State-owned enterprise Antonov (Kyiv) and JSC Tashkent Mechanical Plant (TMZ), following the results of the recent negotiations and visits by the Ukrainian side of the production facilities of TMZ, agreed on a “road map” and on creation of a working group for studying the technological potential of TMZ and the possibility of organizing the production of aircraft parts and assemblies by order of Antonov.

According to the TMZ website, the start of the dialogue was preceded by a meeting in Kyiv of the founder of the investment company Welfare Investment Alliance (Uzbekistan), Alisher Abdualiev, with Director General of Antonov state-owned enterprise Serhiy Bychkov.

During negotiations between Head of the board – TMZ Director General Zafar Isokov and Antonov General Designer Oleksandr Dveyrin with the participation of the Welfare Investment Alliance leaders, the prospects for exporting previously manufactured products and the possibility of expanding the production of parts and assemblies for modern aircraft of SOE Antonov and its subcontractors were discussed.

TMZ said that it continues to produce individual parts and assemblies for the aviation industry, carries out systematic work to restore the production of components for aircraft on the basis of direct contracts with aircraft manufacturers.

Ukraine has registered a vaccine against coronavirus (COVID-19) Janssen manufactured by Johnson & Johnson.

According to the Center for Public Health and the Health Ministry, the vaccine was registered for emergency medical use on July 2.

At the same time, it is specified that one dose of Janssen vaccine is sufficient for complete immunization.

The vaccine is approved for emergency use by WHO. The United States, Great Britain, the European Union, Switzerland, Canada and other countries have also given permission to use it.

This is a vector vaccine developed by Janssen, owned by Johnson&Johnson. It requires a storage temperature from minus two to plus eight degrees Celsius.

The U.S. administration will soon announce the dates of the visit of Ukrainian President Volodymyr Zelensky to Washington, Ukrainian Foreign Minister Dmytro Kuleba has said.

“The dates are not yet known. We were offered the end of July, but we have not yet received specific days when this visit will take place. However, we are waiting for confirmation of the date soon. The U.S. administration is already actively working with us to prepare this visit,” Kuleba told journalists on the sidelines of the Ukraine 30. International Relations forum in Kyiv on Monday.

According to him, the focus of the visit will be the issue of security, that is, the Normandy format, Donbas, Crimea, the issue of U.S. investments in Ukraine and the trade development, as well as the issue of reforms in Ukraine.

“But besides the meeting with the U.S. administration, there will be many other events. There will be contacts through the IMF, there will be meetings with the community, with American business. Therefore, this is not just a visit to President Biden – this is a visit to the United States in a broad sense,” the Minister of Foreign Affairs said.

As reported, Biden invited Ukrainian President Volodymyr Zelensky to visit Washington this summer.

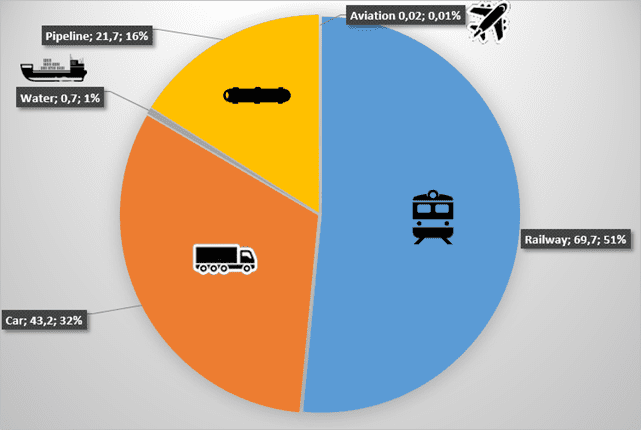

VOLUMES OF CARGO TRANSPORTATION IN JAN- MARCH 2021, MLN TONS

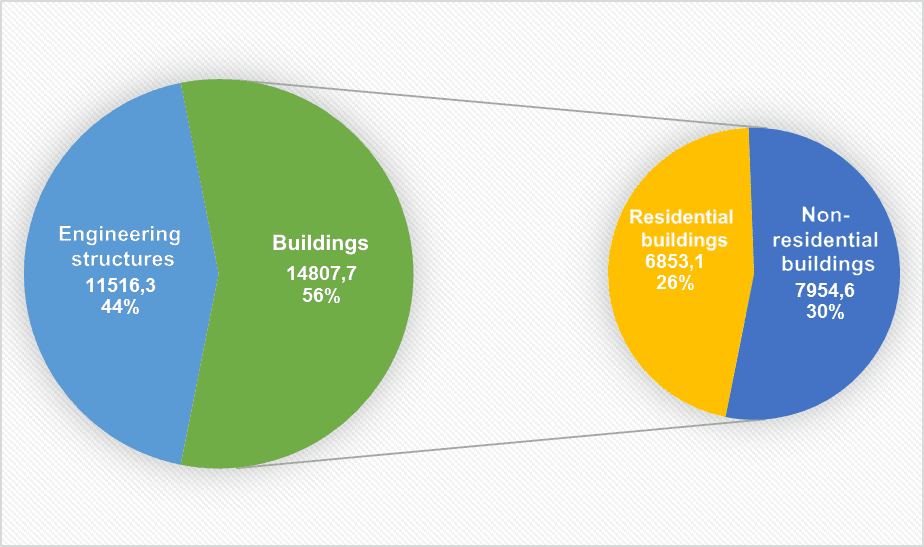

VOLUME OF CONSTRUCTION PRODUCTS PRODUCED BY TYPE IN JAN-FEB OF 2021 (MLN UAH)

Wizz Air Abu Dhabi will operate from Abu Dhabi to Boryspil international airport (Kyiv region), the airport said on Saturday, July 3.

“The airline plans to operate flights with a frequency of once a week, every Saturday. The number of flights will increase during the summer. Wizz Air Abu Dhabi plans to operate three flights a week from the end of August, on Tuesdays, Thursdays and Sundays,” the airport said in the statement.

The flights will be operated on modern Airbus A321neo aircraft with ultra-low emissions, noise and fuel consumption. Wizz Air Abu Dhabi’s fleet consists of four such aircraft.

According to the flight booking service, from July 20 to July 31, the airline will add flights on Tuesdays. For August, the schedule includes flights once a week, on Thursdays, and from September the airline will increase the frequency of flights to three per week: on Tuesdays, Thursdays and Sundays.