The revenue of Metinvest B.V. (the Netherlands), the parent company of Metinvest mining and smelting group, in February 2020 increased by 4.8%, or $39 million, compared to the previous month, to $860 million from $821 million.

According to the company’s preliminary unaudited consolidated monthly financial statements, EBITDA for February totaled $129 million, which is $56 million more than in January ($73 million), while EBITDA from participation in the joint venture was $10 million (in January $7 million).

According to the report, the adjusted EBITDA of the group’s metallurgical division for February 2020 amounted to $46 million (in January $12 million), including minus $10 million from participation in the joint venture (minus $8 million), the EBITDA of the mining division is $102 million (in January $75 million), including $20 million ($15 million) from the joint venture. The management company’s expenses amounted to $7 million ($6 million).

Total revenue in February consisted of $682 million in sales of the metal division ($681 million in January), mining $248 million ($234 million), and intra-group sales of $70 million ($94 million).

The total debt of the company in February increased by $65 million compared with January, to $3.092 billion from $3.027 billion. At the same time, cash flow decreased by $38 million, to $253 million from $291 million.

The funds used in investment activities amounted to $74 million, in financing activities $71 million.

Kyiv mayor Vitali Klitschko has fired his deputy Volodymyr Slonchak, in connection with an incident that happened on Monday night, during which he hit the patrol police inspector.

“I want to inform you that I dismissed deputy chairman of Kyiv City State Administration Volodymyr Slonchak. I think you saw in the news what happened last night. I will not allow the city authorities to be discredited, especially those who represent it,” Klitschko wrote on his Telegram channel on Monday.

PrJSC Zaporizhkoks, one of the largest Ukrainian producers of coke and chemical products, part of Metinvest Group, invested UAH 348.6 million to modernize the enterprise in 2019.

According to a company press release on Friday, April 17, the plant received cost advantages of UAH 35 million from the introduction of energy efficiency measures.

At the same time, a new line for granulation of electrode pitch was put into operation in 2019, which allowed increasing the output of high-margin products.

“The company successfully implements energy efficiency projects. The project for the exchange of secondary gases between enterprises has brought about UAH 1.4 billion of cost advantages over the past three years. Zaporizhkoks partially switched to the supply of compressed air from Zaporizhstal in November 2019. Due to this, the enterprise will additionally save about UAH 3.1 million per year,” the enterprise said in a press release.

Due to the renewal of production facilities, the enterprise produced 888,900 tonnes of coke in 2019, which is 5% higher than the business plan. Under current production conditions, the annual program for the overhaul of coke oven batteries No. 2 and No. 5-6 was implemented with an investment amount of UAH 130 million.

Over the year, the plant was replenished with new technological equipment – a quencher for coke oven battery No. 2 and a door extracting machine for coke oven battery No. 5-6. The company’s investments in updating the plant amounted to more than UAH 70 million.

Investments in labor protection projects amounted to UAH 5.9 million, which was a record amount. Moreover, UAH 13.7 million was allocated to the development of the social sphere, employee salaries for the year were increased by 38.4%. The level of taxes and fees to budgets of all levels amounted to UAH 367.4 million.

Zaporizhkoks produces about 10% of coke produced in Ukraine, owns a full technological cycle of processing coke chemical products. In addition, it produces coke oven gas and pitch coke.

Metinvest is a vertically integrated group of mining companies. Its main shareholders are SCM Group (71.24%) and Smart-Holding (23.76%), jointly managing the company.

Metinvest Holding LLC is the managing company of Metinvest Group.

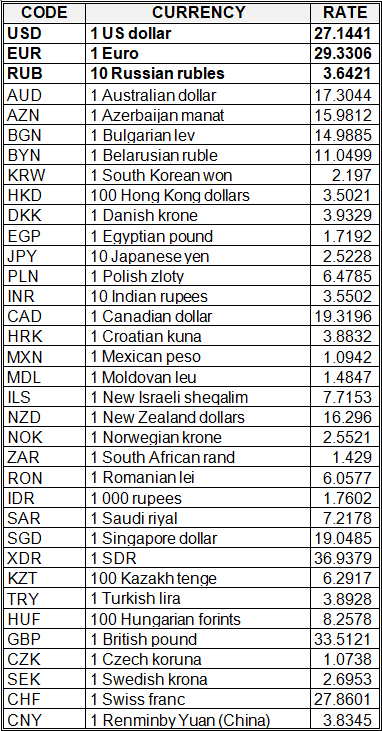

National bank of Ukraine’s official rates as of 27/04/20

Source: National Bank of Ukraine