The European Bank for Reconstruction and Development (EBRD) could issue up to $80 million to Kernel, one of the largest Ukrainian agricultural groups, within the framework of a syndicated loan to finance working capital, which is associated with the procurement, storage, transportation and sale of grains for export.

According to the information on the bank’s website, the total cost of the project is $300 million (consists of the existing and increased working capital financing).

The decision on the project can be made on September 4, 2019. Now the project is at the concept review stage.

“The provision of up to $40 million in the form of participation in a syndicated senior secured revolving credit facility to finance working capital needs of Kernel Group. Working capital financing is associated with the procurement, storage, processing, transportation of oilseeds and vegetable oil products, and export sale,” the report on the website says.

The cost of the entire project is estimated at $390 million.

The project will be considered on September 4 of the current year. It is now at the study stage.

Kernel is the world’s largest producer and exporter of sunflower oil, a leading manufacturer and supplier of agricultural products from the Black Sea region.

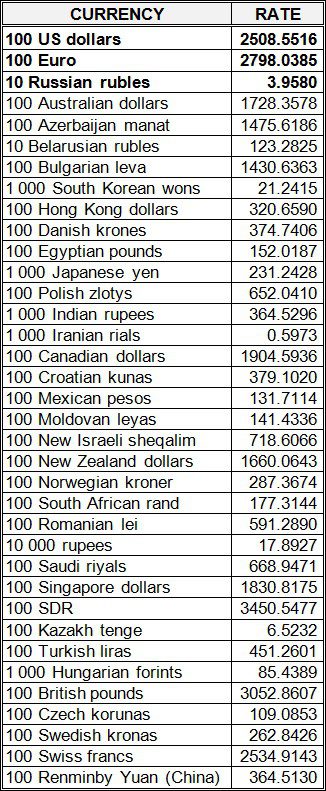

National bank of ukraine’s official rates as of 31/07/19

Source: National Bank of Ukraine

Sopharma AD pharmaceutical company in January-June 2019 increased sales in Ukraine by 35% compared to the same period in 2018.

The company reported that, in general, in the first half of 2019, revenue from the sales to European countries rose by 13% compared with the first half of 2018.

The main reasons for sales growth in Europe are higher sales in Ukraine, as well as in Russia, where sales in January-June grew by 7%.

As reported, in 2014 Sopharma reduced sales in Ukraine by 37%, but in 2017 the company expressed confidence in the resumption of sales growth in Ukraine.

In Ukraine, Sopharma AD has been controlling PJSC Vitamins since January 2008, and in August 2012 it established the subsidiary Sopharma Ukraine LLC (Kyiv) to optimize trading business.

Representatives of the American Chamber of Commerce (ACC) and adviser to the president of Ukraine Mykhailo Fedorov have discussed the problematic issues of work in Ukraine and the prospects of development of digital economy, according to the official website of the president of Ukraine.

American business representatives focused, in particular, on searches at IT companies, IT industry taxation and access to infrastructure to install the telecommunications equipment of providers, as well as the key interests in the development of mobile and fixed broadband Internet, electronic court and the adoption of priority bills necessary for the IT industry.

The report says that all the above mentioned proposals will be considered by the Office of the President of Ukraine in order to attract innovative American business to the development of the digital sphere in Ukraine.

“We are very interested in attracting the capabilities of members of the American Chamber of Commerce to the development of joint projects in the field of broadband Internet, electronic identification, and so on,” Fedorov said.

ACC representatives expressed interest in the development of digital economy in Ukraine.

Fedorov presented a digital action plan during the meeting.

“The development of digital economy should be priority number one for Ukraine. We must implement the digital transformation of the existing sectors of the economy and create favorable conditions for the emergence of new ones. Otherwise, we risk lagging behind the leading economies of the world forever. Together with the core business and the public, we have defined clear objectives and goals until 2024,” he said.

The largest Ukrainian online shop Rozetka.ua (Rozetka.Ua LLC, Kyiv) to launch Rozetka.Travel virtual tourist agency.

A new online service will make it easy to buy an online tour from the reliable tourist operators in single-click ease without visiting the tourist agency. The tourist now may get all the necessary documents, namely a contract with a tour operator on providing tourist services, air tickets, a voucher for check-in, a medical insurance, by e-mail and check them in his personal account.

“Everyone got accustomed to easily buy online tickets, book hotels, apartments all over the world. Since purchase of a tour on popular charter destinations (Turkey, Egypt, Greece and other countries) still somehow foresees visiting of a travel agent. We want to change this for everyone could easily spending in a couple of minutes to choose the best suitable tour, to pay for it without danger and to set down for the trip with no worries,” a press service of Rozetka CEO Travel quotes Yulia Chelikpazu as saying.

Now the system has already switched to Anex Tour, TUI, Tez Tour, Pegas Touristik, Mouzenidis Travel Ukrainian tourist operators, which according to Chelikpazu have technical means to download the tours via the Rozetka.

At present times Rozetka. Travel is working in beta-testing regime. Besides, round-the-clock customer support telephone service works, the offline sales points to be set.

Rozetka was founded in 2005 in Kyiv as an online store of electronics and home appliances. In subsequent years, the company was transformed into a multi-category online supermarket.

According to its website, as of May 2019, Rozetka has four stores in Kyiv and three in Odesa.