Prime Minister of Ukraine Denys Shmyhal and Prime Minister of the Slovak Republic Eduard Heger agreed on the need to intensify bilateral cooperation.

“Today we have agreed on the need to intensify our bilateral cooperation. Holding the next fifth meeting of the Ukrainian-Slovak combined commission on economic, industrial, scientific and technical cooperation will be an important step in assessing the state of trade between our countries,” Shmyhal said at a joint briefing with Heger in Kyiv on Friday.

In addition, the parties agreed to maximize the use of the transit potential of the countries. Shmyhal also noted that the introduction of joint border and customs control at the border is important for both countries.

Among other things, the parties agreed that cooperation between countries in the field of employment and labor migration requires additional attention from governments.

Ukraine has recorded 3,306 new cases of COVID-19, along with 13,298 recoveries and 156 related deaths over the past 24 hours, the press service of the Ukrainian Health Ministry said on Facebook on Friday morning.

“Ukraine has registered 3,306 new daily cases of the coronavirus infection as of May 28, 2021, including 169 children and 77 medical workers. Also, 1,402 people have been admitted to hospitals. Medics have recorded 156 fatalities and 13,298 recoveries over the past day,” it said.

Ukraine reported 3,509 new COVID-19 cases on May 27, 3,395 on May 26, and 2,608 on May 25.

Ukraine has recorded a total of 2,196,673 cases of COVID-19, including 50,232 deaths and 2,020,216 recoveries, since the pandemic began.

CORONAVIRUS, CORONAVIRUS CASES, COVID-19, HEALTH MINISTRY OF UKRAINE

The presidential offices of Slovakia and Ukraine are working on a declaration recognizing Ukraine’s European integration aspirations, said Prime Minister of Slovakia Eduard Heger.

“Slovakia has been a staunch supporter of Ukraine and her European aspirations of Ukraine. This is one of my main messages today in Kyiv. And we are vocal on that in Brussels as well. Presidential offices of both countries are working on the declaration you mentioned,” Heger said in an exclusive interview with Interfax-Ukraine.

He stressed that Ukraine’s European integration aspirations had already been officially recognized many times.

“For now, it is important to use all the provisions the Association Agreement between the EU and Ukraine offers,” the premier added.

He noted that during his visit to Kyiv on Friday, he would talk with Ukrainian interlocutors about the reforms.

“Indeed, transformation and modernization of the country is a prerequisite for becoming a member of the EU and NATO. The reform process in Ukraine is continuing and Slovakia believes it will be sustainable and successful. Btw, the changes are not about the EU and NATO, they need to be introduced be Ukrainians themselves to make Ukraine stronger, more resilient, to the benefit of all the Ukrainians,” Heger said.

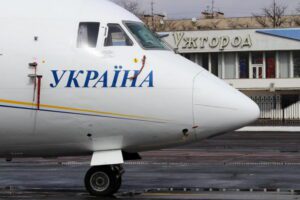

The bilateral agreement on the use of the Slovak airspace by the international airport Uzhgorod will be in effect from June 5, said Prime Minister of Slovakia Eduard Heger.

“There are still some technical measures and procedures to be put in place and you simply cannot make shortcuts. It is about safety and established mechanisms in the air transportation, not about politics. I was informed that all the process will be finished in September,” Heger said in an exclusive interview with Interfax-Ukraine.

The Slovak Republic has always been a reliable transit country for Russian gas to the West through Ukraine, and it is interested in maintaining this transit through Ukraine, said Prime Minister of Slovakia Eduard Heger.

“As for the Nord Stream 2 Project, it is not in the hands of Slovakia to decide. Slovakia has always been a reliable transit country for the Russian gas to the West through the territory of Ukraine and we are definitely interested in keeping this gas transit through Ukraine. We believe the transit contract between Russia and Ukraine will be fulfilled further on,” Heger said in an exclusive interview with Interfax-Ukraine.

The Ukrainian government has banned aircraft registered in Belarus from using Ukraine’s airspace from midnight on May 29.

“The government has approved the official instruction of the Ministry of Infrastructure and the State Air Traffic Services Enterprise (UkSATSE) to ban aircraft registered in the Republic of Belarus from using the airspace of Ukraine from midnight on May 29,” a government source told Interfax-Ukraine.