The attitude of Ukrainians towards Hungary is one of the most critical among all EU countries. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical centerin August 2025.

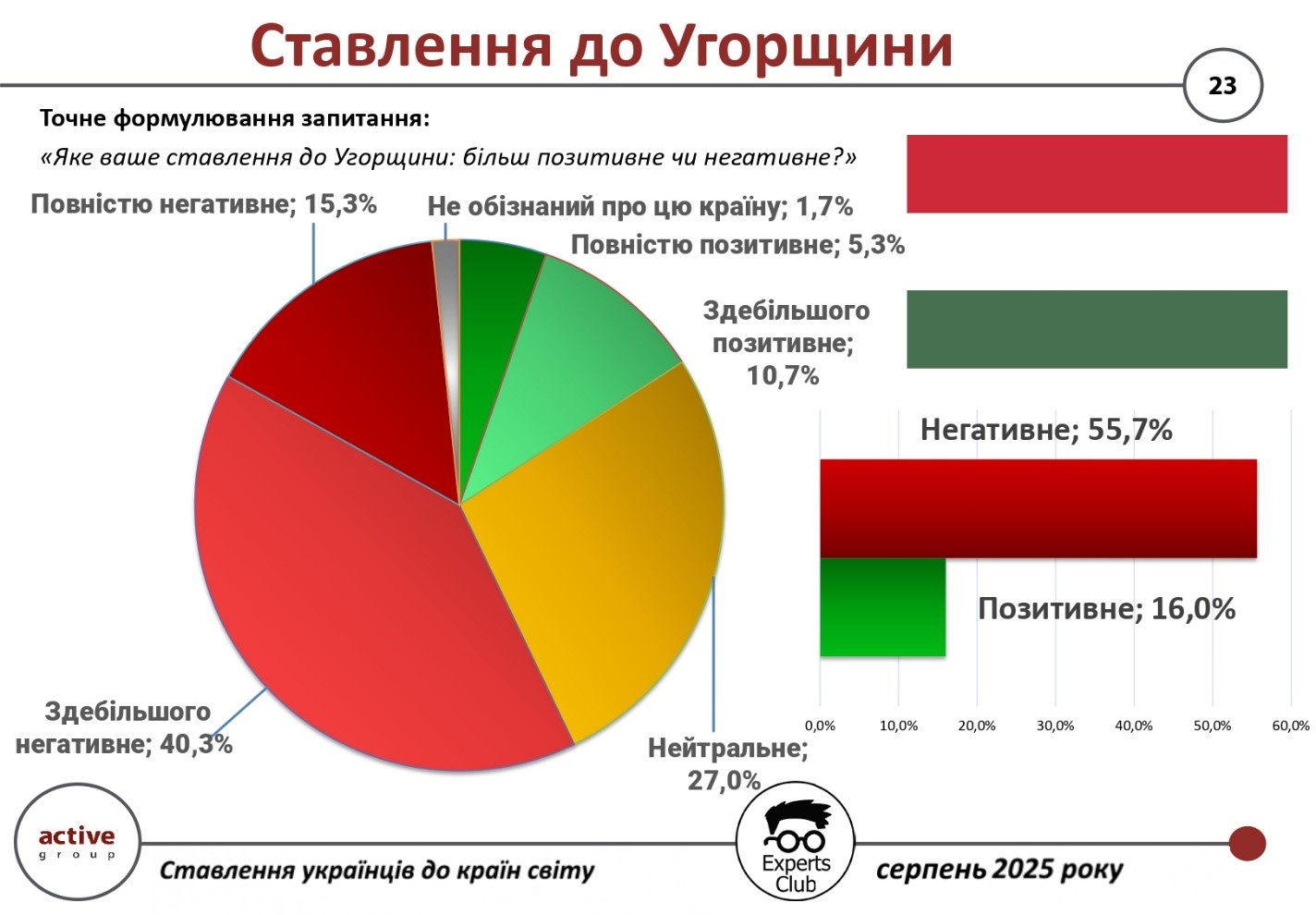

According to the survey, 55.7% of Ukrainian citizens have a negative attitude towards Hungary (40.3% – mostly negative, 15.3% – completely negative). Only 16.0% of respondents expressed a positive attitude (10.7% – mostly positive, 5.3% – completely positive). Another 27.0% of respondents took a neutral position, and 1.7% said they did not know the country well enough to form their own opinion.

