The sales of new commercial vehicles (including heavy vehicles) in June decreased by 21% compared to June 2019, to 760 units, Ukrautoprom reports.

According to the association, at the same time, the June sales result is 11.8% more than in May this year.

In June, Fiat demonstrated the best sales result, pushing Renault into the second position and managing to increase registrations by 16%, to 118 units.

Renault lost 35% of sales, completing the month with 106 registered cars, in third place, as a year earlier, was occupied by Ford with the registration of 82 cars against 80 in June 2019 and 50 in May this year.

Peugeot ranked fourth, having improved the position in the rating by one step and increased sales by 22%, to 77 vehicles. Belarus’ MAZ closes the top five of the June market of new commercial cars, with 64 registrations in its classification (15% less).

Ukrainian commercial vehicles were not included in the list of the 15 best-selling commercial cars, and Russia’s GAZ ranks 14th with the registration of 12 cars against 39 units in June 2019 and nine units in May of this year.

In total, in the first half of the year, the Ukrainian fleet of trucks and special vehicles was replenished with 4,100 new vehicles, which is a quarter less than in the same period last year.

At the same time, according to the statistics of the association, the bus market of all classes in Ukraine in June decreased by 5% compared to June last year, and almost doubled compared to May of the current year, to 94 buses.

The Business Activity Outlook Index (BAOI) calculated by the National Bank of Ukraine (NBU) grew by 9.6 points in June, to 45.5 points, which is lower than the neutral index reading of about 50 and means that pessimistic expectations of business prevail, the regulator said on its website on Wednesday.

“Ukrainian business is gradually recovering from the blow that the coronavirus crisis inflicted on it. The NBU poll indicates that the mood of entrepreneurs in June improved. Economic activity gradually recovered, both in Ukraine and abroad, after quarantine restrictions were eased,” the NBU said.

According to the regulator, the new wave of quarantine easing contributed to economic activity of retail companies – the diffuse index (DI) grew to 50.5 points from 37.6 in May.

The service sector also showed better expectations: DI grew by 12.3 percentage points, to 40.8.

Expectations of industrial enterprises, which DI grew from 40.4 to 49.2, also improved.

Construction enterprise expect the worsening of its activities: DI in June fell by 4.1 pp, to 36 points.

Employment assessments of all sectors retain pessimistic.

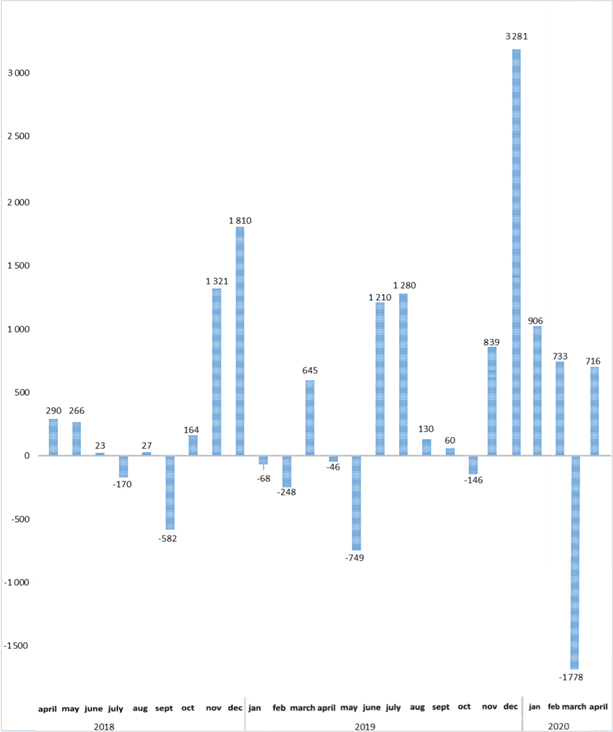

Dynamics of balance of payments of Ukraine (USD MLN)

The Hungarian low cost airline Wizz Air has opened the second base in Ukraine at Lviv International Airport.

According to the press service of the Infrastructure Ministry of Ukraine, in July the company will operate five new flights from western Ukraine, in particular, from Lviv to Billund (Denmark), Tallinn (Estonia), Lisbon (Portugal), Hamburg (Germany), and Szczecin (Poland).

Wizz Air also plans to expand its route network by opening flights from Kharkiv to Tallinn and Berlin.

“The Ukrainian aviation industry needs to be restored as soon as possible for a further stable functioning and growth. Therefore, it is very pleasant that both Ukrainian and leading international airlines do not lose optimism during the coronavirus crisis, but rather seek new opportunities for development, opening up new popular directions. Wizz Air is a leading low cost company, which was one of the first to enter the Ukrainian market back in 2008,” Minister of Infrastructure Vladyslav Krykliy said.

It is expected that the opening of a new Wizz Air base will bring Lviv more than $100 million investment in 2020 and create more than 30 jobs.

“We are convinced that investments in opening the base and new routes will stimulate the development of the local economy, aviation and tourism,” Andras Sebok, the chief supply chain officer at Wizz Air, said.

The director general of Lviv Airport, Tetiana Romanovska, in turn, noted that 17 directions to different cities of Europe have already been opened from the airport.

Foreign Minister of Ukraine Dmytro Kuleba will pay a visit to Turkey on July 3-4 to participate in the 8th meeting of the Ukrainian-Turkish Joint Strategic Planning Group along with his Turkish counterpart Mevlut Cavusoglu. During the meeting, the parties will sum up the results of cooperation in the first half of 2020 and set priority tasks until the end of the year.

According to the press service of the Foreign Ministry of Ukraine, the ministers will also discuss a wide range of issues related to mutual cooperation and regional security.

“Special attention will be focused on the militarization of Crimea, violation of human rights on the peninsula by the Russia-occupation authorities, the situation with security in the Azov and Black Sea region and in the Middle East, resistance to Russia’s aggression in Donbas and initiatives aimed at peaceful settlement of the conflict in eastern Ukraine,” the ministry said.

The ministers will also discuss the development of trade and investment between Ukraine and Turkey, deepening of cooperation in the spheres of energy, security and defense, the prospects of the completion of the negotiation process on the Free Trade Agreement, cooperation within the UN, NATO, OSCE and the Council of Europe. The officials will also discuss the preparations for the 9th meeting of the High Level Strategic Council chaired by the presidents of Ukraine and Turkey.

The ministers will give a joint press conference on the results of the meeting.

Kuleba will also hold a separate meeting between Ukrainian businesspeople and Turkish entrepreneurs, who are ready to invest in Ukraine.

He will also meet with representatives of the Ukrainian and Crimean Tatar communities in Turkey, the ministry said.

On July 2-3 the Eastern Partnership Youth Engagement Summit will be held.

Eastern Partnership Youth Engagement Summit will be the first large youth event in the European Union and Eastern Partnership countries in an online format.

Details at: https://www.salto-youth.net/mysalto/login/?pfad=%2Ftools%2Feuropean-training-calendar%2Fapplication-procedure%2F9470%2F