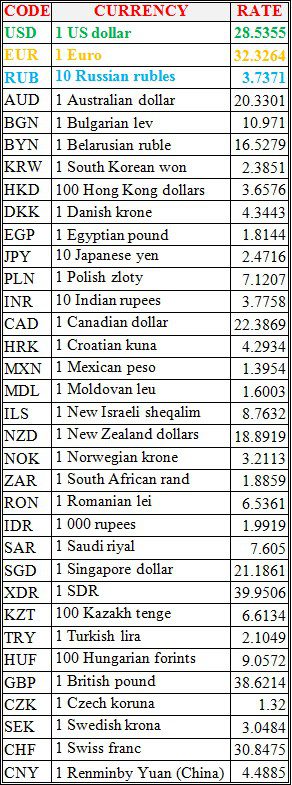

National bank of Ukraine’s official rates as of 15/02/22

Source: National Bank of Ukraine

The Indian embassy in Kyiv continues to function as usual, but calls on Indian citizens in Ukraine to consider temporarily leaving the country. “In view of the uncertainties of the current situation in Ukraine, Indian nationals in Ukraine, particularly students whose stay is not essential, may consider leaving temporarily. Indian nationals are also advised to avoid all non-essential travel to and within Ukraine,” the embassy said in a statement published on its website.

The embassy also asked Indian citizens to inform it of the status of their presence in Ukraine to enable the embassy to reach them where required.

“The embassy continues to function normally to provide all services to Indian nationals in Ukraine,” it said.

Ukraine International Airlines (UIA) will continue operating flights according to the existing schedule, the company’s press service reported on February 14. “Ukraine International Airlines will continue to operate flights according to the existing schedule, operating 16 medium-haul aircraft without any changes in the schedule. In particular, today’s evening flights and tomorrow’s morning flights are operated without changes,” the company said in a statement.

UIA said the preservation of operational work was made possible by a constructive dialogue between UIA’s business partners, as well as cooperation with the Government of Ukraine.

“Currently, tickets for flights of UIA and partners are on sale on the official website of the airline. The airline will continue to regularly report any possible changes in its operations,” the airline said.

Businessman Sergiy Tigipko, whose assets include PrJSC Dneprometiz, intends to acquire Nail LLC (Khmelnytsky), a large Ukrainian plant for production of nails and various fasteners, a market source told Interfax-Ukraine.

According to the source, in the near future the relevant documents for approval of the purchase will be submitted to the Antimonopoly Committee of Ukraine.

TAS Group has not yet commented on this information to Interfax-Ukraine.

Tigipko’s TAS Group includes assets in the financial and agricultural sectors, real estate, venture projects and an industrial group.

Nail LLC, according to information on its website, was founded in 1994 as a manufacturer of nails. In 2018, it merged with Avismetiz LLC. In addition to traditional construction, carpentry and roofing nails, the company produces special types of nails – in reels and loose, which are used in production of wooden containers and pallets, as well as various means of fastening: self-tapping screws, screws, confirmations, bolts, nuts, washers, threaded rods, anchors , drills, etc. The main office and production facilities of the company are located in Khmelnytsky.

Ukrainian coke and chemical plants in January of this year imported 860,000 tonnes of run-of-mine coking coal and coal concentrate for coking, which is 5.2% more than in the same period last year.

According to an information statement of the Ukrmetalurgprom association on Monday, the supply of Ukrainian coal for this period amounted to 280,000 tonnes, which is 11.6% lower than in January 2021.

In general, in January 2022, Ukrainian coke and chemical plants received 1.14 million tonnes of coal for coking, which is 0.5% more than in January 2021. At the same time, the share of imported coal in the total supply amounted to 75.5% in January 2022 versus 72.2% in January 2021.

Some 772,000 tonnes of coke (106% compared to January 2021), including 668,000 tonnes of Ukrainian origin (95%), and 104,000 tonnes of imported coal (4.16 times more) were supplied to Ukrainian steel enterprises in the specified period. The share of imported coke in the total supply amounted to 13.47% versus 3.43% in January 2021.

In addition, last month, 237,000 tonnes of scrap metal were collected (78.2% compared to January 2021), of which 231,000 tonnes (81.3%) were supplied to Ukrainian consumers as imported. Export of scrap metal in January amounted to 6,000 tonnes (31.6% compared to January 2021).

It is noted that the provision of steel enterprises with Ukrainian iron ore raw materials in January 2022 was carried out in accordance with the needs of metallurgical production. There were no imports of iron ore. Export of iron ore for the first month of the year amounted to 3.85 million tonnes (104.3% compared to January 2021).

According to updated data of Ukrmetalurgprom, in January 2022, plants produced some 2.785 million tonnes of sinter (101.3% compared to January-2021), 807,000 tonnes of 6% moisture gross coke (95.5%), 1.786 million tonnes of cast iron (98.2%), 1.851 million tonnes of steel (100.7%), 1.672 million tonnes of rolled products (100.6%), and 91,000 tonnes of pipe products (168.2%).

As of February 11, 2022, of the main operating production facilities, 17 out of 21 blast furnaces, seven out of eight open hearth furnaces, 13 out of 16 converters, five out of 15 electric furnaces and 16 out of 17 continuous casting machines were in operation.