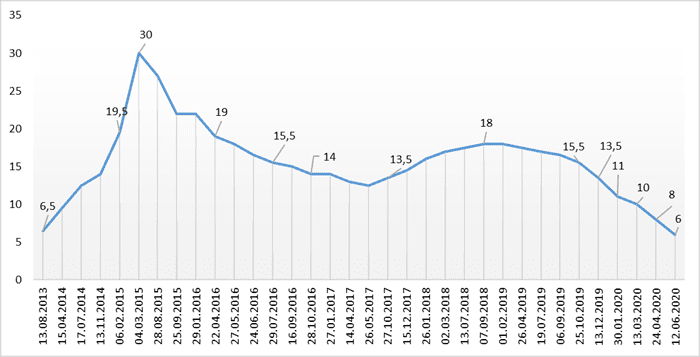

Dynamics of changes in the discount rate of National Bank of Ukraine

NBU

BofA Global Research analysts again worsened the forecast for the pace of real GDP in Ukraine: in 2020, they now expect it to fall by 6.8% compared to 5.6% earlier, and in 2021 – by 6.5% instead of the previous estimate of 7.4%. The reduction of Ukraine’s GDP in January-April 2020 will deepen to 5%, the Ministry of Economic Development, Trade and Agriculture of Ukraine expects in a review of economic activity in April.

Ukraine’s economy will shrink by 3.5% in 2020 due to the coronavirus-related crisis, while the global economy will lose 5.2% overall, the World Bank announced this in the updated Global Economic Prospects.

Ukraine’s GDP will fall by 6.7% in 2020, but the country’s economy will recover by 5.7% in 2021, ICU Investment Group predicts.

The International Monetary Fund (IMF) has reviewed downwards its forecast for Ukraine’s GDP decline in 2020 to 8.2% from 7.7% in its April World Economic Outlook.

The Cabinet of Ministers has said that a drop of Ukraine’s GDP in 2020 could be up to 8% compared to 2019, according to the updated government action plan.

The decline of Ukraine’s GDP in January-March 2020 was 1.3% year-over-year, while according to the preliminary assessment published in the middle of May, the indicator was 1.5%.

The fall in Ukraine’s real gross domestic product (GDP) in 2020 may be deeper than expected in the April forecast of the National Bank of Ukraine (NBU), that is, below the 5% level, the regulator’s website reports.

Head of Dragon Capital Tomas Fiala predicts a decline in Ukraine’s gross domestic product (GDP) in 2020 by about 7% and its recovery in 2021 by about 4%.

The ICU Investment Group estimates Ukraine’s gross domestic product (GDP) decline in May 2020 at 10.3% year-over-year and predicts a 10% year-over-year decline in the second quarter, Head of the macroeconomic research department of the group Serhiy Nikolaichuk has said.

The International Monetary Fund’s (IMF) new program for Ukraine betrays Ukraine’s national interests, Opposition Platform-For Life faction co-chairman Yuriy Boiko said.

The total losses for the Ukrainian economy from the introduction of quotas for the import of mineral fertilizers could be $100-238 million, according to a study by the Kyiv School of Economics (KSE).

The Ministry for Development of Economy, Trade and Agriculture of Ukraine expects that the Ukrainian economy would resume growth in October-December 2020, Minister Ihor Petrashko has said.

Real wages in Ukraine in May 2020 increased 1.4% compared with May 2019, while compared with April 2020 by 0.8%, the State Statistics Service has said. According to the authority, the average nominal wage of full time employees in May 2020 compared with April 2020 grew by 1.1%, year-over-year (compared with May 2019) it rose by 3%, amounting to UAH 10,542.

The deficit of Ukraine’s foreign trade in goods in January-April 2020 decreased by 3.15 times (66.7%) compared with January-April 2019, to $675 million from $2.124 billion, the State Statistics Service has reported.

According to its data, export of goods from Ukraine for the reporting period compared to the same period in 2019 decreased by 1.7%, to $16.086 billion, imports by 9.3%, to $16.76 billion.

PJSC Farmak pharmaceutical company (Kyiv) in April-July exported to the EU propofol, a medication that is used for artificial lung ventilation of patients with coronavirus (COVID-19), worth more than $635,000,

The company told Interfax-Ukraine that due to the shortage of this medication in the EU and its active use for treatment of COVID-19 patients the supplies of the medication were carried out without its registration at the EU’s profile agency, which is a mandatory condition for sale of drugs in Europe.

“Such an exclusion is connected with the crisis, and at the same time it shows the level of confidence in Ukrainian manufacturers and quality of their products,” the company said.

First phase of the unified public electronic system in the field of construction and development has been launched in Ukraine as part of a pilot project that will last until November 30, 2020, the press service of the Ministry of Communities and Territories Development has said.

According to the report, the implementation of the project will allow receiving services in the field of urban planning activities through an account, enhancing openness and transparency, will allow receiving up-to-date information on the status of document consideration, and automating the process of checking the completeness of data in documents.

“The introduction of first phase of the unified public electronic system in the construction industry will reduce paperwork, neutralize the biased attitude of officials and reduce the likelihood of submitting forged documents,” the press service said, citing First Deputy Minister of Communities and Territories Development Vasyl Lozynsky.

The government will draw up a list of strategic industries and submit it to the Verkhovna Rada of Ukraine for approval, Deputy Prime Minister for Strategic Industries Oleh Urusky has said.

“Surely, this should be formalized by a common document. It should be worked out by the government and submitted to the Verkhovna Rada for approval,” Urusky said in an exclusive interview with Interfax-Ukraine.

According to him, such a list will help determine the priorities of the government regarding support for industries, but the future Ministry of Strategic Industries will deal with all sectors without exception.

“On the other hand, the new ministry, which will be created, will become a ‘home’ for all sectors. The entire industry will be able to count on it,” Urusky said.