As of September 20, Ukrainian agricultural producers sowed the main winter crops on an area of 411 thousand hectares (9% of the forecast of 4.56 million hectares), 0.25 million hectares were sown over the past week, according to the website of the Ministry of Agrarian Policy and Food on Tuesday.

In particular, wheat was sown on 9% of the planned area, or 364 thousand hectares (+207 thousand hectares for the week of September 13-20), barley – 32 thousand hectares (+25 thousand hectares, 5% of the area), rye – 15.3 thousand hectares (+10 thousand hectares, 18% of the area).

According to the ministry, the most intensive sowing of winter grains is carried out in the Ternopil region, where 29.2 thousand hectares have already been sown, or 20% of the forecast.

In addition, agrarians from 13 regions of Ukraine have fully completed the sowing of winter rapeseed, by September 20 it was sown on 98% of the planned areas – 948 thousand hectares (+107 thousand hectares per week).

As reported, in 2021, Ukraine allocated 8.87 million hectares for winter crops, including 6.66 million hectares for wheat, 1.02 million hectares for barley, 160.6 thousand hectares for rye, and 1.03 for rapeseed. million ha.

Stock indices of Western European countries mainly rise on Wednesday, market participants are waiting for the results of the September meeting of the Federal Reserve System (FRS).

The composite index of the largest companies in the region Stoxx Europe 600 increased by 0.38% by 11:42 a.m. to 404.94 points.

The British stock index FTSE 100 rose by 0.64%, the French CAC 40 – by 0.04%, while the Italian FTSE MIB and the Spanish IBEX 35 added 0.8% and 0.2% respectively. Meanwhile, the German DAX fell 0.14%.

The Fed meeting will end on Wednesday at 21:00 CST, after which the traditional press conference of Central Bank Chairman Jerome Powell will begin at 21:30. Markets are convinced that the regulator will raise the key interest rate by at least 75 basis points.

Uniper shares fell 22% on news that the German government, the management of the energy company and its parent company Fortum have reached an agreement on state support.

The terms of the agreement provide for the government to inject 8 billion euros into the company’s capital through an additional issue of shares in favor of the state at a price of 1.70 euros per share. In addition, the German government will acquire Fortum’s stake in Uniper, after which the state stake in Uniper will reach about 99%.

Fortum’s market value soared 14%, leading the stock in the Stoxx Europe 600 index.

The price of securities of another German energy company, E.ON, rises by 0.7% on the announcement of the extension of the contract with CEO Leonard Birnbaum for another five years, until June 30, 2028.

Shares in France’s Schneider Electric shed 0.3%, while British software developer Aveva rose 2.3%. Aveva shareholders approved the sale to Schneider for 9.482 billion pounds ($10.8 billion).

Capitalization of Lloyds Bank rises by 0.4% after Citi analysts were optimistic about the profit prospects of European banks against the background of rising interest rates in the world’s leading economies. Shares of Societe Generale and UBS, also included by Citi among the region’s most attractive financial companies for investment, are down more than 1.5%.

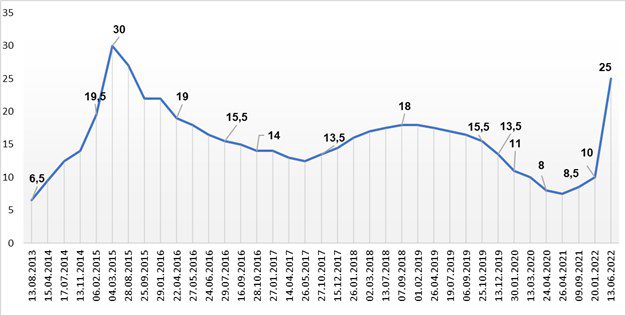

Dynamics of changes in discount rate of NBU

NBU

Canadian mining company Black Iron Inc. with assets in Ukraine, despite the ongoing war, continues to promote the Shimanovsky iron ore project through negotiations with the Ministry of Defense regarding the transfer of land, the execution of an investment support agreement with the government of the country and obtaining permits for the extraction of minerals and their processing.