“Ukrainians perceive Hungary ambiguously due to a number of political factors. This directly affects the level of trust in society. Nevertheless, if we look at the economic component, in the first half of 2025, the volume of trade between Ukraine and Hungary exceeded $1.52 billion, of which exports from Ukraine amounted to $652 million and imports to almost $874 million. The negative balance of more than $221 million indicates a certain asymmetry in relations, but at the same time demonstrates that Hungary remains a prominent partner in our market,” said Maksym Urakin, founder of Experts Club.

In his turn, Active Group co-founder Oleksandr Poznyi emphasized that the sociological results do not mean complete rejection of cooperation.

“More than half of the citizens do demonstrate a critical attitude towards Hungary, but a quarter of respondents remain neutral, and one in six Ukrainians assesses Hungary positively. This means that there is still potential for restoring trust at the level of interpersonal contacts, cultural ties, and business relations. In the future, these factors may become the basis for mitigating the current negative assessments,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the context of the current geopolitical situation.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, HUNGARY, Poznyi, SOCIOLOGY, TRADE, URAKIN

The European Bank for Reconstruction and Development (EBRD) may provide Bank Lviv with an unsecured loan in hryvnia for up to EUR 40 million and guarantees for EUR 31.5 million to cover the credit risk on new loans to the Ukrainian bank for a total amount equivalent to EUR 45 million.

According to the EBRD website, its Board of Directors plans to consider the relevant projects at its meeting on October 22 this year.

According to published materials, the loan is planned to be provided in four equal tranches of EUR 10 million each. It will consist of two components: at least 75% under the EBRD’s Resilience and Livelihoods Program and up to 25% under the EU4Business-EBRD Credit Line with incentives to finance long-term capital investments by MSMEs.

As for the guarantee project, unlike most similar projects with larger banks, it covers 70% of the risk, rather than the usual 50%. It is noted that the mechanism will include two sub-limits with a covered portfolio: EUR 36 million under the Sustainability and Livelihoods Guarantee product and EUR 9 million under the EU4Business-EBRD credit line with incentives.

The EBRD notes that Bank Lviv is a regional bank focused on MSMEs operating in western Ukraine, with total assets of EUR 333 million (0.5% of the market, ranked 23rd among 60 banks) and a loan portfolio (mainly SMEs) of approximately EUR 212 million as of the end of the second quarter of 2025 (1.2% of the market). Bank Lviv has its head office in Lviv and 20 branches.

Ukrainians have a mostly positive attitude toward the Czech Republic, which is an important partner in the European Union and one of the main destinations for labor migration. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club.

According to the survey, 62% of Ukrainians expressed a positive attitude towards the Czech Republic (40.7% – mostly positive and 21.3% – completely positive). Neutral attitudes were expressed by 33% of respondents, while negative opinions accounted for only 3.3%. Another 2% of respondents admitted that they did not have sufficient information about the country.

Thus, the Czech Republic is among the countries that have a consistently high level of positive perception among Ukrainians, on par with other Central European countries.

According to the State Customs Service of Ukraine, in 2024, trade between Ukraine and the Czech Republic reached USD 1.64 billion. THIS IS A SIGNIFICANT INCREASE. At the same time, Ukrainian exports amounted to USD 478.7 million, and imports from the Czech Republic amounted to USD 1.16 billion. The negative balance amounted to $683.5 million.

Ukraine’s exports to the Czech Republic are mainly ferrous metals, machinery, and agricultural products. Imports from the Czech Republic consist mainly of automotive machinery, equipment, electronics, and pharmaceuticals.

“The positive attitude of Ukrainians toward the Czech Republic is explained not only by historical proximity but also by Prague’s active support for Ukraine. At the same time, economic relations between the two countries are characterized by a significant imbalance – imports from the Czech Republic significantly exceed exports. This creates prospects for the development of new areas of cooperation, especially in the fields of high technology, investment projects, and energy,” emphasized Maksym Urakin, founder of Experts Club, economist.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CZECH REPUBLIC, DIPLOMACY, EXPERTS CLUB, Pozný, SOCIOLOGY, TRADE, URAKIN

Ukrnafta JSC continues its rebranding program for filling stations acquired from Shell, adding eight more complexes in the Kyiv region to its UKRNAFTA brand.

“The renewal of the UKRNAFTA gas station network continues — we are expanding our presence in the Kyiv region. From now on, eight more rebranded complexes are ready to welcome customers,” the company announced on Facebook.

