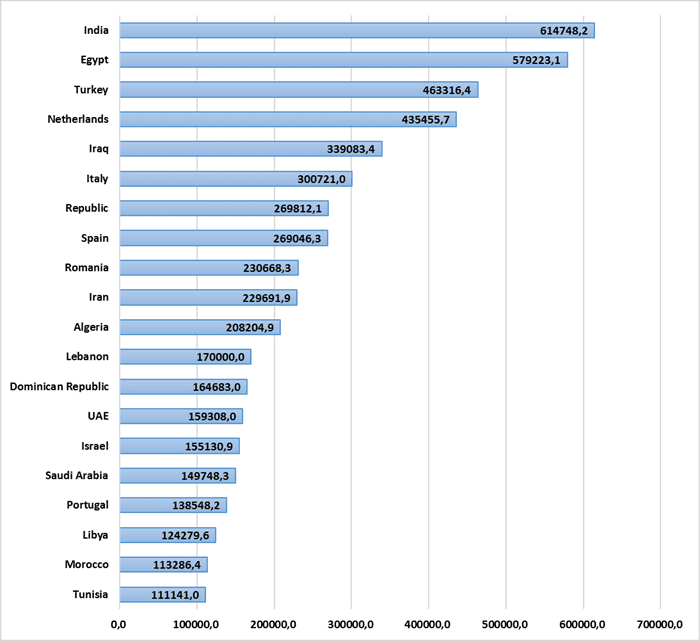

TOP 20 COUNTRIES UKRAINE HAS POSTED THE HIGHEST SURPLUS OF TRADE IN GOODS JAN-MAY 2021

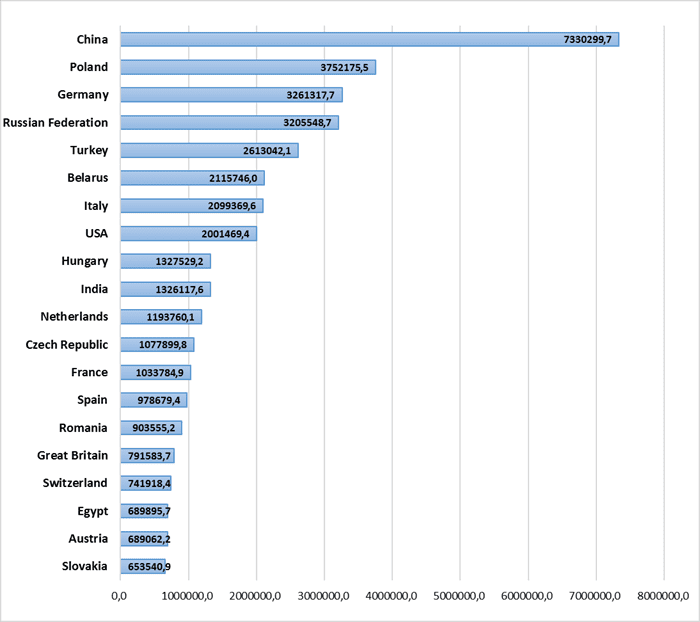

TOP 20 COUNTRIES OF UKRAINE’S FOREIGN TRADE PARTNERS JAN-MAY 2021 (THOUSAND USD)

The system of cyber protection of state information resources of Ukraine and critical infrastructure facilities at monitoring sites recorded 376,100 suspicious events from August 18 to 24 August 2021, which is 28% less than in the previous week.

According to the State Service for Special Communication and Information Protection on Thursday, the overwhelming majority of recorded suspicious events concern violations of corporate security policy (32%), detection of network malware (22%), and attempts to obtain administrator rights (20%).

The system of state bodies’ protected access to the Internet blocked 43,100 different types of attacks, which is 18% less than in the previous week. Of these, 99% are application-level network attacks; two DDoS attacks were also recorded and blocked.

During this period, the Government Computer Emergency Response Team of Ukraine (CERT-UA) registered and processed 2,150 cyber incidents.

The vast majority of processed incidents belong to the UACOM domain zone (about 99%). The majority of incidents are related to the distribution of malware (96% of the total) and phishing (3%).

The Black Sea Trade and Development Bank (BSTDB, Thessaloniki, Greece) at the next meeting of the Board of Directors in September will offer its member countries to add EUR 250 million to its capital to increase the bank’s capabilities and efficiency, BSTDB President Dmitry Pankin has said.

“Such additional capitalization will show the rating agencies that the member countries are ready to help and support the bank,” Pankin said at a meeting with journalists in Thessaloniki.

According to him, additional capitalization increases the chances of raising the rating, which has been at the “A-” level for a long time with a positive outlook.

The president of the bank added that with the current capital of the BSTDB, its portfolio of projects of EUR 2.3 billion is also close to the ceiling, which is about EUR 2.6 billion.

Pankin noted that the BSTDB, like any other similar development bank, would be happy to increase capital by a larger amount – EUR 3-4 billion, which would allow it to participate in projects with participation in the capital of companies, however, it understands the difficulties of the member countries with their deficit budgets.

The bank told the agency it will be about increasing the subscribed capital by EUR 700-800 million, while direct investments or additional paid-in capital will amount to about a third – EUR 250 million.

BSTDB is an international organization uniting 11 states of the Black Sea Economic Cooperation organization. The shares of Turkey, Russia and Greece in the capital are 16.5% each, Romania – 14%, Ukraine and Bulgaria – 13.5% each, Azerbaijan – 5%, Albania – 2%, Armenia – 1%, Georgia and Moldova – each 0.5%. The bank aims to promote economic cooperation, trade and cooperation of the countries of the Black Sea region. The bank’s charter capital is EUR 3.45 billion, and its long-term credit ratings are “A-” from S&P and “A2” from Moody’s.

Ukrainian athlete Maryana Shevchuk has won the gold medal in powerlifting among women weighing up to 55 kg at the Paralympics in Tokyo.

The Ukrainian sportswoman lifted a barbell weighing 125 kg from the first attempt. This result was enough to win the competition.

The second time she tried to lift 128 kg, and the third – 133 kg, but she failed.

The Chinese and Turkish athletes who lifted 124 kg each came closest to Shevchuk’s result.

The Paralympic Games in Tokyo are held from August 24 to September 9. Ukrainian athletes have already won two gold, nine silver and five bronze medals. In the overall medal standings, the Ukrainian team takes 10th place.

Production of ready-to-use fish products and canned fish products in Ukraine increased in January-July 2021 by 36% compared to January-July 2020, to 8,300 tonnes, the State Fisheries Agency said on the website on Thursday evening.

The agency said with reference to the State Statistics Service that production of jerked, dried, salted or unsalted fish; salted fish (but not dried); fish in brine (except for smoked fish, fish fillets, fish heads, tails and bellies) in January-July 2021 amounted to 5,990 tonnes (more by 4% compared to January-July 2020). During this period, production of jerked and dried fish amounted to 2,820 tonnes (more by 9%), fish caviar – 2,140 tonnes (more by 30%), smoked fish – 2,370 tonnes (more by 10%), ready-to-use products and canned food from herring – 1,790 tonnes (more by 1%), and salted fish (except for herring) – 1,170 tonnes (more by 1.2%).