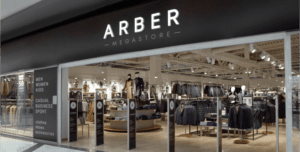

The Arber chain of clothing stores has opened its first store abroad, in Georgia, the network’s press service said.

“Now we demonstrate style and quality of Ukrainian production in Georgia. Arber has won the hearts of more than a million domestic customers and now we are entering a new level,” – stated on the official Facebook page of the company.

It is specified that the area of the store in East Point Shopping Center in Tbilisi is 176 square meters.

Arber Fashion Group – vertically integrated Ukrainian holding for clothing and accessories. It is represented by a retail network of more than 90 stores in all regions of Ukraine under the Arber, F’91 and “Kokon” brands.

The AFG production complex is represented by seven in-house factories for the production of men’s and women’s clothing, capable of producing more than 2 million units annually.

In Ukraine, due to problems with energy supply caused by shelling of energy facilities and infrastructure, a significant increase in demand for autonomous solar stations, both domestic and industrial, is recorded, Artem Semenyshyn, executive director of the Solar Energy Association of Ukraine, said.

“According to the results of our analysis based on data from the main suppliers and distributors of equipment, for domestic SPPs, demand for autonomous stations increased approximately 10 times, for industrial ones – 4-5 times,” he said, answering questions from a journalist from the Energy Reform Internet portal during a thematic online seminar in Kyiv on Wednesday.

At the same time, he noted that traditionally demand for grid inverters, which make it possible to supply electricity to the grid at a feed-in tariff, significantly prevailed over the demand for autonomous ones, providing personal power consumption.

At the same time, according to him, due to a sharp increase in demand in Ukraine, there is a shortage of the necessary equipment.

“There is not even enough equipment available. Here we compete for consignments of equipment with Europe, where the demand for solar power plants is also growing,” Semenyshyn said, expressing the hope that the situation with such equipment will improve in the coming months.

At the same time, he drew attention to the need to stimulate the development of small solar generation for personal consumption, given the situation with energy supply in the country.

At the same time, he pointed out that an autonomous solar power plant of the appropriate capacity has several advantages over diesel generators.

“For example, a battery has a response time of milliseconds, while a generator needs 1-3 seconds. In the case of a hospital, in particular, the switching speed is important in order to maintain certain settings of medical equipment. In addition, large generators consume a huge amount of expensive fuel, and the solar power plant battery can also be charged from the grid when there is electricity,” Semenyshyn explained.

Ukreximbank board member Alexander Ignatenko is cooperating with the investigation into the Ukrgazbank case, where he served as a board member until March 2020, which is being conducted by the National Anti-Corruption Bureau (NABU) and the Specialized Anti-Corruption Prosecution Service (SAP), and is taking all legal methods to prove his innocence, Ukreximbank said in a statement.

“Ukreximbank reports that the case currently being investigated by the NABU and the SAP is not related to the current activities of Ukreximbank. Ukreximbank has no information pointing to the illegal actions of a member of the bank’s board,” the financial institution said in a release on its website.

According to it, Ignatenko has been in Kyiv since the date the case went to court and has been performing his official duties as a board member of Ukreximbank, “contributing to supporting the defense capability of the state, its energy and food security.”

“Ukreximbank is interested in the full and impartial performance of the anti-corruption bodies of Ukraine assigned tasks to protect the interests of the state in the fight against corruption and is open to cooperation with investigative authorities,” – noted in the statement.

As reported, on October 31, the Supreme Anti-Corruption Court of Ukraine selected a preventive measure in the form of bail of about 40 million UAH in connection with the investigation into the infliction of more than 200 million UAH of losses to Ukrgazbank.

In addition, the suspect must come to the detective, prosecutor and the court at the first request, to report the change of residence and work, to refrain from communicating with other suspects in the case and witnesses, to deposit a foreign passport.

As reported, anti-corruption bodies of Ukraine in early October reported on the exposure of illegal activities of officials of the state Ukrgazbank and the suspicion of the 5 main figures in this crime, including the former head of Ukrgazbank and resigned from the post of the National Bank of Ukraine Kyrylo Shevchenko.

According to the prosecutor’s office, it was established that the bank’s management, possessing information about banking service contracts concluded with large customers, used it to steal money.

“For this purpose, bank officials ensured the conclusion of fictitious contracts with individuals and legal entities, which allegedly being “agents” of the bank attracted large customers to it. For such “agent services” the bank illegally paid monthly “remuneration” to these persons,” – explained in the SAP.

The investigation found that during 2014-2020 under this scheme, 52 fictitious agents were groundlessly transferred money of the state bank in the amount of more than 206 million UAH.

Then, on 23 October, the NABU put former NBU head Shevchenko, deputy board chairman of Ukrgazbank Denys Chernyshov and deputy director of the corporate VIP client department Olena Khmelenko on the wanted list.