According to the company, this includes the renovated gas stations on Stolichnoe Highway in the direction of Obukhiv, on the Kyiv-Chop highway within Korostyshiv, and on the Kyiv-Kharkiv highway near Boryspil and within Berezan.

In addition, gas stations in the city of Uzyn in the Bila Tserkva district, in the city of Skvyra in the direction of Zhytomyr, and in the center of the city of Pereyaslav have been rebranded.

“Stop by. Refuel. Relax,” Ukrnafta emphasized.

As reported in August this year, citing former Ukrnafta commercial director Serhiy Fedorenko, Ukrnafta acquired 131 gas stations from Shell, 118 of which are operational, while the rest are located near the front line or in temporarily occupied territories. After closing the deal, the company planned to consolidate its position as the largest network in Ukraine, with the number of its gas stations set to increase by 22% to 663. Its closest competitor, OKKO, has 410 gas stations.

Under the agreement with Shell, Ukrnafta must complete the rebranding of its gas stations, the cost of which is insignificant on a network scale, by the end of February 2026. In turn, the cost of rebranding, which includes the renovation and standardization of gas stations and will take several years, will be significant but justified.

Ukrnafta is Ukraine’s largest oil producer and operates the national gas station network. In March 2024, it took over the management of Glusco’s assets and currently operates a total of 662 gas stations.

The company holds 92 special permits for industrial development of deposits. It has 1,832 oil and 154 gas production wells on its balance sheet.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the company’s corporate rights, which belonged to private owners, to the state, and they are currently managed by the Ministry of Defense.

Ukrnafta’s net profit for 2024 was UAH 16.38 billion.

Ukrainian Foreign Minister Andriy Sybiga received Ole Egberg Mikkelsen, Ambassador Extraordinary and Plenipotentiary of the Kingdom of Denmark to Ukraine, who is ending his diplomatic mission in Ukraine after five years of service.

According to the press service of the Ukrainian Foreign Ministry, Sibiga expressed his gratitude to Ole Egberg Mikkelsen for his personal commitment to the Ukrainian-Danish partnership and noted that the ties between Ukraine and Denmark established during his tenure go far beyond official relations.

“Denmark has become a world leader in terms of aid to Ukraine as a percentage of GDP (2.89%) and has provided our country with more than €9.9 billion in support. In addition, Denmark’s unique partnership with Mykolaiv and the Mykolaiv region has become a model of regional cooperation for other international partners. We greatly appreciate this,” Sibiga said.

The minister also noted the recent launch of the long-term humanitarian support program Ukraine Transition Programme and unprecedented military assistance, namely Denmark’s transfer of its entire artillery arsenal, the provision of F-16 fighter jets, and the launch of the Danish model of direct investment in the Ukrainian defense-industrial complex.

The interlocutors discussed the further development of relations between Ukraine and Denmark on the path to a just peace and the restoration of security in Europe.

The Foreign Minister wished Ole Egberg Mikkelsen success in his new endeavors.

Ukrainian company AII Systems has introduced an artificial intelligence platform for automated control of heating, ventilation, and air conditioning (HVAC) systems, which allows commercial buildings to reduce energy consumption by 10-20% without additional capital expenditures, the company’s press service reported.

“Energy efficiency is becoming a determining factor in competitiveness in the commercial real estate sector. Businesses need tools that make consumption predictable and transparent. Our AI platform provides exactly that,” said Yaroslav Smolko, CEO and owner of AII Systems.

According to him, the AI platform integrates with existing control systems and analyzes sensor data, weather conditions, and building occupancy levels. Algorithms predict loads and optimize equipment operation in real time. Results are monitored through KPI dashboards: energy consumption; COP; CO₂ levels; comfort indicators, etc.

According to estimates by the International Energy Agency, HVAC systems consume up to 40% of electricity in commercial buildings. Similar technologies are already actively used in the EU and the US, where they provide savings of 10-25%.

Smolko noted that even a 10% saving would have a significant financial impact, especially for networked facilities. In Ukraine, the AII Systems system is already being tested at two commercial facilities, and its effectiveness will be reported in the near future.

AII Systems is a Ukrainian technology company specializing in the development of solutions for energy-efficient building management. The owner of the “Aii systems” platform is “Company Siayti” LLC (38799735). According to OpenDataBot, the company’s revenue for 2024 amounted to UAH 8.3 million, which is 1.8 times more than in 2023, with a net profit of UAH 171,900 compared to UAH 6,200 in 2023.