The vessel Lady Zehma with grain from Ukraine was refloated in the Bosphorus Strait, the local publication Maritime Executive reports.

According to reports, after a 173-meter dry cargo ship with 3,000 tons of Ukrainian corn got stuck in the strait, rescue tugs were sent to help, which “quickly launched it into the water.”

“As of Thursday evening, the ship was moving at a slow pace, accompanied by several tugboats,” the publication said.

On August 30, the UN reported that the Joint Coordinating Center (JCC) had given permission for six ships, including the Lady Zehma ship carrying 3,000 tons of corn, to leave Ukrainian ports on Tuesday as part of an Istanbul food deal.

On July 22, in Istanbul, with the participation of the UN, Russia, Turkey and Ukraine, two documents were signed on the creation of a corridor for the export of grain from three Ukrainian ports – Chernomorsk, Odessa and Yuzhny.

In August, Ukrzaliznytsia increased the volume of cargo transportation by 4.5%, from 10.318 million tonnes to 10.787 million tonnes, Oleksandr Kamyshin, head of the company’s board, said on Telegram on Thursday evening.

“There is a significant increase in grain, our strategic position. Up to 42% was transported, primarily due to the unblocking of seaports,” he wrote.

According to information provided by Kamyshin, 2.088 million tonnes were transported in August compared to 1.447 million tonnes in July.

In addition, the transportation of oil products increased by 2.6%, to 556,000 tonnes, and construction materials – by about 10%, the head of the board of Ukrzaliznytsia said.

According to him, the transportation of iron ore decreased by 6.8%, to 1.895 million tonnes, as well as ferrous metals – by 10%.

“But here the reason is clear – unfortunately, the decline in steel production in the world continues. But the decrease in coal transportation by 10% really worries me,” Kamyshin said.

He stressed that Ukrpzaliznytsia was fighting for every tonne of cargo and increasing the export-import potential of the railway by building new sections, opening new junctions with neighboring countries and increasing the capacity of western crossings.

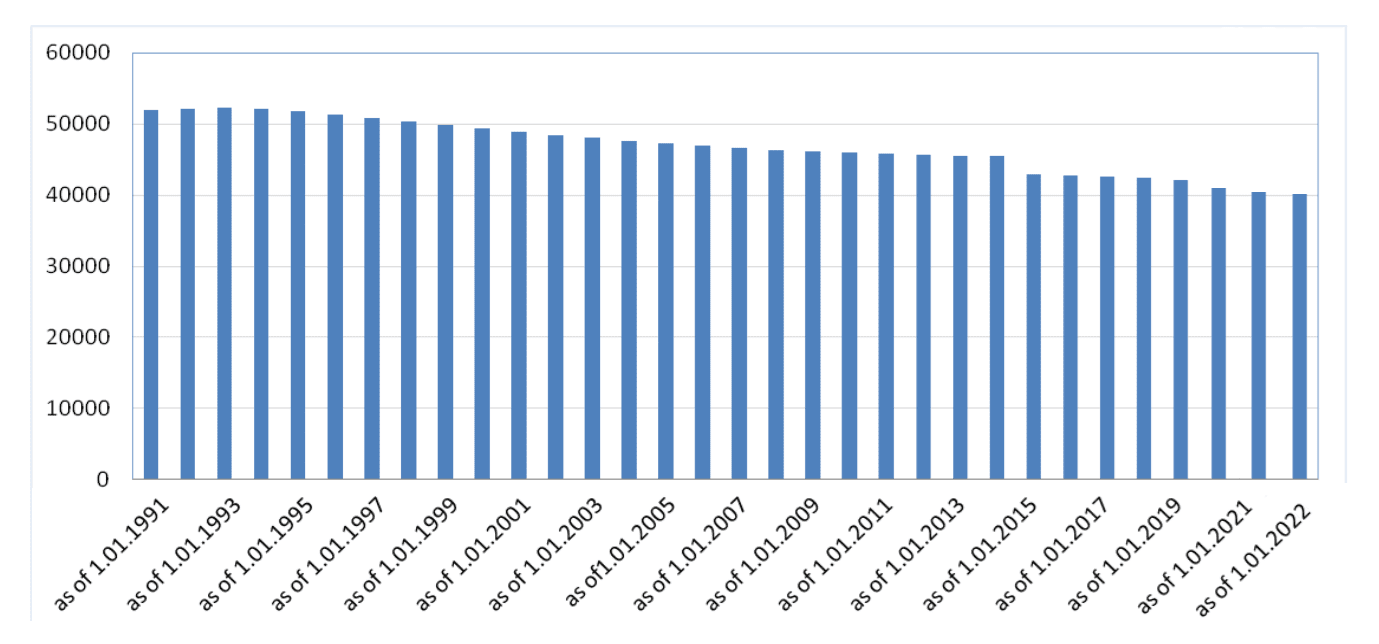

Dynamics of changes in population of Ukraine from 1991-2022

SSC of Ukraine

Hong Kong’s Hang Seng index fell 0.6% by 8:10 qoq, while China’s Shanghai Composite rose 0.3%.

