In April 2025, Express Insurance paid out UAH 46.6 million, including UAH 37.4 million for comprehensive motor insurance and UAH 9.3 million for compulsory civil liability insurance, according to the company’s website.

In April, the company settled 620 insurance claims under CASCO and MTPL agreements, of which 522 were under CASCO and 98 under MTPL.

Incidents under CASCO contracts in April mainly involved traffic accidents, as well as damage to vehicles due to falling objects, animal attacks, natural disasters, and the actions of third parties. Most of the claims came from Kyiv and the surrounding region, accounting for about 59% of all cases.

According to the report, the largest payouts in April included: UAH 3.6522 million for a car that veered off the road and overturned into a ditch in the Rivne region on the Kyiv-Lviv highway, UAH 2.616 million as a result of an accident at a roundabout in the Zhytomyr region, and UAH 993,200 for a collision with a roe deer in the Vinnytsia region.

In addition, Express Insurance continues to support customers outside Ukraine. In April, the company’s customers sought assistance from various European countries. Most often, they came from Portugal, Poland, Spain, and Italy. Individual cases were also settled in the Netherlands, Germany, France, Latvia, Moldova, the Czech Republic, Slovakia, and Hungary. Most of the cases involved traffic accidents or damage caused by external factors, and there was one case of car theft. In Italy, a customer left his car in a parking lot and later discovered that it was missing. The company confirmed the theft and paid compensation in the amount of UAH 4.69 million. In the Czech Republic, a customer’s car was hit by a garbage truck with a metal protrusion at a gas station (the payment amounted to UAH 185,600). In Slovakia, a customer was unable to avoid a collision with an obstacle while driving, and UAH 129,900 was paid out.

As for MTPL payments, in more than 66% of cases, the paperwork was completed with the participation of the police, and in about 34% of cases, the Europrotocol procedure was followed. Most claims were received from Kyiv, Dnipro, Odesa, Kropyvnytskyi, Zaporizhzhia, Ternopil, Uzhhorod, Lviv, Zhytomyr, Kharkiv, and Cherkasy.

Express Insurance was founded in 2008 and is part of the UkrAVTO group of companies. It specializes in car insurance. The consistently high speed of claims settlement is ensured by optimal interaction with partner service stations.

Since April 2012, Express Insurance has been an associate member of the Motor Transport Insurance Bureau of Ukraine.

