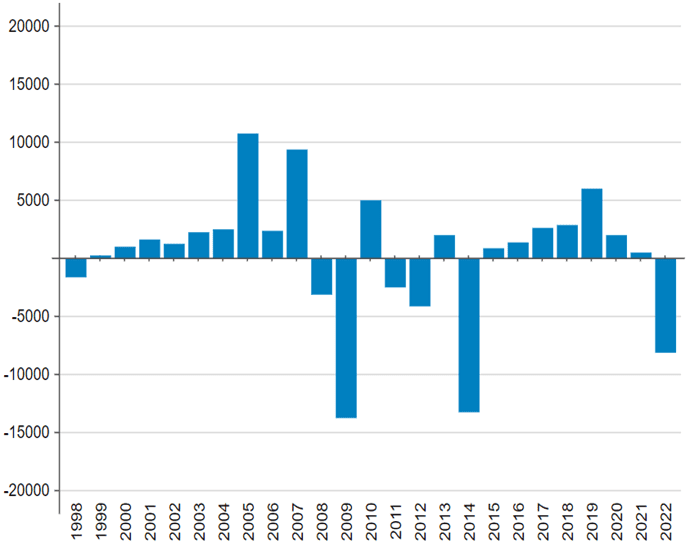

Dynamics of balance of payments of Ukraine in 1998-2022 (USD mln)

http://www.minfin.gov.ua

The leaders of Romania, Bulgaria and Croatia have supported the “Grain from Ukraine” initiative announced by the president of Ukraine and announced further efforts to increase existing and create new transit corridors for the export of Ukrainian grain and other agricultural products.

“Since the beginning of the war, 8.4 million tons of grains and oilseeds from Ukraine have been transited (through Romania) to consumers in the world. We expect transit exports from Ukraine to increase in the coming months,” Romanian Prime Minister Nicolae Ciuca said in a video message at the international food security summit in Kiev on Saturday.

He noted that Romania has acted very strongly in support of Ukrainian grain exports through Romanian ports and will continue working to increase connectivity between the countries by land and rail, including the recent opening of a new border crossing.

Ciuche also stressed that Romania has and will not back down from supporting Ukraine and Moldova in the energy sphere. “We will not allow Russia to plunge the region into darkness,” he said.

Bulgarian President Rumen Radev said at the summit that Bulgaria has managed to transport about 200,000 tons of grain from Ukraine across the Danube in recent months, and the country intends to continue this transportation project.

“Unfortunately, the loss of power in Ukrainian ports due to Russian shelling has made this process difficult for Bulgarian vessels,” he said.

Radev also said Bulgaria is providing fuel to Ukraine so the country can support the agricultural and transportation sectors.

Croatian Prime Minister Andrea Plenkovic also supported work on new corridors for the supply of Ukrainian products as part of the EU’s Solidarity Routes project.

“Croatia is actively joining, and will attract other ports on the Adriatic and there are opportunities for corridors along the Danube River,” said the Croatian government head.

The three leaders welcomed the extension of the Black Sea Grain Initiative for another 120 days, and the Bulgarian president urged the search for stable long-term solutions.

The State of Qatar will allocate $20 million to buy agricultural products for African countries in the framework of the Grain from Ukraine initiative, announced by President Vladimir Zelensky at the G20 Summit last week, to help feed people around the world.

Sheikh Mohamed Al Thani, deputy prime minister and foreign minister of the State of Qatar, said this during a speech at the international summit on food security on Saturday.

“Qatar welcomes special programs and projects that promote food security and increase the sustainability of countries. We welcome the Grain from Ukraine initiative as it aims to help African countries get Ukrainian food exports. Qatar will allocate $20 million to support this initiative”, – emphasized the representative of Qatar.

He also reminded that the Qatar Foundation for Development will provide $12 million to the Horn of Africa to ensure food safety, and has already provided the UN World Food Program (WFP) with $90 million to feed famished people in Yemen.

In addition, Qatar has already allocated $5 million to the Ukrainian Ministry of Health for the purchase of ambulances and other medical equipment.

“Qatar remains a reliable international partner, and we support collective initiatives, international activities aimed at ensuring our country works effectively together with international partners to confront challenges that threaten specific communities and also pose a collective threat to humanity,” Sheikh concluded.

As reported, the humanitarian program Grain from Ukraine, announced by Ukrainian President Volodymyr Zelensky at a speech before the G-20, which will be implemented in partnership with the UN WFP, provides grain for at least 5 million people until the end of spring 2023.

Ukraine has decided to send part of its grain reserves under the program to those African countries where there are already problems of hunger. Part of the grain ready for export can be bought by the project participants, thus the international partners can simultaneously support the Ukrainian economy in a difficult situation and help poor countries in Africa.

The U.S. has already earmarked $20 million for the project implementation, while Germany and Japan are to contribute EUR 15 million, Belgium EUR 10 million, France EUR 6 million and Canada USD 30 million (about $22.4 million).