Among the leaders in the fall of quotations on the Hong Kong Stock Exchange are shares of real estate developers Country Garden Holdings Co. Ltd. (-4%) and China Resources Land Ltd. (-3.7%), manufacturer of sports goods Anta Sports Products Ltd. (-2.3%) and PC maker Lenovo Group Ltd. (-2.2%).

Shares of Chinese electric vehicle manufacturers are also actively declining, including NIO Inc. become cheaper by 2% and XPeng Inc. – by 4.1%. Companies reported an increase in deliveries of electric cars in August, but the pace of increase fell short of investors’ expectations, analysts at Citi said.

The value of the Japanese index Nikkei 225 to 8:20 q decreased by 0.02%.

Among the components of the indicator, shares of NEXON Co., a mobile game developer, are depreciating most actively. Ltd. (-3.6%), machine-building Mitsubishi Heavy Industries Ltd. (-2.4%) and oil Idemitsu Kosan Co. Ltd. (-2%).

Meanwhile, Japanese retailers Isetan Mitsukoshi Holdings Ltd. are the leaders of growth. (+2.7%), Seven & I Holdings Co. Ltd. (+2.5%) and J. Front Retailing Co. Ltd. (+2.4%).

The South Korean index Kospi rose by 0.3% by 8:25 a.m.

Shares of automaker Kia Corp. rise in price by 1.2%, one of the world’s largest manufacturers of chips and consumer electronics Samsung Electronics Co. cheaper by 0.9%.

Consumer prices in South Korea in August rose by 5.7% in annual terms, showed data from the statistical office of the country. Inflation slowed down from a 24-year high of 6.3% in July and came in below analysts’ forecast of 6.1%, according to Trading Economics.

The slowdown in the growth of consumer prices in the country was ensured by a slowdown in the rise in prices for food and energy resources, according to the report of the statistical office.

On a monthly basis, consumer prices fell 0.1% last month after rising 0.5% in July.

The Australian S&P/ASX 200 fell 0.1%.

The market value of the world’s largest mining companies BHP and Rio Tinto falls by 2% and 2.6% respectively.

Oil quotes add about 2% during trading on Friday, recovering after falling the day before.

Meanwhile, prices for both brands could show their biggest weekly decline in four weeks amid fears of a recession in the global economy and the consequences of another lockdown in China, writes Trading Economics.

The price of November futures for Brent on the London ICE Futures exchange by 8:10 a.m. on Friday is $94.22 per barrel, which is $1.86 (2.01%) higher than the closing price of the previous session. As a result of trading on Thursday, these contracts fell by $3.28 (3.4%) to $92.36 per barrel.

The price of futures for WTI oil for October in the electronic trading of the New York Mercantile Exchange (NYMEX) is $88.38 per barrel by this time, which is $1.77 (2.04%) higher than the final value of the previous session. By the close of the market the day before, the cost of these contracts decreased by $2.94 (3.3%) to $86.61 per barrel.

As reported, the finance ministers of the G7 countries at a meeting on Friday plan to approve and outline their plan to set a price limit for Russian oil.

Under martial law, PIN-UP Ukraine, one of the representatives of the legal gambling business in Ukraine, transferred UAH 23.4 million of license fees to the state budget.

The gambling business supports the Ukrainian economy and makes annual payments for licenses, despite the possibility of a delay due to Russia’s full-scale war against Ukraine.

“Today, the Ukrainian economy is suffering losses due to the full-scale invasion of the Russian Federation. PIN-UP Ukraine, as one of the leaders in the market of licensed casinos in Ukraine, did not stop its activities in the online segment of the gambling market and regularly pays annual fees for licenses. The PIN-UP Ukraine team will continue to support the economy of Ukraine,” commented Igor Zotko, COO PIN-UP Ukraine.

In 2021, PIN-UP Ukraine paid a license fee in the amount of UAH 23.4 million to the state budget.

Recall, according to the Commission on Gambling and Lotteries, this year, for the first six months, UAH 746.94 million has already been received from paying for licenses to carry out activities in the field of organizing and conducting gambling and issuing and conducting lotteries.