Three new AIRBUS H125 helicopters for the State Border Guard Service arrived in Lviv from France on Wednesday, December 22, the Ministry of Internal Affairs has said.

“Today, three helicopters arrived in Lviv. And if the weather conditions permit, then tomorrow, December 23, they will fly to the capital,” the ministry said.

It is noted that they have modern powerful equipment for detecting and suppressing offenses at the state border. The helicopters are equipped with an optoelectronic surveillance system that allows monitoring, including in infrared mode.

“The helicopters are also equipped with a warning system with loudspeakers and specialized aviation searchlights, which can be used synchronously with the optical-electronic surveillance system,” the Interior Ministry said.

According to the Ukrainian-French contract, the Ukrainian border department already has seven H125 helicopters from the French company Airbus Helicopter. The first four helicopters arrived in Ukraine in January 2020 and November 2021.

In total, within the creation of the Unified System of Aviation Security and Civil Protection in Ukraine, the State Border Guard Service should receive 24 new N125 helicopters.

Ukraine International Airlines (UIA, Kyiv), according to the financial strategy proposed by the company’s management, expects an increase in passenger traffic by 34% in 2022 compared to 2021 – up to 4.3 million people, while the number of flights should increase by 30% – to more than 37,000 per year.

According to the press service of the company, the corresponding indicators are included in its budget for 2022, which was approved by the supervisory board the day before.

The airline’s management focuses on the dynamic increase in the volume of regular passenger traffic in 2022, respectively, laying down a decrease in charter programs – to minus 34%. As for cargo and mail, UIA plans to increase the traffic dynamics by almost 36% compared to 2021.

“The budget stipulates that 2022 will be the year of expansion of the UIA fleet after the forced reduction in 2020-2021, as well as the return of long-haul Boeing-777 aircraft to its fleet. The supervisory board confirmed the restart of long-haul flights – New York, Toronto, Delhi. We are also preparing for the resumption of the hub operation at Boryspil airport (Kyiv) with three expansion waves. In general, the restart of the UIA network should be 60% of the pre-crisis 2019 indicator,” CEO of the airline Yevhen Dykhne is quoted as saying.

Currently, the UIA fleet consists of 25 aircraft.

The Ukrainian government has taken a number of systemic measures to avoid a sharp rise in tariffs for housing and utility services amid rising energy prices in the world, Deputy Head of the Office of the President of Ukraine Rostyslav Shurma has said.

According to a posting on the website of the Office of the President on Wednesday, he said that some adjustments of some tariffs are possible within the inflation expectations of 10-11%, including tariffs for gas distribution and delivery, but the price of gas for households will not increase during the current heating season.

“The government has provided large funds to keep gas tariffs for households at last year’s level – below UAH 8 per cubic meter. The government has also allocated funds to provide preferential gas to municipal heating companies, so that households can receive heating at almost last year’s prices,” Shurma said.

According to Shurma, the government also managed to keep electricity prices for the population from rising this year and even cut them for some categories of consumers.

He said that the increase in tariffs for the supply or distribution of electricity for regional power companies will not in any way affect the cost of electricity for households.

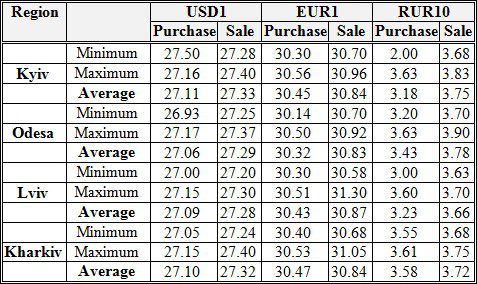

Ukrainian banks’ cash exchange rates on 22/12/21

Source: Interfax-Ukraine

An exclusive interview with Mehmet V. Sacaklioglu, the founder & chairman of the Bosphorus Development supervisory board, for Interfax-Ukraine

Tell us about Bosphorus Development.

Our company is one of the largest investment and development companies in Turkey. My grandparents started a business in the 1930s. I am a representative of the third generation. The family business started with retail, then the company launched other business activities, including the opening of a network of grocery stores, restaurants and bakeries, production of furniture, textiles, as well as gas supply and trade in petroleum products.

Our company implemented the first development project in 1970. More than 5 million square meters of real estate have been built, more than a hundred projects have been completed in 51 years.

Among the landmark projects for us are Istanbul Aquarium – one of the largest themed aquariums in the world, with a total area of 23,000 square meters, and the largest business center Istanbul Tower 205 (220 meters high, 246,000 square meters).

We have our own architectural team, but we also work with the world’s best architects. In particular, for Istanbul Tower 205, we considered the proposals of many leading architects around the world, but focused on the project of the American company Skidmore, Owings & Merrill (Burj Khalifa in the UAE, One World Trade Center in New York, Tianjin CTF in China).