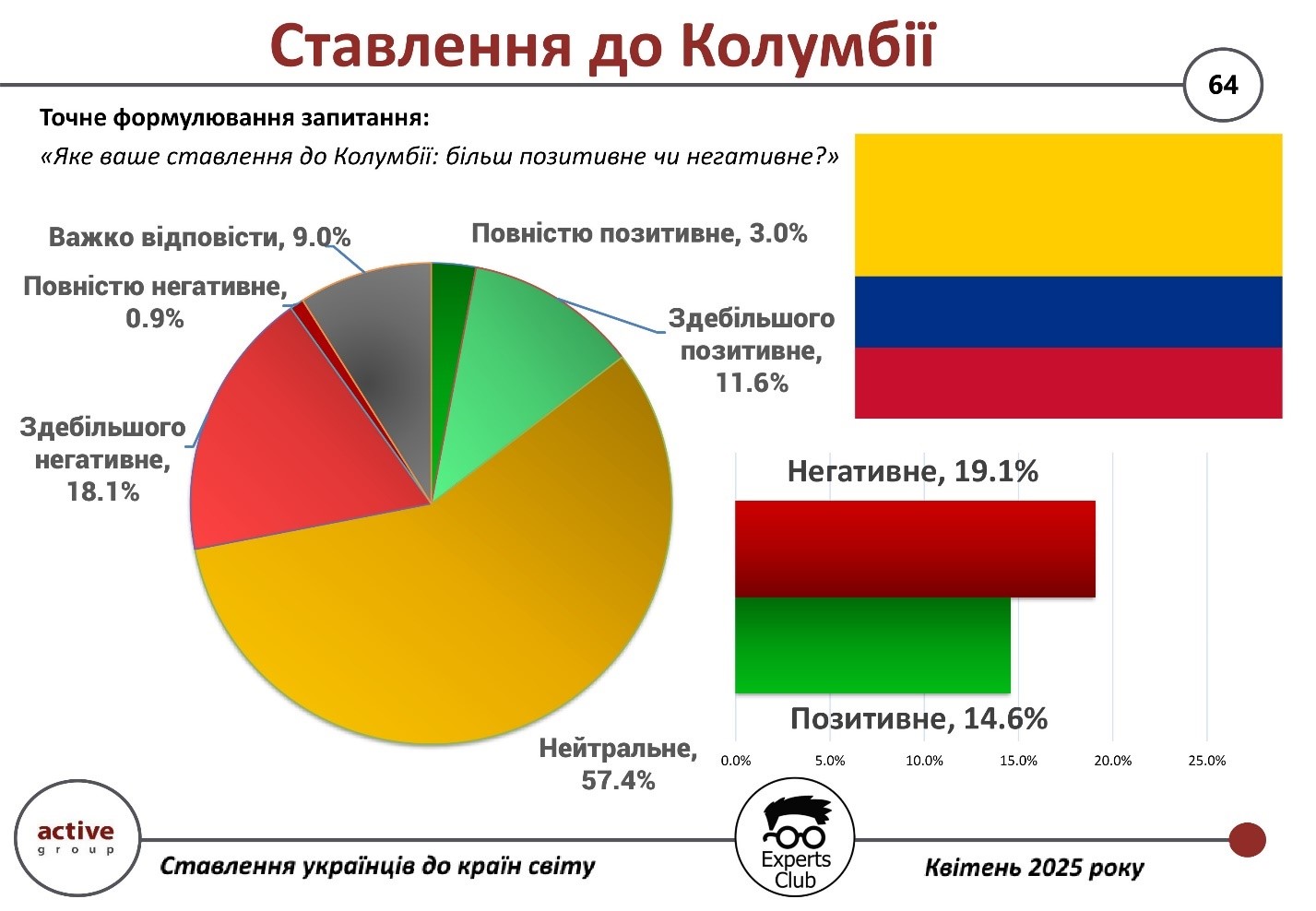

According to a survey conducted by Active Group in collaboration with the information and analytical center Experts Club, Ukrainians’ attitudes toward Colombia remain mostly neutral or negative.

According to the results, 57.4% of respondents hold a neutral position, while 19.1% expressed a negative attitude. Of these, 18.1% said their attitude was “mostly negative” and another 0.9% said it was “completely negative.”

A positive attitude is held by 14.6% of Ukrainians — 11.6% chose “mostly positive” and 3% “completely positive.” Nine percent of respondents were unable to decide on an answer.

“The image of Colombia in popular culture as a country with high crime rates, drug cartels, and political instability influences perceptions. Even with minimal news coverage, this associative framework remains,” comments Maxim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Colombia has one of the highest levels of negative perception among Latin American countries. This demonstrates the power of stereotypes in shaping public opinion, even with a small amount of relevant information.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

The general meeting of shareholders of JSC Concern Galnaftogaz has decided to allocate most of its net profit for 2024 to dividend payments, according to the SMIDA information disclosure system.

According to the report, the total amount of dividends payable for last year is UAH 1.26 billion. The dividend per share is UAH 0.064. The payment period is from May 26 to October 30, 2025 (inclusive).

In accordance with this decision, on May 8, the board of directors of the concern decided to set May 23 as the date for compiling the list of persons entitled to receive dividends.

As reported, at the end of 2024, JSC Concern Galnaftogaz received UAH 1.424 billion in net profit. “Our company pays dividends from one business and reinvests the funds in the creation of new infrastructure and jobs in Ukraine in others. We are talking about our projects in renewable energy – we are building a 147 MW wind farm, with plans for a second phase with a larger capacity of 190 MW; a biofuel production plant is also under construction, and we are developing the agricultural sector. Investments in alternative energy alone amount to over €600 million. These projects are being implemented despite all the military risks, which demonstrates our company’s long-term business motivation within the country,” commented Vasyl Danylyak, CEO of the OKKO group of companies.

Vitaliy Antonov, a shareholder of GNG RETAIL LIMITED registered in Cyprus, who owns 99.22619% of its shares, initiated the distribution of profits at the shareholders’ meeting on April 30, 2025, as follows: UAH 1.26 billion for dividends and UAH 165.67 million to be left undistributed at the disposal of the joint-stock company.

Another draft resolution of the meeting on the distribution of profits provided for leaving it undistributed at the disposal of the joint-stock company.

Galnaftogaz manages one of the largest OKKO fuel station chains, which has over 400 complexes with a network of catering establishments. The concern also includes other businesses.

In June 2024, the EBRD and OKKO signed a EUR60 million loan agreement at the Ukraine Recovery Conference in Berlin for the construction of a new bioethanol plant in the Ternopil region with a capacity of 83,000 tons per year. It is planned to be built in two years. The products will be sold on foreign and domestic markets.

Recently, Vasyl Danylyak, CEO of the OKKO group of companies, announced that its 20 MW energy storage facility (ESF), which was completed at the end of 2024, could start providing energy balancing services to NEC Ukrenergo next month.

