The debut International Defense Investment Forum, dedicated to the search for new directions in the development of Ukraine’s defense industry, which featured about 20 investment projects, was held in Kyiv at the Sikorsky Challenge (National Technical University of Ukraine “Ihor Sikorsky Kyiv Polytechnic Institute”) on Thursday.

“The authorities have an understanding of the existing problems and the need to take all measures aimed at improving the current investment climate in the country,” Deputy Prime Minister for Strategic Industries Oleh Urusky said, opening the forum.

He said that the recently adopted laws On Defense Procurement should remove excessive secrecy in the defense industry and ensure transparency of procurement and On the peculiarities of reforming the state-owned defense industry should facilitate the attraction of investment and private business in the sector, according to which on the basis of Ukroboronprom two holding companies will be created.

Urusky also said that the Ministry for Strategic Industries of Ukraine has developed a Strategy for the Development of Ukraine’s Defense Industry until 2030. According to him, given the nature of modern wars and conflicts, the main directions in the development and production of domestic weapons and military equipment were: automated control systems; rocket and space technology; high-precision means of destruction, ammunition and products of special chemistry; means of electronic warfare; unmanned platforms and shock robotics; “soldier of the future” equipment.

During the forum, which was attended by a delegation from the UAE led by the Mariam bint Mohammed Saeed Hareb Almheiri, about 20 investment projects were presented in three areas: high-precision weapons and ammunition; robotic equipment: air, ground and marine components; automation of control and communication system.

In particular, “Shock unmanned aerial vehicle complex with barrage ammunition ST-35 Thunder (LLC NPP Athlon Avia), Organization of lines for the production of large caliber cartridges 12.7×99; 12.7×108; 14,5х114 for small arms (LLC Stiletto Ukraine) and Unmanned robotic platforms Scorpion 2 and Dwarf scout (LLC Infocom).

Among other projects – “Universal robotic remote-controlled combat module/Project ACHILLES” (LLC Diamond Defense Systems), Light BPAK battlefield Yatagan-2 with a swarm function (LLC First Contact).

German Chancellor Angela Merkel will visit Russia on August 20 and will travel to Ukraine on August 22, German government spokesperson Steffen Seibert told reporters in Berlin on Friday.

“The chancellor will visit Moscow on Friday and Kyiv on Sunday,” Seibert said.

Ukraine in January-July 2021 reduced earnings from electricity exports by 28.1% (by $53.052 million) compared to the same period in 2020, to $135.612 million, according to data from the State Customs Service.

According to the calculations of Interfax-Ukraine, in January-July 2021 electricity for $59.339 million was supplied to Hungary, Poland for $39.783 million, Romania for $21.204 million, other countries for $15.286 million.

In July 2021 alone, electricity was exported for $27.373 million versus $5.505 million in July 2020.

In addition, in January-July of this year, Ukraine imported electricity for $59.058 million versus $110.005 million in the same period last year. Electricity exported from Belarus was worth $24.702 million, Slovakia – $22.401 million, Russia – $5.388 million, other countries – $6.567 million.

Since the beginning of the harvesting campaign as of August 13, Ukrainian farmers have harvested 39.5 million tonnes (a rise of 7.3 million tonnes per week from August 6 to August 13) of grain, legumes and oilseeds from an area of 9 million hectares (56% of the forecast).

According to the information and analytical portal of the agro-industrial complex of Ukraine, in the context of crops, the following crops were threshed: 28.7 million tonnes of wheat from an area of 6.2 million hectares (88% of the total area under this crop), 9.42 million tonnes of barley from 2.3 million hectares (92%), 2.6 million tonnes of rapeseed from 0.95 million hectares (94%), 0.54 million tonnes of peas from 0.23 million hectares (96%).

According to the portal, the yield of harvested wheat was 460 tonnes per ha, barley – 416 tonnes per ha, rapeseed – 275 tonnes per ha, and peas – 233 tonnes per ha.

The portal said that the leaders in harvesting since the beginning of the harvesting campaign were Kherson (the harvest was harvested from 91% of the area), Zaporizhia (90%), Donetsk and Mykolaiv (86% each), Luhansk (84%) regions. At the same time, wheat harvesting was completed by farmers of four regions, barley – by six regions. The collection of peas was completed in 18 regions of the country, rapeseed – in nine.

Agricultural producers of Khmelnytsky region were the leaders in average grain yield, harvesting respectively from 29% of the area with a yield of 614.5 tonnes per ha.

The joint task force staff the State Emergency Service of Ukraine on August 13 in Greece tackled areas of wildfires near the settlements of Ellinika and Kamatriades.

“During the day, fires were tackled on a total area of 3.2 hectares,” the press service of the State Emergency Service said.

Work is scheduled to continue on Saturday August 14.

As reported, on August 6, firefighters from the joint task force of Ukraine arrived in Greece to help fight devastating wildfires. A hundred rescuers of the State Emergency Service with the necessary equipment flew out of the Kyiv airport.

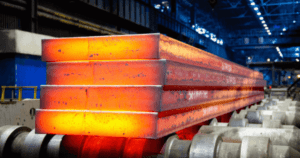

Ukraine in January-July this year reduced exports of semi-finished products from carbon steel in quantity terms by 3.2% compared to the same period last year, to 4.177 million tonnes.

According to statistics released by the State Customs Service, during the specified period, exports of semi-finished products from carbon steel increased in monetary terms by 51.2%, to $2.344 billion.

The products were mainly exported to Italy (31.35% of supplies in monetary terms), Turkey (17.45%) and the Dominican Republic (8.31%).

In addition, Ukraine in January-July 2021 imported 12,806 tonnes of such products, which is 40.7% more than in January-July 2020. In monetary terms, imports increased 2.1 times, to $7.990 million. The products were mainly imported from the Russian Federation (94.04% of supplies), Uzbekistan (3.49%) and Turkey (2.38%).