More than a quarter of pensioners continue to work

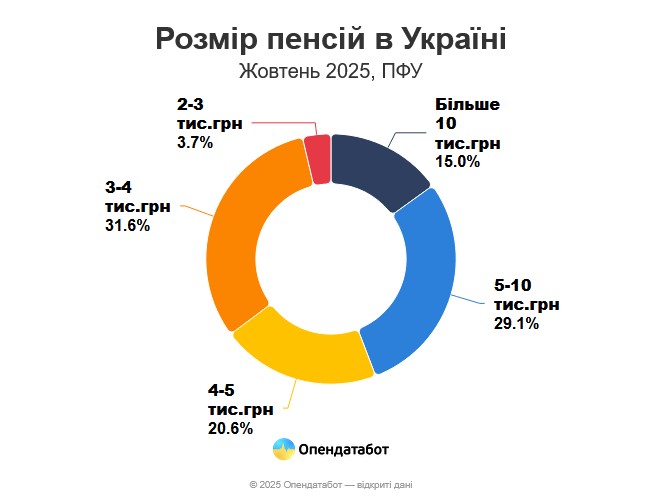

According to the Pension Fund, the average pension in Ukraine was 6,400 hryvnia as of early October 2025.

However, almost a third of pensioners receive, on average, payments of 3,340 hryvnia. In total, there are currently almost 10.2 million pensioners in Ukraine. One in four continues to work.

The average pension in Ukraine is currently 6,436 hryvnia, or 133 euros (exchange rate at the time of publication). Almost a third of Ukrainian pensioners — more than 3.3 million people — receive only 3,340 hryvnia per month. Another 4% of pensioners live on about 2,300 hryvnia per month.

It is worth noting that last year there were even more such pensioners — 26% received less than 3,000 hryvnia, but after indexation, payments increased to 3,000 hryvnia per month.

At the same time, there are those who receive more. About 1.5 million people, or 15% of all pensioners, have an average payment of 15,750 hryvnia — that’s about 325 euros. Almost 3 million Ukrainian pensioners receive an average of 6,860 hryvnia, and 2.1 million receive only 4,510 hryvnia.

Compared to Europe, Ukrainian pensions are among the lowest on the continent. Their size is approximately the same as in Albania — €160. In Romania and Bulgaria, pensions range from €450 to €550, and in Poland and the Czech Republic, from €800 to €900 per month.

The highest pensions in Ukraine are traditionally in Kyiv — 8,848 UAH, which is 37% more than the national average. The lowest are in the western regions: in Ternopil (4,997 UAH), Chernivtsi (5,173 UAH), and Zakarpattia (5,233 UAH).

More than a quarter of Ukrainian pensioners continue to work after retirement. Currently, 2.8 million working pensioners receive an average of 7,069 hryvnia in payments.

https://opendatabot.ua/analytics/pensions-2025-3

In January-June of this year, PJSC Nikopol Ferroalloy Plant (NFP, Dnipropetrovsk region) reduced its net loss by 69.6% compared to the same period last year, from UAH 1 billion 505.962 million to UAH 458.274 million.

According to NZF’s interim report for the first half of 2025, net income for this period increased by 11.7% to UAH 3 billion 915.368 million from UAH 3 billion 505.483 million.

Retained earnings at the end of June 2025 reached UAH 3 billion 778.047 million.

As reported, in 2020, the company received a net profit of UAH 456 million 162.764 thousand. In 2021, the company received a net profit of UAH 5 billion 139 million 528,911 thousand. In 2022, NZF received a profit of UAH 910 million 452,147 thousand.

The plant ended 2023 with a net loss of UAH 2 billion 620 million 398,599 thousand.

As reported, the Pokrovsky Mining and Processing Plant (PGZK, formerly Ordzhonikidze Mining and Processing Plant) and the Marganetsky Mining and Processing Plant (MGZK, both in Dnipropetrovsk region), which are part of the Privat Group, stopped mining and processing raw manganese ore in late October-early November 2023, while NZF and ZZF stopped smelting ferroalloys. In the summer of 2024, ferroalloy plants resumed production at a minimum level.

The business of ZZF, NZF, Stakhanov ZF (located at NKT), Pokrovsky and Marganetsky GZK was organized by Privatbank prior to nationalization.

NZF is Ukraine’s largest producer of silicon and ferromanganese. The average monthly output of ferroalloys during stable operation of the enterprise is about 55-60 thousand tons.

