Ukraine since the beginning of the 2021/2022 marketing year (MY, July-June) and as of August 25 had exported 6.49 million tonnes of grain and leguminous crops, which is 1.9% more than the figures for the same date of the previous MY.

According to the information and analytical portal of the agro-industrial complex of Ukraine, to date, 3.13 million tonnes of wheat (19.9% less compared to the same date in 2020/2021MY), 2.16 million tonnes of barley (up 13.4%), 1.17 million tonnes of corn (2.2 times more), 19,300 tonnes of flour (1.7 times less) have been exported.

As of the indicated date, 6,800 tonnes of rye were also exported, which is 8.5 times more than in the last MY.

As reported, the export of wheat to Ukraine in 2020/2021MY amounted to 16.64 million tonnes, corn – 23.08 million tonnes, barley – 4.23 million tonnes, flour – 129,000 tonnes.

In addition, Ukraine in 2019/2020 MY exported 56.72 million tonnes of grain and leguminous crops.

In order to become a full member of the European Union, Ukraine will have to work hard for 20 years, said Estonian President Kersti Kaljulaid.

In an interview with European Truth, the politician stated that neither Ukraine, nor Georgia, nor Moldova still meet the requirements for membership in the European Union.

“The EU has many conditions. And frankly speaking, none of these countries is ready to fulfill the EU criteria. So, it will be 20 years, maybe, to work before you get there. All these countries have problems with independent justice systems. Therefore, you don’t qualify for European membership,” Kaljulaid said, adding that some “intermediate cooperation format” could help these states on the way to European integration.

The Estonian President also noted that the EU should have been somewhat more courageous in expanding its borders, in particular, the Union could offer Kyiv, Tbilisi and Chisinau either a new format of work for countries that have ambitions to join the EU, or full membership, however it will take “a lot of time”.

In addition, answering a question about joining NATO, Kaljulaid noted that Ukraine would not be able to become a full member of the Alliance until it regains control of all the occupied territories.

“Estonia is a strong proponent of MAP and for Ukraine to work closely with NATO, but we don’t know exactly when we will arrive at this end. We need to wait for some time for the history to turn,” she stressed.

She also expressed hope for a peaceful solution to the issue of de-occupation of Ukrainian territory.

British-based Ferrexpo plc, which controls in Ukraine, in particular, Poltava and Yeristovo mining and processing plants (Poltava GOK and Yeristovo GOK), in January-July of this year, according to recent data, increased production of pellets by 2.9% compared to the same period last year, to 6.563 million tonnes.

A representative of the company informed Interfax-Ukraine that in July production of pellets amounted to 1 million tonnes.

According to an announcement on the London Stock Exchange, on September 17, 2021, a general meeting of shareholders will take place, the only issue at which is the re-election of Vitaliy Lisovenko to the company’s board of directors.

At the same time, it is explained that at the annual general meeting of the company on May 27, 2021, independent non-executive director Lisovenko did not receive the required number of votes for reappointment to the board of directors. In the event that the candidacy of the independent director is approved by a majority of votes of all voting shareholders at the second general meeting, the director will be re-elected before the next annual general meeting.

The second vote will take place at 11:00 on Friday, September 17, 2021, the shareholders can participate in person at the meeting or online.

As of August 23, 2021, the issued share capital of the company consisted of 588,624,142 ordinary shares with one vote each.

Ferrexpo in 2020 increased its total pellet production by 7% compared to 2019, to 11.218 million tonnes. Concentrate output increased by 5.9%, to 14 million tonnes.

Ferrexpo is an iron ore company with assets in Ukraine.

Ferrexpo owns 100% of shares in Poltava GOK, 100% in Yeristovo GOK and 99.9% in Belanovo GOK.

The Ministry of Finance of Ukraine pledges funds for the Affordable loans 5-7-9% program in the draft state budget for 2022, but sees the need to reformat it so that most of the loans are issued for investments in fixed assets, Minister of Finance Serhiy Marchenko said.

“It is important for us to reformat this program so that most of the loans go to investments in fixed assets,” he said in an exclusive interview with Interfax-Ukraine.

Marchenko said that the Ministry of Finance held a meeting with commercial foreign-invested banks with, where they talked about proposals to modernize the Affordable Loans program. “We asked to send proposals in writing. But in writing, this does not mean the need to disturb the market, like, everything is gone and the program is not working. This is one of the most effective programs,” the Minister of Finance said.

“But in the future, it is important to focus on investment goals,” Marchenko said.

Earlier, in June, the Forum for Leading International Financial Institutions (FLIFI), headed by the Board Chairman of Raiffeisen Bank, Oleksandr Pysaruk, sent a letter to the National Bank of Ukraine (NBU) and the Ministry of Finance with a request to limit the implementation of the Affordable loans 5-7-9% program.

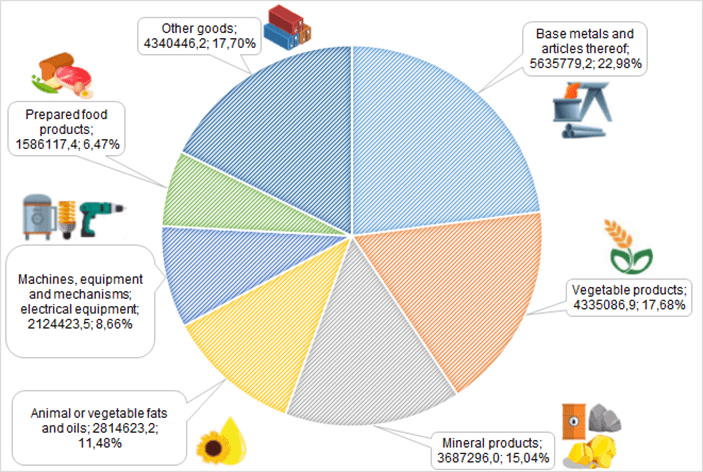

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS IN JAN-MAY 2021 (EXPORT)

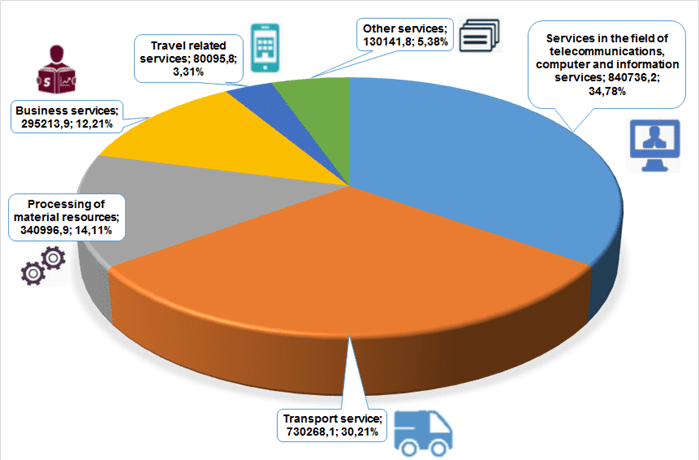

STRUCTURE OF EXPORT OF SERVICES IN JAN-MARCH 2021 (GRAPHICALLY)