Double liability company Interchem (Odesa) and PrJSC Darnitsa pharmaceutical firm (Kyiv), together with the Zagoriy Foundation, have implemented a project to drain the foundations and walls of the Saint Sophia’s Cathedral and adjacent monasteries from excess moisture using the BioDry Swiss technology.

Director General of the Sophia of Kyiv national conservation area Nelia Kukovalska said at the presentation of the project on Wednesday, the project cost was UAH 4 million, the pharmaceutical companies provided UAH 2 million each.

“At present, the humidity of the walls and foundations of the Saint Sophia’s Cathedral is three to four times higher than it is normal. The use of BioDry technology will reduce the humidity by a third during the first year, and within three to four years it will reach the normal humidity of the monument,” she said.

Kukovalska said that currently BioDry equipment is installed in all monuments of the Saint Sophia’s Cathedral.

“The walls of the cathedral do not have waterproofing and are being damaged. When we learned about the threat to the Saint Sophia’s Cathedral due to excessive moisture, we did not hesitate for a second. We were able to find partners with whom we implemented this project. Today, we see moisture leaving the walls, Sophia he is “recovering.” We are glad that we helped the main symbol of spirituality to survive,” Director General of the pharmaceutical company Interchem Anatoliy Reder said.

In turn, Board Chairman of Darnitsa Group Dmytro Shymkiv said that for the implementation of the project the most innovative solution was found, which is used to preserve cultural monuments in the world.

“This technology is biocompatible with the environment. It already works and naturally eliminates the prime cause of moisture in the foundation and walls,” he said.

Co-founder of the Zagoriy Foundation Kateryna Zagoriy said that “the reconstruction of the Saint Sophia’s Cathedral during the time of Ivan Mazepa was a symbol of the restoration of Ukraine after the Ruins.”

“I am confident that this joint project of the pharmaceutical companies will become another important step towards restoring the culture of charity in our country,” she said.

For his part, Eustratius (Zorya), Deputy Head of the External Church Relations department of the Orthodox Church of Ukraine (OCU) said that at present in Ukraine “a huge number of churches are being destroyed.”

“It is important for Ukrainian society to form a culture of patronage. With all due respect to the state, the patron will always invest more effectively in projects. We, the OCU, are working to attract patrons through the structures that our church has created, including through the Mazepa Foundation created by the Metropolitan’s Foundation of the Orthodox Church of Ukraine to implement projects for the preservation and support of monuments. We have a huge number of monuments, more than the number of patrons,” he said.

Eustratius said that, despite the fact that “over the past 30 years, much has been done to revive churches, hundreds of churches throughout Ukraine need to be taken care of, and dozens of churches require prompt intervention to preserve them.”

“Usually these are churches that are located in villages. They are in such a state that local communities are not able to support them,” he said.

Kukovalska said that the Bursa (Seminary) building on the territory of the Saint Sophia’s Cathedral is currently in the most critical condition, the cost of restoration of which is about UAH 162 million.

“Today, there is a big problem that has not been resolved for years and can lead to the destruction of the 17th century monument. Unfortunately, the tenant has not left for two years, he does not vacate the premises. We fear that in the near future serious destruction may occur, some of the premises will perish,” she said.

Oil transit through Ukraine by pipeline to European countries and Belarus in January-August 2020 increased by 7.6% (by 607,500 tonnes) compared to the same period in 2019, to 8.630 million tonnes, according to data from JSC Ukrtransnafta.

The volume of oil transportation to refineries of Ukraine during this period amounted to 1.707 million tonnes, which is 12.2% more than in January-August 2019. In particular, oil transportation along the Odesa-Kremenchuk route amounted to 747,100 tonnes.

Thus, for the eight months of this year, the share of transit volume in the total transportation of oil (10.337 million tonnes) amounted to 83.5%, the share of pumping to the country’s refineries 16.5%.

In August 2020, oil transit through Ukraine by pipeline decreased by 9.2% compared to the same month last year, to 1.262 million tonnes.

