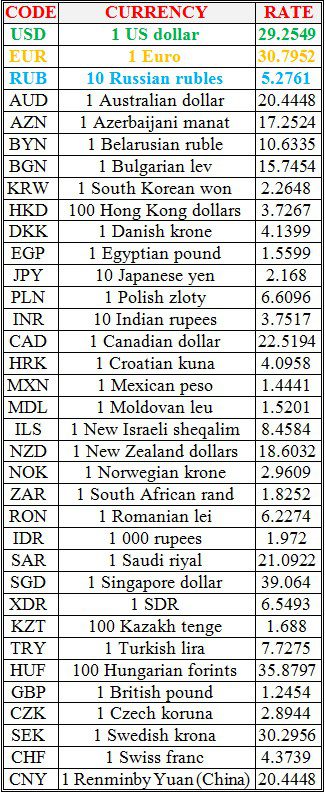

National bank of Ukraine’s official rates as of 21/06/22

Source: National Bank of Ukraine

The issue of permits for temporary travel of IT specialists abroad will be resolved during June-July, predicts Oleksandr Fediyenko, Deputy Head of the Verkhovna Rada Committee on Digital Transformation (People’s Deputy from the Servant of the People faction).

“I think that all this will be done within the framework of the adopted law on Dia.City. Most likely, we will talk about those enterprises that meet the criteria of Dia.City. This is my forecast. Most likely, this will be done throughout this and the next month, when summarizing work will be done to develop appropriate mechanisms for booking the departure of the relevant employees of the relevant specialized companies,” he said in a commentary to the Kyiv TV channel.

Fedienko noted that in the future, companies that meet pre-defined criteria will submit documents and argue the need to travel abroad for their chosen employees.

The MP also stressed that this is done in order to allow IT companies to fully work with foreign clients and fill the Ukrainian budget.

The government of Ukraine is working out a new model for organizing urban transport in order to simplify access to the transportation market, according to the website of the Antimonopoly Committee of Ukraine (AMCU), with reference to its head Olha Pischanska.

During the thematic round table that started in Paris as part of the Competition Week of the Organization for Economic Cooperation and Development (OECD), Pischanska clarified that the main idea of the model being developed is to simplify access to the transportation market as much as possible in order to create favorable conditions for competition.

“As a result of the war, these markets have undergone significant changes. In some cases, public transport has become an uncontested means of transportation (given the shortage of fuel in Ukraine). The Antimonopoly Committee of Ukraine constantly monitors the situation so that changes in the markets do not violate the requirements of competition law,” she said.

According to the committee, the focus on deregulation will have a positive impact on the formation of a new model of public transport in Ukraine – with a more intensive involvement of private business in passenger transportation, including to improve environmental standards.

The net loss of Ukrainian banks in January-May 2022 amounted to UAH 1.3 billion against a profit of UAH 23.8 billion for the same period last year, the press service of the National Bank of Ukraine (NBU) reported on Tuesday.

It is indicated that the net profit for May of this year amounted to UAH 6.1 billion, while in April there was a net loss of UAH 7.426 billion.

According to the NBU, the income of banks for 5 months increased by 15% compared to the same period last year – up to UAH 116.5 billion, including interest income – by 18%, to UAH 76.957 billion, while the commission decreased by 8.9 % – up to UAH 31.032 billion.

At the same time, bank expenses in January-May increased by 51% – up to UAH 117.8 billion, including interest expenses – by 4.3%, up to UAH 22.135 billion, commission expenses – by 13.914%, up to UAH 8.4 billion and expenses from deductions to reserves – by 8.2 times, up to UAH 39.2 billion.

As of June 1, 2022, BTA Bank violated the regulatory capital ratio (norm H1, not less than UAH 200 million) with an indicator of UAH 192.418 million and Alpari Bank (UAH 192.998 million), monthly statistics published on the website of the National Bank of Ukraine show (NBU) for the first time since the beginning of a full-scale war.

The standard for the maximum amount of credit risk per counterparty (N7 standard, no more than 25%) was violated by Industrialbank (39.18%), Oschadbank (25.01%) and Megabank (59.86%).

The risk standard for a total long open currency position (standard L13-1, no more than 5%) was violated by Oschadbank (164.53%), PrivatBank (90.2%), Alliance banks (78.3%) and Portal (fourteen%). Industrialbank (12.7%), Skybank (8.2%), Trust-Capital Bank (5.4%).

According to the NBU, the foreign currency liquidity coverage ratio (LCRів, not less than 100%) was violated by TASkombank (98.33%), Idea Bank (87.4%), Ibox Bank (69.57%), Poltava-Bank (29 .1%) and Megabank (27.97%).

The Net Stable Funding Ratio (NSFR, not less than 100%) was not adhered to by OTP Bank (99.6%). Alliance (97.3%), Globus Bank (95.7%), PIB (95.1%), Megabank (82.3%).

It is indicated that Megabank violated the regulatory capital adequacy ratio (N2 ratio, not less than 10%) with an indicator of 4.08%, the maximum credit risk ratio for transactions with persons related to the bank (N9, not more than 25%) with an indicator of 81.85 %, the risk ratio of the total short open currency position (standard L13-2, no more than 5%) with a value of 54% and the standard for the liquidity coverage ratio for all currencies (LCRвв, no less than 100%) with an indicator of 3.1%.

It is noted that the standard for calculating the short-term liquidity ratio (N6) by banks is not indicated in the statistics of this month, since it was canceled on March 23.