Ukrainian President Volodymyr Zelensky insists that Ukraine will be among the first countries to be able to purchase a vaccine against COVID-19 as soon as it appears on the pharmaceutical market.

The head of state, according to the presidential office, on Saturday held a traditional meeting with representatives of the government, law enforcement agencies and relevant departments on the epidemiological situation in the country and measures to prevent the spread of coronavirus.

Zelensky inquired about progressing of his task of keeping Ukraine on the waiting list for the coronavirus vaccine when it is made.

“Our diplomatic contacts and global resources report that the vaccine is already being produced in several countries. Even if it is ready next year, Ukraine should be among the first countries to purchase the vaccine. We must think about it now. The whole world is lining up,” the president stressed.

Health Minister Maksym Stepanov said that, on the instructions of the president, he conducts consultations and keeps in touch with companies and diplomats from different countries, studying information.

Around 30% of small and medium-sized businesses (SMEs) in Ukraine went online during the pandemic, Director of the Department for Transaction Business of TAScombank Yevhen Zakalata has said.

“As for Ukraine, quite a lot of enterprises are developing online. We can see a growth in carriers, and not just under conditions of the pandemic, carriers grow by 20-40% annually in principle. Around 30% of all SMEs went online and every second business expects an increase online sales,” he said during an international conference titled “Online Banking – the Time of Innovation.”

Zakalata presented data from the Shop Express platform, a partner of the bank whose core business is development of websites for online shops. According to the data, 92% of 1,271 new online shops developed by the platform in March-May 2020 did not practice online sales before the pandemic.

“This does not mean that all of these clients today receive online payments, but at least they have started selling online, which is the first step taken by these clients towards carrying out transactions online,” he said.

According to the National Bank of Ukraine (NBU), as of January 1, 2020, the main owner of TAScombank was Sergiy Tigipko (99.93066% of shares).

According to NBU data as of June 1, 2020, TAScombank was ranked 18th in terms of total assets (UAH 20.675 billion) among 75 banks operating in the country.

On July 14, the Verkhovna Rada of Ukraine adopted the draft law 2285-d “On regulation of activities related to organization and conduct of gambling” at the second reading stage. This long expected event will set the rise of Ukraine to the global gambling market stardom and will allow refilling the budget, emptied by the quarantine crisis.

Overall, 248 deputies voted in favor of the law, 95 – against, 17 – abstained, and 27 – did not vote. The new bill will come into effect the next day after its publication.

The large-scale industry exhibition Ukrainian Gaming Week 2020 (https://ugw.com.ua/en?utm_source=pr_tsenenko&utm_medium=project&utm_campaign=interfax.com.ua) organized by Smile-Expo will be the first big gambling event after the legalization. The event will take place in Kyiv on October 6-7. Exhibitors will present cutting-edge gambling solutions, discuss subtleties of the Ukrainian gambling law, advantages and prospects of the market.

Conference and top speakers

The event will offer an industry-specific conference, featuring international gambling experts, Ukrainian lawmakers, and representatives of specialized organizations. Top speakers are:

· Head of All-Ukrainian Association of Employers in the Recreation and Entertainment Sector Ihor Makiievskyi.

· Director of the Ukrainian Gaming Business Association Tamara Golubchik.

· President of the Ukrainian Gaming Industry Association Iryna Sergienko.

· People’s Deputy of Ukraine Taras Tarasenko.

· Chief Policy Officer at Playtech Francesco Rodano.

Participants of the exhibition

The exhibition with the total area of 5,000 square meters expects 100 exhibitors and 3,000 attendees.

Exhibitors will include software developers, gambling hardware manufacturers, affiliate networks and programs, banks, payment aggregators, gambling operators, bookmakers, marketing and SEO agencies, consulting, law companies, and many others. Some of them are:

IGT – international manufacturer and distributor of stationary slot machines, lottery and betting terminals, video slots, mobile and social games, as well as software for online casinos, betting companies, and lotteries.

Alfastreet – provider of different models of automated roulette, gambling terminals, casino equipment, slot machines, etc.