Pumping to Ukrainian refineries last month decreased by 0.9%, to 225,600 tonnes. In particular, transportation of Ukrainian oil amounted to 117,100 tonnes, Azerbaijani 43,000 tonnes, and American some 65,400 tonnes.

Verkhovna Rada has passed at first reading the President’s draft law on reducing value added tax (VAT) to 7% for representatives of culture, tourism, creative industries.

An Interfax-Ukraine correspondent has reported that some 273 MPs voted in favor of bill No. 3851 on amending the Tax Code of Ukraine to support culture, tourism and creative industries at first reading at the meeting on Tuesday, September 15.

“Since our field of work mainly requires offline performance and it is extremely difficult to shift to online mode, therefore we believe that… theatre, opera, ballet, music, concert, other performances, … production of … films and so on may be charged 7% VAT,” noted the Minister of Culture and Information Policy of Ukraine Oleksandr Tkachenko at the presentation of the law.

He added that the bill provides for 7% VAT for operations related to temporary accommodation services provided by hotels, in view of the extremely high losses that this sector suffered due to quarantine measures.

“This law had been the subject of lengthy debates in the relevant ministries and I ask you now to lend a hand to the field of culture and creative industries,” Tkachenko summed up.

The average OSAGO payment in Ukraine in January-June 2020 amounted to UAH 18,271, which is 5.01% more than in the same period a year earlier, the Motor (Transport) Insurance Bureau of Ukraine has said on the website.

At the same time, it is noted that the average cost of an OSAGO policy was UAH 685, while in the first half of 2019 it was UAH 664.

It is reported, with reference to Director General of the MTIBU Volodymyr Shevchenko, that in 7.1% of insured events the amount of property damage exceeded UAH 100,000, while in 2019 there were only 4% of such events.

“These data emphasize the importance of increasing the sums insured (by 30%), which took place at the initiative of the MTIBU in September last year, and the need to ensure their further approximation to European sizes by changing the norms laid down in the law on OSAGO,” Shevchenko notes.

According to the report, in January-June 2020 the MTIBU made 3,154 payments from the bureau’s guarantee funds for a total of more than UAH 104.3 million. Compared to the same period last year, this indicator slightly decreased by 4.3%, while the amount of payments increased by 10.6%.

The largest number of payments was made for harm caused by the owners of unsecured vehicles (who became the perpetrators of road accidents without a valid OSAGO policy): 1,931 payments in the amount of UAH 68.6 million. The number of payments under this item increased by 23.2%, and the amount of payments by 25.7%.

Share of remittances from abroad sent via Privat24 application of state-controlled bank PrivatBank amounted to 48% in January-August 2020 as compared for the same period in 2019, to 35%.

“Every second money transfer that Ukrainians received from abroad with the help of PrivatBank in 2020 was paid via Privat24 mobile bank,” stated PrivatBank’s press service.

According to the bank data, over the past year, the share of remittances received at the bank’s cash desks decreased by 1.3%, to 24%.

Since the beginning of 2020, the share of money transfers performed through PrivatBank stands at 54% of the total volume of remittances being 1.4% up as compared to 2019.

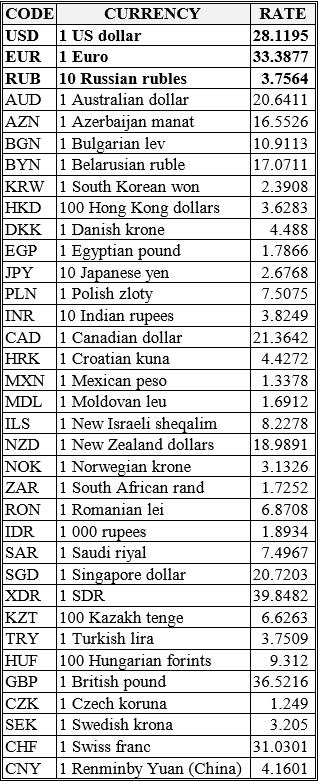

National bank of Ukraine’s official rates as of 17/09/20

Source: National Bank of Ukraine