He also noted that the group is diversifying its business and, as part of this diversification, is developing a number of projects in renewable energy.

According to Danylyak, active preparations are underway for the construction of a 147 MW wind farm in the Volyn region, with financing provided by a number of international financial institutions. The company plans to complete the first phase of the wind farm by the end of this year, with full capacity expected to be reached by the end of the first quarter of next year.

Danylyak also announced further plans to implement a larger project in the Volyn region – a 190 MW wind farm, which has been under development for the past two years. Its cost is estimated at EUR 300 million, while the 147 MW wind farm is estimated at EUR 240 million.

According to him, the company is working with various financial institutions to raise funds for this project.

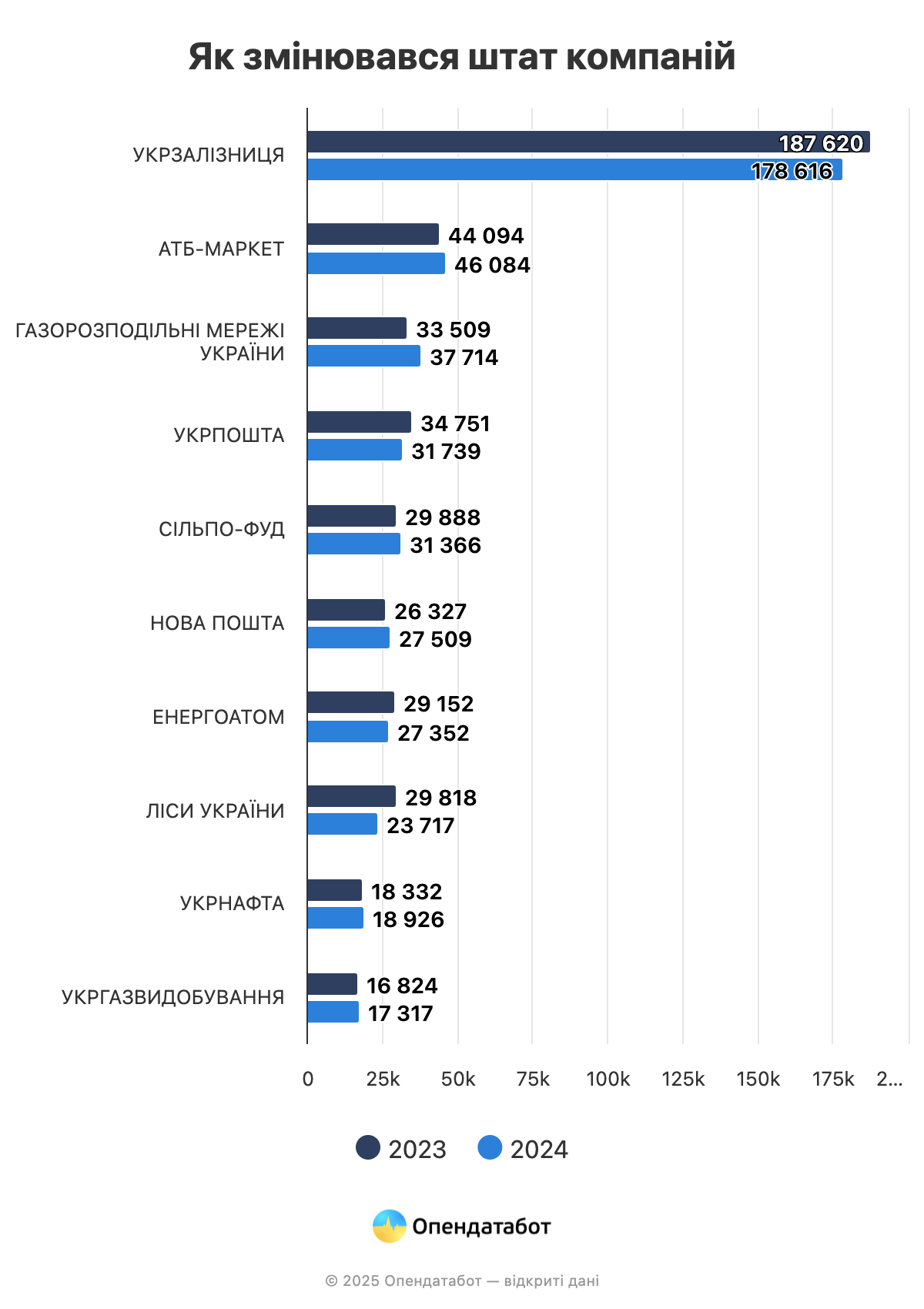

The largest Ukrainian companies are gradually restoring their staff

OpenDataBot has compiled a ranking of the largest employers in 2025 based on data from the State Statistics Service and financial reports of companies. Ukrzaliznytsia has remained the stable and undisputed leader for several years in a row. Despite some turbulence and staff cuts, the company currently employs over 178,000 people. Six companies from the list hired new people last year. Two newcomers also broke into the list of the largest employers.

