IBM Corporation (the United States) has appointed Bohdan Khoroschak new director general of the company in Ukraine from August 13, 2019, according to the website of the company. “I am very pleased to be able to scale my experience in IT services for the benefit of IBM customers throughout the ecosystem in Ukraine. They increase business efficiency by implementing the most advanced solutions, taking advantage of open source technologies and multi-cloud environments,” the company quotes Khoroschak as saying.

Khoroschak has been working in IT-industry for 14 years. He deals with business development, sale management and consulting.

In 2012, Khoroschak appointed as IBM’s trade representative in Ukraine. Through 2014-2015, he became head of corporation’s software department; within 2015-2017 he chaired section of digital sales and updating of software licensing in the states of Central and Eastern Europe; and since November 2017 and until nowadays he managed technical service department in Ukraine.

His predecessor Valeriy Shliakhov held the post since January 2018.

IBM is an American company headquartered in Armonk. It is one of the world’s largest manufacturers and suppliers of hardware and software, as well as IT and consulting services.

Overin Limited (Cyprus) has bought back the shares of minority shareholders of HeidelbergCement Ukraine (Dnipro), having built up a 100% stake.

Thus, Overin Limited completed the procedures related to the mandatory sale by shareholders of common shares of PrJSC at the request of the owner of the dominant controlling interest, HeidelbergCement Ukraine said in the Ukrainian National Securities and Stock Market Commission’s information disclosure system.

As reported, on May 14, 2019, Cyprus-based Overin Limited affiliated with Concorde Capital became the owner of the dominant controlling stake (99.8308%) in PrJSC HeidelbergCement Ukraine.

In early February 2019, Interfax-Ukraine learnt from sources that HeidelbergCement AG, the world’s second largest cement producer, is preparing to sell its assets. Among buyers was the Ukrainian investment group Concorde Capital. PrJSC HeidelbergCement Ukraine, which unites HeidelbergCement’s Ukrainian-based cement factors, then refused to officially comment on the deal.

Concorde Capital’s partners in the deal to acquire HeidelbergCement Ukraine assets were Vice-President of PJSC Concern Galnaftogaz Vasyl Danyliak, as well as businessmen Ivan Shestak and Ihor Zavinovsky.

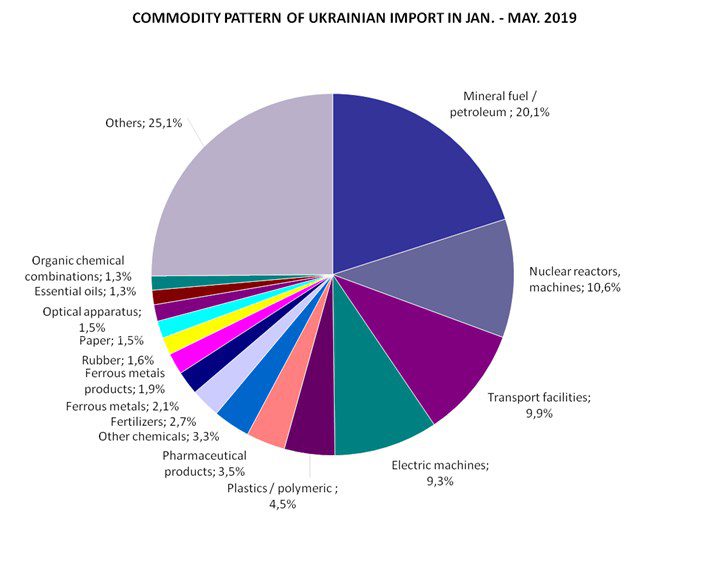

Commodity pattern of ukrainian import in jan-may, 2019

The deficit of Ukraine’s foreign trade in goods in January-June 2019 increased by 36.3% compared with January-June 2018, to $3.736 billion, the State Statistics Service has reported. According to its data, export of goods from Ukraine for the specified period grew by 5.2%, to $24.469 billion, while imports by 8.5%, to $28.205 billion.

The service said that in June 2019 the seasonally adjusted export volume decreased by 3.7% compared to May 2019, to $4.081 billion, while imports by 0.2%, to $5.248 billion.

The seasonally adjusted foreign trade balance in June was also negative and amounted to $1.167 billion, which is 14.4% more than in the previous month.

The service said that foreign trade operations were carried out with partners from 214 countries of the world.

The ratio of coverage of imports by exports amounted to 0.87.

Kyiv-based Omega insurance company in January-June 2019 saw its premium collection rise by 6.9% compared the same period last year, to UAH 49.082 million, the insurer reported on its website.

According to the company, a share of the policies on compulsory motor liability insurance shrank from 61% to 36% year-over-year.

The company paid UAH 14.723 million in claims to its clients under OSAGO policies, which were sold for a total cost of UAH 17.708 million. Thus this indicator shows 83%.

The company showed high dynamics in premiums under medical and other types of personal insurance (from 18% to 26%) and property insurance (from 7% to 23%).

Omega was set up in 1994. It has 24 licenses for providing services under 7 compulsory and 17 voluntary types of insurance.