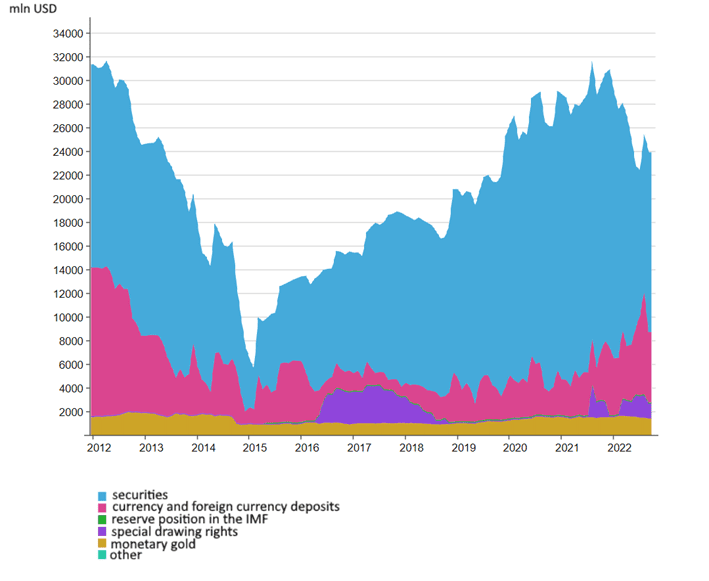

Dynamics of gold and foreign reserves of Ukraine from 2012 to 2022

http://www.minfin.gov.ua

PJSC “Enterprise with foreign investment (EFI) “Intervzryvprom” (Gorishni Plavni, Poltava region) at the end of 2021 increased its net profit in 2.6 times compared with 2020 – up to 113.354 million UAH from 43.858 million UAH.

According to the company’s announcement about the annual meeting of shareholders, which will be held on December 27, the undistributed profits at the end of last year amounted to 72.175 mln hryvnia.

The draft decisions of the meeting proposed to the shareholders to approve the profit received in 2021 in the amount of 113,354 mln hryvnia. Of these UAH 40,879 mln to be used for paying off the losses of previous years, UAH 1 mln 599,9 thousand for the formation of the reserve capital of the company and UAH 70 mln 875,1 thousand to be left undistributed.

Not to pay dividends on the results of activity of PrJSC in 2021.

The stockholders will also summarize the results of the company’s activity for 2021, approve reports and approve major transactions.

As it was reported, in 2004-2005 Intervzryvprom put into operation at Poltava Mining and Processing Enterprise a technological line for production of emulsion and a mixing and charging machine which was purchased in the USA.

PJSC Intervzryvprom Foreign Investment Company (FIC) was founded in May 2001. It is engaged in the production of explosives.

According to the data of the National Tax Service as of the fourth quarter of 2021, PrJSC Ukrainian Financial Company and Intervzryvprom Ltd have 24.9981% each of the company’s shares, while M&Q Trading Limited and West Industrial Investment company Ltd (both in Cyprus) have 24.9972% each.

Intervzivprom Ltd. was registered in September 2000 with the registered capital of 1.5 million hryvnias. The company’s beneficiary Konstantin Nosov (Kiev) owns a 99.2% stake. Among its main activities is the production of explosives.

The registered capital of PJSC Intervzryvprom is UAH 10.666 mln, and the par value of its shares is UAH 100.

As of November 24, the volume of financing actually allocated to Ukraine by international partners since the beginning of the war to cover the state budget deficit totaled $25.731 billion, and another $1 billion – for reconstruction, or 71% of the declared aid totaling $37.581 billion, the Ministry of Finance of Ukraine reports.

According to the data published on its website, grants accounted for less than half of the received funds – $10.49 billion, or 39.2%.

A month earlier, as of October 26, the funding was $23.123 billion to cover the budget deficit and $1 billion for reconstruction, or 65% of the announced aid for a total of $36.959 billion, and the grants were the same.

As indicated by the Ministry of Finance, the largest support to Ukraine was announced by the U.S. and the European Union – respectively, $12.99 billion and $11.5 billion. The U.S. allocated $8.49 billion, or 65%, of this amount, all in the form of grants, the EU – $7.367 billion, or 64%, of which only $626 million in the form of grants.

According to the table, the five largest donors of pledged aid are close to the International Monetary Fund (IMF), European Investment Bank (EIB) and Canada – $2.71 billion, $2.32 billion and $2.021 billion respectively. The IMF has allocated all the funds, while the EIB and Canada – $1.72 billion and $1.521 billion respectively, all as loans. At the same time, the EIB is so far the only one that has provided financing for the recovery.

Next comes the World Bank, Germany and Britain – $1.765 billion, $1.373 billion and $1.076 billion, respectively, of which Germany and Britain provided $1.049 billion and $128 million in grants respectively. These countries have allocated all the pledged funds, while the WB only 56%.

The donor to Ukraine’s budget of over $500 million since the start of the war is also Japan – $581 million: these funds have already been received, and all in the form of loans.

France announced support for the Ukrainian budget of $432 million, of which it received 77%, while Italy and the Netherlands gave $332 million and $330 million, respectively (of which Italy gave $125 million in grants). Italy has already provided all the funds, while the Netherlands has so far allocated one-third – $106 million.

Another nine countries have pledged a total of $172.5 million, of which $149.5 million has already been received, including $80.5 million in the form of grants. Sweden and Denmark are the largest: $49 million and $53 million, respectively, but Denmark has so far given only $53 million, but all in the form of grants.

The Ministry of Finance also pointed out that since the beginning of the war, the National Bank of Ukraine has covered the budget deficit by 355 billion UAH, or $11.246 billion in equivalent, through direct purchase of war bonds.

The monthly need to finance the state budget deficit this year because of the war, according to the Ministry of Finance and the government, is about $5 billion. Next year, the government plans to reduce the state budget deficit by $3-4 billion a month (a total of $38 billion for the year), counting on its financing by the United States, IMF and EU, and intends to raise $17 billion for emergency reconstruction.

Emission financing through the purchase of government bonds by the National Bank in the approved state budget-2023 has not yet been included, although such an option, as noted by Finance Minister Sergei Marchenko, remains. The NBU also admitted that next year the emission financing may still be needed, but insisted that its volume should not exceed 200 billion hryvnias per year.