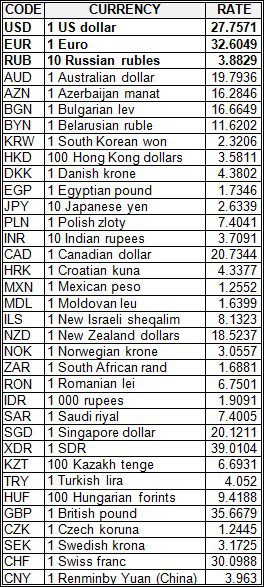

National bank of Ukraine’s official rates as of 28/07/20

Source: National Bank of Ukraine

Cheap loans and mortgage should be based on economic stability, otherwise it is impossible to regulate such programs manually, General Manager of Alfa-Bank Rafal Juszczak has said.

“The idea of making [banks] to open deposits at 5% will reduce the interest rate to 10% indeed. But where is confidence here? The bank is confidence. The economy is stability, predictability. Would you deposit your private money at 5% under a threat of devaluation? Such actions will provoke a response – we won’t see deposit inflows,” the banker said in an exclusive interview to Interfax-Ukraine.

Juszczak also spoke in favor of a free market as long as market mechanisms operate there and it is impossible to force people to do anything.

“I would focus on economic stability. Hence, the interest rates will gradually decrease,” he said.

Alfa-Bank’s general manager also noted that a slowdown in rates could promote changes in banks as their interest income would decrease.

He also said that Alfa-Bank’s interest rates remain at the market level, although they may keep decreasing.

“I don’t rule out that against the background of such a positive dynamics in interest rates we will be able to offer a new product with a very attractive rate so as to get an additional market share due to the price,” Juszczak said.

At the same time, the banker mentioned that the future of the crisis is still not clear.”I agree with out macroeconomist Oleksiy Blinov: he is not as pessimistic as other analysts. Today many of them say that Ukraine, thanks to the specifics of its economy, will get even stronger after this crisis than many other countries,” he said.

As of June 1, 2020, Alfa-Bank ranked sixth among 75 banks operating in the country in terms of total assets (UAH 94.113 billion).

Тhe Ministry of Health of Ukraine intends to fully implement 2D coding [special labeling of packages to prevent counterfeiting] of medicines in Ukraine in two and a half years, Health Minister Maksym Stepanov said during a press briefing in Kyiv on Friday.

“Yesterday, I had a meeting with representatives of leading pharmaceutical companies in Ukraine. The purpose of the meeting was to discuss an action plan in the ministry regarding the pharmaceutical market. The first thing we voiced was the introduction of 2D-coding of all the medicines that are used in Ukraine. When this is implemented, the number of counterfeit medicines in pharmacies will be reduced to almost zero. We believe that in two-two and a half years we will be able to completely switch to 2D coding. We will move gradually: first, we will transfer to 2D coding all medicines according to the reimbursement program, and only after that all import goods,” he said.

According to the minister, it is also planned to completely switch to electronic prescriptions.

“E-prescription is now used in the Affordable Medicines program. We believe that the electronic prescription should be expanded as much as possible in our country, including gradually getting rid of paper prescriptions so that medicines are dispensed exclusively on prescriptions that can be controlled. It also has an economic effect, in this case we envisage a reduction in the prices of medicines. The e-prescription contains the active ingredient, and in the pharmacy you can choose a drug for a suitable price,” Stepanov said.

19% of Ukrainians believe that in general, things in Ukraine are going in the right direction, and 68% have the opposite opinion, according to the results of a survey conducted by Rating Sociological Group on July 15-20, 2020.

More than 60% of respondents believe that the economic situation in Ukraine has deteriorated over the past six months, a quarter believe that it has not changed, and only 8% of respondents noted an improvement.

At the same time, sentiments about the future are more optimistic: 17% believe that the economic situation in Ukraine will improve in the next six months, 35% believe that it will not change, and 40% expect it to worsen. However, in the long-term dynamics, the percentage of those who expect improvement decreases, along with this, the feeling of hope (26%) among the population slightly decreases, and disappointment remains the emotion that is experienced the most (43%).

Some 57% of respondents see the reason for possible economic crisis in the incompetence of the authorities, although 26% believe that the economic decline will come due to the coronavirus pandemic, and 8% believe that the war in Donbas will be the cause of decline. In the course of the survey, which took place in June, a month earlier, such answers were given by 53%, 32% and 6% of respondents, respectively.

In the course of the study, 2000 respondents aged 18 and over were interviewed by the method of personal formalized interview (face-to-face) in all regions, except for Russia-occupied Crimea and Donbas. The sample is representative by age, sex and type of locality. The margin of error does not exceed 2.2%.

JSC Ukrzaliznytsia is discussing with its U.S. partners an agreement for the supply of an additional batch of diesel locomotives, Chairman of the board of the company Ivan Yuryk has said.

“I think that we will move along several parallel paths to modernize diesel traction. Both the modernization of the existing ones and the purchase of a small batch of new diesel locomotives are planned. We are now discussing with our U.S. partners an additional batch of up to 40 new diesel locomotives. I hope we will come to signing by the end of the year,” he said.

Yuryk also said that the company has also begun the process of purchasing new electric locomotives up to 200 units of various types of electric traction.

“Now we are holding an open tender. I hope that by the end of the year there will also be an answer who will become our partner in the construction and acquisition of these locomotives. The task of our company and the government is a large percentage of localization so that we launch the economy inside the country,” the chairman of Ukrzaliznytsia said.