans” on December 16 announced its intention to conclude a contract with IC “VUSO” on compulsory civil liability insurance of owners of ground vehicles, according to the electronic public procurement system Prozorro.

The expected value of the purchase of services was 398,974 thousand UAH, the price offer of the company was 319,7 thousand UAH.

As it was reported, several years in a row the winner of similar tenders was IC “Motor-Garant”.

IC “VUSO” was founded in 2001. The company owns 50 licenses: 34 – on voluntary and 16 – on obligatory kinds of insurance, it is presented in all regions of Ukraine. It’s a member of MTSBU and UFSI, a member of the Agreement on direct settlement of losses and a member of the Nuclear Insurance Pool.