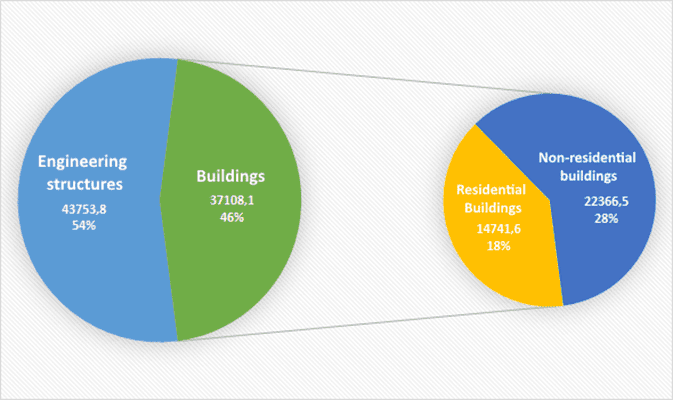

Volume of construction products produced by type in Jan-July of 2020 (MLN UAH).

Source: SSC of Ukraine

National bank of Ukraine’s official rates as of 06/10/20

Source: National Bank of Ukraine

The seaports of Ukraine in January-September 2020 handled, according to recent data, 118.78 million tonnes of cargo, which is 3.7% more compared to the same period in 2019.

According to the latest information on the website of the Ukrainian Sea Ports Authority, transshipment of exported cargo increased to 91.1 million tonnes (5.6% more), cabotage cargo to 1.8 million tonnes (31% more), and transshipment of imported goods decreased to 18 million tonnes (3.1% less), transit to 7.7 million tonnes (5.5% less).

The leaders in terms of transshipment volumes are ore and grain. During this period, the first place was occupied by grain cargo, the transshipment of which amounted to 35.3 million tonnes.

Ore ranked second with the amount of 33.8 million tonnes, which is 25.5% more than the same indicator of the previous year.

Transshipment of ferrous metals increased by 8.9%, to 12.86 million tonnes, oil by 5.6% in the volume of 4.49 million tonnes, and oil by 2.8 times, with a processing volume of 1.6 million tonnes.

Transshipment of containers reached 772,900 TEU and exceeded the last year’s figure by 8.3%.

SkyUp (Kyiv) for the period from December 23, 2020 to January 30, 2021, will launch a flight on the Kyiv-Sofia (Bulgaria)-Kyiv route.

According to the company’s website, flights will be operated twice a week: on Wednesdays and Saturdays. Ticket prices for the Kyiv-Sofia flights start from UAH 1,248 without luggage, Sofia-Kyiv from UAH 1,062 without luggage.

SkyUp notes that from October 1 to November 30, 2020, Bulgaria canceled mandatory self-isolation for Ukrainian citizens who arrive in the country. To cross the border, one must have a negative PCR test done no later than 72 hours before travel.

The company also added that the requirements for winter travel are still unknown, so it is necessary to additionally check the current rules of entry and rest on the eve of departure.