Canada’s draft federal budget for 2022 (starts July 1), presented by Deputy Prime Minister Chrystia Freeland in Parliament on Thursday, provides for the continuation of active financial support for Ukraine, in particular, the allocation of CAD500 million (almost $400 million) of military assistance and CAD1 billion (almost $800 million) loans.

“Canadians support the brave people of Ukraine, who are fighting for their lives, for their sovereignty, for their own and for our own democracy,” reads the preamble to a separate “Support for Ukraine” section of the budget, posted on the Canadian Treasury website.

According to him, at the beginning of this year, Canada announced the expansion of Operation UNIFIER, the mission of the Canadian armed forces to provide military training and support to Ukrainian forces, under which since 2015 Canada has trained about 33,000 Ukrainian military and security forces, as well as the provision of military assistance to over CAD90 million

“The 2022 budget proposes to allocate an additional CAD500 million in 2022-2023 to provide additional military assistance to Ukraine,” the draft reads.

It clarifies that Canada is already providing military assistance, both lethal and non-lethal, and is also partnering with allies to share intelligence and provide support in enhancing Ukraine’s cybersecurity.

With regard to sanctions and holding Russia accountable, the draft 2022 budget announced the government’s intention to clarify the powers of the Minister of Foreign Affairs to confiscate and dispose of assets belonging to individuals and entities under sanctions.

The document states that to date, Canada has provided CAD145 million in humanitarian assistance and CAD35 million in development assistance to provide direct support to Ukrainians affected by the illegal Russian invasion, as well as loans totaling CAD620 million to support Ukraine’s financial stability, economic sustainability and governance reforms.

“The 2022 budget announced that Canada will offer up to CAD1 billion in new credit resources to the government of Ukraine through a new managed account for Ukraine at the International Monetary Fund (IMF) so that the government can continue its activities,” the draft reads.

It clarifies that Canada has worked with the government of Ukraine, the IMF and other member countries to establish this mechanism and encourage allies and partners to participate.

In addition, Canada recalled that since March 17, it has given permission to Ukrainian refugees and their closest relatives of any nationality to stay in Canada as temporary residents for up to three years with the right to work. They will also have access to additional support such as language training and career guidance services.

The federal government is also developing a special permanent residence program for Ukrainians with relatives in Canada.

“The government has provided new funding of CAD111 million over five years with CAD6 million in subsequent years to implement these new immigration measures,” the draft states, including CAD78 million for this purpose in the draft 2022 budget.

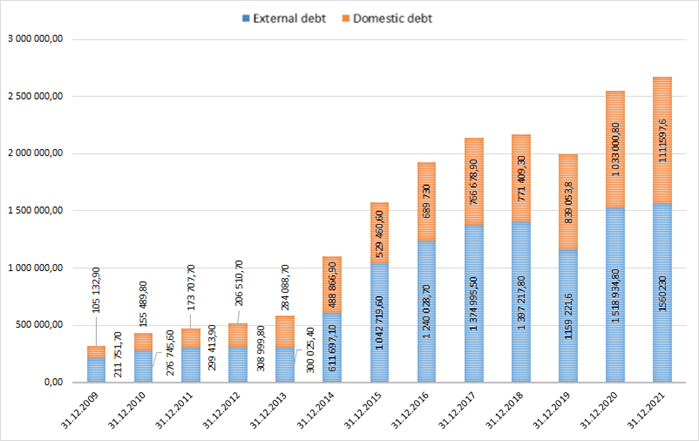

Internal and external debt of Ukraine in 2009-2021

SSC of Ukraine

The vast majority of Ukrainian insurers in the first month of martial law were able to organize and adjust their work in accordance with the prevailing conditions and continue their activities, the National Bank of Ukraine (NBU) said in a comment to the request of the Interfax-Ukraine news agency.

“The National Bank, as a regulator of non-banking financial services markets, in the first days of the war, developed and sent to all insurers a questionnaire in which market participants provide general information about their activities during martial law. This allows the NBU to understand the situation and take timely measures to maintain the insurance market,” the controller notes.

At the same time, it is specified that there are companies that cannot yet work, given their location, in particular, several insurers in Mariupol and Kharkiv reported that they were temporarily unable to carry out their activities.

As for the registration of insurers in the territory of hostilities, according to information from the State Register of Financial Institutions, 112 insurers are registered in Kiev, more than 100 separate divisions of insurers are registered in Kyiv and the Kiev region, including one division each in Vasilkov, Bucha and Brovary.

There are 5 insurers and more than 40 separate subdivisions of insurers registered in the city of Kharkov, one in Dergachi, Kharkiv region, one insurer and 19 separate subdivisions of insurers are registered in Chernihiv, two insurers and 12 separate subdivisions of insurers are registered in Mariupol, and 18 separate subdivisions of insurers are registered in occupied Kherson. subdivisions of insurers, three – in Nova Kakhovka, Kherson region, in Nikolaev – 20 separate subdivisions of insurers, in Sumy – 16.

