The International Programming Olympiad “BalaTech” for schoolchildren will be held on February 19, 2022 in an online format. Estimated 50,000 schoolchildren from the CIS countries will take part in the event and compete for a prize fund of $10,000 USD in the form of:

REGISTER now on BalaTech (www.balatech.org), and/or share this wonderful opportunity with your network. More activities can be followed on Instagram by hashtags: #Balatech #UNDP #AcceleratorLab

United Nations Development Program is the official general partner, who is committed to providing accessible and inclusive digital education for the next generation to be ready for the future works! And “BalaTech” is recognized by the UNDP “Digital x Scale Accelerator” as one of the ten most impactful digital solutions in 2021, with the generous support from the Government of Japan. Thanks to UNDP, BalaTech provides all learning contents and participation at the Olympiad 2022 for FREE for all children and youth.

“BalaTech” ( www.balatech.org ) is a multilingual educational platform for children and youngsters to learn programming in an interactive way among peers. BalaTech makes learning experience fun and engaging through gamification. There are 10 learning modules with 175 challenge-based tasks that users can learn and play for FREE. For completed tasks, users receive their points to unlock the next level game with diverse virtual settings where they continue their learning adventure. With the help of UNDP “Digital X”, BalaTech has enhanced the user’s experience with a better UX design and learning algorithms. Moreover, the platform is designed to be gender sensitive to encourage more girls in learning programming. Anyone with a smartphone (not necessarily laptops) equipped with low-gadget basic internet can access the platform to learn and play from the beginning level. No prerequisite programming knowledge is required. Annually, BalaTech organizes the Olympiad to popularize programming learning among school students. The following entails the criteria and key messages of “BalaTech Olympiad” in 2022:

* For any inquiries on partnership opportunities on BalaTech, please contact: +996 550984747, tech.balatech@gmail.com. For UNDP partnership on digital innovation, please contact the Head of Experimentation at Accelerator Lab UNDP Kyrgyzstan, Jenny Jenish kyzy (Ensi Tszie) at ensi.tszie@undp.org

References:

Meet Digital X’s 10 ambitious new teams | Digital UNDP

Open4business – information partner

The machine building company Corum Group (DTEK Energy) has signed the first contract in the Lithuanian market for the supply of spare parts for Lithuanian Railways, Corum’s press service reports. “As part of the 2030 strategy and plans to diversify the product portfolio, Corum Group entered the Lithuanian market, expanding its presence in the EU market. The contract provides for the supply of two sets of 137 items for the manufacture of the body of railway freight cars,” the press release says.

The cost of the contract is not disclosed, shipment of products is planned in the spring of this year. The order will be fulfilled by Corum Druzhkivka Machine Building Plant (Donetsk region).

“The won tender confirms our high expertise in mechanical engineering. This contract opens up a new, extremely demanding market for us. The manufacture of such products also opens up the prospect of working for Corum Group in the Ukrainian market in the direction of supplying components and spare parts for railway transport,” CEO of Corum Group Mykhailo Potapov said.

Corum Group is a leading manufacturer of mining equipment in Ukraine, part of the energy company DTEK Energy. It unites the machine building enterprises Corum Svitlo Shakhtaria, Corum Druzhkivka Machine Building Plant, Corum Shakhtspetsbud and Corum Repair, as well as foreign trading companies and representative offices.

Great Britain, Canada, Sweden, Switzerland and the United States are planning to create a fund at the end of January 2022 to help Ukraine with financing of GBP 35 million over three years.

“We are talking about the creation of an international fund ‘Partnership for a Strong Ukraine.’ This is a common initiative of Great Britain, Canada, the United States, Switzerland and Sweden. The official start of the work of the fund is planned this month. The agreement is to be signed on January 31,” the Ministry for Reintegration of the Temporarily Occupied Territories of Ukraine press service said.

The goal of the fund is to support long-term sustainable development and increase the resilience of the communities affected by Russian aggression, prevent further escalation and prepare for a smooth and unhindered social, economic and political reintegration of the temporarily occupied territories.

According to the statement, the main projects to be implemented in 2022 with the help of the Fund will be: projects on energy efficiency, strengthening and viability of communities.

