The Macroeconomic Review section has been launched on a monthly basis within the framework of the Experts Club. In the first video, the co-founder of the project, PhD in Economics, Maksim Urakin, analyzed the main macro indicators.

“The goal of our Macroeconomic Review project is to provide the viewer with the key statistics and information in the most convenient form, to do it succinctly and clearly, replacing cumbersome tables and lengthy reasoning with graphic analysis,” research organizer Maksim Urakin said.

In the block on the population of Ukraine, the latest data of the State Statistics Service on the number of residents of our country were presented, a comparison was made between the statistics of state bodies and the indicators of the so-called “electronic census” of January 2020. In addition, the latest data on unemployment and wages in the regions were studied.

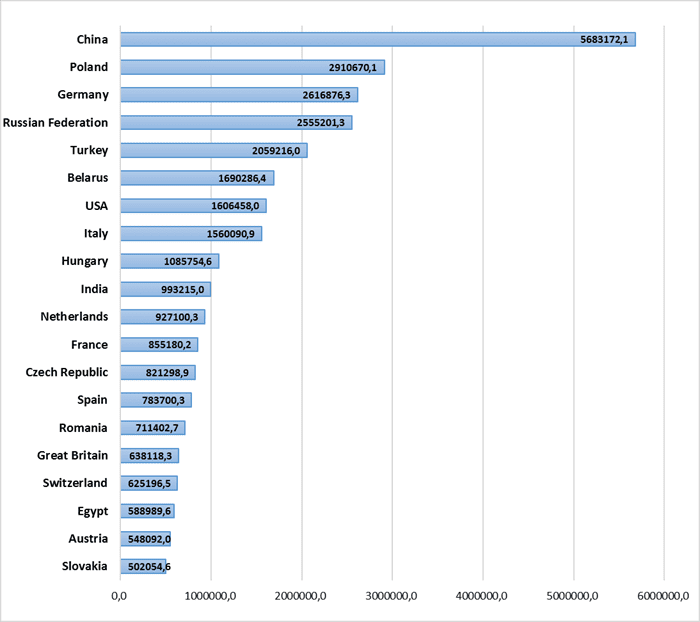

In the economic block, the indicators of GDP, the volume of foreign trade, the main trade partners of Ukraine, the national debt, the indicators and sources of investment and industrial production are analyzed.

All data is presented in the form of graphs and diagrams that complement the visual backdrop.

In the future, the Experts Club will analyze and present both the current statistics of Ukraine and compare the latest data with the previous periods, as well as with the indicators of other countries.

In addition, a series of thematic programs are planned, which will be devoted to the state of various sectors of the Ukrainian economy and their characteristics over the period of 30 years of independence.

The full video can be found on the Experts Club YouTube channel at the link:

https://www.youtube.com/watch?v=tCKGn3uGR_Y

You can subscribe to the Experts Club channel here.

U.S. Charge d’Affaires in Ukraine Kristina Kvien returned to Ukraine after a two-week vacation, the U.S. Embassy in Ukraine said.

“Welcome back, Chargé d’Affaires Kvien! And thanks to Deputy Assistant Secretary George Kent, who filled in as Chargé the last two weeks,” the embassy said on Twitter on Tuesday.

The Azerbaijani service company SOCAR AQS is considering the possibility of investing in Ukrainian subsoil, Head of the State Service for Geology and Subsoil Roman Opimakh said following a working meeting in Kyiv on Monday.

“Representatives of SOCAR AQS are interested in investing in Ukrainian subsoil because of the presence of significant potential of both hydrocarbon deposits and raw materials for the production of batteries for electric cars and electronics in our country,” Opimakh wrote on his Facebook page

According to him, the parties agreed to continue the dialogue with the aim of introducing and implementing joint business projects.

Opimakh also invited Azerbaijani partners to pay attention to the Investment Atlas of a Subsoil User, created by the State Service for Geology and Subsoil, containing vacant subsoil areas with deposits of strategic and critical minerals, as well as a data-room of secondary geological information filled with descriptive information about subsoil use objects, land plots within the contours of deposits, and also geological reports.

According to Interfax-Azerbaijan, SOCAR AQS was established in 2007 by the State Oil Company of Azerbaijan (SOCAR), Nobel Oil Services and Abşeron Qazma Şirkəti as a joint venture providing comprehensive drilling and well management services. Nobel Oil Services is the main shareholder of SOCAR AQS.

The main activity of SOCAR AQS is the provision of services and work on the design and planning of wells, drilling oil and gas wells, drilling directional wells, drilling horizontal wells, well completion, workover, sidetracking and drilling of branched wells.

National bank of Ukraine’s official rates as of 27/07/21

Source: National Bank of Ukraine

TOP 20 COUNTRIES OF UKRAINE’S FOREIGN TRADE PARTNERS JAN- APRIL 2021 (THOUSAND USD)