U.S. Charge d’Affaires in Ukraine Kristina Kvien returned to Ukraine after a two-week vacation, the U.S. Embassy in Ukraine said.

“Welcome back, Chargé d’Affaires Kvien! And thanks to Deputy Assistant Secretary George Kent, who filled in as Chargé the last two weeks,” the embassy said on Twitter on Tuesday.

The Azerbaijani service company SOCAR AQS is considering the possibility of investing in Ukrainian subsoil, Head of the State Service for Geology and Subsoil Roman Opimakh said following a working meeting in Kyiv on Monday.

“Representatives of SOCAR AQS are interested in investing in Ukrainian subsoil because of the presence of significant potential of both hydrocarbon deposits and raw materials for the production of batteries for electric cars and electronics in our country,” Opimakh wrote on his Facebook page

According to him, the parties agreed to continue the dialogue with the aim of introducing and implementing joint business projects.

Opimakh also invited Azerbaijani partners to pay attention to the Investment Atlas of a Subsoil User, created by the State Service for Geology and Subsoil, containing vacant subsoil areas with deposits of strategic and critical minerals, as well as a data-room of secondary geological information filled with descriptive information about subsoil use objects, land plots within the contours of deposits, and also geological reports.

According to Interfax-Azerbaijan, SOCAR AQS was established in 2007 by the State Oil Company of Azerbaijan (SOCAR), Nobel Oil Services and Abşeron Qazma Şirkəti as a joint venture providing comprehensive drilling and well management services. Nobel Oil Services is the main shareholder of SOCAR AQS.

The main activity of SOCAR AQS is the provision of services and work on the design and planning of wells, drilling oil and gas wells, drilling directional wells, drilling horizontal wells, well completion, workover, sidetracking and drilling of branched wells.

National bank of Ukraine’s official rates as of 27/07/21

Source: National Bank of Ukraine

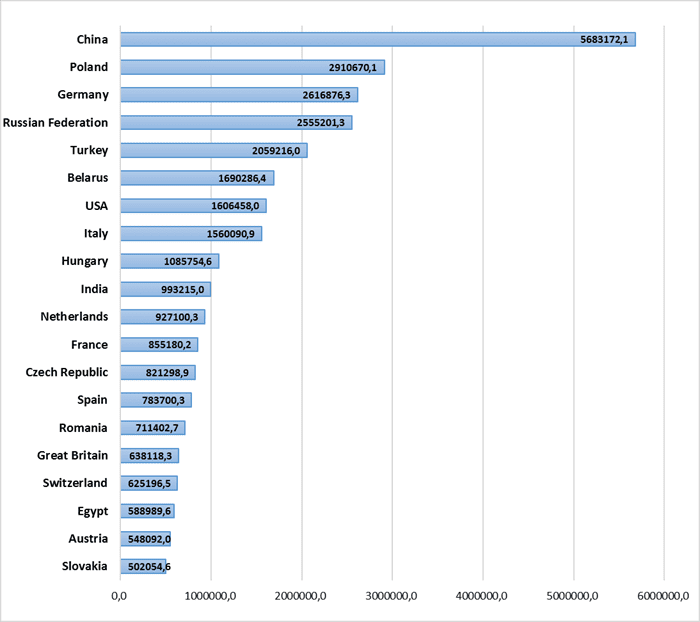

TOP 20 COUNTRIES OF UKRAINE’S FOREIGN TRADE PARTNERS JAN- APRIL 2021 (THOUSAND USD)

The European Union and the United Nations Development Programme (UNDP) in Ukraine, together with national partners, officially opened two renovated medical call centers in Kramatorsk, Donetsk region, and Severodonetsk, Luhansk region.

The equipment for the call centre, worth around EUR 17,000 (about UAH 540.000), was purchased with the financial support of the European Union under the UN Recovery and Peacebuilding Programme, the message reads.

The centers are based at Kramatorsk Primary Healthcare Centre No. 1 and Severodonetsk City Multidisciplinary Hospital. They will serve about 180,000 residents of Donetsk and Luhansk regions.

Up to six coordinators work in the call centers and use a specially designed call system, which helps them call back those who could not reach the centre immediately.

“The European Union continues to support the effective functioning of the healthcare system in eastern Ukraine, ensuring that needs of all local residents are addressed. Together with our partners from the UN Recovery and Peacebuilding Programme and the European Investment Bank, we’ve been piloting new approaches to health service delivery, which is crucial in the times of the COVID-19 pandemic, and renovating medical facilities in Donetsk and Luhansk regions,” Martin Schroeder, acting Head of Cooperation at the EU Delegation to Ukraine, said.