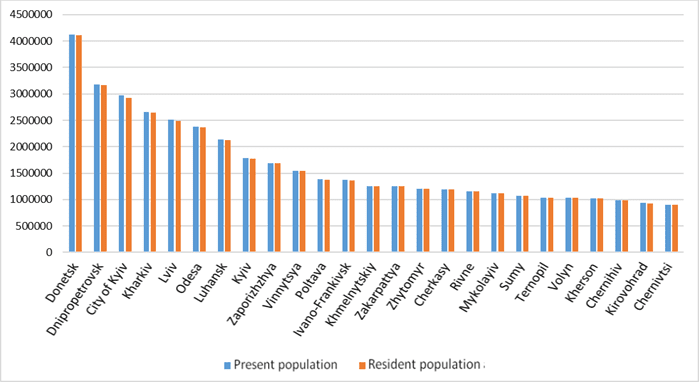

Ukrainian population by regions as of March 1, 2020 (graphically)

The cost of staying in three- and four-star hotels in Odesa has decreased by half compared to the same period in 2019 and averages UAH 650 per day ($24), founder of Ribas Hotels Group Artur Lupashko has told Interfax-Ukraine.

“Today, the average price in three- and four-star hotels is UAH 650 per day ($24) in Odesa. This is an unprecedented low rate over the past 20 years. In the same period last year, such a room cost at least twice as much and was three times more expensive in 2013,” Lupashko said.

According to his estimates, the expected decline in gross income and net profit of hotels will be 20-40% in 2020 compared to the indicators in 2019.

“The positive dynamics can continue in cottage-type hotels and recreation centers, which have been in high demand since April and have increased in price in some cases up to 50%. Some of them have already been booked for the whole summer by guests who, as a rule, spent the summer in Cyprus, Spain, Italy,” he said.

However, hotels do not count on guests from other countries in 2020.

“The vast majority of Belarusian tourists were in the resort budget hotels. According to information available today, guests from Belarus will not be allowed to Ukraine this year. Most likely, these may be guests from Moldova and Turkey in the second half of the year. However, the share of such tourists will be minimal and will not have significant influence on the market,” the expert said.

Ribas Hotels Group collaborates (management and booking) with 25 hotel and restaurant complex facilities (beach and ski hotels, hostels and recreation centers), two of which are its own. The company’s portfolio includes Wall Street Hotel business hotel, Bortoli city mini-hotel (all are located in Odesa), Richard hotel complex (Hrybivka), Kyparys park hotel (Yuzhne), Seazone mini-hotel (Karolino-Buhaz), a chain of youth hostels Friday and others.

The total number of rooms of the chain was 1,234 rooms in various forms of cooperation at the beginning of 2020.

Ribas Hotels Group provides integrated management, exclusive booking, franchising and design services.

Ribas Hotels Group LLC was established in 2017. According to the unified register of legal entities, individual entrepreneurs, director and owner of a 100% stake in charter capital of the company is Lupashko.

Nova Poshta Moldova, a member of the Nova Poshta group of companies, opens the first two branches in Chisinau.

According to the press service of the group of companies, in particular, branch No. 1 carries out accepting and issuing items without restrictions on weight.

Branch No. 2 accepts and issues items weighing up to 30 kg.

The branches will be open from 09:00 to 21:00 from Monday to Saturday. All company services will be available to customers: sending and receiving domestic and international goods and parcels, and one can also use the packaging service. In the future, the range of services will expand.

By the end of the year, the company plans to expand the network of branches in Chisinau, and with good experience, to expand to other regions of the country.

Nova Poshta Moldova, along with Nova Poshta Georgia, NP Logistic, POST FINANCE and Nova Poshta Global, is part of the Nova Poshta group of companies.

Nova Poshta, founded in 2001, is the leader in the express delivery market in Ukraine. The network of the company exceeds 3,300 branches throughout the country.

Metinvest B.V. (the Netherlands), the parent company of the Metinvest mining and metallurgical group, paid a $22.6 million coupon on newly issued eurobonds maturing in 2029.

“We paid the coupon. This is a regular payment. The company usually does not make any announcements on such payments,” the Metinvest’s press service told Interfax-Ukraine.

Metinvest issued 2029 bonds on October 17, 2019 as part of the group’s successful debut placement of bonds in two currencies and the completion of a transaction to extend the maturity of outstanding eurobonds. In particular, 10-year $500 million eurobonds were placed at 7.95% per annum and five-year EUR 300 million eurobonds at 5.75% per annum.

Bond -2029 were added to the high-yield CEMBI indices after their regular recalculation on November 29, 2019: CEMBI Broad and CEMBI Broad Diversified.

Hennadiy Chyzhykov will remain on the post of president of the Ukrainian Chamber of Commerce and Industry (UCCI) for another five years. The UCCI congress held as a video conference made the unanimous decision on May 19.

“The Ukrainian Chamber of Commerce and Industry has the largest regional and international presence among organizations that represent the interests of Ukrainian business. The UCCI has great potential for development,” Chyzhykov said in a report of the chamber.

UCCI delegates also approved the chamber’s mission: creating conditions for business development, opening new markets for Ukrainian exports, and promoting the integration of Ukrainian business in the global economy.

The Ukrainian Chamber of Commerce and Industry unites more than 8,000 Ukrainian enterprises, which, according to the organization, provide 70% of the export earnings of Ukraine. The UCCI system unites 25 regional chambers and has representative offices in 55 countries.

The President of Ukraine, international and national partners – the heads of the EUROCHAMBRES, the World Chambers Federation (WCF), the American Chamber of Commerce, the European Business Association, the business ombudsman, the embassies of Argentina, Croatia, the Czech Republic, Vietnam and others congratulated the delegates of the UCCI congress. More…

The Cabinet of Ministers will return to the issue of resuming air transportation after June 15, 2020, Prime Minister Denys Shmyhal has said.

“As for the operation of airports and the launch of scheduled flights, we will return to this issue, obviously, after June 15, when airlines can fly somewhere. So far, the airports of our partner countries are closed,” the prime minister said during a government meeting.

So far, there is no point in renewing scheduled flights, he said.

“The possibility of international transportation, both bus and rail, will resume through open checkpoints that will work after the adoption of amendments to resolution No. 288. We do not yet open interregional traffic,” Shmyhal said, adding that interregional transportation could renew in early June.