According to the company’s press release, the land adjacent to the Shimanovsky ore body, necessary for the location of the future processing plant, waste rock warehouses and tailings, belongs to the government of Ukraine and is used by the Ministry of Defense for training purposes. Discussions with the Department of Defense led to an agreement on a preliminary amount of funds that Black Iron would have to pay as compensation for obtaining this piece of land for its use.

“Efforts are now focused on drawing up a binding agreement on the transfer of this land (to the use of Black Iron – IF) after peace is established in Ukraine,” the press release states.

In addition, Black Iron is also negotiating with the government of Ukraine on an investment support agreement that will include several benefits, such as the permanence of legislation (company operating conditions – IF) and exemption from import duties on equipment needed for the project.

In turn, Black Iron management prepared an extensive report covering several aspects of the project, such as the proposed new jobs, tax payments and social benefits. Before submitting this document, it will be necessary to make some changes to the legislation of Ukraine in order for Black Iron to comply with the requirements, and work in this direction is currently in full swing, the press release emphasizes.

“In order to keep our permits valid, work is currently underway in Ukraine to update the geological and mining plans. Finally, while Black Iron stakeholders wait for peace in Ukraine to bring the Shimanovsky project to the construction stage, management is considering new potential projects to increase shareholder value “, – summed up in a press release.

As reported, in October 2010, Black Iron acquired the Cypriot subsidiary of Geo-Alliance Ore East Limited from EastOne investment group of Ukrainian businessman Viktor Pinchuk, together with licenses, for $13 million, then renaming it BKI Cyprus. The main assets are 99% in LLC “Shymanovskoe Steel” and “Zelenovskoe Steel” (both – Dnipro).

In July 2013, after a series of problems with the implementation of the Black Iron project, it announced an agreement with Metinvest, the largest Ukrainian mining and metallurgical group, to develop its iron ore assets. Metinvest B.V. paid to Black Iron Inc. $20 million and acquired 49% in BKI Cyprus. Later, however, Metinvest withdrew from the project.

The Shimanovskoye iron ore deposit is surrounded by five other operating mining enterprises, including the ArcelorMittal iron ore complex. The existing infrastructure, including access to electricity, railway and port facilities, according to Black Iron, will allow the project to be quickly implemented to the production stage.

According to a presentation dated May 2021, the expected capital investment in the launch of the first stage is estimated at $452 million, the second – $364 million. the first stage and 8 million tons per year – at the second.

Benchmark oil gains slightly on Wednesday morning after dropping to two-week lows the day before as the dollar strengthened ahead of a series of central bank meetings.

The cost of November futures for Brent crude on the London ICE Futures exchange by 8:13 CST on Wednesday is $90.84 per barrel, which is $0.22 (0.24%) higher than the closing price of the previous session. As a result of trading on Tuesday, these contracts fell by $1.38 (1.5%) to $90.62 per barrel.

The price of futures for WTI oil for November in electronic trading on the New York Mercantile Exchange (NYMEX) is $84.09 per barrel by this time, which is $0.15 (0.18%) higher than the final value of the previous session. By the close of the market the day before, the value of these contracts fell by $1.42 (1.7%) to $83.94 per barrel.

“A strong dollar, rising bond yields and concerns about demand amid a global economic slowdown are putting pressure on oil prices again,” said Michael Hewson, senior market analyst at CMC Markets UK. “The market is expecting rate hikes this week from the Fed, the Bank of England and Swiss National Bank”.

“Worry about the lack of supply does not provide the support for quotes, which could be expected, but it also means that we will not see a strong collapse either,” the expert added.

The Fed meeting will end on Wednesday evening, and analysts generally believe that as a result of it, the key interest rate in the United States will be increased by at least 75 basis points.

Meanwhile, data from the American Petroleum Institute (API) indicated that U.S. oil inventories rose 1 million barrels last week after rising 6 million barrels a week earlier. The official inventory report from the US Department of Energy will be released at 17:30 CST.

The 42nd US President Bill Clinton said that Ukraine will receive even more support.

“I don’t speak for the government, I don’t work there, but I can say on behalf of the United States and the whole world that you will receive even more support,” he said on Tuesday, answering a question from Ukrainian President Volodymyr Zelensky during the Global Clinton Initiative .

“People see your courage and your people. People understand that we cannot change democracy, freedom and independence. I believe that we will help and follow. You will turn to us for help, and we will be proud to help you,” he said.