We have also built several malls, the Crowne Plaza Istanbul hotel and about a hundred business and premium class residential projects. Today, six facilities in Istanbul are under design and initial implementation.

Why did you choose Ukraine to expand your development direction?

I have been living in Ukraine for 20 years, married and raised two children here, graduated from the Institute of International Relations of the Taras Shevchenko National University of Kyiv. Ukraine is my second homeland. During these years I’ve developed business in various directions, but now decided to focus on development.

In Ukraine, we already have a fairly large land bank. Today it includes four land plots, we are negotiating the purchase of three more land plots. Before the start of construction work, we would not like to name the locations. I can only say that all the sites are located in the central part of the capital.

What characteristics must a land plot have to be interesting for your company?

Many factors are important for the implementation of a successful project: location, infrastructure, transport links, the availability of social facilities and others. The size of a land plot must be at least 1 hectare, but if the location is very interesting, it may be less. A necessary condition is that it must be impeccable from a legal point of view. To establish the compliance of a land plot with our standards and requirements, we necessarily conduct due diligence, they were made for us by well-known international companies such as Baker McKenzie, Ernst & Young, DLA Piper.

Unfortunately, there are no completely “white” areas in the capital, without potential conflicts.

If this is true, it may be one of the reasons why there are very few international developers in Ukraine.

Ukraine and Turkey have historically had very good relations, with Turkish companies actively involved in the construction of important infrastructure facilities in Ukraine, but Bosphorus Development will be the first Turkish development company to implement projects of this scale in the Ukrainian capital.

Which construction sector did you choose to invest in? What projects do you plan to implement?

As I mentioned, we have experience in implementing projects of any complexity and different types: housing, hotels, trade, commercial real estate, infrastructure and others.

Our first project in Kyiv will be a multifunctional residential complex with commercial and social facilities. It will be business class housing, with interesting and original architectural solutions, with the use of high-quality materials, in harmony with the environment, with a well-thought-out and useful infrastructure for residents. The project has already been developed by our architects in collaboration with Ukrainian colleagues.

In the construction of our facilities, we use only high-quality and environmentally friendly materials that have undergone thorough inspection, examination and certification. In Turkey, we have our own production of construction and finishing materials. For example, all wood elements and constructions in our projects are our own.

In Ukraine, we are currently studying manufacturers and suppliers of construction materials, analyzing which Ukrainian materials to use and which to import. As an example, the quality and characteristics of Ukrainian finished granite completely suits us. As for ceramic granite – we choose between Turkish, Italian and Spanish manufacturers. Windows and facades – there are several representative offices of Turkish and German manufacturers in Ukraine, we are studying their proposals. If we control the whole process of materials production and if they fully meet our requirements, then, perhaps, we will make a choice among Ukrainian manufacturers.

When will you present the projects and start their construction?

The construction of our first project will start in the first quarter of 2022, then we will talk about it in more detail, make a presentation. Our second project, no less large-scale – at the end of 2022.

How many staff do you have in the company in general and how many will work in Ukrainian projects?

The Turkish staff is over 1,500 people. In Kyiv, we are currently recruiting a team for the first project, and plan about a hundred employees at the initial stage. If necessary, we will bring highly qualified specialists from Turkey – management, engineers, architects, builders and others. We are studying this issue in terms of the quality of work and professionalism of local staff. About 500 employees will be needed to implement our initial projects.

Are you planning to certify your projects according to “green” standards?

Most of our projects in Istanbul are certified according to LEED standards. For example, Istanbul Tower 205 meets the LEED Platinum quality standard. Regarding Ukrainian projects, we are currently in the process of negotiating and choosing a certification system.

How much will be invested in the implementation of projects?

After the official presentation of our projects, we will launch sales, but regardless of the activity of buyers in the real estate market and potential investors, regardless of the economic situation in Ukraine, we have enough financial resources to complete and implement them in a timely manner.

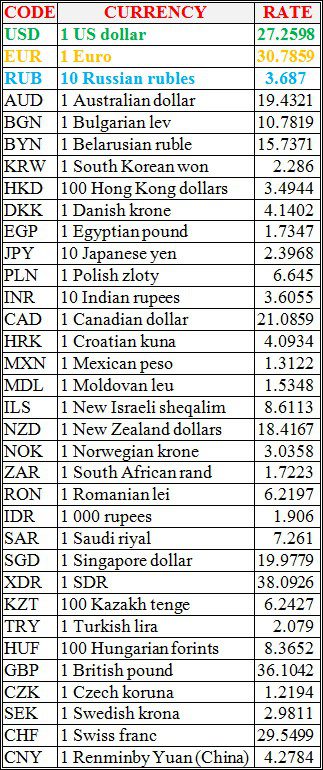

National bank of Ukraine’s official rates as of 22/12/21

Source: National Bank of Ukraine