Winsystems – distributor of comprehensive solutions for gambling business, including casino management tools, electronic roulette, slot machines, solutions for lottery business and innovative systems for gambling industry.

Gamebridge – manufacturer and supplier of game equipment for poker clubs and casinos.

· Papa Karlo – CPA network that focuses on the payday loan (PDL) niche and works with affiliates using the RevShare model.

Digital Chain – a full-cycle agency that offers customers a wide range of efficient marketing solutions that allow achieving different business goals – will act as an exhibitor and Badge Sponsor.

Alpha Affiliates will play the role of a Bracelet Sponsor of UGW 2020. This affiliate program works in the gambling niche with offers from direct advertisers and focuses on foreign markets.

UGW Awards

Besides, Ukrainian Gaming Week 2020 will select the best companies in the sector. Winners of UGW Awards in 12 nominations will be awarded at the huge party on October 6.

Organizer and venue

The international company Smile-Expo that has been hosting events about innovations, including gambling events, for 14 years worldwide is organizing the exhibition.

Ukrainian Gaming Week 2020 will take place at Kyiv-based International Exhibition Centre, pavilion 4-B on October 6-7.

Program and event highlights (https://ugw.com.ua/en?utm_source=pr_tsenenko&utm_medium=project&utm_campaign=interfax.com.ua).

The Board of the National Bank of Ukraine (NBU) has retained the refinancing rate at 6%, the central bank said on Thursday.

“The Board of the NBU has decided to keep the refinancing rate unchanged at 6% per annum. On the one hand, it will keep prices from growing under conditions of economic recovery in 2021-2022, and on the other hand it will leave enough space for further decrease in cost of loans to the individual character level,” it said.

According to the statement, the central bank revised its forecast for refinancing rate for 2020 from 7% to 6% per annum with its further growth to 6.5% in 2021.

Bosch in Ukraine in January-June of this year, despite the difficulties due to the situation with the coronavirus crisis, increased sales by more than 10% compared to the same period in 2019, CEO of Robert Bosch Ltd. Vitaliy Bulda has said.

“We started the year quite successfully. In April-May, due to the coronavirus crisis, we “sagged” in trade, but June showed a record growth and, in general, in the second quarter, I think, we grew by several percent. Now we are working out our lag – July has become even better than June in sales,” Bulda said during an online conference, adding that half-year growth has not been as desired, “but we did everything to take additional share in the falling market.”

At the same time, he refrained from forecasting sales for the current year, noting that the main task is to keep the company.

“We do not know what will happen until the end of the year, so our submitted budgets are understated, but today we see that if something more unusual than has already happened does not occur, we will fulfill it (the budget). And I am sure we will remain financially a stable company and we will do our best to take the market share that our competitors give us,” he said.

In his opinion, it is more expedient to sum up the results based on the results of the third, or better, the fourth quarter, which will show everything.

Bosch in Ukraine started its work in 1993. The company currently employs 357 people. As reported, in 2019, the company’s sales grew by 34% from 2018, to EUR 121 million.

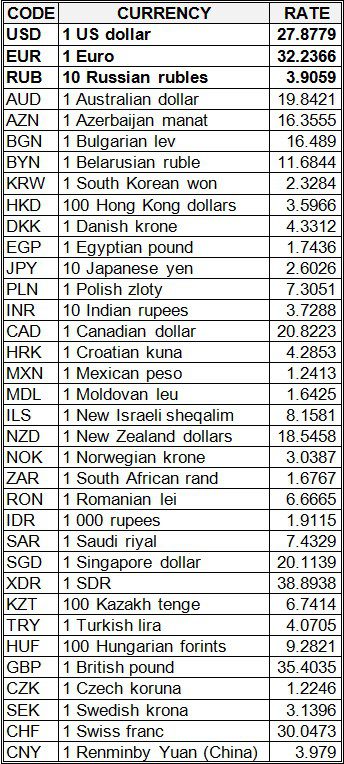

National bank of Ukraine’s official rates as of 24/07/20

Source: National Bank of Ukraine