The first decade of November is usually a period of national celebrations and sports competitions. Traditionally, for 98 years the largest sports public association celebrates the anniversary of its foundation. In the conditions of full-scale military aggression, when more than 3 thousand Dynamo soldiers are defending Ukraine at the front, titled athletes, well-known activists and government officials gathered to support the tradition and the Ukrainian sports movement in the conditions of war.

The honorary guests of the FSO “Dynamo” of Ukraine were: Georgii Mazurashu, member of the Verkhovna Rada Committee on Youth and Sports, Serhii Shkarlet, Minister of Education and Science, Kateryna Pavlichenko, Deputy Minister of Internal Affairs, Matvii Bidnyi, Deputy Minister of Youth and Sports of Ukraine, Valerii Borzov, Vice-President of the NOC, the main heroes of the celebrations were outstanding athletes who are prize-winners and Olympic champions: Lyudmila Turishcheva, Lyudmila Luzan, Taras Danko, Hennadiy Avramenko, the event was also attended by heads of law enforcement agencies.

Viktor Korzh, the First Deputy Chairman of the Dynamo Football Society of Ukraine, emphasized that despite the cancellation of all sports events in the first half of 2022 for the period of martial law, the Dynamo Football Society of Ukraine did not stop working, radically changing the format of its activities and focusing on providing assistance to the Armed Forces, territorial defense, internally displaced persons and all those who are fighting.

To the daily tasks of the Society on physical culture and health improvement, implementation of the state policy on involving children in physical culture and sports, education of patriotism and humanistic values, preparation of the Olympic reserve, urgent humanitarian directions were added.

“We organized and held 41 humanitarian events, 11 charity events for more than 1000 participants. More than UAH 200000 was collected for the needs of the Armed Forces, other military formations and internally displaced persons. We also collected and distributed more than 190 tons of humanitarian aid. For more than 5000 of our citizens, who became refugees as a result of military aggression, the Dynamo Football Club of Ukraine found and equipped new homes. Thus, the motto of the FSF “Dynamo” of Ukraine – strength in movement and unity is not only about sports, this is how we understand our vocation to unite the sports community of our country”, – said Viktor Korzh, First Deputy Chairman of Dynamo.

To the congratulations and commemoration of the 98th anniversary was added an announcement of a new direction of cooperation with the Charitable Foundation “Reconstruction and Development of Ukraine” – a collection for mobile hospitals for the front.

“The availability of emergency professional medical care in modern conditions means 100 lives of our citizens every day, the best and bravest defenders. Today, the frontline needs 52 mobile hospitals, and in almost two weeks the first of them will go to the East. Dear friends, I am sure that with the habit and will to win as the FC “Dynamo” of Ukraine, medical care will be available to every defender of our country”, – called Artem Goncharenko, Chairman of the CF “Reconstruction and Development of Ukraine”.

Novovolynsk Foundry (Volyn Region) increased its net loss by 36% year-on-year in 2021 to UAH 25.3 mln from UAH 18.599 mln.

According to the company’s December 8 annual shareholders meeting announcement, its retained earnings by the end of last year amounted to 137.868 mln hryvnia.

The shareholders at the meeting intend to summarize the results of work in 2021, define plans for 2022 and elect a new composition of the supervisory board of the company.

It is suggested to pay off the loss for 2021 at the expense of profit of previous years.

As reported, the plant ended 2020 with a net loss of 18.539 million UAH, while in 2019 received a net profit of 35.877 million UAH.

The plant specializes in the production of high quality steel and iron castings for mechanical engineering.

According to the NDU for the fourth quarter of 2021, Dnister-M LLC (Lviv region) owns 84.6099% of Novovolynsk Casting Plant PJSC.

The authorized capital of the company is 1 million 568.06 thousand UAH, the par value of the share is 0.25 UAH.

Specialists of the governmental team of response to computer emergency events in Ukraine CERT-UA warn of the mass distribution of emails with malicious links, allegedly on behalf of the State Service for Special Communications and Information Protection of Ukraine.

“If you click on a link from an email, a RAR archive will be created on your computer (for example, 11/08/2022.rar) containing a shortcut file called “VBI tools with an expert opinion on compliance with the requirements of technical information protection”. lnk”. Opening this file will lead to the download of malware, including those that steal data,” the message said on Wednesday.

According to him, experts associate such activity with a group of hackers UAC-0010 (Armageddon).

“At the end of October, malicious emails were sent out on behalf of a number of structures in the security and defense sector – the press service of the General Staff of the Armed Forces of Ukraine and the Security Service of Ukraine. Therefore, it is possible that hackers can use such a “cover” in the future,” CERT experts noted. -UA.

As reported, the hacker group UAC-0010 (Armageddon) is associated with the FSB of the Russian Federation. Since the beginning of Russia’s full-scale military invasion of Ukraine, they have been on the list of the most active groups attacking Ukraine.