Ukraine increased imports of hard coal and anthracite by 15.4% in 2021 year-on-year (by 2.612 million tonnes), up to 19.563 million tonnes.

According to the State Customs Service, coal was imported for $2.489 billion, which is 47.2% more than in 2020 ($1.691 billion).

Ukraine received $1.545 billion worth of coal (62.09% of imports) from Russia, $494.636 million (19.88%) from the United States, $253.469 million (10.18%) from Kazakhstan and $195.383 million (7.85%) worth of coal from other countries.

German Foreign Minister Annalena Baerbock said that she would soon visit Ukraine along with French Foreign Minister Jean-Yves Le Drian and they would visit the country’s eastern regions.

“The two of us will soon visit Ukraine again, we will go to the contact line in Donbas, since in recent weeks I have received information about how much the civilian population is suffering: women, children, young people, the elderly. We have lost sight of them. We must talk about security and peace in the region,” Baerbock said at a joint press conference with Ukrainian Foreign Minister Dmytro Kuleba in Kyiv on Monday.

In turn, Kuleba said that during the joint visit of Baerbock and Le Drian to Ukraine, their trilateral meeting will take place, during which they will discuss in detail the prospects for a meeting of Normandy format’s Foreign Ministers.

The capitalization of seven largest Ukrainian agricultural holdings decreased over the period of January 10-14, while one increased, according to the data presented on the Warsaw and London Stock Exchanges, where their securities are quoted.

Thus, the capitalization of the agro-industrial group Kernel decreased by 1.5% over the past week, from PLN 4.873 billion ($1.23 billion) to PLN 4.798 billion ($1.21 billion).

The capitalization was also reduced by such agricultural holdings MHP – by 1.5%, from $737.7 million to $726.6 million, IMC – by 2.4%, from PLN 1.078 billion ($272.9 million) to PLN 1.051 billion ($266.0 million), Astarta – by 2.6%, from PLN 1.035 billion ($262 million) to PLN 1.007 billion ($254.9 million), and Ovostar – by 0.7%, from PLN 405 million ($102.5 million) to PLN 402 million ($101.8 million).

In addition, over January 10-14, the capitalization of the Agroton group of companies decreased by 0.5%, from PLN 146.05 million ($36.9 million) to PLN 145.19 million ($36.8 million), KSG Agro – by 0.7%, from PLN 57.1 million ($14.4 million) to PLN 56.63 million ($14.3 million), and Milkiland – collapsed by 17.8%, from PLN 68.43 million ($17.3 million) to PLN 56.56 million ($14.31 million).

During the specified period, only the capitalization of the Agroliga holding increased by 4.5%, from PLN 77.2 million ($19.5 million) to PLN 80.69 million ($20.4 million).

Accordingly, by the close of trading on January 14, the share price of Kernel was PLN 57.1 per share; MHP – $6.56 (PLN 25.9); IMC – PLN 31.7, Astarta – PLN 40.3, Ovostar – PLN 67.0; Agroton – PLN 6.7; KSG Agro – PLN 3.77; and Milkiland – PLN 1.8.

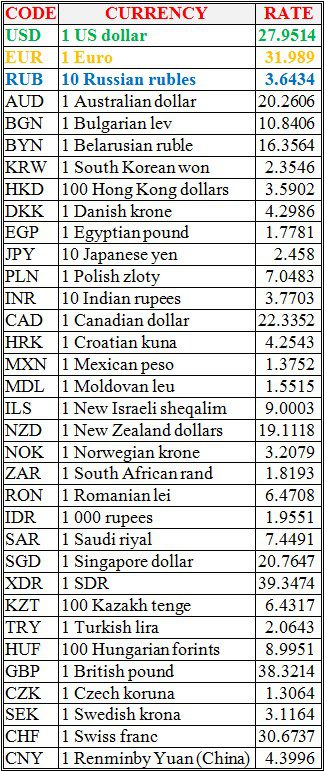

National bank of Ukraine’s official rates as of 17/01/22

Source: National Bank of Ukraine

The Ukrainian airline Air Ocean will stop operating flights until March 15, the airline’s press service has reported.

“Dear passengers, due to the delay in the delivery of aircraft and the need for scheduled maintenance of currently operated aircraft, the airline is forced to postpone flights with resumption starting from March 15, 2022,” the airline said in the report.

The press service also said that if the tickets were bought on the airline’s website, the funds will be automatically credited in full to the card from which the payment was made. If the ticket was purchased from an air travel agent, the passenger should contact the place of purchase for a refund of the ticket price. “Or we offer you to retain the right to fly with an open departure date, and when buying the next ticket, we provide a discount of 50% of the ticket price,” the airline said.