Ukrainian Locomotive Building Company LLC plans to occupy up to 10% of freight rail traffic in Ukraine over the next five years, Technical Director of the company Volodymyr Krot said in an interview with the Center for Transport Strategies.

“I think that the nearest ambitions of our company, which can be set for ourselves, are up to 10% of the freight rail transportation market in Ukraine in the horizon of five years and more. Further, it is quite possible that this percentage can be increased. Or it will be possible to speak on other types of transportation, for example, passenger and suburban,” he said.

According to Krot, the company also plans to purchase a large number of electric locomotives, since the issue of renting non-working cars from Ukrzaliznytsia has not been resolved.

If the issue of admission to the electric locomotive tracks is resolved positively, at the first stage the company plans to increase the fleet to 50 electric locomotives. The company also plans to purchase a certain number of diesel locomotives – not only mainline, but also shunting ones.

The technical director of Ukrainian Locomotive Building Company also said that the company plans to carry cargo from the grain group, raw materials for the production of cement and the cement itself on the nine routes determined by the tender commission as part of a pilot project to launch private traction.

Plans to resume domestic vaccine production are being discussed in Ukraine, Ukrainian Health Minister Maksym Stepanov said in an interview with Radio Liberty.

“You probably know that in Ukraine, apparently back in the 1990s, the production of any vaccine was completely destroyed. Now we have repeatedly talked with the President of the country to start restoring vaccine production. This concerns influenza, this applies to other vaccines, which we use every year,” Stepanov on the air of the Saturday Interview program.

According to the minister, the country has a corresponding scientific potential.

“We have a good school. Of course, this process is not very fast. It will take several years for us to have our own vaccine developed by our scientists. At the same time, I have already held several meetings with our entrepreneurs who have appropriate production lines. Farmak, Lekhim, which have the corresponding certified lines for the production of vaccines,can produce either a Ukrainian vaccine, if it appears, or another,” Stepanov said.

The board of JSC Odesa Port-Side Plant has extended a control for tolling gas processing with Agro Gas Trading LLC from September 1, 2020.

The plant said that the contract was extended until the moment when the new winner of the tender is selected, but no later than the end of 2020. As part of the prolongation of the contract, the terms of cooperation have been improved: from September 1, the price for one tonne of ammonia will be $41 and $60 per tonne for urea.

The Odesa Port-Side Plant recalled that the last announced tender was blocked in courts by one of its participants, and the procedure for selecting a supplier company approved by the supervisory board of the plant provides for a ban on out-of-tender selection.

“According to the current legal regulations, the decision to extend the contract with the current tolling supplier was the only one to which the board had the right, taking into account the existing injunction, and no alternative from the point of view of ensuring the stable operation of the plant,” the plant said.

The plant said that the continuity of the production process in terms of improving financial and social performance is a priority for the company’s management.

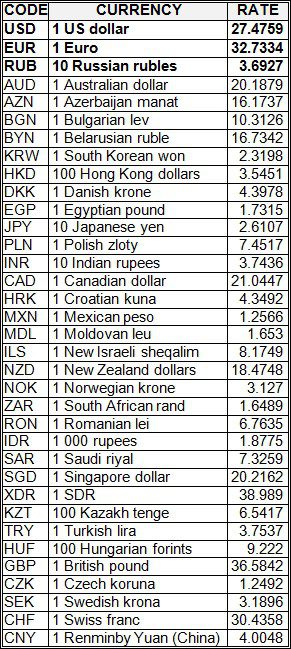

National bank of Ukraine’s official rates as of 31/08/20

Source: National Bank of Ukraine