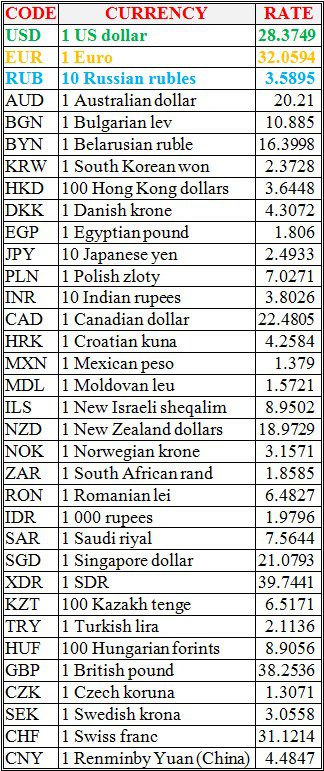

National bank of Ukraine’s official rates as of 25/01/22

Source: National Bank of Ukraine

Ukraine received 32 points out of 100 possible in the Corruption Perceptions Index in 2021 and ranked 122nd out of 180 countries, Transparency International Ukraine says. “Ukraine scored 32 points out of 100 possible in the Corruption Perceptions Index (CPI) for 2021. Our indicator has decreased by one point, and now Ukraine ranks 122nd out of 180 countries in the CPI,” Transparency International Ukraine said on its website.

“The African state of Eswatini (Swaziland) is next to Ukraine. Zambia, Nepal, Egypt, the Philippines, and Algeria are one point ahead – with 33 points each,” the report says.

Comparing to its neighbors, Ukraine continues to be only ahead of Russia — the aggressor neighbor also lost 1 point and now ranks 136th in the list with 29 points. In addition, Hungary’s scores have decreased to 43 points (down 1 points, ranking 73rd). Belarus has lost as many as 6 points this year and ranks 82nd with 41 points,” it says.

“This year, Finland has joined the permanent leaders of the CPI Denmark and New Zealand; these three countries are now heading the Corruption Perceptions Index with 88 points. Somalia, Syria, and South Sudan remain at the bottom of the list,” according to the document.

“This decrease within the margin of error indicates a period of stagnation. The authorities are delaying the fulfillment of many important anti-corruption promises. On the one hand, a significant part of the anti-corruption reform was restored after the decision of the Constitutional Court in 2020, and basic laws were adopted to restart the HQCJ and the HCJ. On the other hand, there are still negative practices that invalidate the achievements – such as interference in the Tatarov’s case, delaying the election of the SAPO leadership, excluding certain public procurement tenders for the Constitution Day and the Independence Day from the scope of the specialized law. We must remember that deviation from the anti-corruption agenda plays into the hands of both internal and external enemies of Ukraine,” Andriy Borovyk, the executive director of Transparency International Ukraine, said.

“At the beginning of 2021, TI Ukraine provided three systematic recommendations to reduce the level of corruption in Ukraine, but none of them was fully implemented, and two were partially fulfilled. This year, we have identified 5 specific steps that will help in the fight against corruption in Ukraine: to complete competitions and select professional, independent and high integrity heads of the anti-corruption bodies: the Specialized Anti-Corruption Prosecutor’s Office, the Asset Recovery and Management Agency, and the National Anti-Corruption Bureau; to adopt the national Anti-Corruption Strategy and the program for its implementation; to reform constitutional justice, considering the conclusions provided by the Venice Commission; to ensure transparent accounting of public property and continue the course of privatization; to minimize the risks of adopting draft laws which exclude procurement from the scope of the law of Ukraine on public procurement,” he said.

“If these steps are not fulfilled, Ukraine risks losing not only its position in the ranking, but also the trust of its citizens and international partners, Ukrainian and foreign investors. This, in turn, will worsen the economic situation and weaken Ukraine in the confrontation with the external enemy – the Russian aggressor,” the expert noted.

The Corruption Perceptions Index (CPI) is a ranking calculated by the global organization Transparency International since 1995. The organization itself does not conduct its own surveys. The index is calculated based on 13 studies of reputable international institutions and think tanks. Nine sources are used to calculate Ukraine’s score.