Answering the question whether there are preliminary calculations of how much the insurance market could shrink both in terms of quantity and business, the NBU noted that, given the conditions of martial law, a number of measures were taken to ensure the functioning of the financial system of Ukraine. In particular, the NBU extended reporting and decided not to apply measures of influence to non-banking financial services market participants, including insurers, for violation of reporting deadlines, including for 2021. The deadlines (until April 1, 2002) for the submission by insurers of information and documents at the request of the National Bank, sent within the framework of on-site supervision, were also postponed. In addition, the activities of participants in the non-banking financial services market under martial law have been regulated.

“Given the extension of the deadlines for reporting by insurers until April 1, 2022, calculations and conclusions on the reduction of the insurance market can only be made after receiving reports and their analysis for 2021 and the first quarter of 2022. We will definitely publish this information on our website,” noted the regulator.

The regulator also clarified that in order to resolve the issue of obtaining insurance companies the opportunity to purchase short loans secured by government bonds in order to obtain instant liquidity, he turned to the National Commission for Securities and Stock Market (NCSM).

The NSMSC, guided by paragraph 13 of Article 8 of the law “On State Regulation of Capital Markets and Organized Commodity Markets” and in connection with the introduction of martial law in Ukraine, amended Annex No. 2 to its decision No. 144 of March 08, 2022 “On drawing up transactions in the capital markets for the period of martial law” new paragraph: “10. Depository institutions have the right to conduct depository operations in the depository accounting system related to the pledge of government securities in banks, the change and termination of such pledge, as well as the foreclosure of the subject of pledge” .

Answering the question whether the regulator, in connection with the current situation, does not intend to recommend banks to amend the existing deposit agreements of insurers, giving the right to unblock part of the funds necessary, in particular for payments, the NBU noted that the insurance companies that had such a problem are solving it with the National Bank on an individual basis.

So far, none of the allies has provided their vision of security guarantees for Ukraine, Ukrainian Foreign Minister Dmitry Kuleba said.

“I did not raise the issue of security guarantees at the meeting, because we know exactly the list of allies that we see as potential security guarantors with whom we are negotiating on a bilateral basis. But in my bilateral meetings here, we raise and discuss this issue with them. They receive a better understanding of what we want. But we are still discussing. None of them have given us their vision of security guarantees at the moment,” Kuleba said at a press conference after attending a meeting of NATO foreign ministers in Brussels on Thursday.

In March this year, Ukrainians registered 8.3 thousand used cars imported from abroad during the war, Ukravtoprom reported.

“This is much less than a year earlier (-76%), but this result was 15 times higher than the March market for new passenger cars,” the association’s website said on Thursday.

As reported, registrations of new passenger cars in March 2022 fell by 16.5 times compared to the “covid”, but peaceful March of last year – up to 546 units.

According to the Association, the most popular used car in March this year was Volkswagen Golf with 484 registrations, Renault Megane is second with 472 units, Volkswagen Passat is in third place with 422 customs cleared and registered cars.

Skoda Octavia continues the list (339 units), and Ford Focus closes the top five with a score of 217 units.

Taking into account March registrations, almost 69,000 used cars imported from other countries received Ukrainian license plates in January-March, which is six times more than new passenger cars over the same period.

As reported, in the first quarter of last year, 87.7 thousand units were registered in Ukraine. used foreign cars imported from abroad, which exceeded the registration of new cars by four times.

On March 24, 2022, the Verkhovna Rada of Ukraine, in order to stimulate important imports for the country, among a number of goods for the period of martial law, exempted the import of vehicles by citizens from taxation (cars, motorcycles, trucks and buses).

After the economic recession caused by the Russian invasion of Ukraine, 60-65% of milk processing enterprises resumed work, even in the conditions of hostilities, the industry is able to meet domestic demand, so importing milk into the country is not advisable.

This opinion was published on the website of the profile association “Union of Dairy Enterprises of Ukraine” (SMPU) on Thursday.

According to her, the import of dairy products to Ukraine is inappropriate, since the resumption of the work of two-thirds of the enterprises of the industry, taking into account the stocks of dairy products intended for export, the supply of which disrupted the hostilities, makes it possible to meet the needs of the domestic market.

In addition, the association predicts that the production of raw milk in Ukraine per capita in 2022 will grow by 8% compared to 2021 – up to 229 kg from 212 kg.

At the same time, the SMPU recalls that after the start of the war, the Cabinet of Ministers included military goods, meat and edible offal, milk and dairy products, vegetables, nuts and a number of other goods on the list of critical imports. “However, the SMPU believes that there is no need to import milk. After all, even in the conditions of war, the dairy industry of Ukraine continues to work and fully supplies the country with high-quality dairy products. Therefore, the inclusion of dairy products in the lists of critical imports is a useless waste of precious foreign exchange funds,” the statement emphasizes. message.

In addition, according to the association, competition with imported “milk” will lead to a reduction in production by Ukrainian dairies and, accordingly, to a decrease in milk production.

“The government should support Ukrainian dairy producers. Now one of the main tasks of the state is to preserve the number of cows and the dairy industry. Therefore, SMPU insists on removing dairy products from the list of critical imports,” the organization said in a statement.

As reported, on February 28, the Cabinet of Ministers significantly expanded the list of critical imports. It includes meat and meat by-products, milk and dairy products, poultry eggs, natural honey, vegetables and edible root crops and tubers, fruits and nuts, coffee, tea, spices, cereals, wheat and wheat-rye flour, soybeans, juices. and plant extracts.