According to the NDU for the first quarter of 2025, Sofalon Investments Limitad owns 15.503% of the shares of the private joint-stock company, Rougella Properties Ltd. – 9.6904%, Dolemia Consulting Ltd. – 15.7056%, Sonerio Holdings Ltd. – 9.2158%, Manjalom Limited – 5.8824%, Treelon Investments Limited (all – Cyprus) – 15.1013%.

The authorized capital of PJSC NZF is UAH 418.915 million.

NZF is controlled by the EastOne group, created in the fall of 2007 as a result of the restructuring of the Interpipe group, as well as the Privat group (both based in Dnipro).

The Lisovy Kvartal residential complex in Brovary is entering a new stage of development with the start of sales of apartments in the final building. The complex is positioned as comfortable housing close to a green area and the developed infrastructure of the city center. The final phase implements the best solutions and standards that have ensured the success of the entire Lisovy Kvartal complex: functional layouts, high-quality materials, modern construction technologies, and attentive consideration of the needs of future residents.

Real estate sales are conducted according to the MON (future real estate object) mechanism. MON is a part of a divisible object of unfinished construction, which, after commissioning, will become an independent real estate object, for example, an apartment, garage, or commercial premises. Investments in FPO are registered in electronic systems and protected by law, so the buyer receives property rights to the selected part of the property even before the completion of construction.

Advantages of FPO for buyers:

The complex is located in the central district of Brovary, just 15 minutes from the Lisova metro station and important transport hubs of the capital. A reliable monolithic frame structure was used for the construction of the final building, which guarantees durability, fire resistance, and resistance to seismic activity.

There is a modern kindergarten on the territory of the complex, and nearby is the largest city park and a picturesque pine forest, which create a comfortable environment for families to live in.

Various types of apartments are available for sale: from one-room apartments (approximately 40 m²) to spacious family options (up to 100 m²). The construction is being commissioned by MTDK BUDIVELNE MISTO LLC in partnership with Alliance Novobud.

The sales office at 8A V. Chornovola Street, Brovary, tel. +38 (044) 344-08-23, is already scheduling appointments with buyers and providing detailed information about available layouts, purchase terms, etc.

The insurance company INGO made an insurance payment of UAH 20 million for an electronics warehouse in Kyiv that was completely destroyed as a result of a rocket and drone attack in July 2025.

According to the insurer, one of the strikes caused a large-scale fire at a warehouse complex in the Solomyanskyi district, where the company’s inventory was stored. The fire completely destroyed more than 57,000 items, mainly mobile and portable electronics, household appliances, and accessories.

The payment was made under an insurance contract for the inventory of an electronics store chain.

“This is one of the most difficult war insurance cases we have ever dealt with. The complete destruction of the warehouse meant that there were no identifiable remnants of the goods left. Therefore, we initiated an economic examination, which allowed us to document the volume of inventory and the actual cost of the damage. It was thanks to the accuracy of this process that we were able to complete the settlement in less than three months,” said Alexander Kolpakov, head of INGO’s property damage settlement department.

The assessment confirmed that at the time of the incident, the warehouse contained goods with a total value of over UAH 20 million. Thanks to the payment from INGO, the company was able to cover a significant part of the losses and resume its activities.

The payment was made on October 7, 2025.

INGO Insurance Company has been operating in the Ukrainian market for over 30 years and provides insurance solutions for businesses and individuals. It has licenses for 18 classes of insurance, is one of the market leaders in terms of premiums, assets, and insurance payments, and has an extensive service network throughout the country.

The Japan Export Credit Agency (NEXI) is ready to expand military risk insurance in Ukraine, which is key to attracting Japanese investment and technology to rebuild Ukrainian industry and infrastructure.

According to the website of the Ministry of Economy, Environment and Agriculture, this was discussed at a working meeting between a Ukrainian delegation led by Economy Minister Oleksiy Sobolev and NEXI President Atsuo Kuroda on October 21, 2025, in Tokyo.

During the meeting, it was also noted that Ukraine is preparing to introduce compensation for enterprises throughout Ukraine where insurance companies operate. A special component of direct compensation will apply to frontline regions. This will make insurance, in particular NEXI, more affordable. Ukraine is interested in using NEXI tools to insure Japanese equipment supplies as part of the Industrial Ramstein initiative.

An agreement was reached to expand cooperation with other export credit agencies, in particular the Polish KUKE and the British UKEF.

“Expanding cooperation with NEXI is a step towards unlocking Japanese investment and supporting industrial recovery. War does not cancel development, but rather the opposite. We are actively looking for solutions that allow us to attract financing and launch projects today,” said Alexei Sobolev.

The information emphasizes that NEXI already covers about half of Japanese exports and investments in Ukraine.