Karina Avramenko, one of the video authors, a student and deputy president of the Student Parliament of International European University, said that she decided to carry out the experiment after seeing a sticky situation. Coming home after classes, she saw how a foreign student asked pedestrians for money to get to a place of residence because his purse was stolen. It triggered her to initiate the shooting of a social video in order to raise a topic of good deeds, as it is, unfortunately, quite a rare phenomenon nowadays.

“Since childhood, parents have been teaching me to help others and not to leave someone to their fate. I always follow their advice and can’t ignore similar situations. Therefore, I try to help people facing difficulties if I have such a possibility,” Karina Avramenko states.

The video shows Geneva, a student from Nigeria, near the metro station, who addresses pedestrians asking for money for a trip because somebody has stolen his bag with all his stuff, including a purse, and he needs to get to the hotel where he lives. Geneva, without knowing the language, talked to passersby in English and asked them to help.

Thus, students of International European University appeal to other people not to ignore individuals who, in certain circumstances, are in trouble and become more kind. No one knows what you will face tomorrow.

The International European University was founded in Kyiv in 2019. The university has its own educational building at 16a Mahnitohorska Street in Kyiv. Ukraine and Austria are its co-founders.

The university specializes in teaching foreign students and Ukrainians, studying in scientific and educational institutions in seven areas: business schools, architectural and engineering, language, medical, IT, law and art schools.

The Council for Trade and Sustainable Development has selected two representatives of Ukraine to the Group of experts in accordance with Article 301 of the Ukraine-EU Association Agreement, thus Ukraine has completed the formation of its representatives in the Group, the Ministry of Economy reported on the website.

“Based on the results of the interviews with the candidates, two additional experts were selected by voting of the Council members. This allows us to fully form a pool of experts from the Ukrainian side and ensure the full work of the group by the end of this year,” the ministry said following the fifth meeting of the Council on Wednesday.

Additional recruitment of experts from Ukraine became a key issue of the meeting, the Ministry of Economy noted.

The ministry recalled that the expert Group should consist of 15 people: five each from Ukraine and the EU, as well as five people who are not citizens of any of the parties to the Agreement. The main task of the Group is to study any issue under Chapter 13 “Trade and Sustainable Development” of the Association Agreement between Ukraine and the EU, if this has not been satisfied through intergovernmental consultations.

Ukraine selected three experts during the fourth meeting of the Council, held in Kyiv in June 2019.

The approval of the full list of experts requires a decision by the Ukraine-EU subcommittee on trade and sustainable development, which is currently undergoing domestic approval procedures, the Economy Ministry added.

In Ukraine, new border crossing rules have been introduced for all unvaccinated persons who have been in Russia or India for more than seven days over the past two weeks, according to the Coronavirus Info Telegram channel.

In particular, a mandatory 14-day self-isolation is established for all unvaccinated persons who have been in Russia or India for more than seven days in the last two weeks.

It is noted that crossing the state border for Ukrainians arriving from any country is unhindered if there is a full course of vaccination or a 063-O certificate of the first vaccination.

“Foreigners are required to have an insurance policy and one of the documents: negative PCR test (72 hours in advance), negative antigen test (72 hours in advance), and a full course of vaccination,” the message says.

It is emphasized that in the absence of the necessary documents, the Vdoma application is installed and the person begins self-isolation after 72 hours, if the result of testing for COVID-19 by PCR or rapid testing for the determination of the SARS-CoV-2 coronavirus antigen, made already in Ukraine after crossing the border, is positive.

“If it is impossible to use the Vdoma application, the person will be under observation,” the message says.

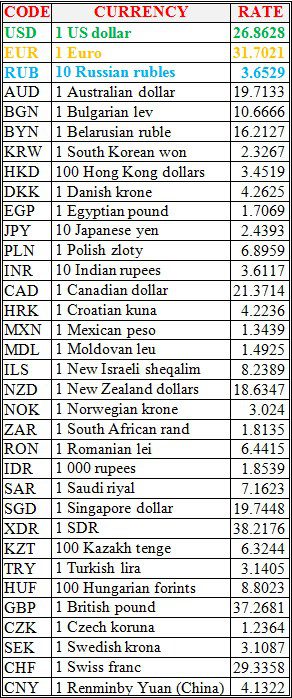

National bank of Ukraine’s official rates as of 29/07/21

Source: National Bank of Ukraine

The Cabinet of Ministers of Ukraine on Wednesday approved the draft decree on the signing of an agreement between the government of Ukraine and the government of the United States on projects in the field of research, developments, testing and evaluation, the authority to sign the agreement was given to Minister of Defense of Ukraine Andriy Taran, according to the Press and Information Office of the Ukrainian Defense Ministry.

“The signing of this agreement will give the Ukrainian side the opportunity to: conduct joint research and development work on the development of weapons and military equipment, their individual components; obtain information about advanced defense technologies, trends in their development; conduct of tests and testing of military equipment using equipment and technologies that are not available in Ukraine,” the office said.

The agreement also opens up the possibility of attracting foreign funding for research work by Ukrainian research institutions, as well as increasing the research potential of Ukraine through cooperation with partners in joint projects.

The ministry said that the implementation of the agreements will take place under project contracts within the framework of the agreement concluded between the Ministry of Defense of Ukraine and the U.S. Department of Defense.

“The signing of the Agreement is planned during the visit of the President of Ukraine to the United States and will be another important step in the development of strategic partnership with the United States in the field of armaments,” the Defense Ministry said.