Ukrzaliznytsia has been Ukraine’s largest employer for four years in a row, with 178,616 employees. However, the company lost more than 9,000 employees over the year, with its workforce shrinking by almost 5%. In total, the company’s workforce has decreased by 54,000 employees since the start of the full-scale war.

ATB-Market came in second with 46,084 employees. Over the year, the company grew by almost 2,000 employees. The top three is rounded out by Gas Distribution Networks of Ukraine with 37,714 employees. Over the past year, the company managed to increase its staff by 4,200 employees.

ATB notes that despite all the difficulties, the company created about 2,000 new jobs last year alone. This was achieved thanks to ATB’s dynamic development strategy, with the planned opening of new stores, the expansion of distribution centers, and the modernization of other enterprise facilities. This not only gave an economic boost to certain regions, but also provided thousands of Ukrainian families with a stable source of income. ATB’s personnel policy is aimed at developing what is known as human capital, which the company traditionally considers its most valuable resource and the key to its success.

The top ten employers also include retail chains, logistics companies, energy giants, and state-owned enterprises. Among them are the well-known Ukrposhta (31,739 employees), Silpo (31,366), Nova Poshta (27,509), Energoatom (27,352), Lisy Ukrainy (23,717), Ukrnafta (18,926), and Ukrgazvydobuvannya (17,317).

It is worth noting that Gas Distribution Networks of Ukraine and Lisy Ukrainy broke into the top ten for the first time.

Only four companies reduced their staff last year. The leader, Ukrzaliznytsia, suffered the greatest losses. Ukrposhta also reduced its workforce by more than 3,000, Energoatom by 1,800, and Forests of Ukraine by 20% (more than 6,000 jobs).

At the same time, other companies are expanding. The largest increase was seen in Ukraine’s gas distribution networks: +12.5%. Silpo (+4.9%), ATB (+4.5%), Nova Poshta (+4.5%), Ukrnafta (+3.2%), and Ukrgazvydobuvannya (+2.9%) also actively increased their teams.

It is worth noting that there are companies that did not make it to the top but have seen good growth in the number of employees. For example, the Aurora chain of stores has quadrupled its staff during the full-scale war, from 3,000 to over 12,000 employees. And every year, their numbers are growing.

Aurora says that its team is its main asset. The chain does not have an HR department, but instead has a Human Capital Department. It is very important to treat employees as “capital” and not as a “resource.” The company’s approach is based on the idea that employees feel needed, that their opinions are valued, and that their ideas are heard — so they can make decisions or influence them. This is the key to everyone’s engagement and motivation.

NovaPay, part of the Nova Poshta group, is also growing rapidly: +7.5% in staff numbers in 2024. The same is true for the EVA chain of stores: +2% per year.

McDonald’s grew by only 0.2% and has not yet returned to its pre-war staffing levels, like most companies.

The company notes that McDonald’s is a business where people come first, and it is thanks to this approach that they continue to grow in Ukraine, despite any difficulties, supporting a team of 10,000 employees. The company cares about their well-being, indexes salaries annually, offers health insurance, and provides financial assistance to employees affected by the war. In addition, McDonald’s continues to pay salaries to all mobilized employees.

Ukrainian President Volodymyr Zelensky will arrive in Turkey on Thursday, May 15, for Russian-Ukrainian talks proposed by Vladimir Putin, and will wait there personally for Putin.

“I will be waiting for Putin in Turkey on Thursday. In person. I hope that this time the Russians will not look for reasons why they cannot come,” he wrote on social media on Sunday evening.

“We are waiting for a ceasefire starting tomorrow – a complete and lasting one, to provide the necessary basis for diplomacy. There is no point in prolonging the killings,” Zelensky also stressed.

Earlier, US President Donald Trump called on Ukraine to immediately agree to talks in Istanbul on May 15.

“Russian President Putin does not want a ceasefire agreement with Ukraine, but wants to meet on Thursday in Turkey to discuss a possible end to the bloody carnage. Ukraine must agree to this immediately,” Trump wrote on social media on Sunday.

He added that at least they would be able to determine whether an agreement was possible, and if not, European leaders and the US would know where things stood and could act accordingly.

“I am beginning to doubt that Ukraine will agree to a deal with Putin, who is too busy celebrating victory in World War II, which could not have been won (not even close!) without the United States of America. Have the meeting, IMMEDIATELY!!!” he wrote.